- Can Students Get a Mortgage?

- What is a Student Mortgage?

- What Types of Mortgages Are Available to Students?

- How Do I Get a Mortgage as a Student?

- Is a No-Deposit Mortgage an Option for Students?

- How Much Can I Borrow for a Student Mortgage?

- What Rates and Fees Should I Expect?

- The Pros and Cons of Getting a Student Mortgage

- The Mortgage Application Process for Students

- Can You Get a Mortgage as a PhD Student?

- Which Are the Best Student Mortgage Providers?

- Alternatives to Student Mortgages

- The Bottom Line

How To Get A Student Mortgage in the UK: A Guide

Being a student can make securing a mortgage challenging. Lenders are often cautious due to your limited credit history and fluctuating income.

But, here is the deal – it’s not impossible. With the right guidance, you can get on the property ladder while being a full-time student.

Curious, how?

This article will show you how to qualify for a mortgage as a student in the UK.

Can Students Get a Mortgage?

Yes, students can get a mortgage, but there are some special conditions to meet.

It’s not always easy, and here’s why: when you’re a student, you might not have a job that pays regularly, which lenders usually look for.

Plus, if you’ve never had bills or loans in your name, your credit history might be a bit thin.

Some folks think students can’t get mortgages because of these challenges, but that’s not true. With the right preparation, like having a guarantor (usually a parent or another close family member who promises to cover the mortgage if you can’t), it’s possible.

Guarantors are a big help in getting lenders’ approval for a student mortgage. They give the lender confidence that the mortgage payments will be covered, making them more willing to lend you the money to buy your place.

What is a Student Mortgage?

A student mortgage lets students buy their place while they’re still studying. It’s similar to a standard mortgage most people get to buy a house, but it’s specially designed for students.

This means it has some different rules and features to make it easier for students who might not have a regular income or a long credit history.

To get one of these student mortgages, you usually need to be at least 18 years old, studying at a university or college, and living in the UK.

Lenders will look at these things to decide if you’re eligible.

They want to make sure you’re a student and that you’ve got a connection to the UK, which makes sense, right?

What Types of Mortgages Are Available to Students?

Here are two types of mortgage available to students:

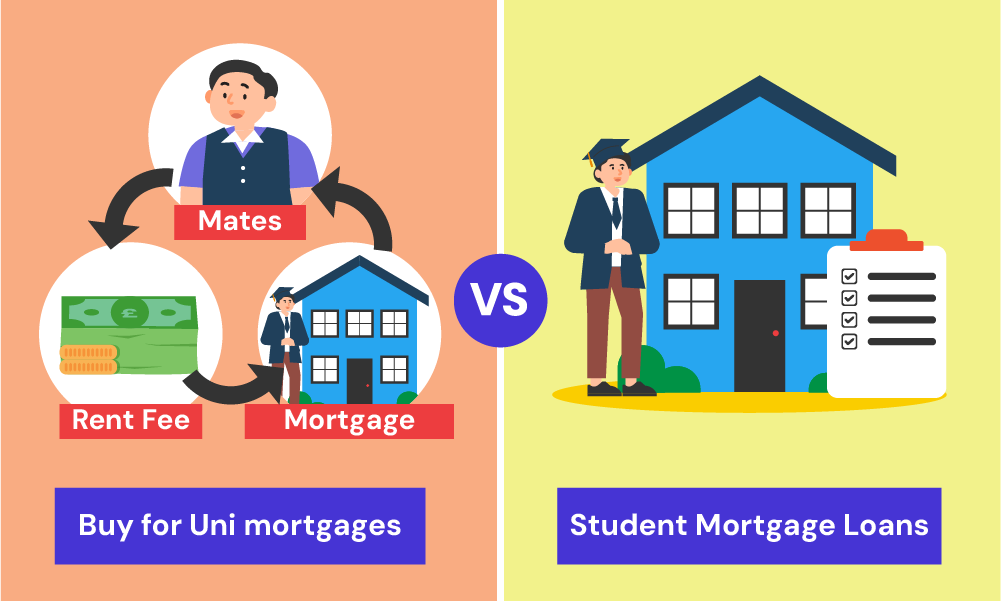

Buy for Uni Mortgages

This is a special mortgage that lets you buy a home, live in one room, and rent out the others to your mates. It’s a student-friendly take on the classic buy-to-let mortgage.

As the landlord, the rent you collect could help pay off your mortgage every month.

However, it’s not as simple as picking any house and moving in. To qualify, you’ll generally need to meet the following criteria:

- Guarantor – Have a guarantor, usually a parent or close relative, who agrees to cover the mortgage if you can’t.

- Income from Rent – Show that the expected rent from letting out rooms will be enough to cover mortgage payments.

- Proximity to University – The property should be within a reasonable distance from your university, often within 10 miles.

- Property Size – Typically, the property should not have more than three or four bedrooms.

- Type of Property – The property should ideally be a house, as some lenders may not accept flats or studio apartments.

- Academic Status – You must be a student with at least one full academic year left on your course.

It’s worth noting that not all lenders have the same criteria. Some might be more flexible than others, so it’s important to shop around and see what different lenders offer. This way, you can find the best fit for your situation.

And, be mindful of the interest rates, which were around 6% to 8% in recent times – higher than many standard mortgages.

Student Mortgage Loans

These are a bit more general than the buy-for-uni mortgage but still aimed at students. Student mortgage loans can vary a lot depending on the lender.

Some might be more flexible with their requirements, understanding that students won’t have the same financial background as someone who’s been working for years.

The trick here is finding a lender that gets the student lifestyle and is willing to work with it, not against it.

Both of these options are about making it possible for students to step onto the property ladder. They come with their own set of rules and perks, be sure to weigh up everything before diving in.

How Do I Get a Mortgage as a Student?

Thinking about buying a home while studying might seem a bit out there, but it’s possible. Here’s how you can make it happen:

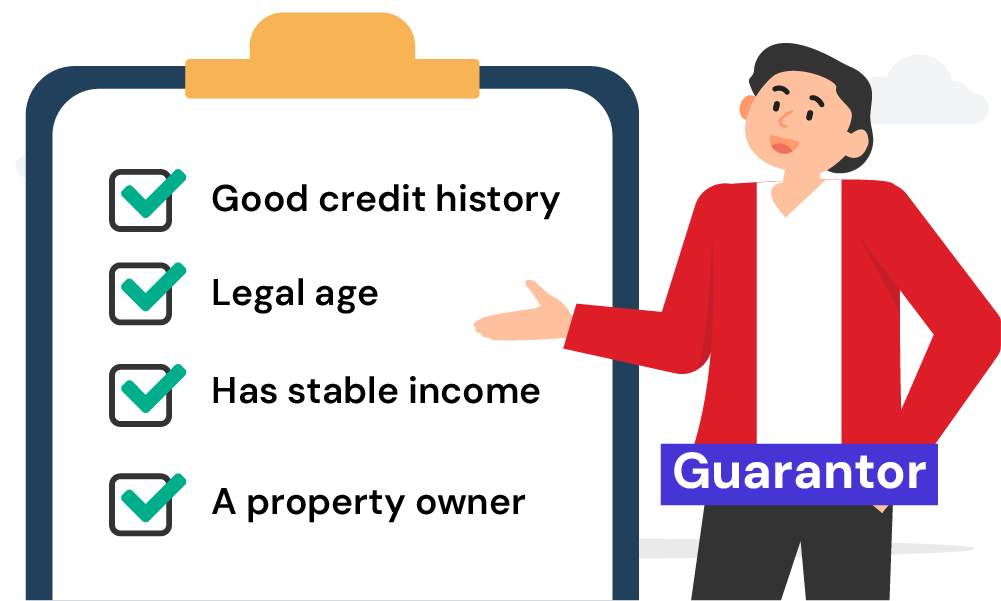

1. Get a Guarantor

Most of the time, students need a guarantor to get a mortgage.

This is usually someone like a parent or a close relative who agrees to cover the mortgage if you can’t.

They’re your financial safety net.

For lenders, having a guarantor means they’re more likely to see their money again, making them more inclined to lend to you.

Your guarantor should be a UK resident, own a UK property, usually under the age of 65, and have a good income, and a solid credit history to back you up.

2. Put Down a Large Deposit

Putting down a large deposit is a great move when you’re looking to get a mortgage. For example, if the house you want to buy is £200,000 and you put down a £40,000 deposit, your LTV ratio is 80%.

This means you’re borrowing less in proportion to the property’s value. Lenders see this as a good thing because it lowers their risk.

If you can put down a big deposit, lenders are more convinced that you’re a solid choice and are more likely to give you the thumbs up for your mortgage.

But, what if a large deposit, like 20% of the home’s price, isn’t something you can do right now? Here’s what you can do:

Cash Security

Instead of a traditional deposit, cash security involves you or your guarantor putting a sum of money into an account with the lender.

This money acts as a promise to cover the mortgage payments if there are any issues.

The great part is that you’re not using your savings for a deposit; you’re just moving it to a different account where it still belongs to you but is kept an eye on by the lender.

This way, you avoid a big deposit and even skip the stamp duty usually required, saving you money. But remember, your money won’t earn any interest while it’s in this account, and you can’t use it until your mortgage is fully paid off.

Collateral Security

Collateral security is all about using what you’ve already got. If you or your guarantor own another property, you can use the equity in that property as a safety net for the lender.

This is handy if coming up with a deposit is proving difficult.

But here’s the kicker: The lender will put a second charge on your property, which means it’s marked as a backup for payment. This means if you can’t keep up with mortgage payments, your property could be at risk.

However, there’s a positive side. Once you graduate, you might be able to remortgage for a regular mortgage, which could remove the property from being used as security.

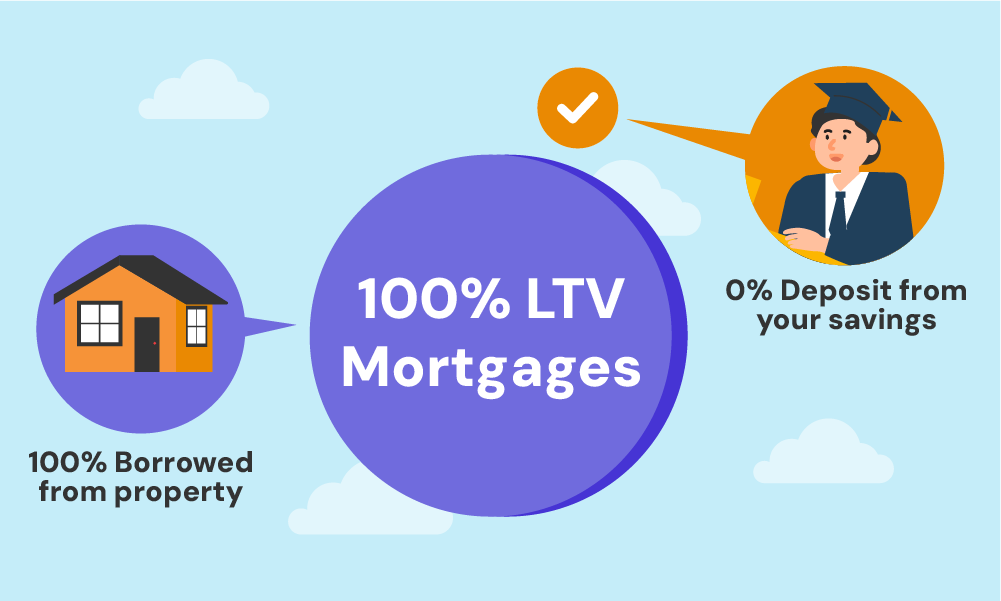

Is a No-Deposit Mortgage an Option for Students?

Yes, a no-deposit mortgage, or a 100% LTV (Loan to Value) mortgage, can be an option for students, but it’s not very common.

These mortgages let you borrow the full value of the property, meaning you don’t need to put down a deposit. Sounds great, but there’s a catch.

They’re riskier for lenders, so they’re harder to get.

Again, you’ll likely need a strong guarantor, and the interest rates might be higher. This means your monthly payments could be more expensive. It’s important to think about whether you can afford this in the long run.

How Much Can I Borrow for a Student Mortgage?

Figuring out how much you can borrow depends on a few things: your income (or potential income from renting out rooms), your guarantor’s financial situation, and the lender’s rules.

Lenders use all this info to decide how much they think you can pay back.

A student mortgage calculator can give you a rough idea.

Simply punch in some numbers, like your income and expenses to get an estimate about how much you can afford.

Remember, this is just a starting point. The exact amount will be sorted out when you apply and the lender checks everything over.

[Embedded Mortgage Affordability Calculator]

What Rates and Fees Should I Expect?

When you’re looking into student mortgages, you’ll find the interest rates might be a bit higher than usual, around 6-8%.

Why? Because lenders see students as a bit riskier.

They’re not sure you’ll always have the cash to pay them back on time. So, they charge more interest as a sort of safety net for themselves.

On top of interest, there are fees to think about.

These can include arrangement fees, valuation fees (that’s paying someone to check how much the property is worth), and possibly legal fees.

Each lender has different charges, but you could be looking at anything from a few hundred to a couple of thousand pounds to get everything set up.

It’s worth shopping around to see who offers the best deal.

The Pros and Cons of Getting a Student Mortgage

Let’s have a closer look at the upsides and downsides of getting a student mortgage.

Pros

- Save on Rent. Often, your monthly mortgage payments can be less than what you’d pay in rent. This means you could be saving money each month.

- Early Start on the Property Ladder. Buying a home early gets you onto the property ladder sooner. It’s a smart move, especially in a rising market.

- Investment Opportunity. If the value of your property increases, your investment grows. Plus, with a buy-for-uni mortgage, renting out rooms not only covers your mortgage payments but might also provide extra income.

- Independence. Being the owner means you’re the boss. You can say goodbye to dealing with landlords and their rules.

Cons

- Financial Commitment. A mortgage is a long-term commitment, often stretching over decades. You need to be ready for this ongoing responsibility.

- Potential Financial Risk. If the property market dips and your home’s value falls, you could end up owing more than your property is worth.

- Upkeep and Maintenance. Owning a home means you’re responsible for all repairs and maintenance, which can be both costly and time-consuming.

- Guarantor Risks. If you have a guarantor and you fail to make the mortgage payments, your guarantor is on the hook. This could strain relationships and put their property at risk.

The Mortgage Application Process for Students

Here’s how you can get started:

1. Gather Your Finances

Before anything else, take a good look at your finances. This means understanding your income, checking your credit score, and getting any debt under control.

It’s also the time to start putting together all the necessary paperwork, such as your ID, proof of income, and university enrollment details. Having a clear picture of your financial health is crucial for the next steps.

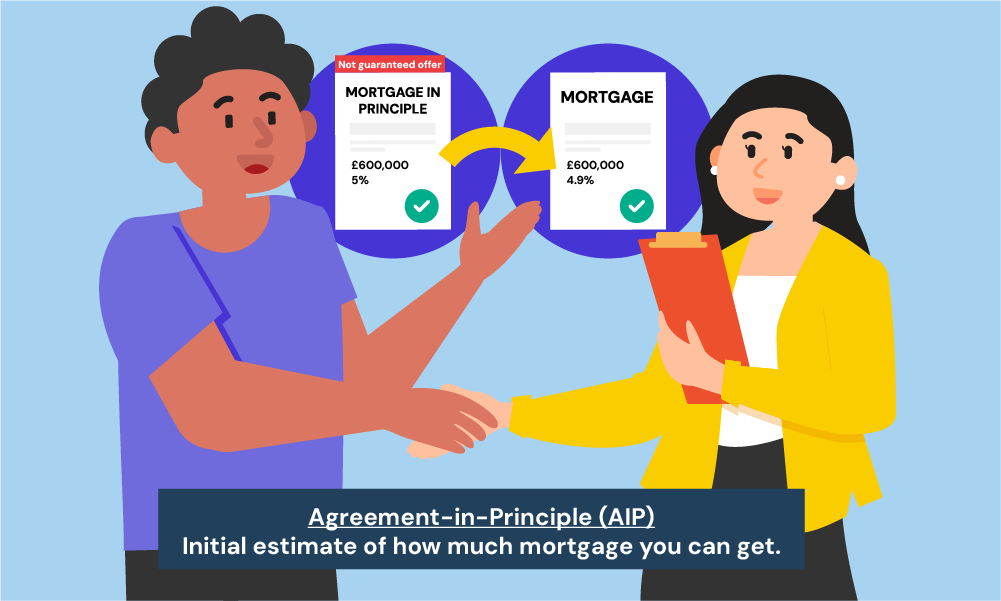

2. Get an Agreement in Principle (AIP)

An Agreement in Principle is essentially a lender giving you pre-approval to borrow a certain amount. It’s not a final offer but shows you how much you could potentially borrow, which is super helpful when house hunting.

You can get this from a lender or mortgage advisor. It’s a great way to show estate agents and sellers you’re serious about buying.

3. Start the House Hunt

Now you know how much you can borrow, you can start looking for your new home.

Stick to properties within your budget and consider how they might work if you’re planning to rent out rooms. Remember, location and suitability for your needs are key.

4. Apply for a Mortgage

Once you’ve found your perfect property and your offer has been accepted, it’s time to apply for the mortgage.

This is where you’ll need all the documents you gathered earlier, including any guarantor information if necessary.

Your lender or mortgage advisor will guide you through this process, ensuring you submit everything needed for a smooth application.

5. Finalise with a Solicitor

After your mortgage application is approved, a solicitor will come into the picture to handle all the legal aspects of buying your home.

This includes managing contracts, dealing with the land registry, and ensuring everything is legally sound.

They play a crucial role in moving you from mortgage approval to officially being a homeowner.

Throughout this process, finding a guarantor might be necessary, especially for student mortgages.

Remember, buying a home is a significant commitment, not just financially but also in terms of responsibility.

Make sure you’re ready for both the benefits and the obligations that come with being a homeowner. Take your time to understand each stage of the process, and don’t rush into anything.

Can You Get a Mortgage as a PhD Student?

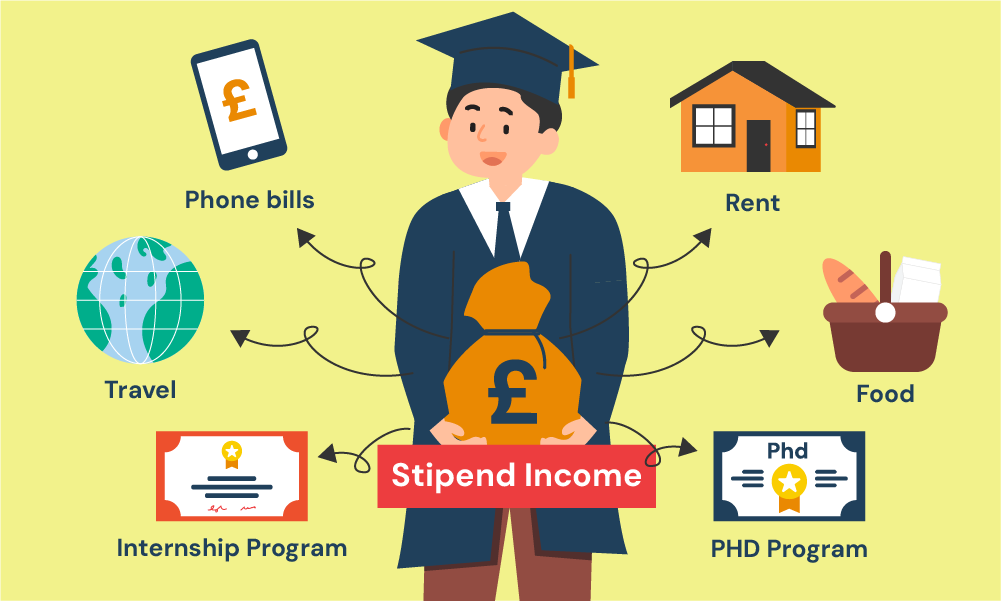

Yes, PhD students can get a mortgage, but there are a few things to keep in mind.

Your stipend is key. Some lenders might count it as income, but not all will because it’s usually less than a full-time salary and only lasts for a while.

Plus, the end date of your PhD might make lenders wonder about your money situation afterwards.

Showing you have a steady income is vital, whether it’s from your stipend, part-time jobs, or something else. If you’re close to finishing your PhD, explaining your future income plans can help lenders feel more confident about you paying back the mortgage.

A good tip is to take on teaching or other part-time work related to your studies. This not only proves you have a regular income but also shows you’re serious about your career, easing lenders’ worries about the short-term nature of a stipend.

Which Are the Best Student Mortgage Providers?

Several lenders stand out for student mortgages:

- Vernon Building Society. They offer deals specifically designed for students, making them a top choice for those looking to get on the property ladder early.

- Loughborough Building Society. Known for their “Buy for Uni” mortgage, they’re a go-to for students wanting to buy a home and potentially rent out rooms.

- Bath Building Society. Another provider offers “Buy for Uni” mortgages, giving students a chance to own their place while studying.

- Scottish Building Society. They provide options that consider the unique circumstances of student borrowers, making them a solid option in Scotland.

- Halifax. With their “Family Boost” mortgage, they allow first-time buyers, including students, to get a mortgage with help from their families, without needing a deposit.

These lenders are known for being more flexible and understanding of students’ situations. It’s worth checking them out and comparing what they offer.

Alternatives to Student Mortgages

If a standard student mortgage doesn’t seem right for you, there are other ways to buy a property:

- Guarantor Mortgages. These involve a family member or friend agreeing to cover the mortgage payments if you can’t. It’s a way to get a mortgage based on someone else’s financial stability, not just your own.

- Gifted Deposit Mortgages. Sometimes, family members can ‘gift’ you the deposit needed for a mortgage. It’s a generous way to get the lump sum you need without the pressure of paying it back.

- Buy-to-Let Mortgages. If you’re buying a property to rent out, this type of mortgage might be an option. It’s a different kind of financial commitment but can work well if you’re living in one room and renting out the others.

Each of these alternatives has its own set of rules and requirements, so it’s important to do your research and see which one fits your situation best.

The Bottom Line

Seeking expert advice on student mortgages is essential. Mortgages are major financial decisions, and advice from a specialist familiar with student needs can save you a lot in the long run.

The student mortgage market is small, but some brokers and advisors know it well. They can help you find the best mortgage deal for you.

Starting a chat with an expert is key. They’ll look at your situation, explore your options, and help you make smart choices about your mortgage.

Get in touch with us, and we’ll set up a free, no-obligation consultation with a good mortgage broker.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Do students have to pay stamp duty when buying a property?

Generally, students are exempt from paying stamp duty on their first property purchase. This exemption applies because most students are buying their first home, which typically falls under the threshold for stamp duty.

Furthermore, if parents are helping by providing security for the mortgage, they also won’t face stamp duty charges, as they’re not buying the property themselves.

This setup can lead to significant savings when starting a mortgage, making it financially advantageous for students and their families.

Are eligibility requirements different for student mortgages in Scotland?

No, the rules and regulations for student mortgages are the same across England, Scotland, Wales, and Northern Ireland.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.