- What Is a No Deposit or 100% Mortgage?

- Are No Deposit Mortgages Available in 2024?

- How Do No Deposit Mortgages Work?

- What Are the Eligibility Criteria for a 100% Mortgage?

- What Are the Pros and Cons of Mortgages With No Deposit?

- Alternatives to No Deposit Mortgages to Consider

- Key Takeaways

- The Bottom Line

Can I Really Get a Mortgage With No Deposit in the UK?

While saving a deposit is the traditional path to home ownership, the dream of buying a house with no money down is very tempting.

With soaring property prices, can you really get a 100% mortgage and avoid years of gruelling savings? 🤔

What Is a No Deposit or 100% Mortgage?

A no deposit or 100% mortgage allows you to borrow the full purchase price of a property without putting down any upfront cash deposit. The lender is taking 100% of the risk by lending the entire mortgage amount.

Normally UK mortgage lenders require at least a 5% deposit, and most buyers aim for a 10-20% deposit to access better rates.

With the average UK home at £281,000 home, that could mean saving £14,050 to £56,200 just for the deposit.

With a no deposit mortgage, there’s no such lump sum needed upfront. You’re borrowing 100% of the property value from day one.

Are No Deposit Mortgages Available in 2024?

In the years before the 2008 financial crisis, 100% mortgages were relatively common. But after the credit crunch, they virtually disappeared from the market as lenders saw them as too HIGH risk.

It’s only very recently that a small handful of 100% mortgage products have started to emerge again for buyers who can’t raise a deposit. However, they remain an extremely niche product making up less than 1% of the current UK mortgage market.

In May 2023, Skipton Building Society launched the first true no deposit mortgage since 2008 with its “Track Record” product.

This allowed first-time buyers or home movers to borrow 100% of the property value up to £600,000 with no deposit required.

Some lenders also now offer limited no deposit options, often requiring a guarantor or security deposit from a relative.

How Do No Deposit Mortgages Work?

With a typical no deposit mortgage, you borrow 100% of the purchase price from the lender. So on a £250,000 property purchase, you’d take out a £250,000 mortgage with no cash down.

While no lump sum deposit is required, you’ll still need funds upfront for:

- Legal fees

- Property surveys/valuation

- Mortgage arrangement fees

- Stamp duty (unless a first-time buyer)

- Moving costs

These upfront cash costs can run into thousands of pounds, so you’ll need some savings behind you. And without a deposit, your loan-to-value (LTV) will be at the maximum 100% which means you’ll likely be paying a HIGHER mortgage interest rate.

What Are the Eligibility Criteria for a 100% Mortgage?

While the exact criteria varies by lender, common requirements include:

- Being a first-time buyer or home mover (not a buy-to-let)

- Likely residency requirements, such as being a UK resident or having a right to reside in the UK

- Clean credit history with no recent missed payments in the last 6 months

- Minimum age requirement, usually at least 21 years old

- Demonstrable stable income and employment history

- Able to evidence 12+ months of on-time rent payments

- Must pass lender affordability checks

- No history of bankruptcy or significant financial delinquency

- Some lenders might require that the applicant has no other significant loans or financial obligations

- Sufficient income to cover mortgage repayments and associated homeownership costs

- Property restrictions, such as not applicable for purchasing new build flats or properties in Northern Ireland

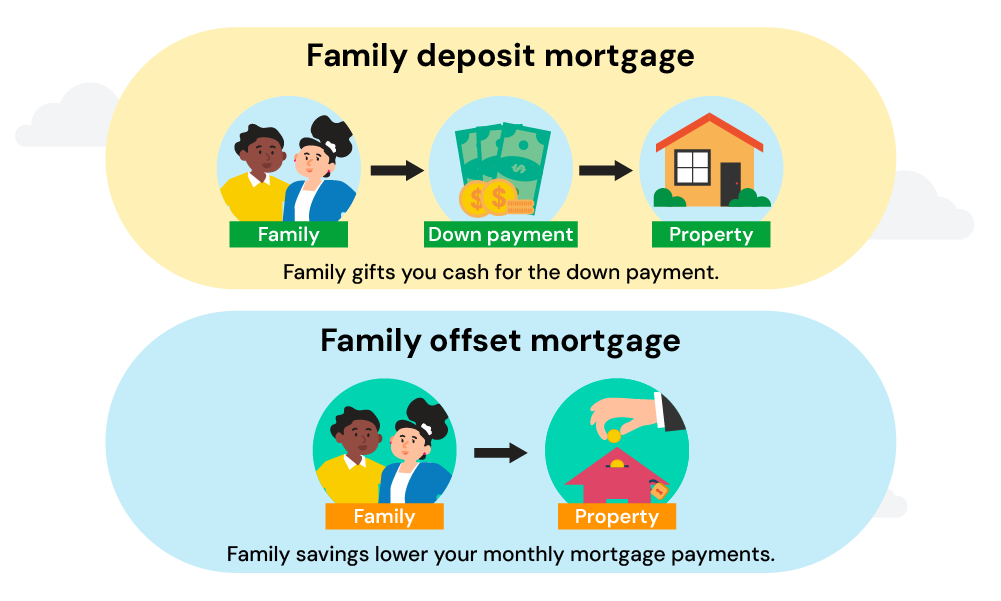

In addition, many no deposit mortgages are either:

- Guarantor mortgages where a relative guarantees the loan using their property or savings

- Family deposit or offset mortgages where relatives provide 10-20% of the purchase price as security

So having a willing family member to act as a guarantor or stump up 10% of the purchase price is often crucial to being accepted.

What Are the Pros and Cons of Mortgages With No Deposit?

The main advantages of no deposit home loans are:

- You can buy a property much sooner without years of saving.

- Easier to get on the property ladder, especially for first-time buyers.

- You start building home equity immediately with your repayments.

However, the potential disadvantages are significant:

- High mortgage rates compared to buyers with a deposit.

- Greater risk of negative equity if property values fall.

- You pay much more in total mortgage interest over the loan.

- Fewer lenders and products to choose from.

- Need to pass tougher affordability checks with maximum borrowing caps.

- Could put relatives’ property or savings at risk as guarantors.

Given the drawbacks, most experts suggest saving a deposit is preferable if possible to access mainstream mortgage deals at lower rates.

Alternatives to No Deposit Mortgages to Consider

If you’re struggling to raise a deposit, some other options could help get you on the property ladder sooner:

- Mortgage Guarantee Scheme. Ending on 30th June 2025, This scheme helps you buy a home with just a 5% deposit. The government promises to cover part of the mortgage losses in case you default.

- Shared Ownership. This scheme lets you buy between 25-75% share of a property. Then, pay a mortgage on the share you own. For the remaining share, you pay rent to a housing association. Later on, you can opt to buy more shares to own more of your home–this is known as ‘staircasing’.

- Lifetime ISA. It’s a special tax-free savings account. The government tops up your LISA savings by 25% which can be put towards your first home deposit. This means for every £4 you save, the government adds £1. You can use this money plus interest towards your first home deposit.

- Bank of Mum & Dad. Your parents can also help you buy a home. They might ‘gift’ you some money or lend it to you without charging any interest. This can make it easier for you to start buying your own place sooner. You can use this money for the deposit you need for a house.

- Deposit Unlock Scheme. This lets you buy a new-build home with just a 5% deposit. Certain lenders and developers are part of the scheme. You pay a monthly fee on top of your mortgage. It helps people get on the property ladder sooner.

- Joint Mortgages. You can team up with others (family/friends) to jointly buy a property. By combining incomes and deposits, it’s easier to get approved for a mortgage. But you both legally own the home together.

- Concessionary Purchases. Some housing associations offer homes at a discounted price for certain buyers. For example, you may get 25% off a new property if you are a key worker. This makes raising a deposit more achievable.

- 95% LTV Mortgages. Most lenders offer mortgages if you have a 5% deposit. The mortgage covers 95% of the property value. Higher rates than bigger deposits, but an accessible option.

- Right To Buy Mortgages. If you rent from the council, you may qualify to buy your home at a discount. The bigger the discount, the smaller the deposit needed to purchase.

- Saving For a Deposit. The traditional route involves saving up enough for a deposit over time. Open a savings account, cut expenses, and get government bonuses – it takes discipline but unlocks the best mortgage rates.

While not a perfect solution, these deposit-boosting schemes could allow home ownership to become a reality much sooner.

Key Takeaways

- A no deposit mortgage lets you borrow the full cost of a home without savings upfront, but these options are rare, come with higher interest rates, and often require stricter eligibility checks.

- Many no deposit mortgages need a guarantor or family member’s savings as security, which can put their property or money at risk.

- These mortgages are mostly for first-time buyers or home movers with stable income, clean credit, and a good track record of rent payments.

- While you avoid saving for a deposit, these loans have higher monthly payments, fewer options, and a higher chance of negative equity if property values drop.

- Alternatives include schemes like Shared Ownership, Lifetime ISAs, or the Mortgage Guarantee Scheme, which help you buy with a smaller deposit.

- Family support through gifted deposits, guarantor agreements, or joint mortgages can also make buying a home more accessible.

- Saving for a deposit remains the best way to access better mortgage rates and lower long-term costs, and more loan options, even if it takes more time.

The Bottom Line

No deposit or 100% mortgages are back, but only in small numbers. They’re still much rarer than low deposit options like 5% or 10% mortgages.

Many won’t qualify because of the strict rules and the need for a guarantor or secured family asset. They’re also more expensive in the long run, so saving a deposit is usually the BEST option for most buyers.

However, if you’re a disciplined borrower who can’t afford to buy a home otherwise, a 100% mortgage could be a way to get on the property ladder without waiting years to save a large sum.

Just remember to carefully consider the pros and cons and talk to an independent broker before you go for a no deposit mortgage.

To get started, reach out to us. We’ll connect you with a qualified mortgage broker to help you make informed decisions about your finances and homeownership.

Get Matched With Your Dream Mortgage Advisor...