- What Are Contractor Mortgages?

- Who Is It For?

- Can I Get a Mortgage as a Contractor?

- How Contract Type Influences Your Mortgage Application

- How To Apply for Contractor Mortgages?

- Is It Possible To Get a Mortgage As a Contractor Under IR35?

- How Much Can I Borrow?

- Do Lenders Offer Better Deals to Professional Contractors?

- What Should I Do If My Contract Is Nearing Its Term?

- How To Get Contract Mortgages As A New Contractor

- Can I Remortgage as a Contractor?

- The Bottom Line

A Guide to Getting a Mortgage as a Contractor in the UK

Securing a mortgage as a contractor used to be tough. It can be a long process that could leave you feeling stressed and confused.

But that’s all in the past.

With more people working as contractors today, lenders have started to open their doors, offering special mortgages designed just for them.

This guide is here to teach you the ropes. We’ll explore what contract mortgages are and how you can get one in the UK.

What Are Contractor Mortgages?

A contractor mortgage is a special type of loan that lets you buy a house if you work for yourself or on short-term contracts. It’s different from regular mortgages that people with permanent jobs get.

This is because contractors might not get paid the same way every month, making it hard for lenders to know how much they earn.

Contractor mortgages are designed to solve this problem. They look at your daily or yearly pay in a different way.

Who Is It For?

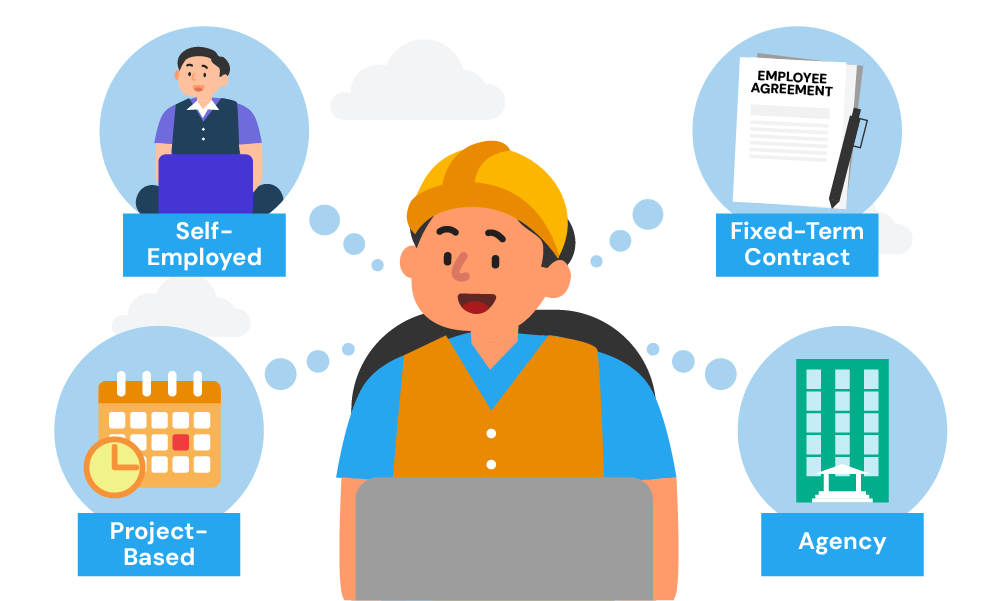

Understanding if you qualify for a contractor mortgage depends on how lenders classify your work situation. Here’s a quick guide:

You’re a contractor if:

- You work for yourself (self-employed)

- You’re working with a company on a short or fixed-term contract.

- Your pay rate is agreed upon for the length of the contract.

- You take on jobs one at a time through an agency or zero-hours contract

However, if:

- You juggle multiple clients simultaneously.

- You report your income independently, managing your taxes.

Then lenders might classify you as a freelancer. This is important because, while having many clients diversifies your income, some lenders see freelance work as less stable than a single, longer-term contract.

Furthermore, lenders look at how you pay taxes and get paid to decide if you’re employed or self-employed.

If you file your taxes with no fixed employer, you’re usually seen as self-employed. But if you work through an agency or company that handles your taxes and pays you, you might be considered employed.

Can I Get a Mortgage as a Contractor?

Yes, you can!

Despite the challenges, there are now more mortgages available for contractors than before. This is good news if you’re looking to buy a home.

Banks and lenders are starting to understand that contractors are a big part of the workforce and they’re making it easier to apply for a mortgage.

Different types of contractors can get a mortgage. This includes self-employed people, those who work on fixed-term contracts, and contractors who work through an umbrella company.

Each type of contractor has different ways of showing how much they earn, but don’t worry, there are options for everyone.

How Contract Type Influences Your Mortgage Application

As we’ve discussed, the type of contract you work underplays a crucial role in your mortgage application. Lenders evaluate your job and income to determine their willingness to lend to you.

Let’s explore how various contract types impact your application and what lenders look for:

Fixed Term Contractors

If you’re on a fixed-term contract, lenders usually want to see at least 6-12 months left on it when you apply. This gives them confidence in your ongoing employment, which could put you in a similar category to an employee, especially if your income is taxed at the source.

Limited Company Directors

If you’re directing a Limited Company, some lenders might only consider your salary and dividends when assessing your loan application. However, if you retain profits within your company, seeking out lenders who take these into account can be advantageous for your borrowing potential.

Professional Contractors

Professionals such as IT contractors, medical professionals, and accountants often need to show a minimum of 12 months of continuous contracting, with at least six months remaining on their current contract. This requirement assures lenders of your stable and ongoing income.

Short-Term Renewable Contractors

Lenders may accept applications from contractors with short-term contracts (e.g., three to six months) if you show at least twelve months of continuous work. Additionally, your future contracts can strengthen your application by providing ongoing employment prospects.

Self-Employed Contractors

Lenders will need two key pieces of information to gauge the stability of your income:

- Business accounts for the last two to three years, prepared by a certified accountant.

- Your tax returns or SA302 forms from the same period.

They’ll either calculate your average income over these years or, if your earnings vary a lot, they might base their decision on the lowest yearly income.

Special Considerations for CIS Participants

For contractors in the construction sector enrolled in the Construction Industry Scheme (CIS), lenders may use the gross income reflected on your payslips for a more favourable assessment of your earnings.

Temporary Contracts and Agency Workers

For those in temporary roles or working via an agency, the consistency of your employment history is key. You should show at least three months remaining on your current contract and 1 year’s worth of steady work. An employer’s reference from your agency might also be requested to back up your application.

Zero Hours Contract Workers

Workers on certain zero-hours contracts, like NHS Bank Nurses, retained firefighters, and supply teachers, can get approved more easily with proof of consistent work over the previous twelve months.

How To Apply for Contractor Mortgages?

Applying for a mortgage can seem hard, especially if you’re a contractor. But don’t worry, here’s how you can start the process, step by step.

Get Your Documents Ready

You’ll need to show some paperwork to prove how much you earn. Here’s a checklist of what you must prepare:

- At least 6-12 months of current and past contracts to show you have a steady job.

- At least two to three years of SA302 or tax returns to prove your income.

- Bank statements for both your personal and business accounts (3-6 months).

- Proof of identification and address like a passport and utility bills.

- Any proof of your outgoings such as travel costs, childcare costs, or credit card payments.

Note: Look over your documents carefully to make sure there are no errors.

Check Your Credit Report

Make sure your credit report is up to date and looks good. This makes it easier to get a mortgage. You can download credit reports for free from these credit agencies:

If you notice any mistakes or errors, contact the agency and ask them to fix them. you should get them fixed.

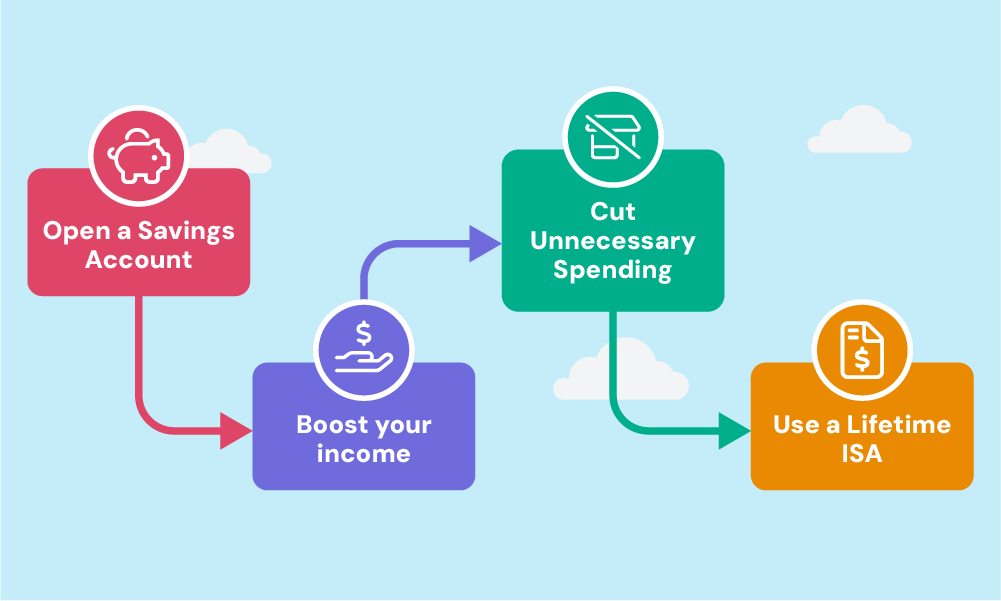

Save a Big Deposit

Putting down a big deposit is a great idea when buying a house. The more you can pay upfront, the better your mortgage deal could be. It tells lenders you’re a safe bet and can lead to lower interest rates.

Here is how to save up:

- Start a Savings Account – Open a special account just for your house deposit. Choose one that gives you good interest, so your money grows faster.

- Cut Back on Spending – Look at what you spend each month. Try to spend less on things you don’t need, like eating out a lot or paying for things you hardly use.

- Earn More Money – If you can, try to take on more work or projects that pay more. Any extra money you make can go into your deposit savings.

- Consider a Lifetime ISA – A Lifetime ISA can help you save for your first home. You can put in up to £4,000 a year, and the government will add 25% on top. That’s extra money towards your home for free! But remember, this money should go towards buying your first house or be saved until you’re 60 to get the most benefit.

Talk to a Specialist Broker

Lastly, it’s a good idea to speak to a broker who knows all about mortgages for contractors. They understand how contractors work and can help find the best mortgage for you.

To get matched to the right broker, simply reach out to us. We’ll set up a free, no-obligation chat with a reliable mortgage broker to guide you in the process.

Is It Possible To Get a Mortgage As a Contractor Under IR35?

Yes, you can get a mortgage if you’re under IR35, but it might be a bit harder. Not all lenders have clear rules for contractors in IR35 yet.

This means you might not have as many choices for loans. Since IR35 started, some people working for companies or on fixed contracts have struggled to show they earn enough for the mortgage they want.

This is often tougher for people new to contracting or getting their first mortgage. However, if you run your own company, your chances of getting a good mortgage don’t change much with IR35.

How Much Can I Borrow?

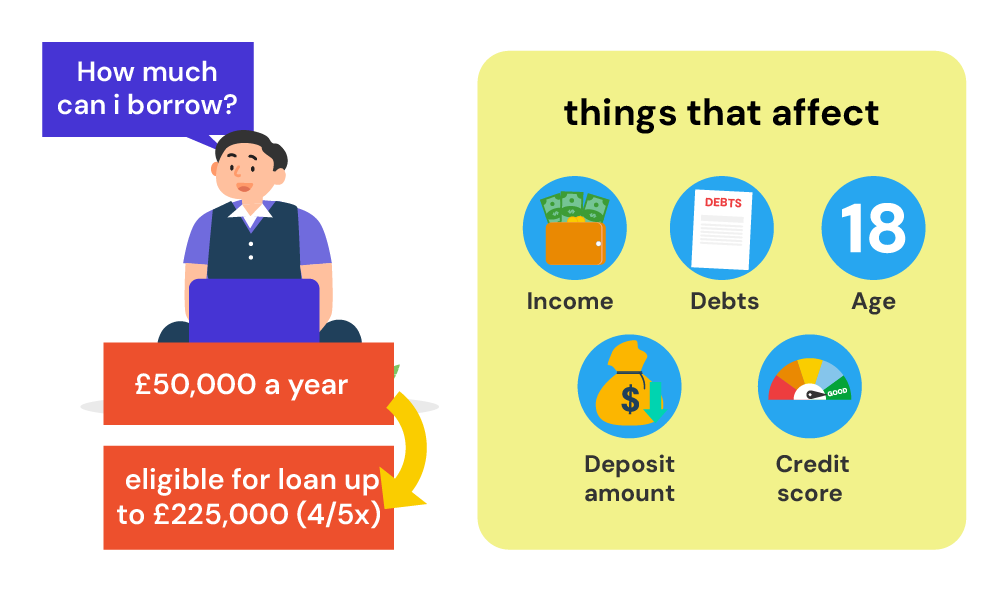

Lenders use something called “income multiples” to decide this. Usually, they will lend you a certain amount of money based on how much you earn every year.

For contractors, they typically consider your daily or yearly rate and multiply it by a number (often 4.5) to determine the maximum loan. So, if you earn £50,000 a year, you might be eligible for up to £225,000.

Some lenders look at your average income over 2-3 years, while others use your lowest income from that period.

But hold on, it’s not that simple. Other things like your credit score, age, and deposit amount also play a role.

Fortunately, specialist lenders for contractors exist. They understand your income structure better and may offer higher amounts.

If you’re unsure about how much you might be able to borrow, it’s a good idea to talk to a mortgage advisor. They can explain your options and find the best mortgage for you.

Do Lenders Offer Better Deals to Professional Contractors?

Not necessarily. While some lenders may view professional contractors favourably due to potentially stable income and perceived reliability, they don’t automatically receive better deals.

Here’s why:

- Different lenders have different rules. Some specialise in mortgages for contractors and might offer better rates or allow you to borrow more based on your income.

- Your overall financial picture matters. Lenders consider your credit score, income stability, your specific industry’s stability, and how long your contracts typically last.

- Certain professions might have an edge. For example, some lenders view IT professionals or doctors as lower risk, offering them more favourable terms.

What Should I Do If My Contract Is Nearing Its Term?

When you apply for a mortgage, lenders usually want to see that your contract will keep going for a while (between 6-12 months left). This makes them feel sure you’ll keep earning money and can pay back the loan.

If your contract is almost finished, here’s what you can do:

- Talk to a mortgage broker. They specialise in contractor mortgages and can advise on improving your application.

- Showcase your strengths. Highlight your work history, experience, future contract prospects, and positive client/employer testimonials. Show a consistent and reliable income stream, even amidst contract changes.

Doing these things can help you show lenders that you’re a good person to lend money to, even if your current contract is about to end.

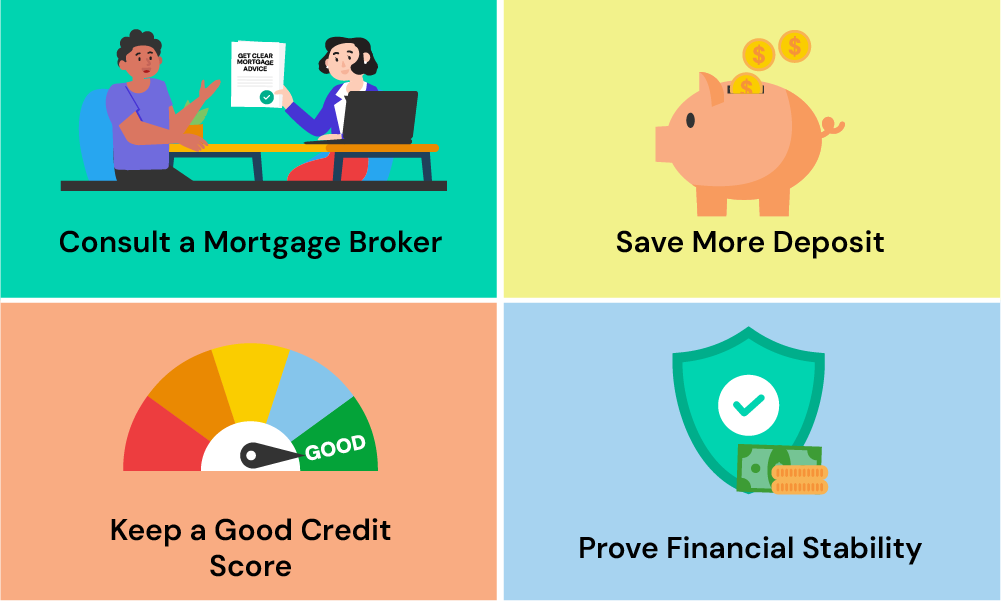

How To Get Contract Mortgages As A New Contractor

If you’re a new contractor, you might wonder if getting a mortgage is possible for you. The good news is, yes, it’s possible!

Having a strong work history in your field can help. Here are some important steps to make your dream of owning a home come true:

Talk to a Specialist Mortgage Broker

First, find a mortgage broker who knows all about mortgages for contractors. They can guide you through the process, help you understand what lenders are looking for, and find the best mortgage for you.

Save for a Big Deposit

The more money you can save for a deposit, the better. A big deposit not only makes it easier to get a mortgage but might also get you a better deal. Start saving as much as you can, as early as you can.

Keep Your Credit Record Clean

Make sure your credit history is the best it can be. This means paying bills on time, not borrowing too much money, and making sure there are no mistakes on your credit report. A good credit score makes lenders more likely to give you a mortgage.

Show Your Financial Stability

Gather all the proof you can of your income and work. This includes contracts you’ve had, any new contracts you’re starting, and details of your past jobs. This shows lenders that you have a steady income and can afford to pay back the loan.

Can I Remortgage as a Contractor?

Yes, you can. Remortgaging means switching your current mortgage for a new one, potentially with lower interest rates or more money borrowed. This could help you save money or access funds for big plans.

If you’ve been a contractor since your first mortgage, remortgaging is usually easy. Your lender will still check your income, but if it’s steady and enough, you shouldn’t have any issues.

But, if your income has changed or you’re new to contracting, things get trickier. Lenders might be cautious if your income has dropped or you’re a new contractor.

When remortgaging, it’s a good idea to check out with different lenders because some are more open to contractors. Make sure all your financial information is accurate and up to date.

The Bottom Line

Getting a mortgage as a contractor in the UK is possible. We’ve seen that there are special mortgages just for contractors, and even though it might seem a bit tricky at first, with the right approach, you can find a good deal.

Remember, your job, the type of contract you have, and your income can influence your application. But don’t let that worry you.

The best step you can take is to talk to a specialist broker. They know all about contractor mortgages and can give you advice that’s just right for your situation. They’ll help you find the best deals and make the application process smoother.

For an easier path to finding the right broker, get in touch with us. We’ll link you with a top mortgage advisor specialising in contractor mortgages.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can contractors get buy-to-let mortgages?

Yes, it’s possible. Buy-to-let mortgages focus on the property’s rental income rather than your earnings. Contractors who run their businesses might find exclusive deals from some lenders

Is it possible to get a contractor mortgage even if I’m on maternity leave?

Obtaining a mortgage during maternity leave is possible. Showing plans to return to work or a history of consistent contracts can help reassure lenders of your financial stability.

Are there 100% mortgages for contractors?

While 100% mortgages are now rare, there are still options for those unable to put down a deposit. These options often involve having a family member act as a guarantor.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.