- What Is a Fixed Term Contract?

- Can I Get a Mortgage on a Fixed Term Contract?

- How Can I Qualify for a Mortgage on a Fixed Term Contract?

- How Much Can I Borrow on a Fixed Term Contract Mortgage?

- Are There Specific Lenders for Fixed Term Contract Mortgages?

- What Should I Do If My Contract Is Nearing Its End?

- The Bottom Line

How To Get Mortgages with a Fixed Term Contract: A Full Guide

Fixed-term contracts, once considered less common, have become increasingly popular in today’s job market. They differ from regular employment mainly in the structure of the contract.

While regular jobs typically involve an ongoing contract until termination or resignation, fixed-term contracts specify a defined timeframe for your employment.

This timeframe could be based on a specific project completion or a set duration, like a year-long teaching contract.

Despite the time limit, fixed-term employees still fall under the PAYE (Pay As You Earn) tax system, similar to those with regular contracts.

In this guide, we’re going to take a closer look at what these contracts mean for your mortgage application.

What Is a Fixed Term Contract?

A fixed-term contract is a type of job agreement with a clear end date. This means if you’re working on a fixed-term contract, you’re hired for a specific period.

This could be for a few months or even a year or two, usually to complete a particular project or cover a temporary need like maternity leave.

Here’s what counts as a fixed-term contract for a lender in the UK:

- You have an employment contract with the organisation you work for

- Your contract ends on a certain date or completion of a specific project.

Lenders pay close attention to this kind of contract. They want to make sure you have a steady income to pay back a mortgage.

Can I Get a Mortgage on a Fixed Term Contract?

Yes, getting a mortgage on a fixed-term contract is possible!

While lenders often prefer permanent employment for their stability, they can still approve your application if you demonstrate your financial responsibility.

What do lenders look for?

- Steady income. They’ll examine your contract length and income to assess your ability to repay the loan.

- Financial reliability. A good credit history and manageable debts show you’re responsible with money.

- Strong application. Prepare a strong application with clear income proof and a realistic budget.

Tip: To boost your application, seek an expert’s advice. Good mortgage brokers with experience in fixed-term contracts can guide you through specific lender requirements and navigate the application process smoothly.

How Can I Qualify for a Mortgage on a Fixed Term Contract?

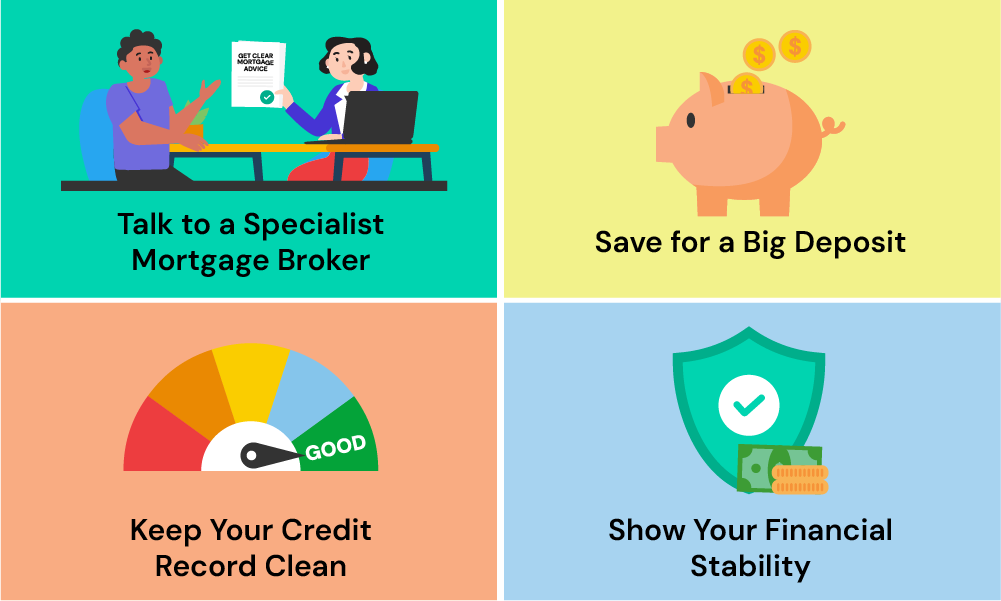

Qualifying for a mortgage on a fixed-term contract requires some extra steps, but it’s possible.

Here’s what you need to qualify:

Gather Your Documents. Begin by collecting all necessary paperwork that demonstrates your income. You should include:

- Business accounts for the last two to three years, prepared by an accountant.

- Tax Returns (SA302) for the same period.

- Recent bank statements (3-6 months) for both personal and business accounts.

- Any current and past employment contracts.

- Documents for other sources of income, such as benefits, maintenance payments, or pensions.

- Identification and proof of address, like a passport and utility bills.

- Evidence of your monthly spending and available income.

Check Your Credit Score. A strong credit score shows lenders you’re reliable with repayments. Get free credit reports from Experian, Equifax, and TransUnion.

If you find errors, promptly contact the Credit Reference Agency to correct them. Additionally, cut ties financially from old flatmates or ex-partners to improve your application.

Save for a Bigger Deposit. A larger deposit reduces the amount you need to borrow, making you a lower-risk borrower. To save effectively:

- Open a savings account specifically for your deposit, choosing one with a high interest rate.

- Increase your income with additional work, directing the extra earnings towards your deposit.

- Cut back on non-essential expenses to boost your savings.

- Consider a Lifetime ISA, where the government adds 25% to your savings for a first home, up to a set limit.

Work with a Specialised Mortgage Broker. Mortgage brokers are invaluable in navigating the mortgage landscape.

They have the expertise to match you with lenders suited to your fixed term contract status, simplifying the application process.

To get started, simply drop us a line. We’ll arrange a free, and no-obligation chat with a reliable mortgage advisor to help you with the process.

How Much Can I Borrow on a Fixed Term Contract Mortgage?

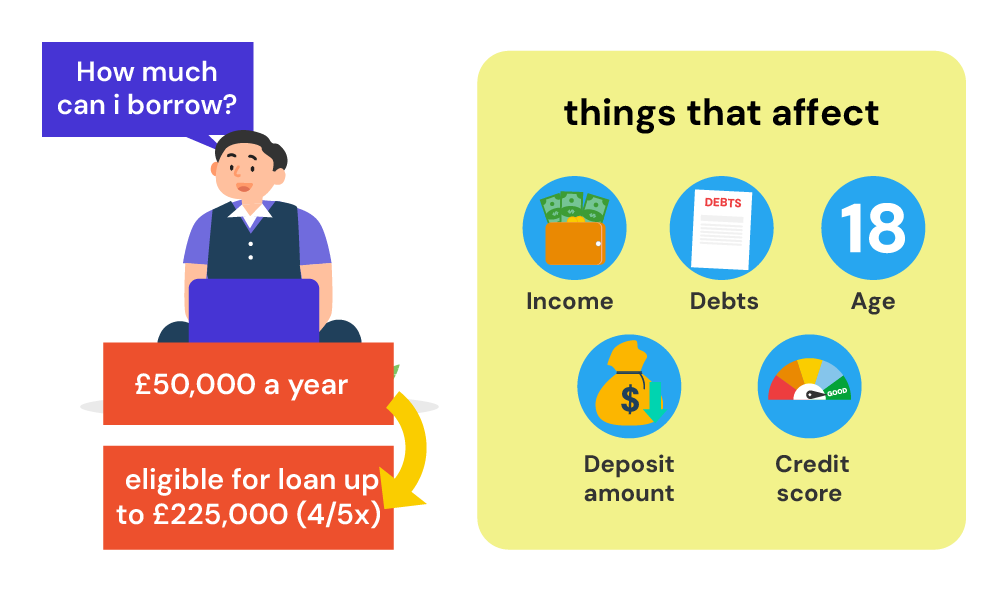

There’s no exact answer to how much money one can borrow. a mortgage. However, lenders look at a few things.

To figure out how much they’ll lend you, lenders often multiply your yearly income by 4.5 or 5. This helps them decide a safe amount you can pay back.

For those on fixed term contracts, lenders also look at your earnings history and how steady your income has been.

If you’ve consistently earned money from your contracts and your income has been stable or going up, this is good.

It shows lenders you’re smart with your money and likely to keep earning enough to pay the mortgage. The better your earnings history, the more money you might be able to borrow.

Are There Specific Lenders for Fixed Term Contract Mortgages?

Yes, certain lenders are more open to giving mortgages to people working on fixed-term contracts. These lenders can be found both among the well-known high street banks and specialist lenders who focus on helping people with unique work situations.

High street banks are the big names you’re likely familiar with, like Halifax and Santander. They often have specific deals or terms that are more favourable to people on fixed-term contracts.

Specialist lenders, on the other hand, are not as widely known because they usually focus on helping people who might not fit the typical profile for a mortgage.

They take a closer look at your situation, such as your contract and income, and they might be more willing to lend to you even if your job situation seems less stable to other lenders.

What Should I Do If My Contract Is Nearing Its End?

If your contract is nearing its end and you’re still looking for mortgages, there are two things you must have to increase your chances:

- Show a track record of consistent work history. Even if your contracts are short, having minimal gaps between jobs helps. Lenders see this as reliable income potential.

- Highlight your future job prospects. If you have job opportunities coming in, lenders might be more comfortable giving you a mortgage.

To support your application, you should gather the following documents:

- Past employment contracts that show the length and terms of your previous work

- Upcoming contract offers that indicate potential future employment opportunities.

- Recent bank statements that prove your financial stability and regular income.

- Tax Returns (SA302 forms)

- CV or Professional Résumé to show your skills and experience

- References from Previous Employers that attest to your likelihood of employment

The Bottom Line

Buying a house with a fixed-term contract is possible.

While lenders typically prefer permanent employment for its stability, they can still approve your application if you demonstrate financial responsibility.

This includes showcasing a steady income, maintaining a good credit history, and presenting a strong application with clear income proof and a realistic budget.

Seeking guidance from a mortgage advisor can improve your chances of success. These experts are well-versed in the complexities of fixed-term contract applications and can guide you through lender requirements with ease.

By working with a specialised mortgage broker, you can simplify the process and ensure you’re making informed decisions tailored to your specific situation.

If you’re looking to save time and stress in your search for the right broker, get in touch with us. We will connect you with a reliable broker who can help you solve your specific mortgage situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a mortgage if I just started a new job on a fixed term contract?

Yes, you can still get a mortgage if you’ve just started a new job on a fixed term contract. Lenders will want to see that your job is stable and that you earn enough money to pay back the mortgage. A mortgage broker can help you show this to lenders.

Is it possible to remortgage on a fixed term contract?

Yes, it’s possible to remortgage when you’re on a fixed term contract. Remortgaging means you get a new mortgage to replace your current one. This can be a good idea if you want to get a better deal. Lenders will look at your income and job history, just like when you got your first mortgage.

How do lenders view gaps in employment?

Lenders might be worried if you have long gaps in your employment because they want to be sure you’ll keep earning money. If you have gaps, it’s important to explain them.

Maybe you were studying or had a good reason for not working. A mortgage broker can help you explain your situation to lenders in the best way.

Using a mortgage broker can make getting a mortgage much easier if you work on a fixed term contract. They can guide you through the whole process and help answer any questions you have along the way.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.