- What Counts as Income for Mortgage Applications?

- What Is a Complex Income Mortgage?

- What Is Classed as Complex Income?

- Why Is It Difficult to Get a Complex Income Mortgage Product?

- Which Complex Income Qualifies for a Mortgage?

- Types of Income Not Typically Accepted by Lenders

- Can Rental Income Influence Your Mortgage Application?

- How Can You Get a Complex Income Mortgage?

- The Bottom Line

Complex Income Mortgages: A Definitive Guide

In the UK, income comes in many forms – from standard salaries to more unique sources.

And if you earn through non-traditional means, getting a mortgage might be tougher.

Lenders need assurance they can repay the loan, making the mortgage journey—from choosing the right lender to navigating paperwork and applications—potentially stressful.

Fortunately, you have this guide.

Here we’ll cover how various non-standard income types impact your mortgage approval. We’ll also provide practical tips to guide you through the process, ensuring you make well-informed decisions every step of the way.

What Counts as Income for Mortgage Applications?

For mortgage applications, lenders typically consider income as the regular money earned from employment. However, not everyone earns their income this way.

Some have “non-traditional” income, like business profits, rental income, or earnings from various jobs at different times, leading to irregular income flows.

Complex income refers to earnings from multiple sources or fluctuating incomes, complicating mortgage applications.

Lenders prefer stable income to ensure loan repayment. Those with complex incomes may need to take extra steps to prove their financial stability for a mortgage.

What Is a Complex Income Mortgage?

A complex income mortgage is for individuals who earn money through various sources, not solely from employment. This can include rental income, business ownership, multiple jobs, or working abroad, leading to inconsistent earnings.

Such income diversity can complicate mortgage applications, as lenders may find it challenging to predict future earnings and assess the risk of missed payments or fraud. Therefore, they often require additional documentation to verify income.

Successfully securing a mortgage with complex income involves presenting all income sources to the lender, potentially involving extra steps and the guidance of a mortgage adviser experienced in complex income scenarios.

What Is Classed as Complex Income?

Complex income is money beyond a regular paycheck. Here are some examples:

- Company Directors. They earn through dividends and salaries from their businesses.

- Freelancers. They work independently across various projects without a permanent employer.

- Contractors. They work on longer-term projects, differing from freelancers in project duration.

- Entrepreneurs. They generate income from their startups through sales, services, or investments.

- Expats. They earn money in foreign currencies due to working abroad.

- Gig Economy Workers. Performs short-term tasks or jobs, such as ride-sharing or food delivery.

Lenders find these income types complex because the money doesn’t come in a steady stream like a regular salary. It can go up and down, making it hard for lenders to know if you’ll always have enough to pay back a mortgage.

Why Is It Difficult to Get a Complex Income Mortgage Product?

Getting a mortgage with a complex income can be harder for a few reasons:

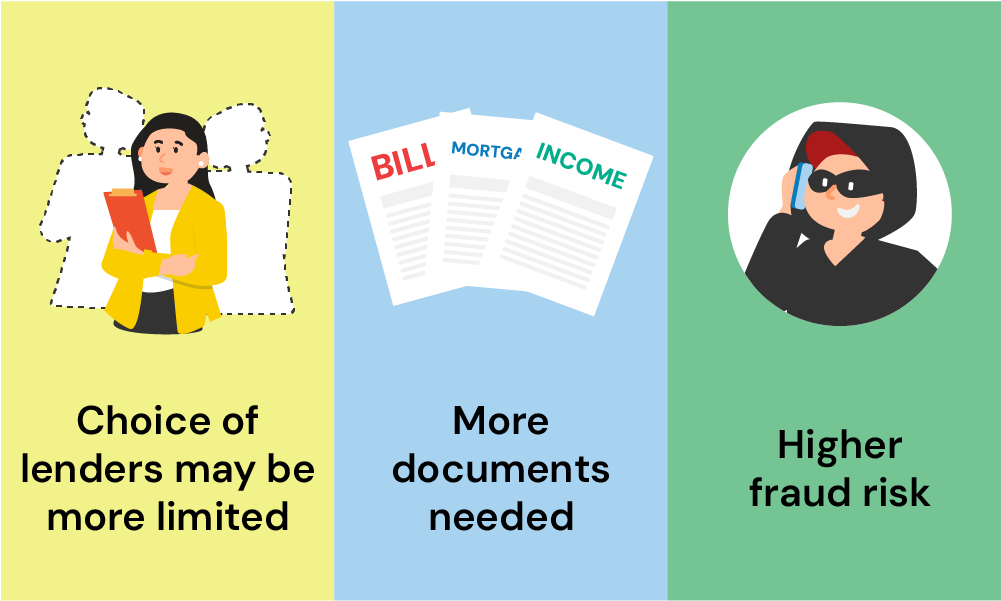

- Higher Risk for Lenders. If your income changes a lot, lenders might worry that you won’t be able to make your mortgage payments if you suddenly earn less.

- Administrative Burdens. It takes more work for lenders to check and understand complex income. They need to look at lots of different documents to see how much money you make.

- Fraud Risks. There’s a bigger chance someone might not tell the truth about how much they make if their income is complex. Lenders have to be very careful to check everything is right.

Because of these challenges, it’s important to show lenders that your income is reliable, even if it’s complex. You might need to give them more documents or records of your income.

It can also really help to talk to a mortgage broker who knows about complex income. They can give you advice and find lenders who are willing to give you a mortgage.

Which Complex Income Qualifies for a Mortgage?

Traditionally, mortgage qualification revolves around steady, fixed income. Today, however, many individuals have diverse income streams.

Here’s a deeper dive into what counts:

Self-Employment

Being self-employed means your income might change more than someone with a fixed salary. Lenders often want to see a solid three years of income history, but some may accept less, showing flexibility for newer businesses.

Contract Work

Contractors work on specific tasks for a certain period. Your income from these jobs can help you get a mortgage, especially if you can show contracts showing ongoing work and your earnings.

Temporary and Zero-Hour Contracts

These jobs don’t guarantee a certain number of work hours each week, making it trickier to prove a steady income. Demonstrating a history of regular earnings through payslips or bank statements is crucial.

Investment and Dividend Income

Money earned from investments or as a company director also counts. Lenders will need to see proof that these earnings will continue, like investment account statements or records of dividend payments.

Apprenticeships and Bursaries

Although usually lower, income from apprenticeships or educational bursaries is considered. In some cases, having a guarantor or looking into shared ownership can make it easier to qualify for a mortgage.

Government Benefits and Maintenance Payments

Certain government benefits and regular maintenance payments, like child support, can contribute to your mortgage eligibility. Reliable documentation is key to proving these income sources.

Types of Income Not Typically Accepted by Lenders

Sometimes, when you try to get a mortgage, there are certain types of money that lenders might not want to count.

Two common types are:

- Cash-in-Hand Salaries. This is when you get paid in cash instead of the money going directly into your bank account. Lenders often worry about this kind of income because it’s hard for them to check if it’s real and regular.

- Professional Gambling Incomes. Money made from gambling, even if you do it as a job, is usually not accepted. Lenders see it as too risky because it can go up and down a lot.

If you have money coming in from these or other unusual sources, it’s really important to tell your mortgage broker about all of them.

A broker can help you understand which types of income lenders will consider and how to show your income in the best way.

Can Rental Income Influence Your Mortgage Application?

Yes, rental income can positively impact your mortgage application. If you rent out a property, the income you earn can be included in your mortgage request. Lenders value this as it represents additional funds to cover loan repayments.

However, they’ll require evidence of consistent rental income, such as tenant contracts or bank statements showing regular payments. This helps verify your ability to afford the mortgage.

How Can You Get a Complex Income Mortgage?

Getting a mortgage when you make money in different ways can seem hard. But there are steps you can take to make it easier for lenders to say yes to your mortgage.

Here’s how you can make your complex income look good to them:

1. Organise Your Finances

First off, get your finances in a row.

Check your credit score through agencies like Experian, Equifax, and TransUnion. If you see any mistakes in your report, contact the Credit Reference Agency (CRA) to fix them.

Also, consider removing old financial ties like flatmates or ex-partners from your accounts. These links can affect your mortgage application.

You must also gather all important paperwork including:

- Business accounts for the last 2-3 years, if self-employed.

- Tax returns (SA302) for the last 2-3 years.

- Recent bank statements (last 3-6 months) for both personal and business accounts.

- Proof of Dividend Payments

- Current and past work contracts for contractors

- Documentation of other incomes (e.g., benefits, maintenance payments, pensions).

- Identification and proof of address (passport, utility bills).

Saving for a deposit is critical. Aim for 10-20% of the property value to improve mortgage terms.

To boost your deposit, you can open a high-interest savings account, increase your income (if possible), cut back on non-essential spending, and possibly use a Lifetime ISA to get a government boost on your savings.

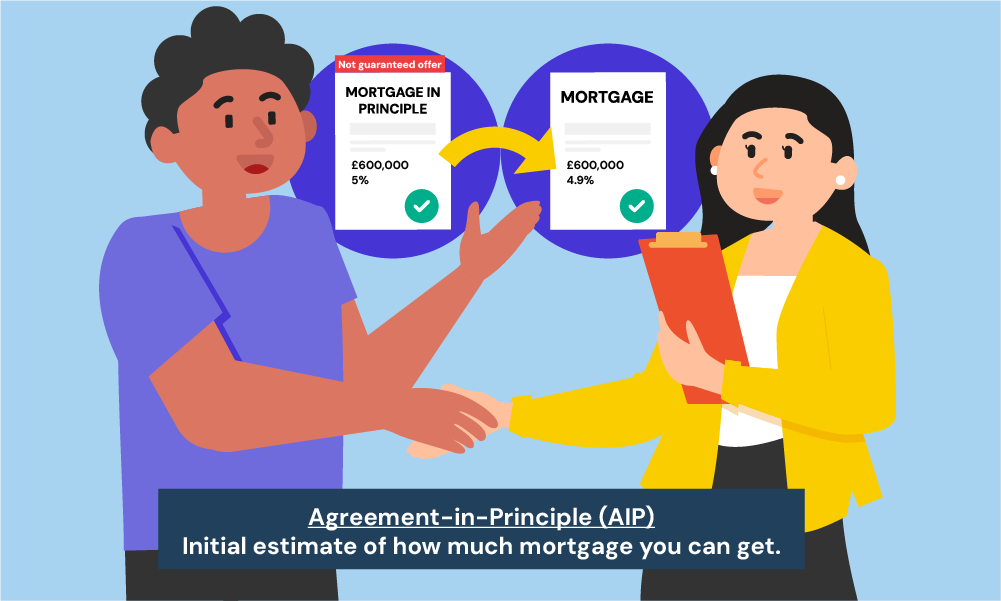

2. Secure an Agreement in Principle (AIP)

An AIP gives you a rough idea of how much you can borrow and adds credibility to your house search.

Although not mandatory, it’s beneficial for budgeting and showing sellers your intent.

You can get an AIP from banks or via a mortgage broker, but watch out for any that require a hard credit check, as this could impact your credit score.

3. Begin House Hunting

With your AIP in hand, start looking for the perfect home within your budget.

Take your time to find a place that meets your needs, and once you find it, make your offer through the estate agent.

4. Apply for a Mortgage

After your offer is accepted, proceed with the mortgage application, either directly with a lender or through a broker.

A property survey will be necessary to assess its value and condition.

This step usually takes between 4-6 weeks, after which you’ll receive your mortgage offer to review and accept.

5. Complete the Purchase

Engage a solicitor or conveyancer to handle the legal aspects of the purchase, including land registration and contract exchange.

Once contracts are exchanged, the commitment to buy and pay the mortgage is binding.

Note: Borrowing against your home carries risks, and failing to keep up with repayments could mean losing your property.

The Bottom Line

Speaking with a specialist mortgage broker simplifies the process with complex income. They understand which lenders are open to your kind of income and can negotiate effectively on your behalf.

Brokers can also guide you towards the best mortgage deals, knowing the ins and outs of various rates and terms.

To save yourself from endless research for the right broker, send us an enquiry. We’ll set up a free, no-obligation consultation with a trustworthy mortgage broker to guide you in your mortgage application.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What should I do if I make money from dividends?

Show clear records of these dividends, like your tax returns or company accounts, to prove this income to lenders.

How can I get a mortgage if my income goes up and down?

Keep detailed records and use a good broker who can explain your situation to lenders in a way they understand.

Is it harder to get a mortgage if I earn in a foreign currency?

It can be, but with the right documents and a specialist broker, you can show lenders that your income is reliable.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.