- What Is an IT Contractor Mortgage?

- Can IT Contractors Qualify for Mortgages?

- How Do Lenders View IT Contractor Income?

- What Are the Borrowing Criteria for IT Contractors?

- How Much Can IT Contractors Borrow?

- How Does IR35 Legislation Affect IT Contractor Mortgages?

- Which Lenders Offer the Best Mortgages for IT Contractors?

- Preparing for a Mortgage Application as an IT Contractor

- The Bottom Line

A Guide to Buying a Home with IT Contractor Mortgages

Are you struggling to buy a home as an IT contractor?

Traditional mortgage lenders often overlook the unique financial situations of IT professionals, making it hard for you to prove your income stability.

This is because your job doesn’t fit into the neat little boxes most banks use to assess borrowers.

That’s why in this guide, we’ll walk you through the process of getting an IT contractor mortgage to help make an informed decision in your home-buying journey.

Let’s get started!

What Is an IT Contractor Mortgage?

Contrary to the term, ‘IT contractor mortgages‘ aren’t specific loan products solely for IT professionals. Instead, some lenders, like Halifax, Barclays, Nationwide, and Santander, offer contractor mortgages.

These mortgages cater to individuals with irregular income, like IT contractors, whose earnings may not arrive as fixed monthly salaries.

Traditional mortgages typically assess your stable monthly income from a salaried job. Contractor mortgages, on the other hand, focus on your overall earning potential.

They consider your contract history, earning power, and project value/duration to understand your income potential.

This means lenders will assess:

- Any income fluctuations that might vary based on project availability.

- Your full financial picture including any current or future contracts.

If you’re unsure whether a contractor mortgage is right for you, speak with a good mortgage advisor. They can help you compare different mortgage products, and guide you during the process and requirements.

To get started, simply get in touch with us. We’ll arrange a free, no-obligation chat with a trustworthy mortgage advisor to help with your mortgage situation.

Can IT Contractors Qualify for Mortgages?

Yes, IT contractors can qualify for mortgages.

Just like traditional salaried individuals, you can access financing to purchase your dream home.

Lenders understand that your income structure differs from regular salaries, but they see the value and stability in the IT sector.

How Do Lenders View IT Contractor Income?

When lenders look at your income, they consider your day rates and contract terms.

A day rate is how much you get paid each day you work. Having a long contract term is a good sign as this means you have a steady job and reliable income.

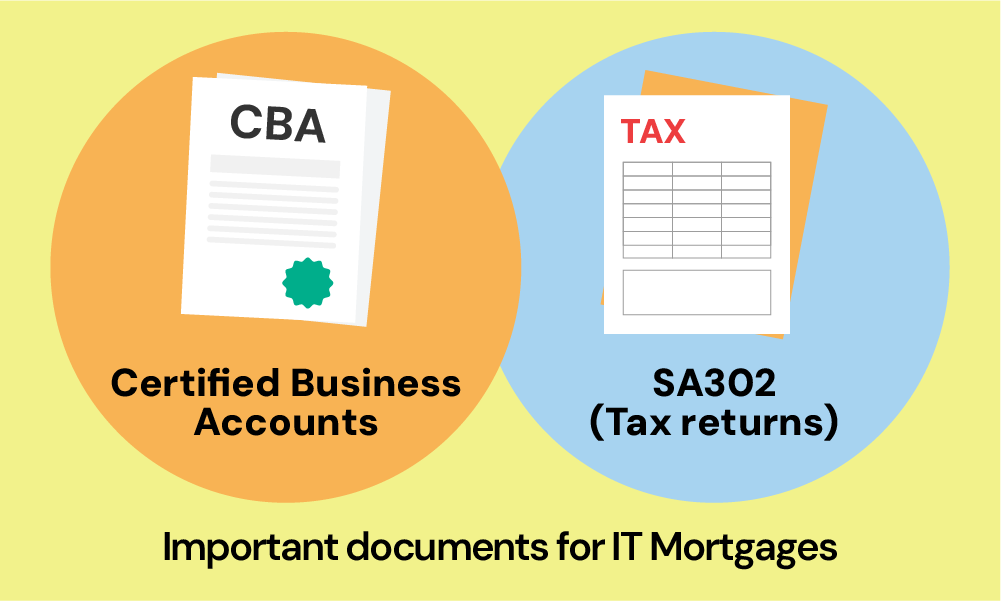

Moreover, lenders will check your certified accounts and SA302s or tax returns.

Certified accounts are official records of your business income, prepared by an accountant.

An SA302 is a form from the tax office that shows your income and the tax you’ve paid. These documents prove how much money you make.

They help lenders understand your income better, especially because you don’t get paid the same way people with regular jobs do.

What Are the Borrowing Criteria for IT Contractors?

If you’re an IT contractor looking to get a mortgage, there are a few important things lenders look at.

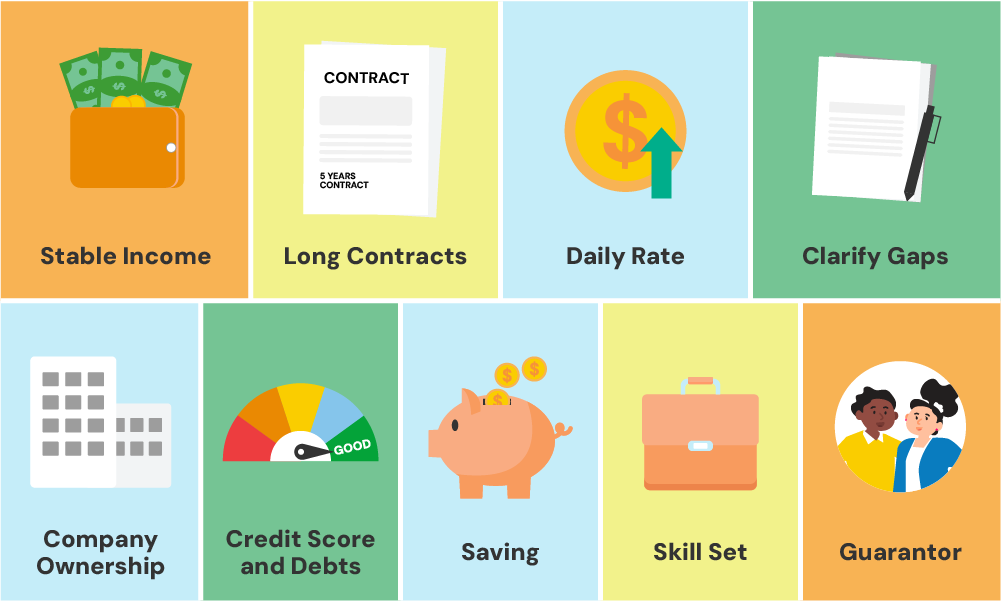

- Income Stability – Lenders want to see that you earn enough money consistently. They usually look for a yearly income of at least £50,000 to £75,000. They also like to see that you’ve been working as an IT contractor for at least two years. If you’re new to contracting, some lenders might still consider you, but you’ll have fewer options.

- Contract Length – Your current and future contracts matter. Lenders prefer contracts that last for at least three to twenty-four months. If your contract is about to end, showing you have a renewal can help your application.

- Day Rate – Lenders look at your daily earnings, typically wanting to see a minimum day rate of £250. This shows them you have a stable financial situation.

- Income Gaps – If you’ve had breaks in work over the past year, lenders usually allow for six to twelve weeks of gaps. It’s important to explain these gaps to show you still have reliable income.

- Company Ownership – If you run your own limited company, some lenders want you to own 100% of it. This shows you have full control over your income.

- Loan Details – The loan-to-value ratio (LTV) and the total loan amount you can get vary by lender. Often, LTV ranges from 80% to 95%, and the maximum loan might be capped at £250,000 for IT contractors.

- Credit Score and Debts – A good credit score and a low debt-to-income ratio, below 50%, are important. They show you can manage your debts well.

- Savings – Having savings or investments proves you can cover unexpected costs without defaulting on your mortgage.

- Qualifications – Any special qualifications or skills you have make your application stronger, showing you’re in demand.

- Guarantor – Sometimes, having a guarantor can make your application more appealing. This is someone who agrees to cover your payments if you can’t.

Note that this is just a general overview. Specific criteria might vary depending on the lender and your circumstances. Always consult a mortgage advisor for personalised advice.

How Much Can IT Contractors Borrow?

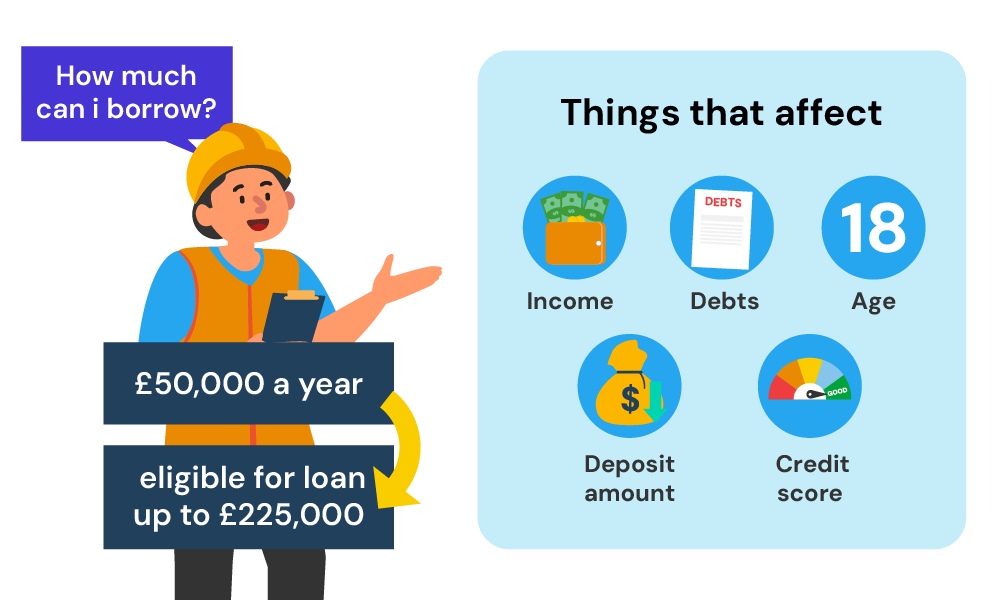

In the UK, lenders use income multiples to figure this out. This means they take the annual income each year and multiply it by a certain number to decide how much they’ll lend you.

For IT contractors, lenders will look at your average income. They often use a multiple of 4 to 5 times your yearly income. So, if you make £50,000 a year, you could potentially borrow between £200,000 and £250,000.

However, it’s not just about your income. Lenders also consider other factors like your credit score, deposit size, debts, and regular spending.

How Does IR35 Legislation Affect IT Contractor Mortgages?

IR35 is a tax rule that can change how much tax you pay if you’re an IT contractor. It checks if you’re self-employed or a salaried employee who doesn’t have the usual benefits.

This is important for your mortgage because it can affect your borrowing options. If IR35 includes you, lenders might see your income in a different light, which could make getting a mortgage a bit more tricky.

If you’re dealing with IR35, you should get ready before you apply for a mortgage. It’s a good idea to be able to explain how you work and how you earn your money.

Luckily, some lenders understand the special situation of contractors and how IR35 works. That’s why it’s important to choose the right lender.

Which Lenders Offer the Best Mortgages for IT Contractors?

As an IT contractor, you must understand that not all banks are ready to lend to you.

But, in the digital age nowadays, some banks are more open to lending to contractors, especially in your profession.

Here are some banks offering contractor mortgages:

- Halifax

- Barclays

- Nationwide

- Santander

Picking the right lender depends on your financial situation and goals. Make sure to prepare and check with your bank the right requirements before you apply.

Preparing for a Mortgage Application as an IT Contractor

It’s important to have the right documentation and information before applying for a mortgage. Here’s what you need:

- At least two to three years of business accounts prepared by an accountant

- At least two to three years of tax Returns (SA302)

- Bank statements for both your personal and business accounts (3-6 months).

- Proof of Dividend Payments

- Current and past work contracts for contractors

- Recent investment statements showing value and returns

- Other documentation for other Incomes such as letters or statements for any government benefits, maintenance payments, or pension contributions you receive.

- Proof of identification and address like a passport and utility bills.

To boost your chances of approval:

- Keep Contracts Consistent. Try to have ongoing contracts or ones lined up. This shows lenders you have steady work.

- Save a Larger Deposit. If possible, a bigger deposit can make you look less risky to lenders.

The Bottom Line

As an IT contractor, finding a mortgage that fits your unique way of working can be tough. It’s not always easy to show banks and lenders how stable and profitable your job is.

This is where the help of a specialised mortgage broker can make a difference. They understand the challenges you face and know which lenders are more likely to offer you a good mortgage deal.

Getting advice from a broker who knows all about IT contractor mortgages can save you a lot of time and stress. They can guide you through the process, help you gather the right documents, and find a mortgage that suits your needs and income pattern.

If you’re not sure where to start looking for the right broker, we can help. Get in touch with us, and we’ll connect you with a reliable broker.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can IT contractors secure buy-to-let mortgages?

Yes, IT contractors can get buy-to-let mortgages. The key is proving your income can cover the mortgage payments, especially from your contracting work. Some lenders are more flexible with contractors.

How do income gaps affect mortgage eligibility?

Income gaps can be a concern for lenders because they suggest your income might not be stable. To reduce this, show evidence of your overall income stability over the years, or explain how you manage gaps financially.

What are the options for IT contractors with less than two years of trading history?

If you’ve been contracting for less than two years, don’t worry. Some lenders will still consider you if you have a strong day rate, a good deposit, or if you’re moving from a permanent role in the same industry to contracting. Showing potential for consistent contracts can also help.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.