- Can You Secure a Mortgage on Benefits?

- What Types of Benefits Count Towards Mortgage Applications?

- How to Maximise Your Chances of Getting a Mortgage on Benefits?

- How Much Can You Borrow?

- Government Schemes Supporting Mortgage Applications on Benefits

- What If Your Situation Changes After Getting a Mortgage?

- The Bottom Line

A Complete Guide To Mortgages on Benefits

Worried you can’t get a mortgage because you’re on benefits?

It’s common to feel unsure, especially if you’re concerned about lenders not accepting benefit income, your credit history, or if you can use government schemes.

This feeling of being stuck with “what if” questions is tough.

But, our guide is here to help. We’ll show you the steps to apply for a mortgage when benefits make up part or all of your income.

Let’s dive into your options.

Can You Secure a Mortgage on Benefits?

Yes, you can get a mortgage on benefits in the UK. The approval process may differ, focusing on your ability to make regular payments.

The duration you’ve been receiving benefits and the type of benefits significantly influence lenders’ decisions.

Benefits like Disability Living Allowance received over a long term, are particularly favourable to lenders.

Having a job as well as benefits can help your chances of getting a mortgage. This combination signals financial stability to lenders.

On the other hand, Without employment, relying solely on benefits, you may encounter difficulties. Lenders see this as a higher risk due to the absence of job-related income.

What Types of Benefits Count Towards Mortgage Applications?

When applying for a mortgage, various types of benefits may be considered as part of your income.

Lenders often accept:

- Universal Credit

- Disability Living Allowance (DLA)

- Personal Independence Payment (PIP)

- Child Benefit

- Income Support

- Jobseeker’s Allowance (JSA)

- Employment and Support Allowance (ESA)

- Pension Credits

- Personal Independence Payments (PIP)

- Attendance allowance

- Carers Allowance

- Child Tax Credit

- Incapacity Benefit

- Industrial Industries Benefit (IIB)

- Maternity Allowance

- Severe Disablement Allowance

- Widow’s Pension

If you’re considering a mortgage and receiving Universal Credit, it’s important to be aware that the portion intended for housing expenses will not contribute to your mortgage application assessment.

This is because the housing support ends once you buy a home. Understanding this will help you accurately assess your eligible income for a mortgage.

Also, please note this list is not exhaustive. Acceptance of these benefits can vary between lenders.

Some benefits might not fit the bill for every lender, showing why it’s super important to check if your income matches what they’re looking for.

If you’re feeling a bit lost in all this, talking to a mortgage broker could be a big help. They’re experts at understanding what different lenders are looking for and can help you based on what benefits you’re getting.

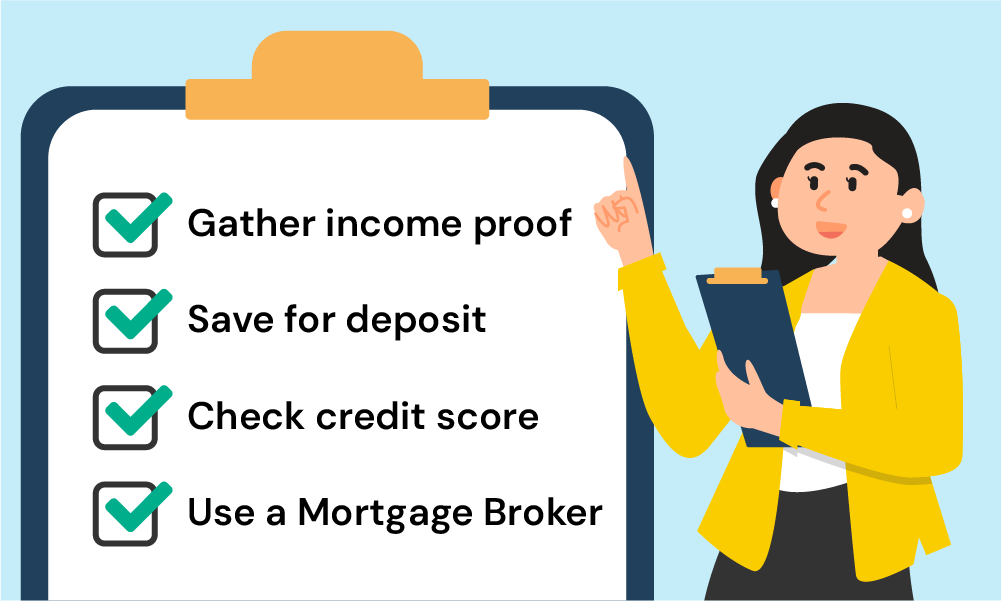

How to Maximise Your Chances of Getting a Mortgage on Benefits?

To increase your mortgage chances while on benefits in the UK, it’s key to approach your application with care and preparation.

Here’s how you can make your mortgage application stronger and more attractive to lenders:

Document All Your Income Sources Clearly

Document every bit of your income, not only your benefits but also any earnings from part-time jobs, freelance work, or other sources. Include details like how much you earn, how often, and for how long.

Keep handy your payslips, official income confirmations, and bank statements as evidence.

You can create a folder, either digital or physical, where you keep all your financial documents organised and up to date.

Missing some paperwork? No problem. A skilled mortgage broker can guide you in filling in these blanks.

Plan Your Budget and Increase Your Deposit

Crafting a detailed budget is crucial, particularly if you’re working with a limited income. It helps pinpoint where you can reduce expenses, perhaps cancelling subscriptions you no longer use.

Saving might seem challenging, but every penny saved is a step closer to mortgage approval.

Here are some practical ways to save:

- Open a Savings Account. Start a separate savings account for your mortgage deposit. Choose an account with a competitive interest rate to grow your savings faster.

- Increase Your Income. If possible, take on additional work. Extra earnings can significantly boost your deposit savings.

- Cut Back on Extras. Reduce spending on non-essentials like luxury items and dining out. Redirect these funds to your savings.

- Use a Lifetime ISA. For first-time buyers, a Lifetime ISA offers a 25% government bonus on savings up to a certain limit, enhancing your deposit.

Improve and Monitor Your Credit Score

Stay on top of your credit by ensuring all bills and debts are paid promptly. Regularly check your credit report for errors and get them corrected to boost your credit score.

In the UK, you can access your credit reports for free from major credit reference agencies.

Should you find inaccuracies, promptly contact the relevant Credit Reference Agency to rectify them.

Also, remove any outdated financial connections, such as those with former flatmates or ex-partners, from your accounts as these could influence your mortgage application negatively.

Consult With a Specialised Mortgage Broker

Engaging with a mortgage broker who has experience in helping those on benefits can be immensely beneficial.

They offer access to a broader range of lenders and can expertly match you with a lender that suits your situation. Their advice can be pivotal in optimising your application.

Looking for a broker? Simply send us an inquiry. We’ll connect you with one of our vetted mortgage brokers, free of charge and without obligation.

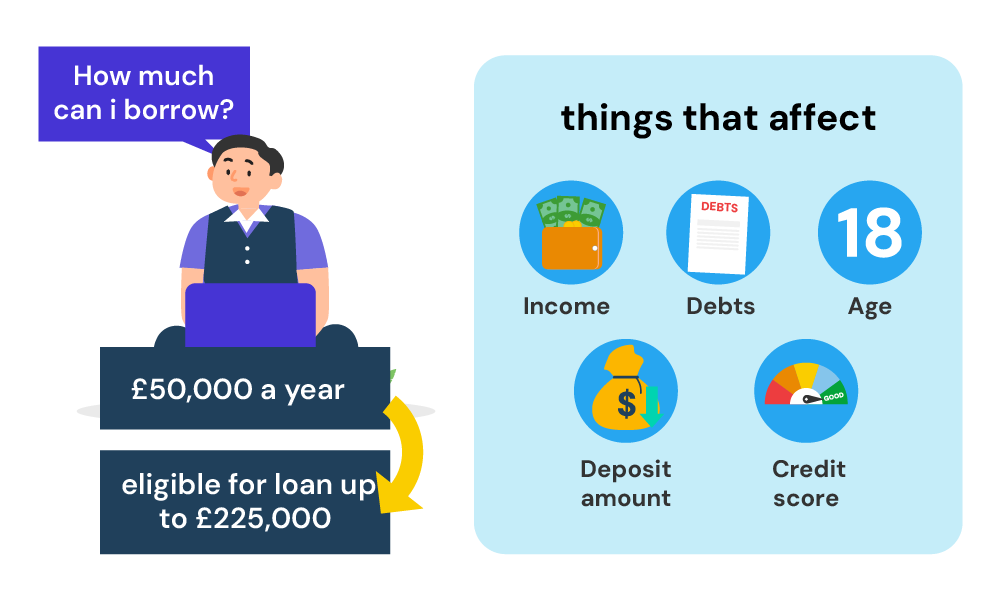

How Much Can You Borrow?

The amount you can borrow when applying for a mortgage on benefits depends on several factors.

Lenders use a combination of your total income, including benefit income, and apply an income multiple to determine the maximum loan amount.

This multiple can vary but typically ranges from 3 to 4.5 times your annual income.

For example, if your total income is £20,000 a year, a lender using a multiple of 4 could potentially offer you a mortgage up to £80,000.

However, your deposit size also plays a crucial role. The larger your deposit, the less you need to borrow, and the more likely you are to be approved for a mortgage.

A substantial deposit can also help you secure a lower interest rate, reducing your monthly repayments.

Remember, lenders also take into account your ability to repay the mortgage, considering your other monthly expenses and financial commitments.

It’s essential to realistically assess how much you can afford to borrow without stretching your finances too thin.

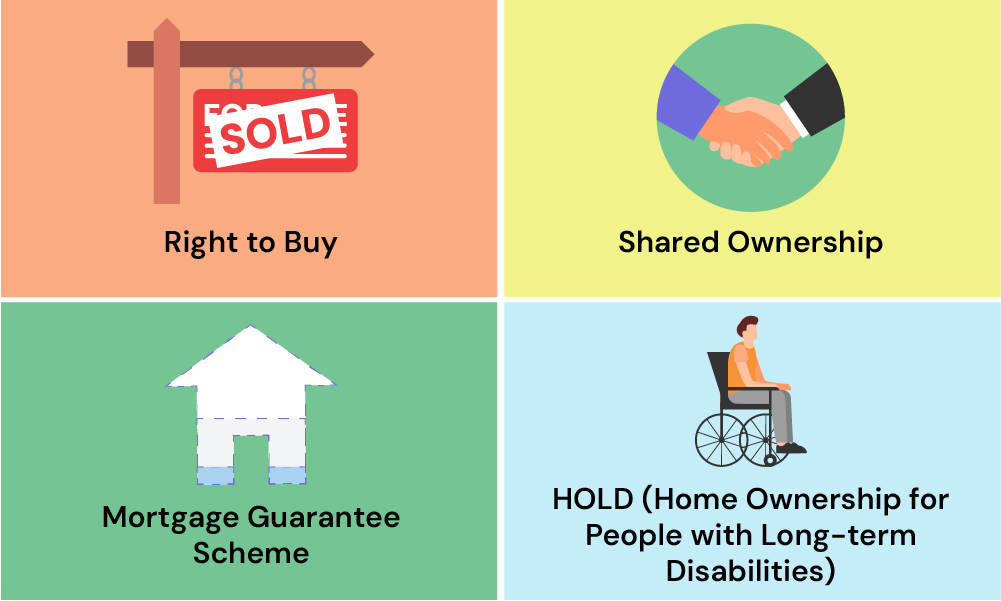

Government Schemes Supporting Mortgage Applications on Benefits

The UK government offers help to people on benefits who want to buy their own home. These schemes are especially good for those with lower incomes, making it easier and more affordable to own a home.

- Right to Buy. If you’ve lived in a council house for a long time, this scheme could let you buy your home at a lower price. It’s a good option for long-term public sector tenants.

- Shared Ownership. This lets you buy part of your home (between 25% and 75%) and pay rent on the rest. It’s for people who don’t own a home yet and includes those on benefits. Remember, when calculating if you can afford this, most lenders won’t count your benefits as income.

- Mortgage Guarantee Scheme. For those who can manage a 5% deposit, this scheme helps you get a mortgage for up to 95% of the house price. It’s designed to make lenders more willing to offer mortgages to people with smaller deposits. This scheme is only around until 30 June 2025.

- HOLD (Home Ownership for People with Long-term Disabilities. This is like Shared Ownership but for people with long-term disabilities. It gives you a way to own part of your home, helping overcome some of the extra challenges disabled people might face in the housing market.

These schemes can make the dream of owning a home more achievable if you’re on benefits. If you’re interested and need more information, talking to a mortgage broker can be very helpful.

What If Your Situation Changes After Getting a Mortgage?

If you start receiving benefits such as Universal Credit, Income Support, Jobseeker’s Allowance, or Pension Credit after you’ve taken out a mortgage, you might be eligible for the Support for Mortgage Interest (SMI) scheme.

This scheme offers financial support by paying a portion of your mortgage interest directly to your lender, easing your financial burden during tough times. The assistance kicks in after a waiting period, which varies depending on the type of benefit you receive.

It’s crucial to inform your lender as soon as there’s a change in your financial situation. Lenders usually have policies in place to assist borrowers who encounter financial difficulties.

They may offer options to modify your payment plan or temporarily reduce your payments, helping you to manage your mortgage more effectively.

If you’re considering remortgaging while receiving benefits, getting advice from a remortgage broker can be very beneficial.

They can help you navigate the process and ensure you find the best possible terms for your situation.

This step becomes particularly important if changes in your finances could affect your current mortgage agreement.

The Bottom Line

Securing a mortgage while on benefits is possible, but it requires careful planning and understanding of the lenders’ criteria.

That’s why consulting an experienced mortgage broker is important. They have the knowledge and expertise to guide you during the application process and give you wider access to more lenders for your situation. This can help you save time, stress, and potentially money.

Unsure where to start? Reach out to us. We’ll connect you with a reliable broker specialising in mortgage applicants receiving benefits.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Should I use a broker to compare lenders that accept benefit income?

Yes, using a broker can be very beneficial when you’re looking for lenders that accept benefit income. Brokers have extensive knowledge of the market and can guide you to lenders suited to your specific circumstances.

They understand which lenders are more likely to consider your application positively, saving you time and increasing your chances of approval.

Are there laws against discrimination when applying for a mortgage as a disabled person?

Under the Equality Act, it’s illegal for mortgage lenders to discriminate against disabled individuals. This law makes sure that disabled people can access the mortgage process just like anyone else.

For example, lenders must ensure their buildings are accessible, provide information in formats like Braille or large print, offer help with forms if needed, and allow information to be submitted in various ways, such as email or phone, to accommodate those who might find it difficult to visit in person.

Can I get a mortgage even with bad credit and benefits?

Yes, obtaining a mortgage while on benefits and with bad credit is challenging but achievable.

Different lenders have different views on what counts as bad credit.

It’s important to understand a lender’s requirements before applying because getting turned down can affect your credit score even more.

Remember, a previous credit problem doesn’t always stop you from getting a mortgage, especially if it was resolved more than six years ago.

Your income, job stability, and age will also influence lenders’ decisions. Sometimes, you might pay a higher interest rate because lenders see you as a higher risk.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.