- Can I Get A Mortgage with Low Income?

- How Much Can I Get with a Low Income?

- How Can I Improve My Mortgage Eligibility on a Low Income?

- How Much Deposit Should I Save for a Mortgage on Low Income?

- Where Should Your Deposit Come From?

- Is There A Minimum Income Required To Get a Mortgage?

- Can I Use My Assets as a Deposit for a Mortgage?

- Can You Secure a Mortgage on Benefits in the UK?

- The Bottom Line

How To Get a Mortgage on a Low Income: A Full Guide

Does the dream of homeownership feel out of reach because of your income?

The fear of rejection when applying for a mortgage can be immense, especially when you know your income might not match the typical picture.

But, there are ways to make it happen. It’s about knowing what options are out there and how to approach them.

This comprehensive guide will discuss everything you need to know about applying for a mortgage on a low income.

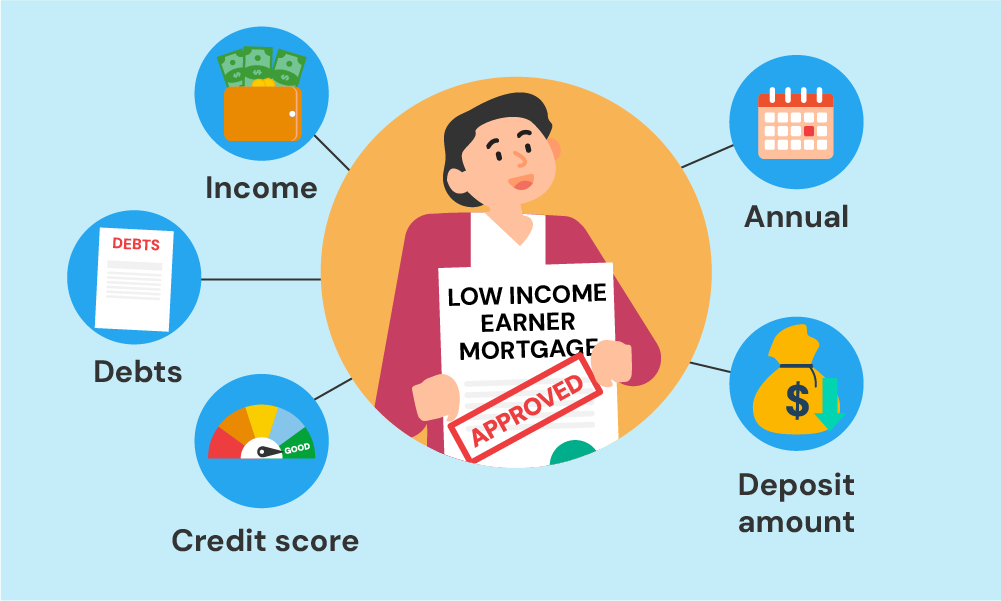

Can I Get A Mortgage with Low Income?

Yes, getting a mortgage on a low income is possible. Lenders look at more than just your annual income.

Important factors include the property’s value, your deposit size, credit rating, and any other assets you might have.

Generally, lenders don’t specify a minimum income requirement; instead, they assess each application based on its overall affordability.

While some lenders may have minimum income rules for certain borrower profiles, these are not uniform and vary widely.

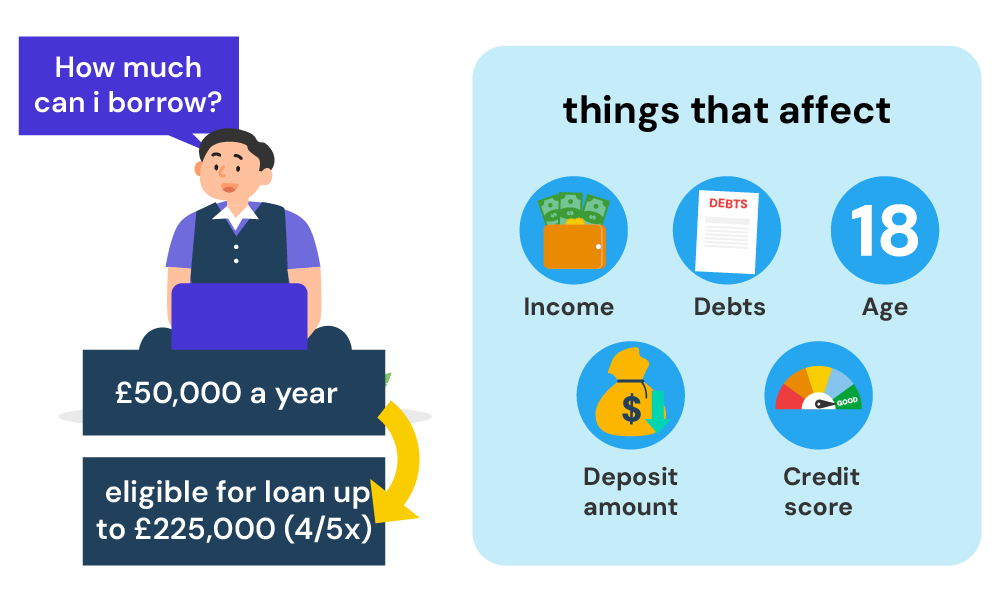

How Much Can I Get with a Low Income?

Lenders determine the amount you can borrow through ‘income multiples’. This approach involves multiplying your annual income to decide on a loan amount.

Typically, you could be eligible to borrow around 4 to 4.5 times your yearly income. For instance, with an annual income of £20,000, you might secure a mortgage between £80,000 and £90,000.

Basically, they might lend you a certain amount of money based on how much you make in a year. Often, they’re willing to lend you around 4 to 4.5 times your annual income.

So, if you earn £20,000 a year, you might be able to borrow between £80,000 and £90,000.

Your income isn’t the only thing lenders look at. They also care about factors like deposit size, and credit score.

A larger deposit shows your ability to save and manage finances effectively, making you a more attractive candidate for a mortgage. Similarly, a positive credit history indicates reliability in repaying debts.

Let’s look at different ways how you can increase your borrowing amount and mortgage chances.

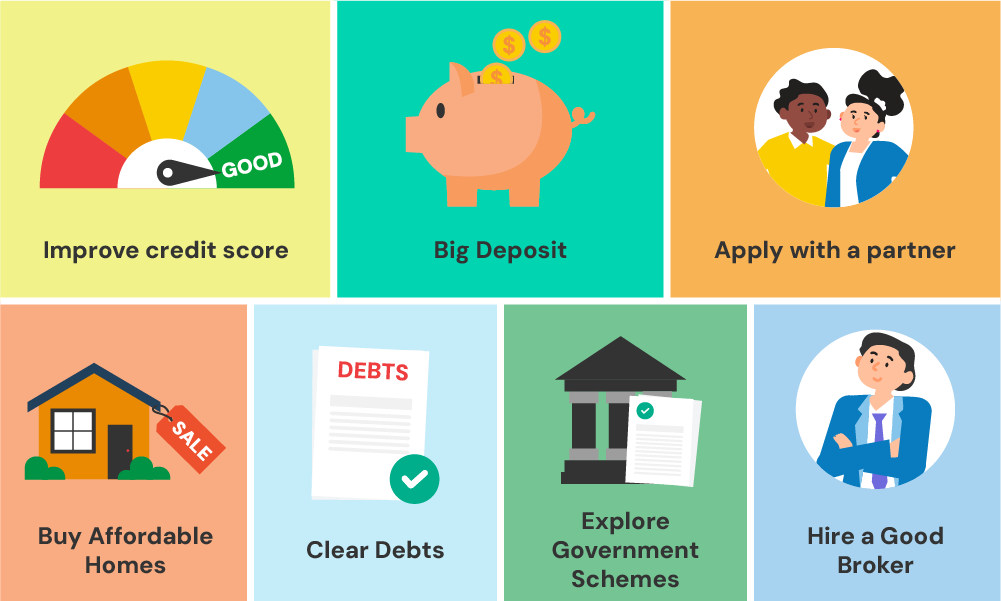

How Can I Improve My Mortgage Eligibility on a Low Income?

Here’s how to make lenders see you as a great choice:

Boost Your Credit Score

Your credit score is like your financial health report.

If you want to show lenders you’re responsible with money, it’s wise to have a good credit score. Start by downloading your credit reports from:

Then, check them carefully and dispute any errors, as even small mistakes can damage your score.

To boost your score, ensure you pay bills on time, use credit wisely, and avoid too much credit application before applying for a mortgage.

A strong score translates to better mortgage rates, saving you money in the long run.

Save for a bigger deposit

A larger deposit reduces the amount you need to borrow, making you less risky for lenders.

Start saving early, even if it means smaller, consistent amounts. The benefits of a bigger deposit can significantly improve your mortgage deal.

Here are some practical tips:

- Open a dedicated savings account. Choose one with a high-interest rate to make your money grow faster.

- Boost your income. If you’ve got the time and flexibility, consider earning extra. Every penny saved goes towards your deposit.

- Cut back on luxuries. Ditch expensive treats, eating out, and unused subscriptions. Put that money towards your goal.

- Consider a Lifetime ISA. The government tops up your savings by 25% (up to a limit) specifically for your first home purchase.

Consider a joint application

Partnering with someone who has a good income can strengthen your application. Combined incomes mean you may qualify for a larger loan, opening up more options.

Remember, this is a big decision, so ensure you’re both comfortable with the shared responsibility.

Focus on affordable properties

Opting for less expensive properties increases your chances of approval. While it might not be your dream home today, it’s a clever step towards your ultimate goal.

Reduce your debt

Pay off existing debts before applying. A lower debt-to-income ratio shows lenders you can comfortably manage monthly mortgage payments.

Explore government schemes

The UK offers schemes like the Mortgage Guarantee Scheme, Shared Ownership, and First Homes specifically designed to assist first-time buyers with lower incomes.

You can check out our guide to see if any align with your situation and homeownership goals.

Seek professional advice

Consult a mortgage broker. They can match you with suitable lenders, navigate the application process, and find a mortgage that fits your budget and income level.

Their expertise can be invaluable in securing the best mortgage for your needs.

How Much Deposit Should I Save for a Mortgage on Low Income?

Although there’s no fixed amount you must save, a larger deposit means you borrow less and get lower interest rates.

Ideally, saving a deposit of at least 10% to 20% of the home’s purchase price is recommended. The bigger your deposit, the less you’ll need to borrow, leading to lower interest rates.

This not only improves your chances of mortgage approval but also makes your loan more affordable.

Where Should Your Deposit Come From?

Lenders like to know where your deposit comes from. They usually accept:

- Money saved over time

- Inheritance

- Gifts from family

- Sale of property

Remember, lenders may not accept money from gambling or unregulated loans due to legal concerns. Always aim to have your deposit from a safe and legal source.

Saving a big deposit on a low income might take time, but it’s worth it for a better mortgage. Aim high, save steadily, and explore government help to increase your deposit size.

Is There A Minimum Income Required To Get a Mortgage?

Yes and no.

Most mortgage lenders don’t set a fixed minimum income you need to earn. They’re more interested in whether you can afford the mortgage based on your total financial situation.

This means they look at your income, outgoings, and your deposit size to decide if you can handle the loan.

However, some lenders do have income rules. For example, a few building societies might ask for at least £25,000 income for first-time buyers or £20,000 for retirees applying for a mortgage.

These rules make sure your income matches the mortgage you want, whether it’s just you or with someone else.

But, there are lenders with lower minimums, like Aldermore Bank starting at £10,000, and Tandem Bank at £12,500. The exact income you need can vary, with some lenders asking for between £15,000 and £25,000.

Knowing this helps you look for the right lender for your income. If all this sounds a bit much, a mortgage advisor can be a big help.

They know which lenders might say yes to your application, making it easier for you to find a good mortgage on a low income.

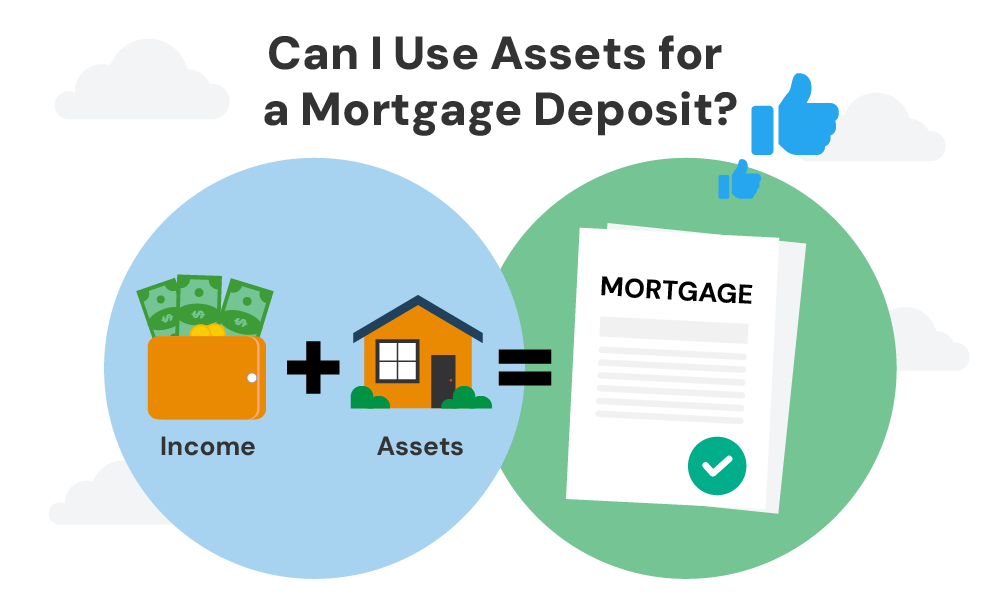

Can I Use My Assets as a Deposit for a Mortgage?

Yes, you can use your assets for deposit. This can certainly have a positive impact on your mortgage application.

While lenders mainly focus on your income to assess how much you can borrow, having significant assets can also be helpful.

These assets show your financial stability and potentially act as extra security or proof that you can make a larger deposit.

But, it’s important to note that the specific ways in which assets affect your eligibility and the deposit requirement will vary depending on the policies of different lenders.

Can You Secure a Mortgage on Benefits in the UK?

Buying a home on benefits in the UK is doable, but it comes with its own set of hurdles. While lenders can’t discriminate based on income source, they have different rules about accepting benefits, and not all benefits are treated equally.

Benefits can help your application, especially if your income is low. They can even be combined with schemes like Shared Ownership to make things more affordable.

However, not all lenders accept benefits, and some might exclude certain types altogether. This means your application might be scrutinised more if benefits are your main source of income.

For people with disability benefits, finding a lender might be a bit trickier, but it’s not impossible. Some assess the permanence of your benefits and your total income to decide affordability.

If you have a long-term disability, programs like the Home Ownership for People with Long-term Disabilities (HOLD) offer a rent-to-buy option that might suit your needs.

Accepted benefits might include:

- Personal Independence Payments

- Child Benefit

- Disability Living Allowance

- Universal Credit

- Jobseeker’s Allowance

However, how they are considered varies greatly between lenders. Hence, it’s important to choose the right lender.

A mortgage broker can be invaluable in this process. They know which lenders are more likely to accept your application based on your benefits and can guide you towards government schemes like First Homes or Shared Ownership.

Before applying:

- Gather all income details.

- Create a realistic budget.

- Save for a deposit.

- Consider improving your credit score.

The Bottom Line

This guide has shown you that even with a lower income, there are ways to become a homeowner.

Remember, your income isn’t the only factor affecting your mortgage chances. Your savings, credit history, and government schemes can also make a big difference.

However, it’s important to get expert advice tailored to your situation. Mortgage brokers can be invaluable helpers.

They can explain your options, and what you can realistically afford, and connect you with lenders who are more likely to approve you based on your income and circumstances.

Unsure where to start? Reach out to us. We’ll connect you with reliable mortgage brokers who specialise in helping people with low income find the best mortgage solution.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can low-income households get help buying a home?

Absolutely! The government offers several schemes to assist low-income families and individuals in buying their own homes. The Mortgage Guarantee Scheme is one such program, enabling you to purchase your home with just a 5% deposit.

Another option is Shared Ownership, which allows you to buy a portion of your home and rent the rest, making it more accessible to step onto the property ladder.

These programs are designed to lessen both upfront costs and monthly payments, helping bridge the gap to homeownership for those with lower incomes.

Is it possible to get a mortgage on an income of £20,000 per year in the UK?

Yes, getting a mortgage with an annual income of £20,000 in the UK is definitely within reach. The amount you can borrow is influenced by several factors beyond just your income.

Lenders consider your credit history, the size of your deposit, the presence of any additional income from a partner, and other aspects of your financial situation to assess your affordability.

What options are available if I can't afford my mortgage due to a lower income?

If you’re struggling with mortgage payments because your income has decreased, don’t worry, there’s support available. Changes in your financial situation, like job loss or reduced earnings, can make it tough to keep up with payments. It’s important to act quickly and seek advice.

Start by talking to your mortgage advisor or lender. They can discuss possible solutions with you, such as adjusting your payment plan.

Additionally, you might qualify for government programs designed to help homeowners in financial difficulty. These can offer temporary relief, helping you manage your payments during challenging times

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.