- Can You Use Pension Income to Qualify for a Mortgage?

- How Much Can You Borrow on Pension Income?

- What Types of Pensions are Accepted as Income?

- Does the Way You Access Your Pension Affect Mortgage Options?

- How to Secure a Mortgage on Pension Income?

- Which Lenders Accept Pension Income?

- Can I Use Pension Funds as Deposit?

- Can I Pay My Existing Mortgage with Pension Income?

- The Bottom Line

How To Get Mortgages On A Pension Income?

Strict mortgage rules for retirees can be frustrating.

Lenders can be particularly stringent about age limits, income requirements, and the consistency of your pension income.

That’s why knowing how the mortgage process is important. And for that, we got you covered.

This guide shows you how to use pension income to apply for a mortgage in the UK.

Ready?

Can You Use Pension Income to Qualify for a Mortgage?

You can qualify for a mortgage with pension income.

Lenders like pension income because it’s steady and predictable, making it easier for you to repay the mortgage.

More lenders are now considering pension income when deciding if you can afford a mortgage.

However, qualifying for a mortgage as an older borrower can be difficult. Many lenders have an upper age limit, typically 75 by the end of the mortgage term.

Some lenders are more flexible, offering mortgages to borrowers up to 85 and a few have no age limit at all.

To prove you can afford the mortgage, lenders will consider your pension income alongside any other income you have.

They will carefully check your finances to ensure your pension can support the mortgage repayments.

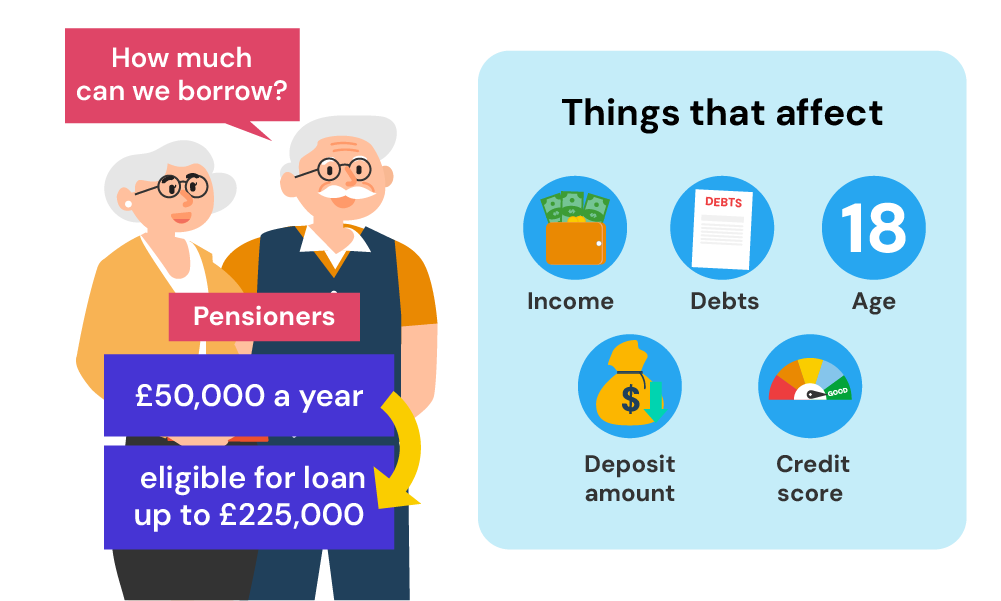

How Much Can You Borrow on Pension Income?

When it comes to borrowing on pension income, lenders have a straightforward approach.

They usually look at your annual pension income and apply a multiplier, often up to 4.5 times this amount, to determine how much you can borrow.

This calculation helps them ensure you can manage the mortgage repayments alongside your regular expenses.

To get an idea of how much you might be eligible to borrow, you can use a mortgage affordability calculator. By entering your total pension income, the calculator provides an estimate, giving you a starting point for your mortgage plans.

This tool is particularly useful for setting realistic expectations before diving deep into the mortgage application process.

[Embedded Mortgage Affordability Calculator]

What Types of Pensions are Accepted as Income?

Lenders are generally open to a variety of pension incomes when assessing your mortgage application. They include:

- State Pension – The regular payment you receive from the government once you reach retirement age.

- Private Pensions – Savings you’ve built up with a private pension provider, separate from the state pension or employer schemes.

- Employer Pensions – Pensions from your workplace, where both you and your employer contribute to your pension pot.

- Self-Invested Personal Pensions (SIPPs) – Flexible pensions that allow you to manage your investments.

- Stakeholder Pensions – Pensions with low charges and flexible contribution options.

- Widows Pensions – Benefits received upon the death of a spouse or civil partner.

- Armed Forces Pensions – Pensions for those who have served in the military.

- Disability Pensions – Benefits received due to disability, often coming with certain tax advantages.

Lenders evaluate each pension type based on its ability to provide a stable income, ensuring you can meet mortgage repayments.

But, criteria vary among lenders, so checking directly or consulting a mortgage broker is advisable. A broker can help you find lenders best matched to your pension income.

Does the Way You Access Your Pension Affect Mortgage Options?

Yes, the method you use to access your pension significantly affects your mortgage options.

Choosing between a lump sum and regular annuity payments can change how lenders view your application.

- Lump Sum Withdrawals. Using a lump sum from your pension as a deposit shows you can make a substantial initial payment. This is useful for interest-only mortgages, where, for example, withdrawing £100k from your pension could let you borrow about £25k

- Annuity Payments. Lenders prefer annuity payments for standard repayment mortgages because they provide a steady and predictable income, much like a regular salary.

- Defined Contribution Pensions. If you have this type of pension and are looking at an interest-only mortgage, your lump sum could be used to pay off the loan, giving you flexibility in loan management.

- Defined Benefits Pensions. These pensions offer a set income each month, which matches what lenders seek for stability in repayment mortgages.

Annuities with withdrawal restrictions might pose challenges for mortgage financing, as lenders typically want to see a consistent monthly income.

With today’s variety of pension schemes, you have many options. It’s important to understand how each choice fits into your overall financial plan and mortgage strategy.

Consulting a financial advisor or mortgage broker is key. They can guide you on using your pension effectively for a mortgage, helping you find the path that best fits your situation.

How to Secure a Mortgage on Pension Income?

Securing a mortgage with pension income starts with finding the right support.

A specialist mortgage broker experienced in pension-backed mortgages can be your best ally. They’ll guide you through every step, making sure you know what to do.

Here are the steps you can take to secure a mortgage:

Gather Your Documents

First things first, you need to get all your paperwork together. Here’s a detailed list of what you’ll need:

- Pension Statements. These show how much you’re getting from your pension. You’ll need statements from all your pension pots, including state, private, and employer pensions.

- Proof of Additional Income. If you have any other money coming in, like from part-time work, rental income, or investments, you’ll need proof. This could be bank statements, payslips, or rental agreements.

- Bank Statements. Lenders will want to see your recent bank statements to check your income and outgoings.

- ID and Address Proof. A valid passport or driving licence and recent utility bills or council tax statements will prove who you are and where you live.

- Credit History. You’ll need to show a clean bill of financial health, so have your credit report ready.

- Savings and Investments. If you’ve got savings or investments, including ISAs or stocks and shares, bring along your statements.

Having these documents ready makes the whole process smoother and shows lenders you’re serious and organised.

Optimise Your Credit

Check your credit file for free with Experian, Equifax, or TransUnion.

If you spot any errors, get them corrected. A higher credit score makes you more appealing to lenders, so try to clear any debts and keep credit card balances low.

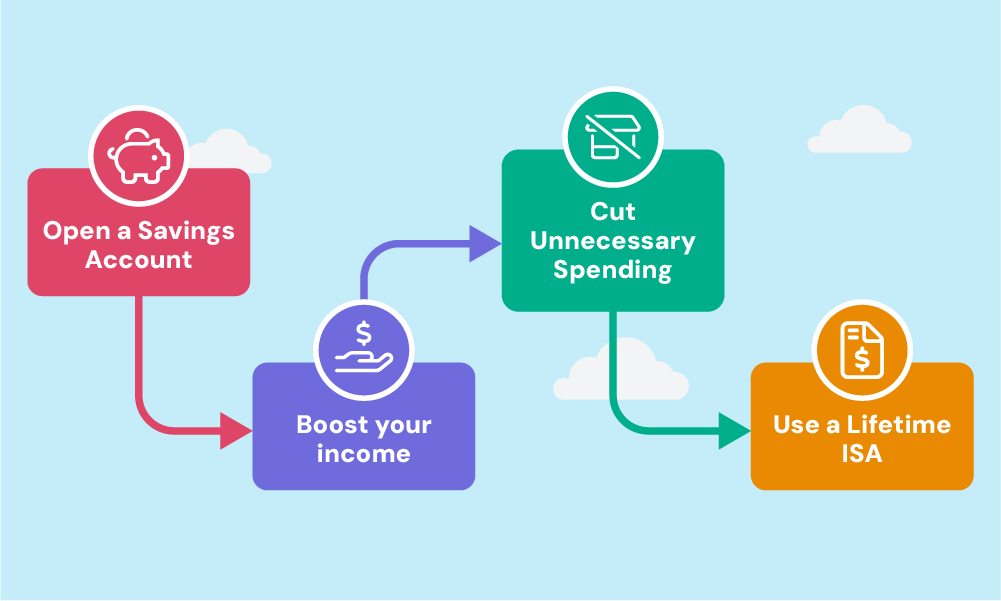

Boost Your Deposit

The bigger your deposit, the better. Usually, the best deals start at 10-20% of the home’s value.

Here’s how you can save up:

- Open a Savings Account. Choose one with a good interest rate to grow your deposit faster.

- Increase Your Income. If possible, take on extra work. Every bit helps increase your savings.

- Cut Back on Extras. Reduce spending on non-essentials and funnel those savings into your deposit account.

- Lifetime ISA. This is a great option for first-time buyers. You save money, and the government adds a 25% bonus on top.

Which Lenders Accept Pension Income?

Many UK lenders accept pension income when you apply for a mortgage.

High street banks like HSBC, Santander, Nationwide, and NatWest, as well as specialist lenders such as Pepper and Scottish Building Society, all consider pension income.

They look at how much you get from your pension to decide if you can afford a mortgage. Each lender has its own rules:

- Income Requirements. Some lenders need you to earn a minimum amount, but others focus on whether you can afford the mortgage payments with your pension income. This means more pensioners can find a mortgage that fits their situation.

- Age Limits. Lenders differ in their age limits for giving out mortgages. Some offer mortgages to people up to 85 years old, and a few have no age limit at all, as long as you meet their other requirements.

Because the rules can be complex, it’s a good idea to work with a mortgage broker.

They know the market well and can tell you which lenders are most likely to give you a mortgage based on your pension.

Can I Use Pension Funds as Deposit?

You can indeed use a lump sum from your defined contribution pension as a house deposit.

When you’re over 55, you’re allowed to withdraw 25% of your pension tax-free for any reason, including buying a property. This option can provide a substantial boost to your deposit, potentially improving your mortgage terms.

But, remember that taking out a large portion of your pension early might impact your retirement funds.

It’s less about the immediate benefits and more about how this decision fits into your long-term financial planning.

Before proceeding, consider speaking with a mortgage advisor to explore all possible options and understand the implications fully.

Can I Pay My Existing Mortgage with Pension Income?

Yes, you can. In fact, using your pension to clear an existing mortgage is another strategy.

Accessing the 25% tax-free lump sum from your pension can provide the necessary funds to pay off your mortgage, possibly even before you retire.

This move can offer financial relief and peace of mind. Yet, tapping into your pension early comes with its own set of risks and considerations.

The benefits need to be weighed against potential downsides, like reducing your available retirement funds

If you need guidance on how to best use your pension for property investments or mortgage payments, seeking advice from a mortgage advisor is highly recommended.

The Bottom Line

Securing a mortgage with pension income is entirely possible with the right approach and expert guidance.

Whether you’re looking at buying a new home or investing in buy-to-let properties, understanding your mortgage options is key.

Working with a mortgage broker who specialises in pension income mortgages can make a world of difference.

These brokers understand the unique challenges and opportunities that come with using pension income to secure a mortgage.

They have the expertise to navigate the market, find lenders who are receptive to pension incomes, and negotiate terms that suit your financial situation.

Ready to find the perfect mortgage? Don’t go it alone.

Get in touch with us today. We’ll match you with a broker who’s experienced in securing mortgages for clients with pension incomes. This way, you can streamline your search, save time, and reduce stress.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a buy-to-let mortgage on pension income?

Yes. Lenders look at whether your pension and any other income can cover mortgage payments. They consider several factors:

- Income and Affordability. Your pension should comfortably cover the mortgage, along with any other income.

- Rental Income vs Mortgage Payments. Expected rental income must exceed mortgage payments by a certain percentage, usually 125%–145%.

- Borrower’s Age. There are age limits, but these vary by lender.

- Credit History. A solid credit history is essential.

- Deposit Amount. Expect to need a larger deposit, typically around 25% of the property’s value.

- Property Type and Loan-to-Value Ratio. The type of property and the loan amount compared to the property’s value affect approval.

Meeting these criteria helps ensure you can manage the investment over time.

Can I use using SIPPs for property investments?

Using Self-Invested Personal Pensions (SIPPs) for property investments comes with specific rules:

- You can buy commercial property, like offices or shops, with your SIPP.

- You cannot buy residential property, like houses or flats, to live in with your SIPP. If you do, you could face a high tax penalty of up to 55% on the investment.

- Even if you buy commercial property, you cannot convert it to residential use and live there. If you do, you must sell the property before moving in to avoid penalties.

These rules are in place to make sure that SIPPs are used for retirement savings and not for personal benefit.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.