- What Is Stipend Income?

- Can a PhD Student Get a Mortgage?

- Do You Need Someone Else to Apply With You?

- What Documentation Should I Prepare for a Stipend Mortgage?

- How Much Can You Borrow with a Stipend Mortgage?

- What Deposit Is Required for a Stipend Mortgage?

- Are PhD Students Eligible for First-Time Buyer Mortgages?

- How Do Student Loans and Other Debts Affect Stipend Mortgages?

- Can You Apply for a Stipend Mortgage with a Partner Also on Stipend?

- The Bottom Line

Stipend Mortgage: Can You Buy a Home as a PhD Student?

Getting a mortgage while you’re doing a PhD can seem as tricky as cracking a tough equation.

The main hurdle?

Most lenders aren’t familiar with stipend income and might worry about its reliability since it doesn’t grow like a regular salary. They might also question how long you’ll receive it.

The good news: with some preparation, you can still get a mortgage.

This guide will explain how stipend income affects mortgages and help you achieve your dream of homeownership.

What Is Stipend Income?

Stipend income isn’t your regular paycheck from a 9-to-5 job.

Instead, it’s a set amount of money you receive regularly to help you focus on your studies, research, or training without the need to work full-time.

Whether you’re diving into a PhD program, an internship, or a fellowship, a stipend is there to cover your basics like food, travel, phone bills, and rent.

It’s not just for students, though. Clergy members, charity workers, and others in similar roles often receive stipends too.

Can a PhD Student Get a Mortgage?

Yes, getting a mortgage as a PhD student is possible, though you might have to jump through a few extra hoops.

Since stipend income isn’t the same as a regular salary, some banks might be a bit wary. But don’t worry, there’s a way around this.

A key point for lenders is your future income potential.

For example, if you’re doing a PhD in a high-demand field like engineering, teaching, or accounting these areas are known for their strong earning potential.

Make sure you highlight if you’ve already secured a role in such fields after your studies, or if your research area has a solid track record of leading to high-paying jobs.

This reassures lenders that your income will grow, making you a safer bet for a mortgage.

A stipend mortgage is made just for situations like yours. It’s for people who get their income from academic grants or research stipends, not from a typical 9-to-5 job.

The reality is, that while some banks might be sceptical about stipend income, there are lenders out there who appreciate its value.

This is where a mortgage broker becomes your best ally. They’re good at finding lenders who are happy to work with PhD students. They know exactly how to show lenders that you’re a safe bet, even with a stipend.

Do You Need Someone Else to Apply With You?

It’s not a must to apply with someone else, but it can sometimes work in your favour.

If your main income is from a stipend, teaming up with someone else for your mortgage application can make your case stronger.

By adding both incomes together, you show that paying back the mortgage won’t be a problem.

This other person could be your partner, a family member, or even a friend ready to share the responsibility of the mortgage with you.

It helps if they’ve got a steady income that can back up your stipend, making your application more appealing to lenders.

What Documentation Should I Prepare for a Stipend Mortgage?

Getting your paperwork right is key to every mortgage application. Here’s what you’ll need:

- University or Doctoral Centre Letter – A letter confirming your enrollment, stipend amount, and how long you’ll be receiving it. This letter is your golden ticket, showing lenders you’ve got a steady income coming in.

- Bank Statements – The last three months of bank statements are standard. These need to show your stipend payments and how you spend your money, giving lenders a glimpse into your financial habits.

- Stipend Receipts – Keep your most recent stipend receipts handy. Lenders want to see that your income stream is still active.

- Proof of Deposit – You’ll also need to show proof of your deposit for the house. This could be bank statements or a letter if the money’s a gift.

- Spending Overview and Credit File – Some lenders might ask for an overview of your spending or even a peek at your credit file. It’s all part of the standard mortgage process, stipend or not. This helps them get a full picture of your financial health.

These documents help lenders understand your financial situation. They want to make sure you can handle a mortgage, and having your paperwork in order is a big part of proving that.

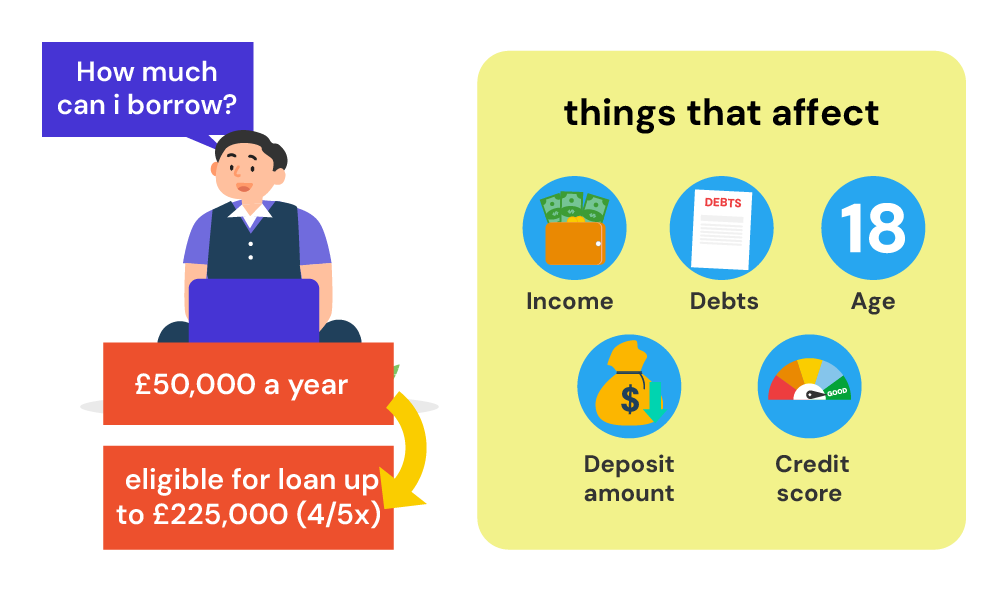

How Much Can You Borrow with a Stipend Mortgage?

Stipend mortgages typically let you borrow up to 4.5 times your annual stipend.

This could increase to 5 times your total income if you have a big deposit or another income source like a part-time job.

Remember, lenders consider your outgoings too. High monthly bills like car payments or credit cards could limit how much you can borrow.

Teaming up with someone who has a salary can help. Some lenders offer more flexibility for joint applications, potentially allowing you to borrow more than the usual 4.5 times income ratio.

To get a better idea of what you can afford, try a mortgage affordability calculator. We’ve included one below to estimate your potential mortgage amount.

[Embedded mortgage affordability calculator]

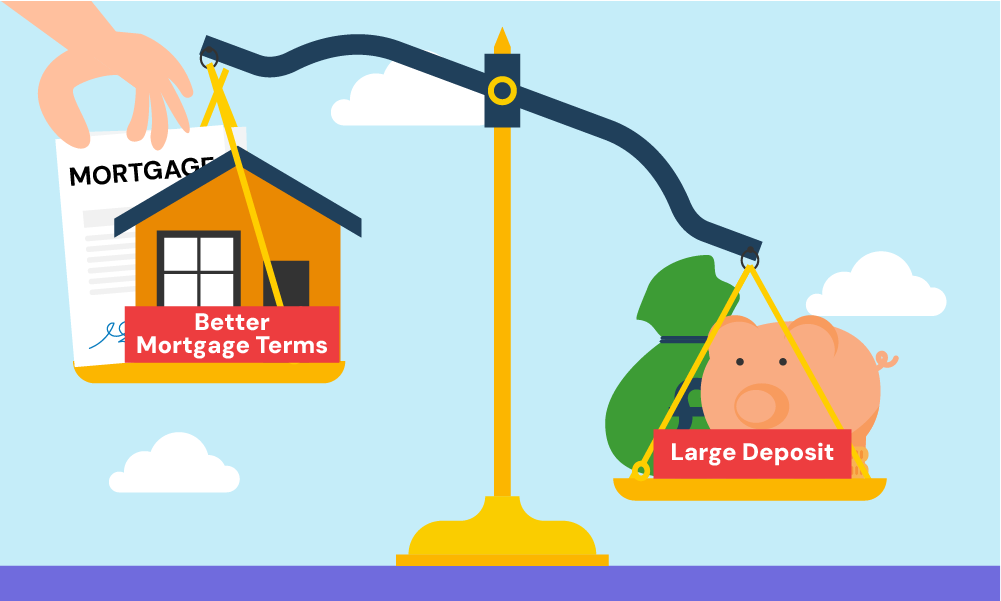

What Deposit Is Required for a Stipend Mortgage?

The bigger your deposit, the better your mortgage deal will be.

While some lenders accept a 5% deposit, aim for 10-15% to get a lower interest rate. This shows lenders you’re a reliable borrower.

Consider a Lifetime ISA to boost your deposit. The government helps you save more, faster.

Family or friends can also contribute to your deposit. Many banks accept gifts from family, and some even accept them from friends or non-relatives.

If someone gives you a large gift, they can protect themselves by getting a temporary stake in your property until you repay them (through selling the property or remortgaging).

A good credit score helps, especially if you want a smaller deposit. A history of managing finances responsibly makes lenders more likely to approve your mortgage.

For new builds, expect to need at least a 10% deposit. If you have stipend income and want a fixed-rate mortgage, you might need a 15% deposit.

Are PhD Students Eligible for First-Time Buyer Mortgages?

PhD students have a shot at first-time buyer mortgages, even if they’re living on a stipend income.

This could be a smart financial move since, often, paying a mortgage can be cheaper than renting.

But, it’s crucial to think about whether you can commit financially before diving in.

Some lenders are open to the idea of stipend income for mortgages, whether you’re buying your first place, moving, or remortgaging.

The key is to show them your stipend is a reliable income.

Owning your own home not only potentially saves you money on rent but also gives you a stable place to live during and after your PhD. It’s a big step for your personal and financial future.

Additionally, it’s an investment in your future, both personally and financially.

Many PhD graduates also consider remortgaging to a buy-to-let option after completing their studies, adding a potential income stream by renting out the property.

How Do Student Loans and Other Debts Affect Stipend Mortgages?

Student loans are a big part of life for many PhD students, but here’s some good news: they usually don’t stop you from getting a mortgage.

Even though you might owe money for your studies, lenders are more interested in what you pay back each month rather than the total debt you owe.

This means if your stipend income isn’t high enough to start repaying your student loans, lenders won’t hold this against you.

Plus, since stipends aren’t typically considered taxable income, you might not hit the repayment threshold even if your stipend seems high.

But, it’s a different story with other debts like credit card debt or personal loans.

These debts directly affect how much you can borrow because they take up a chunk of your monthly budget. Cleaning up these debts before you apply for a mortgage can help your chances.

Can You Apply for a Stipend Mortgage with a Partner Also on Stipend?

Getting a mortgage with your partner when you’re both on a stipend is possible and can be a smart move.

Combining your stipends can boost the total income lenders consider, potentially increasing how much you can borrow.

It’s like teaming up for a project where both of you bring something to the table, making it easier to reach your goal of buying a home.

You don’t have to be married or in a relationship, either. Friends or relatives can join forces for a joint mortgage, no guarantor is needed.

This can make the dream of owning a home more reachable, especially if one or both of you have a lower stipend.

The Bottom Line

Taking that first step is crucial for any big achievement. And buying your own home as a PhD student is no exception.

Applying for a mortgage takes time, planning and understanding your finances. This can be stressful on top of your studies.

A mortgage advisor can simplify the process. They’ll find lenders who accept stipend income and help you put together a strong application, saving you time and stress.

Not sure where to begin? Just get in touch with us. We’ll arrange a free, no-obligation consultation with an experienced mortgage broker who understands stipend mortgages.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How does applying with someone who has a regular salary affect the mortgage process?

Applying together with someone earning a regular salary can boost your mortgage application. It shows lenders that there’s additional income to help with mortgage payments, which can be particularly helpful if your stipend income isn’t very high.

Can I get a buy-to-let mortgage with a stipend income?

Yes, it’s possible to get a mortgage for renting out properties on stipend income. Lenders usually want the rent you’ll charge to be 125-145% more than your mortgage payments.

You’ll likely need a 25% deposit, though some lenders might ask for less. They often want your yearly income to be at least £15,000.

Can foreign nationals or non-UK citizens get a mortgage with a stipend income?

Yes, people from other countries, including EU citizens with pre-settled or settled status, can get a mortgage. If you don’t have the permanent right to live in the UK, you might need a larger deposit, usually about 25%.

But if one person applying has permanent residency rights, you might not face these higher deposit requirements.

Can I get a mortgage with a stipend income even with bad credit?

Even with a not-so-great credit history, getting a mortgage with a stipend income can happen.

Your choices might be fewer, and you could need to put down a bigger deposit. Lenders will look at your whole financial situation, including any debts and your credit history.

Does my field of study impact my eligibility for a PhD stipend mortgage?

What you’re studying doesn’t usually influence your chance of getting a mortgage with a PhD stipend. Lenders are more interested in your future income potential after you finish your PhD, no matter the field of study.

Do I need to get my stipend income monthly to qualify for a mortgage?

How often you get your stipend (like monthly or quarterly) isn’t usually a problem for mortgage applications. Lenders care more about your total income and its stability rather than how often you’re paid.

How long do I need to have been getting my stipend to apply for a mortgage?

Having 12 months left on your stipend is ideal for more mortgage options. You can still apply with at least six months remaining, but less than that might limit your choices. Getting a job offer, though, could help your application.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.