- What is an Umbrella Company Mortgage?

- Can You Get a Mortgage While Working for an Umbrella Company?

- What Do You Need to Qualify?

- How To Get an Umbrella Company Mortgage?

- The Pros and Cons

- How Much Can I Borrow?

- What is the Difference Between an Umbrella and a Limited Company Mortgage?

- Which Lenders Offer Umbrella Contractor Mortgages?

- The Bottom Line

Umbrella Company Mortgages Explained

Struggling to buy a house while working for an umbrella company?

You’re probably worried that your job setup will make getting a mortgage a bit trickier.

Here’s some good news – securing a mortgage is totally doable for umbrella company workers. This quick guide will show you how to successfully ace your mortgage application.

Let’s get started.

What is an Umbrella Company Mortgage?

An Umbrella Company Mortgage is made for UK individuals working under an umbrella company, such as IT contractors, graphic designers, builders, and freelancers.

These professionals are employed by a third-party company that handles their payroll, taxes, and National Insurance contributions on their behalf.

This arrangement affects how lenders assess their income and mortgage eligibility.

Can You Get a Mortgage While Working for an Umbrella Company?

Absolutely, working under an umbrella company doesn’t lock you out of getting a mortgage. However, it might indeed narrow down your options for potential lenders.

While a fair number of lenders might hesitate or not accept applications from umbrella contractors, some do, treating each case with a tailored approach that may involve a detailed look at your finances.

What Do You Need to Qualify?

Just like any mortgage, you’ll go through checks on your affordability and credit. It’s key to pick a lender who understands your contractor status and is willing to lend you the amount you need, based on your unique work situation.

Here’s what most lenders will look for:

- Proof of Employment – Evidence of working under an umbrella company, such as a contract or agreement that outlines the terms of employment.

- Stable Income – Demonstrating a consistent income through payslips issued by the umbrella company, usually for the last 3-6 months.

- Credit History – A good credit score and clean credit history are essential to assure lenders of the applicant’s reliability in making mortgage repayments.

- Length of Contracting – Some lenders may require you to have been contracting for a minimum period, often ranging from 6 to 12 months, to ensure stability and predictability of income.

- Remaining Contract Duration – Evidence that your current contract with the umbrella company will continue for a foreseeable period, providing income security.

- Deposit – A sufficient deposit amount, typically between 10-25% of the property’s value, although this can vary based on the lender and the applicant’s creditworthiness.

- Age and Residency – Applicants must be of legal age to apply for a mortgage and have the right to reside in the UK, with some lenders having specific age and residency requirements.

How To Get an Umbrella Company Mortgage?

After knowing the criteria for umbrella contractor mortgages, let’s now deep dive into the process of mortgage application. Here’s how you can get started:

1. Sort Your Finances

First, you need to get a clear picture of your finances. Check your credit score with credit agencies like Experian or Equifax to spot and correct any errors.

You’ll also need to collect various documents. This includes:

- Proof of identity, such as a passport or driving licence

- Proof of address, like recent utility bills or council tax bills

- Recent payslips, usually covering the last 3-6 months

- Bank statements, also from the last 3-6 months, to show your income and outgoings

- Details of your umbrella company contract, demonstrating your employment status and terms

- Proof of your deposit, which could include savings account statements or a gift letter if the deposit is being given to you

- Additional income documentation, if you have other sources of income beyond your umbrella company earnings

Moreover, building up a substantial deposit is crucial; a larger deposit often means better mortgage terms. Consider ways to boost your savings, such as opening a high-interest savings account or cutting back on non-essential expenses.

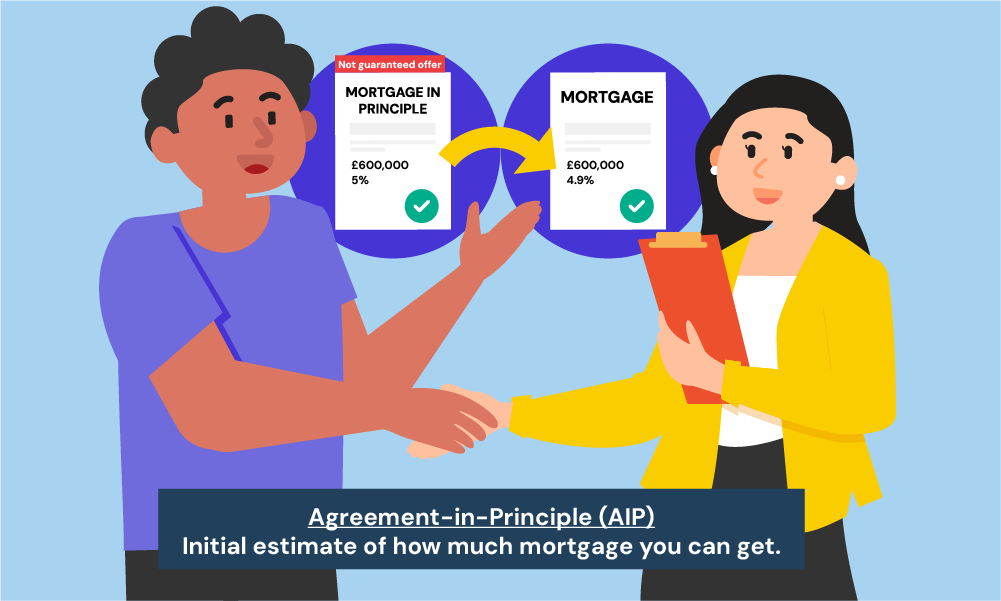

2. Get an Agreement in Principle (AIP)

An Agreement in Principle (AIP) can give you an estimate of how much you might be able to borrow.

While not mandatory, it’s a wise step forward.

AIPs can be obtained from banks, building societies, or via a mortgage broker. They show you’re a serious buyer, but be cautious, as some AIPs may require a hard credit check, potentially impacting your credit score.

3. Start with the Property Hunt

With an AIP in hand, begin your search for the perfect home. Take your time to explore different areas and properties, keeping in mind what you want in a home and staying within your budget.

4. Apply for a Mortgage

Once you’ve found your ideal property, the next step is to apply for a mortgage.

This can be done directly with a lender or through a mortgage broker, who can offer advice and help you compare different mortgage offers.

A property survey will be part of the application process, assessing the property’s value and condition.

5. Complete the Process with a Solicitor

Engage a solicitor or conveyancer to manage the legal aspects of the purchase, including the exchange of contracts and the completion.

It’s crucial to remember that once contracts are exchanged, you’re legally bound to proceed with the purchase and keep up with mortgage repayments.

Failure to do so could result in losing your home.

If all this sounds daunting, especially working under an umbrella company, don’t hesitate to reach out to us.

We can connect you with a specialist mortgage broker for a free, no-obligation consultation. They understand umbrella company mortgages and can guide you through the process, making it as smooth as possible.

The Pros and Cons

Here are some pros and cons when working for an umbrella company:

Pros:

- Simplifies tax and National Insurance contributions as they’re handled by the umbrella company.

- Potentially easier to prove a stable income, as you receive regular payslips.

- Some lenders are familiar with umbrella company structures, offering tailored mortgage products.

Cons:

- Fewer lenders to choose from, as not all are willing to work with umbrella company contractors.

- Can be viewed as a higher risk than traditional employment, affecting loan terms and interest rates.

- The complexity of umbrella company contracts may require additional documentation and checks.

How Much Can I Borrow?

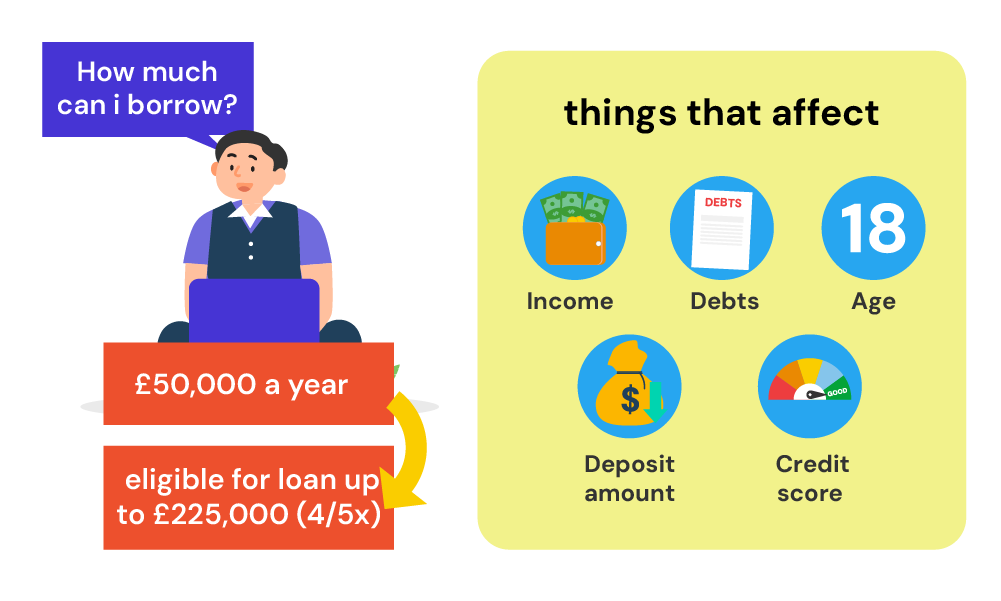

Figuring out how much you can borrow as someone working under an umbrella company isn’t always straightforward.

Lenders use different methods to decide how much they’re willing to lend to contractors.

Generally, you might find they offer loans up to 4.5 times your yearly income. However, in some situations, you could qualify for more, possibly up to 5 times your annual earnings.

It’s important to remember they’ll also consider any other debts you have, like loans or credit card bills.

To give you a starting point, use the mortgage calculator. This tool can estimate how much you might be able to borrow based on your income details. Keep in mind, though, these numbers are just a guide.

Your broker will dive deeper, using their knowledge to get you a more tailored figure that fits your unique situation.

What is the Difference Between an Umbrella and a Limited Company Mortgage?

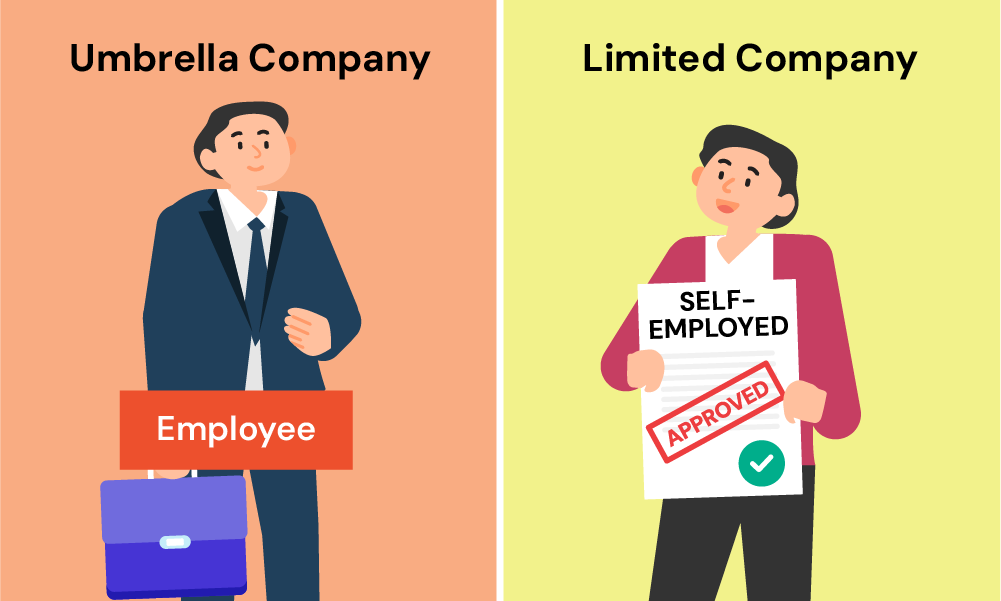

You’re essentially an employee with an umbrella company, even if you’re hopping between different projects.

This means your income is treated more like a regular salary, which can make the mortgage process a bit smoother.

You won’t need to show years of accounts or tax returns like you would if you were self-employed.

On the other hand, if you have a limited company, lenders often see you as self-employed.

They’ll want to look at your business accounts and tax returns to figure out how much you earn.

This can make getting a mortgage a bit more complex, as they’ll usually consider your salary plus dividends, not your overall business turnover.

Which Lenders Offer Umbrella Contractor Mortgages?

If you’re working under an umbrella company and looking for a mortgage, you’ve got options. Not all lenders are the same, and some are more open to working with contractors.

Here’s a look at a few:

- Halifax and Barclays are good starts. Halifax looks at either your contract value or what your payslips say, picking the lower number. Barclays considers your last 3 months’ pay after taking off certain costs.

- Nationwide Building Society doesn’t fuss much about which industry you’re in or how much you’re earning and is okay with breaks between contracts up to 12 weeks.

- Leeds Building Society and Scottish Widows are also in the game, offering flexible mortgage products for contractors. Scottish Widows has options like interest-only and offset mortgages.

- Don’t overlook Metro Bank, Virgin Money, Kensington, Saffron Building Society, and players like Furness and Newbury Building Societies. Each has its way of catering to contractors.

This isn’t an exhaustive list, but it shows there are lenders out there ready to consider your application.

The Bottom Line

Searching for a lender familiar with umbrella company income can be tough. This is where a specialist mortgage broker can make a big difference.

They know exactly how to find the right mortgage deals for contractors, guiding you through the process from start to finish.

Ready to explore your mortgage options but unsure where to start? Contact us for a free consultation with an expert broker in umbrella company mortgages. You’ll get helpful, clear advice to move you closer to buying your home.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a buy-to-let mortgage while working with an umbrella company?

Yes, you can get a buy-to-let mortgage even if you’re working under an umbrella company. Lenders will mainly want to see that the rent you plan to charge covers the mortgage payments by a certain percentage, typically around 125-145%.

They’ll also look at your income to make sure you can cover the mortgage during any periods when the property isn’t rented. Having a decent deposit and a solid credit history will help your case.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.