Mortgage Affordability Test Scrapped: Is It Now Easier to Get a Mortgage?

For many Brits, buying a home is a lifelong dream.

But with ever-increasing house prices, saving for a deposit can feel like an uphill battle. On top of that, there’s the hurdle of getting approved for a mortgage – a process that can seem confusing. 😖

However, in 2022 the Bank of England made things simpler– they got rid of the mortgage affordability test.

This change might have you wondering: is it actually easier to get a mortgage now? 🤔

Let’s delve into the details of the scrapped mortgage affordability test and what it means for future homeowners like you.

What Was the Mortgage Affordability Test?

After the big financial crisis in 2007-08, the Bank of England introduced a measure to ensure responsible lending practices.

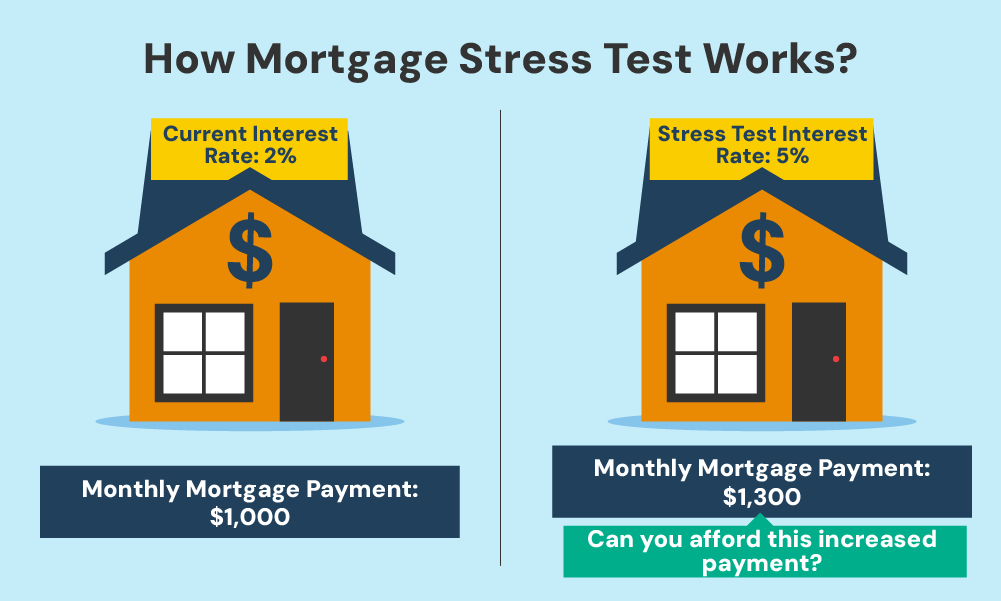

This was the mortgage affordability test, often referred to as a stress test.

Here’s how it worked: Before approving your mortgage, lenders had to assess if you could still make repayments if interest rates rose by a significant margin, typically 3%.

This stress test provided a buffer and ensured you wouldn’t be stretched too thin if interest rates went up.

Why Did They Scrap It?

Fast forward to 2022. The Bank of England decided the affordability test was no longer necessary.

Their reasoning boils down to two KEY points:

- Interest rates weren’t rising as quickly as expected.

- It was seen as a barrier to homeownership.

Interest rates weren’t rising as quickly as expected

First of all, let’s be clear: interest rates have actually gone up quite a bit compared to recent years.

That’s because the government is trying to tackle inflation, which is currently sitting at 3.2%.

But, before 2022, these rates had remained lower for a longer period than some initially expected. They went from 0.25% at the end of 2021 to 3.50% by December 2022.

The government wasn’t exactly expecting this rise either, so they scrapped the stress test back in August 2022.

But does this mean borrowing is much easier? 🧐

Not really. There are still other safeguards in place, such as:

- Lenders have the freedom to set stricter stress tests.

- They will thoroughly scrutinise your income and outgoings.

- The biggest mortgage you can get is still capped at 4.5 times your annual salary.

- A larger deposit and a good credit score are usually necessary.

- The Financial Conduct Authority (FCA) still has its own affordability criteria that lenders must follow.

These restrictions, which align with the Financial Conduct Authority’s (FCA) affordability criteria, are what the Bank believes will prevent reckless borrowing.

It was seen as a barrier to homeownership

The stress was seen as a pain for many first-time buyers trying to get on the property ladder.

They scrapped it to make getting a mortgage EASIER and help more people buy homes without taking unnecessary risks.

They figured the test was too strict, especially as mortgage rates were quite low back then (mind you, this is pre-2022).

So, this is good news for some borrowers who might have been unfairly blocked because of the test’s inflexibility.

Who Stands to Benefit From This Change?

Overall, the change benefits those who previously struggled to qualify for a mortgage. This includes:

- First-time buyers

- Renters who can afford higher mortgage payments than their rent

- “Mortgage prisoners” – These are borrowers stuck on high rates because they can’t meet the old, strict tests to remortgage. This change could help them get a better deal.

- Self-employed individuals

- Borrowers with a large deposit

Is This the Right Move? Potential Concerns

While the potential benefits are evident, some concerns linger regarding the removal of the stress test:

- Increased Risk of Mortgage Debt. Easier access to mortgages could lead some borrowers to take on more debt than they can comfortably manage, especially if interest rates rise further.

- Impact on Housing Market. Increased borrowing could lead to a rise in house prices, further pushing them out of reach for some buyers.

⚠️ Taking out a mortgage is a BIG commitment—make sure you can handle it. Otherwise, you might lose your home.

Just because you qualify for a larger mortgage doesn’t mean you should take it.

Factor in future expenses and potential interest rate rises to ensure you’ll be comfortable with the repayments over the long term.

How Have People Reacted to the Change?

Scrapping the affordability test has sparked mixed reactions.

Some see it as a positive step, helping more people buy a home, especially during tough economic times with high living costs and rising house prices.

However, others worry it could lead to people borrowing more than they can afford, potentially causing higher defaults down the line.

The Bottom Line: What Should You Do?

The scrapping of the stress test has undoubtedly shaken things up a bit for mortgages in the UK.

While the test might offer you some flexibility, it doesn’t mean you’ll suddenly get approval from every mortgage lender.

Affordability will still be a MAJOR factor in their decision. So, to secure a mortgage, preparation is KEY.

Here’s what you should do:

✅ Look closely at your financial health. You can take a FREE test here to ensure you can afford a mortgage.

✅ Figure out how much you can borrow safely, and how much you can put down as a deposit.

✅ Think about how changes in interest rates might affect you.

✅ Save money to build a financial buffer for other mortgage fees and unforeseen expenses.

✅ Have a good credit score that meets your lender’s criteria.

✅ Look at different types of mortgage deals to find the best one for you.

✅ Keep up with news on mortgages and rules that might affect you.

Of course, you don’t have to do this all alone. You can make things easier by getting advice from seasoned mortgage brokers. 😀

A qualified mortgage broker can guide you through the application process, assess your affordability, and help you find the BEST deal based on your circumstances.

Looking for the right broker? Get in touch with us. We can connect you with a qualified mortgage broker in the UK to guide you through the best options that suit your budget.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How strict are affordability checks now?

Affordability checks remain thorough. Lenders still require proof of income and outgoings to ensure you can manage repayments, even without the specific affordability test.

How to pass the affordability test?

To pass modern affordability checks, ensure you have a stable income, maintain a good credit score, and limit your debts. It’s also wise to have a clear budget plan.

For more personalised advice, consult a qualified mortgage broker.

Do you need an affordability check to remortgage?

Yes, you do. When you apply to remortgage, lenders will reassess your affordability to ensure you can manage the new mortgage terms.

How is affordability assessed?

Affordability assessment considers your income and expenses to see if something fits comfortably within your budget.

Your lender will check the following:

- Your income, debts, and expenses

- Amount of deposit

- Property type and condition

This ensures you can pay your mortgage over time.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.