- How Does a Fixed Rate Lifetime Mortgage Work?

- How Do Fixed-Rate and Variable-Rate Lifetime Mortgages Compare?

- Should You Opt for a Fixed or Variable Rate with Lifetime Mortgages?

- How a Lifetime Mortgage Broker Simplifies Your Search

- Are Lifetime Mortgage Rates Typically Fixed?

- Which Providers Offer Lifetime Fixed Mortgages?

- How Do Lenders Determine Interest Rates?

- Key Takeaways

- The Bottom Line

What are Lifetime Fixed Rate Mortgages?

A lifetime fixed-rate mortgage lets you borrow money against your home while staying in it for the rest of your life.

Think of it as a way to unlock the value of your home to use the cash for things you need or want.

The best part? You don’t have to pay back the loan right away.

Instead, the amount you owe, including interest, is paid back when you pass away or move into long-term care.

So, is a lifetime fixed-rate mortgage a good fit for you? How does it work, and what makes it different?

Let’s break it down step by step so you can see if it’s a smart option for your future plans.

In this guide, we’ll explain how lifetime fixed-rate mortgages work, talk about their pros and cons, and show you how to find the best deals with a broker.

Whether you’re new to equity release or just looking for fresh options, this will help you make a choice that suits your needs.

How Does a Fixed Rate Lifetime Mortgage Work?

Let’s start with the basics.

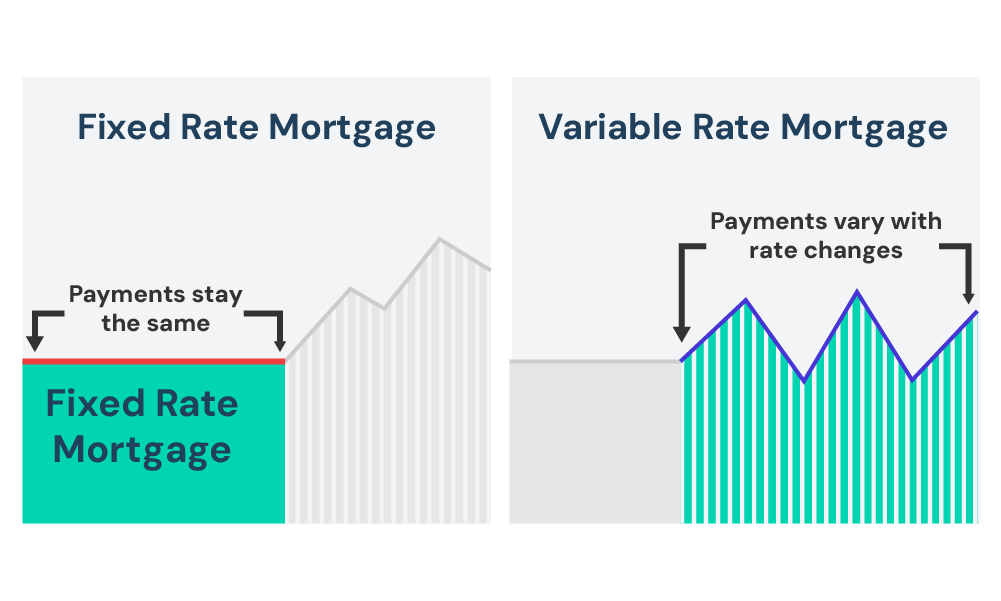

A regular mortgage is a loan you use to buy a home. With these, you usually choose between two types:

- Fixed-Rate Mortgage: The interest rate stays the same for a set time, no matter what happens in the market.

- Variable-Rate Mortgage: The interest rate can change, going up or down depending on the economy.

A fixed-rate lifetime mortgage works like a fixed-rate mortgage.

Once you borrow the money, the interest rate stays the same forever. This is called a “fixed rate.”

The main difference?

With a lifetime mortgage, you don’t have to pay monthly instalments unless you want to.

The interest builds up over time (this is called interest roll-up), and it’s only paid when you sell your home or pass away.

Why choose a fixed rate? It’s simple: it gives you stability.

You know exactly how much interest will add up over the years, and you’re protected from market changes that could make rates higher. This makes it easier to plan for the future.

How Do Fixed-Rate and Variable-Rate Lifetime Mortgages Compare?

Choosing between a fixed-rate and a variable-rate lifetime mortgage can feel like a big decision. The main difference is how the interest rate behaves over time.

Let’s use an example to make things clearer, but first, here’s a quick note: The figures we’re about to show are just examples.

Your actual rates, repayments, and terms will depend on your situation and your lender’s criteria.

Always check with a professional to understand what’s best for you.

Fixed Rate Lifetime Mortgage at 5%

With a fixed rate of 5%, the interest rate stays the same no matter what happens in the market. This makes it predictable and often feels like a safer choice.

| Year | Interest (£) | Total Amount (£) |

|---|---|---|

| 1 | 5,000 | 105,000 |

| 2 | 5,250 | 110,250 |

| 3 | 5,512 | 115,762 |

| 4 | 5,788 | 121,550 |

| 5 | 6,077 | 127,627 |

Variable Rate Lifetime Mortgage (5%, increased to 6% in Year 2)

Now, let’s look at a variable rate mortgage. It might start at 5%, but if the base rate rises, your rate could go up too.

For this example, we’ll assume it increases to 6% from the second year onward.

| Year | Interest (£) | Total Amount (£) |

|---|---|---|

| 1 | 5,000 | 105,000 |

| 2 | 6,300 | 111,300 |

| 3 | 6,678 | 117,978 |

| 4 | 7,079 | 125,057 |

| 5 | 7,503 | 132,560 |

What does this mean for you?

As you can see, the fixed rate offers stability. You’ll always know how much interest will be added, which makes it easier to plan for the future.

On the other hand, the variable rate might cost less to start, but if interest rates rise, it could end up being more expensive over time.

That’s why many people prefer fixed rates for long-term financial security.

Should You Opt for a Fixed or Variable Rate with Lifetime Mortgages?

Picking between a fixed or variable rate for a lifetime mortgage is a big decision. Each has its own good points and downsides.

Here’s a quick comparison to help you decide:

Fixed Rate Lifetime Mortgages

Pros:

- Stability. Your interest rate remains the same throughout the loan, giving you predictability in how interest compounds.

- Less Risk. No matter how market interest rates fluctuate, your rate is locked in, eliminating the risk of unexpected increases.

Cons:

- Potentially Higher Initial Rate. Fixed rates might be slightly higher initially compared to variable rates.

- Less Flexibility. If market interest rates fall, you’re still locked into your fixed rate.

Variable Rate Lifetime Mortgages

Pros:

- Potential for Lower Initial Rate. Variable rates often start lower than fixed rates but can change with market conditions.

- Possible Benefit from Falling Rates. If interest rates decrease, so might your mortgage rate, potentially saving you money.

Cons:

- Uncertainty. Your interest rate could rise, leading to higher costs if market interest rates go up.

- Potential Risk. Though often capped by industry regulations, rising interest rates could still lead to higher payments over time.

How a Lifetime Mortgage Broker Simplifies Your Search

Picking the right lifetime mortgage can feel a bit tricky, but that’s where a lifetime mortgage broker comes in to save the day.

Here’s how they make things easier:

A lifetime mortgage broker knows all about the market. They’ll look at loads of options and find the one that fits your needs best, not just based on interest rates but everything else too.

Different lenders offer all sorts of deals with varying fees, borrowing amounts, and rules. A broker knows how to sort through these details to find the best match for you.

If you try to do this on your own, you could spend hours comparing offers and still miss out on the best ones. It’s like trying to find a needle in a haystack!

A good broker saves you time, stress, and maybe even money. They’re pros at knowing where to look, what’s important, and how to get terms that work for you.

It’s all about finding the right balance between what you want and what’s available, without the hassle.

Are Lifetime Mortgage Rates Typically Fixed?

Most lifetime mortgages come with a fixed interest rate for the entire loan period.

Unlike regular mortgages, where you might fix the rate for 2 to 5 years and then remortgage, a lifetime mortgage rate usually stays the same forever.

This fixed rate gives you peace of mind because you know your payments won’t suddenly go up. Since interest builds up over time, having a fixed rate makes things less risky.

There are some lifetime mortgages with variable rates, but they’re not as common. Why? Well, with a variable rate, there’s a chance the interest could get really expensive if rates go up.

Luckily, the Equity Release Council (ERC), which sets the rules for equity release, says variable rates must have a cap.

This means the rate can’t go over a certain limit. Even so, most people prefer the safety of a fixed rate because it’s easier to know what to expect.

Which Providers Offer Lifetime Fixed Mortgages?

Lifetime fixed-rate mortgages are not something you would usually find at every high street bank. It requires a bit more research.

Some specific providers specialise in lifetime fixed mortgages, offering various features and conditions. Here are some examples:

- Aviva: Available for applicants aged 55 or over owning a UK home worth £75,000 or more. The minimum loan amount is £15,000.

- Legal & General: Products with a minimum property value of £70,000 or £100,000 depending on the property type. The minimum lump sum amount is as low as £10,000.

- Standard Life: Mortgages between £10,000 and £1.5 million on LTVs of 8-44%. Fixed early repayment charges for the first 8 years.

Keep in mind that things might have changed since this was written, so it’s always a good idea to double-check with lenders or have a chat with a broker to get the most up-to-date information.

How Do Lenders Determine Interest Rates?

The interest rate you’ll be offered on a fixed-rate lifetime mortgage isn’t a one-size-fits-all number. Several factors come into play, and here’s how they affect you:

- Property Value. Lenders consider the value of your property. A higher value might secure a more favourable interest rate, as it represents a lower risk.

- Age. Your age plays a vital role. Older borrowers might face higher interest rates since the loan is likely to last for a shorter period.

- Loan-to-Value (LTV). This ratio shows the relationship between the loan amount and your property’s value. A lower LTV generally leads to a lower interest rate.

- Credit History. Though not always a factor, some lenders might look at your credit history. A good credit score could mean a better interest rate.

- Market Conditions. General economic factors, like the Bank of England’s base rate, influence the interest rates available at a given time.

- Regulations. Industry bodies, like the Equity Release Council, have guidelines and requirements that may affect the rates lenders can offer.

- Type of Rate. Whether it’s a fixed or variable rate can also impact the interest rate. Fixed rates offer stability, whereas variable rates might be cheaper initially but come with the risk of future increases.

Key Takeaways

- A lifetime fixed-rate mortgage lets you borrow money using your home’s value while staying in it for life, with repayment only when you pass away or move into care.

- Fixed-rate mortgages keep the interest rate the same forever, making costs predictable and easier to manage over time.

- Variable-rate mortgages can start cheaper but might become more expensive if interest rates go up.

- Factors like your home’s value, your age, and the loan amount affect the interest rate a lender offers you.

The Bottom Line

Finding the perfect lifetime fixed-rate mortgage doesn’t have to be confusing. A good mortgage advisor knows all the details and can do the tricky work for you, like finding the best deal that fits your needs.

They’ll explain everything in simple terms, help you get the best rates, and make sure you understand exactly what you’re signing up for—no big words or boring paperwork left unexplained.

To get started, simply fill out this form. We’ll connect you with one of our top mortgage advisors specialising in lifetime fixed-rate mortgages.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What are the benefits of a fixed mortgage?

Yes, a fixed mortgage offers the benefit of stability. Your interest rate remains the same throughout the loan, providing predictability and eliminating the risk of unexpected increases.

Are lifetime fixed mortgages a good idea?

Yes, lifetime fixed mortgages can be a good idea for those seeking long-term financial security. They lock in an interest rate for the entire duration of the loan, assuring fluctuating market conditions.