- What Are Lifetime Mortgage Rates and How Do They Work?

- What Are the Current Lifetime Mortgage Rates in the UK?

- How Is Interest Calculated on Lifetime Mortgages?

- Whatâs the Difference Between AER and MER?

- Fixed or Variable Rates: Which Oneâs Right for You?

- What Types of Lifetime Mortgages Are Available?

- How to Find the Best Lifetime Mortgage Rates UK Lenders Offer

- Things to Watch Out For

- Key Takeaways

- The Bottom Line

The Best Lifetime Mortgage Rates in The UK in 2025

Thinking about a lifetime mortgage?

If so, you’re probably wondering what lifetime mortgage rates are like and how to snag the best deal.

It’s a big decision, and the numbers can feel overwhelming, but don’t worry—we’re here to break it all down for you.

Whether you’re curious about fixed rate lifetime mortgages, exploring lifetime mortgage interest rates, or just want the best lifetime mortgage rates UK lenders can offer, this guide’s got you covered.

What Are Lifetime Mortgage Rates and How Do They Work?

Lifetime mortgage rates are essentially the interest you’ll pay on the amount you borrow against your home’s value.

These rates vary depending on the type of mortgage you choose, your age, and even your health.

The goal is to find lifetime mortgage interest rates that work for you, so you don’t end up paying more than you should.

Here’s the deal: with lifetime mortgages, you’re not making monthly repayments like a regular loan.

Instead, the interest builds up over time, and the total is repaid when your house is sold—usually after you’ve passed away or moved into long-term care.

But don’t worry, there are options to manage how much the interest grows, which we’ll get to in a bit.

What Are the Current Lifetime Mortgage Rates in the UK?

Lifetime mortgage rates in the UK currently range from 5.79% to 8.89%, with averages at 6.66% for lump sum equity release and 6.28% for drawdown mortgages (see Autumn Market Report 2023 for details).

These rates depend on the product and your personal situation—finding the one that suits you is like hitting the jackpot.

Fixed rate lifetime mortgages are especially popular because they offer stability and no nasty surprises later on.

Keep in mind, the rates we’ve mentioned were accurate when this article was written, but they might have changed by now.

Your actual rates, terms, and costs will depend on the lender’s criteria and your own circumstances.

It’s always worth checking the latest deals before making any decisions.

Now, what determines these rates? Here’s the lowdown:

- Your age: The older you are, the better rates you’re likely to get.

- Property value: A higher-valued property can work in your favour.

- Loan-to-value ratio: Borrowing less compared to your home’s value can mean better rates.

- Health and lifestyle: Some lenders even offer enhanced rates for certain health conditions.

How Is Interest Calculated on Lifetime Mortgages?

At its core, the interest rate is simply the percentage applied to the amount you borrow against your home’s value.

But it’s not just about the numbers—it’s about how they add up over time.

Lifetime mortgages use compound interest, which means you’re charged interest on both the original loan amount and any previously added interest.

This creates a snowball effect where your debt can grow faster than you might expect if left unchecked.

Here’s how it works:

- Each year, the interest is calculated on the total amount owed, which includes the original loan and any accrued interest.

- That interest is then added to your balance, and the process repeats in the next year.

For example, if you borrow £100,000 at a 5% interest rate, you’d owe £5,000 in the first year.

In the second year, the interest is calculated on £105,000 (the original loan plus the first year’s interest), adding £5,250 to your balance, and so on.

Over time, this compounding can significantly increase the amount owed.

The good news? There are ways to manage compound interest:

- Voluntary payments. Some lenders allow you to pay off part of the interest regularly, keeping the total owed more manageable.

- Annual vs. monthly compounding. Choosing a product with annual compounding can slow the rate at which your debt grows compared to monthly compounding.

Knowing how compound interest works and exploring options to control it is key to making the best decision for your lifetime mortgage.

What’s the Difference Between AER and MER?

After understanding how interest is calculated, let’s tackle two terms you’ll often see when exploring lifetime mortgage rates: AER (Annual Equivalent Rate) and MER (Monthly Equivalent Rate).

They’re similar but serve slightly different purposes.

- AER (Annual Equivalent Rate). Think of this as the yearly cost of your loan, expressed as a percentage. It gives you the big-picture view, making it easier to compare different products.

- MER (Monthly Equivalent Rate). This breaks the yearly interest into monthly chunks. It’s what you’d look at to understand how much interest is applied each month. It’s perfect for getting a more detailed breakdown.

While MER helps you understand monthly charges, AER provides a straightforward way to compare products across the market.

Both are useful, depending on what you’re analysing.

If in doubt, ask your adviser to explain which rate matters most for your situation.

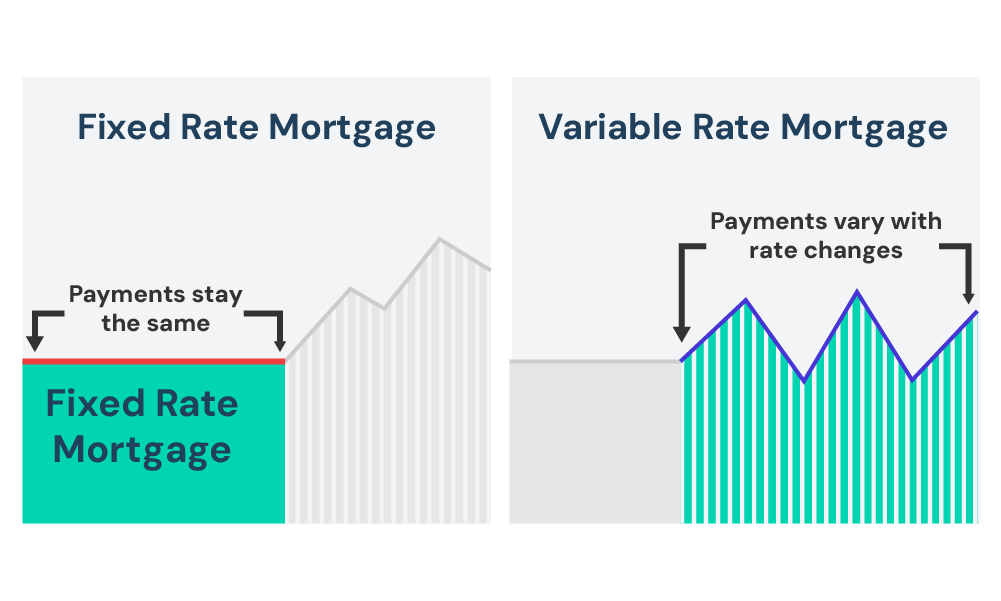

Fixed or Variable Rates: Which One’s Right for You?

The eternal debate: fixed or variable?

Fixed rate lifetime mortgages are the go-to for many because they offer predictability. You know exactly what’s coming, making it easier to plan.

Let’s break it down further with some examples:

A fixed rate means your interest percentage stays the same for the life of the mortgage. This provides stability, which is ideal if you like knowing what to expect.

For example, let’s say you borrow £100,000 at a 5% fixed rate:

| Year | Principal | Interest | Total Owed |

|---|---|---|---|

| 1 | £100,000 | £5,000 | £105,000 |

| 2 | £105,000 | £5,250 | £110,250 |

| 3 | £110,250 | £5,512.50 | £115,762.50 |

As you can see, the amount owed grows steadily. The trade-off? If market rates drop, you won’t benefit from lower payments.

With a variable rate, your interest might start lower but can change based on market conditions.

For instance, suppose you borrow £100,000 at a starting rate of 4%, which increases by 1% each year:

| Year | Principal | Interest | Total Owed |

|---|---|---|---|

| 1 | £100,000 | £4,000 | £104,000 |

| 2 | £104,000 | £5,200 | £109,200 |

| 3 | £109,200 | £6,552 | £115,752 |

Variable rates offer potential savings if rates stay low, but they come with some uncertainty. Thankfully, many lenders cap their variable rates, so you won’t face runaway interest.

Pro Tip: If you’re the type who sleeps better knowing exactly what you’ll owe, a fixed rate might be your best bet.

On the other hand, if you’re okay with a bit of risk for possible savings, a variable rate could work.

Not sure? Chat with a lifetime mortgage adviser—they’ll help you figure out what’s best for your situation.

What Types of Lifetime Mortgages Are Available?

There’s no one-size-fits-all. The best lifetime mortgage for you depends on what you need.

Here are some common options:

- Lump Sum Mortgages. Need a big pile of money upfront? This option lets you borrow all the cash at once, which is great for things like home renovations or helping your family. But here’s the catch: interest starts building straight away on the whole amount, so the total you owe can grow quickly over time.

- Drawdown Lifetime Mortgages. Want to take out money bit by bit instead of all at once? A drawdown mortgage lets you do just that. The cool thing is you’ll only pay interest on the money you’ve actually taken out, not the full amount you’re allowed to borrow. It’s handy for managing costs without letting interest get out of hand.

- Flexible Lifetime Mortgages (Voluntary Payment Options). If you like the idea of staying on top of your loan, this one’s for you. Flexible lifetime mortgages allow you to make voluntary payments towards the interest or even the capital, with no penalties. It’s a great way to keep your loan from growing too quickly and maintain some control over your finances.

- Interest-Only Lifetime Mortgages. This option is all about keeping the principal balance steady. You’ll pay just the interest each month, which means the original loan amount doesn’t grow. It’s ideal if you’ve got a reliable income to cover the payments. But heads up—you’ll need a plan to pay off the principal later, whether that’s through savings, selling your home, or another strategy.

How to Find the Best Lifetime Mortgage Rates UK Lenders Offer

Finding the best lifetime mortgage rates in the UK doesn’t have to feel like a wild treasure hunt.

Here’s how to make the search easier and more effective:

- Shop around. Every lender has its own rates and terms, so don’t settle for the first one you come across. Compare as many options as you can to find the best fit for your needs.

- Use a broker. Mortgage brokers are like your personal guide to the market. They know all the ins and outs, can access deals you might not find on your own, and save you loads of time.

- Think about what matters to you. Are you looking for stability with a fixed rate, or do you want the potential savings of a variable rate? Knowing your priorities can narrow the field and make choosing easier.

- Look beyond the rate. Extras like free valuations, no application fees, or even cashback deals can make a big difference. Don’t forget to factor these perks into your decision—sometimes the added bonuses can tip the scales in favour of one lender over another.

- Read the fine print. This isn’t the most exciting tip, but it’s an important one. Check for hidden costs or terms that could affect you later, like early repayment charges or restrictions on voluntary payments.

Things to Watch Out For

Lifetime mortgages can be super helpful, but they come with a few things you’ll need to keep an eye on. Let’s make it simple:

- Early repayment charges. If you want to pay off your loan early, you might have to pay extra fees. These charges can be a set amount or depend on how long you’ve had the loan. Before you agree to anything, ask your lender to explain their rules clearly so you know what to expect.

- Impact on inheritance. A lifetime mortgage means you’ll owe money when your home is sold, which can leave less for your family. If this worries you, you could make small payments to keep the loan amount from growing too much. Some lenders also offer options to save a part of your home’s value for your loved ones.

- Eligibility requirements. Not everyone or every home qualifies for a lifetime mortgage. For example, some lenders only accept houses worth a certain amount, or they might have rules about leaseholds. An adviser can help you figure this out and avoid any surprises.

- Rising debt with compound interest. Here’s the tricky part—compound interest means you’re paying interest on interest, so the total debt can grow really fast. To keep it under control, look for options that let you make payments or choose yearly interest instead of monthly.

Key Takeaways

- Lifetime mortgage rates in the UK currently range from 5.79% to 8.89%, and your age, property value, and health can all impact the rate you’re offered.

- Fixed rates offer stability and predictability, while variable rates can provide initial savings but come with more uncertainty.

- Compound interest means interest builds on interest, making it crucial to explore ways to manage it, like voluntary payments or annual compounding.

- Different types of lifetime mortgages, such as lump sum, drawdown, flexible, and interest-only options, cater to unique financial needs and lifestyles.

The Bottom Line

Lifetime mortgages can seem confusing, like trying to solve a big puzzle. But with the right help and advice, you can find a plan that works for you.

If you like things to stay the same and prefer knowing what to expect, a fixed rate mortgage might be the best choice.

On the other hand, if you don’t mind some changes and like taking a bit of a chance, a variable rate could be a good fit.

Whichever you pick, make sure it matches your money goals and how you want to live your life. There’s no one perfect answer—what works for someone else might not work for you.

Talking to an expert can make everything easier. They’ll help you figure out what’s best and find the best deals available from lenders in the UK.

In the end, it’s all about making your later years easy and happy.

Ready to get started? Get in touch, and we’ll connect you with a mortgage expert who knows all about lifetime mortgages.

You’ve got this!

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Who offers the best lifetime mortgage?

The best lifetime mortgage depends on your individual needs and circumstances. It’s advisable to consult with a financial expert or mortgage advisor who can assess your situation and guide you to the most suitable option for you.

Can I pay off a lifetime mortgage early?

Yes, paying off a lifetime mortgage is possible. Many providers offer flexible options for homeowners to settle their mortgages. Do keep in mind, however, that you might face early repayment charges depending on the specific terms of your plan.

What are the setup fees for a lifetime mortgage?

Setting up a lifetime mortgage usually costs between £1,500 and £3,000 in fees. Remember, this doesn’t include the actual loan amount or the interest you’ll pay over time.

What interest rates will I pay on a lifetime mortgage?

Interest rates for lifetime mortgages generally fall between 6.05% and 7%, but this can vary based on your specific mortgage plan. Always consult the most up-to-date information or speak with a mortgage specialist for the latest rates.

What factors affect the interest rate on my lifetime mortgage?

Your interest rate depends on several factors, including the type of lifetime mortgage you choose, your loan-to-value ratio, and aspects of your health and lifestyle. Understanding these can help you find the best possible rate for your situation.