- What is a Drawdown Lifetime Mortgage?

- What is the Drawdown Facility?

- Eligibility Criteria

- How to Get a Drawdown Lifetime Mortgage?

- How Much Money Can You Reserve?

- How To Get Money from the Reserve Facility?

- How Much Can You Release Through a Drawdown Lifetime Mortgage?

- What To Do if the Reserve Facility is Depleted?

- How Much Does Drawdown Equity Release Plan Cost?

- How to Repay a Drawdown Lifetime Mortgage?

- The Pros and Cons of Drawdown Equity Release

- Which Lenders Offer Drawdown Equity Release in the UK?

- Alternatives to Drawdown Mortgages in the UK

- Key Takeaways

- The Bottom Line

Drawdown Lifetime Mortgages: A Full Guide in 2025

If you’re a homeowner in the UK and over 55, you might be curious about ways to use your home’s value to access some extra cash.

A drawdown lifetime mortgage could be a great option, giving you flexibility and money to use during retirement.

But what exactly is a drawdown lifetime mortgage? How does it work, and what are the good and not-so-good parts?

In this simple guide, we’ll explain everything you need to know about drawdown lifetime mortgages.

From how they work to their benefits and possible drawbacks, we’re here to help you decide if it’s the right choice for your needs and lifestyle.

What is a Drawdown Lifetime Mortgage?

A drawdown lifetime mortgage is a type of loan designed to give you more control over your money.

Unlike other lifetime mortgages, where you take out a large lump sum all at once, this option lets you withdraw smaller amounts over time.

When you first get the loan, you take out a smaller initial payment. The rest of the loan stays available for you to access later, whenever you need it.

The best part? You only pay interest on the money you’ve actually taken out, not the full amount you’re allowed to borrow. This can save you money and make it easier to manage.

Since the money you receive is usually tax-free, it’s a flexible way to access extra funds. Still, it’s smart to speak to an expert.

An equity release broker can explain how it works, highlight any risks or hidden costs, and help you decide if it’s the right choice for you.

This way, you can feel confident about your decision and avoid surprises.

What is the Drawdown Facility?

The drawdown facility is a key feature of a drawdown lifetime mortgage. It works like a reserve of money you can tap into whenever you need it, without having to take it all upfront.

This feature offers flexibility and can save you money, as interest only applies to the amounts you’ve withdrawn.

But, there are some conditions to be aware of, such as a minimum withdrawal amount and a limit on the total money available.

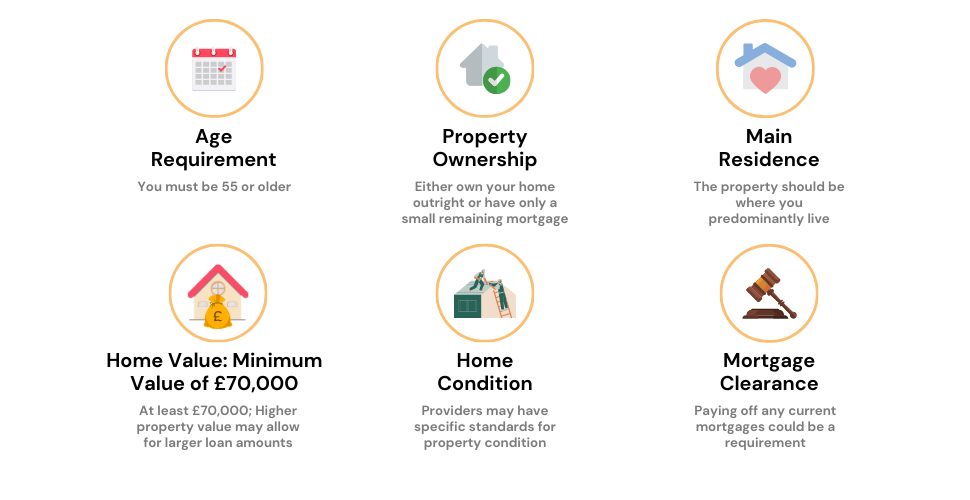

Eligibility Criteria

To get a drawdown equity release mortgage, you need to meet a few basic requirements.

First, you must be at least 55 years old, and your property needs to be worth at least £70,000.

If your home is worth more, you might be able to borrow a bit more too.

Your property also has to be in the UK, well looked after, and your main home. If your house isn’t in good shape, it could affect how much equity you can release.

Any existing mortgages on your home must be paid off as part of the process or included in the new arrangement.

It’s good to know that not all lenders follow the exact same rules. Each one has its own way of deciding who qualifies and how much you can borrow.

Taking the time to understand what different lenders offer will help you find a plan that suits your needs and financial goals.

How to Get a Drawdown Lifetime Mortgage?

Once you know you meet the eligibility criteria, here’s what happens next:

- Talk to an Expert. Start by chatting with a mortgage adviser who knows about drawdown lifetime mortgages. They’ll look at your age, property value, any existing mortgages, and your financial situation to see if this is the right choice for you.

- Pick the Best Plan. Work with your adviser to find a plan that fits your needs and future goals. This step includes comparing lenders, checking their terms, and looking at interest rates to make sure you get the best deal.

- Submit Your Application. Fill out the application form with the help of your adviser. You’ll need to share personal details, information about your property, proof of identity, proof of address, and financial records.

- Get Your Property Valued. A surveyor will visit your home to work out its market value. This valuation helps the lender decide how much money you can access.

- Wait for Approval. The lender will review your application and the property valuation. If everything checks out, they’ll approve your loan and set up a schedule for you to access the funds.

- Handle the Legal Stuff. You’ll need a solicitor to help with the legal side. The Equity Release Council suggests choosing one who specialises in equity release. They’ll make sure you understand all the terms and conditions before you sign anything.

How Much Money Can You Reserve?

The money you can reserve with a drawdown lifetime mortgage depends on a few key things. Lenders also use their own methods to figure it out. Here’s how it works:

First, the lender checks how much your home is worth. The more valuable your property, the more you might be able to reserve.

If you’ve already taken out some money, they’ll subtract that from the total amount you’re allowed to borrow.

Your age is another important factor. Older borrowers usually get larger reserves because lenders expect the loan to be paid back sooner.

Your health and lifestyle can also make a difference. For example, if you smoke or have certain health conditions, some lenders may let you reserve more money.

Each lender has their own rules, so the amount you can reserve will vary.

In the end, your reserve is a personalised amount based on your home’s value, your situation, and the lender’s policies. It’s all about finding what works best for you.

How To Get Money from the Reserve Facility?

Getting money from your reserve facility is easy and straightforward.

First, you contact your provider and ask to withdraw some money. They’ll send you a document to confirm the withdrawal, which you need to sign and send back.

After that, the provider will transfer the money straight into your bank account. This usually takes a couple of weeks, so it’s a handy option if you need funds quickly.

How Much Can You Release Through a Drawdown Lifetime Mortgage?

The amount of money you can get through a drawdown lifetime mortgage isn’t the same for everyone—it’s worked out based on your personal situation.

Lenders look at things like how much your home is worth, your age (yes, getting older has its perks here!), and even your health or lifestyle.

These factors help them decide what’s possible while keeping things manageable for both you and them.

Every lender has their own rules about how much you can take out at once or over time.

Knowing these limits is super helpful for planning your withdrawals and making the most of your loan.

Minimum Release Amount

Most lenders have a minimum amount you can take out in each drawdown, usually around £2,000.

Some plans might also require you to take out a minimum amount each year to keep the agreement active.

Maximum Release Amount

The maximum amount you can release depends on the value of your home and your age.

Generally, the older you are and the more valuable your property, the more you can borrow.

Lenders also use a loan-to-value (LTV) ratio to make sure the amount you release doesn’t exceed a certain percentage of your home’s value.

What To Do if the Reserve Facility is Depleted?

So, you’ve used up all the money in your reserve facility—don’t panic.

It just means you’ve reached the limit of what you can borrow on your current drawdown lifetime mortgage plan.

Here’s what you can do: contact your equity release adviser or broker.

They can help you explore whether you’re eligible to borrow more money or if switching to a new plan with better features or rates might be a good idea.

Here’s what your adviser will look at:

- Are there better plans out there? They’ll check if you qualify for any new deals that might offer improved features or more flexibility.

- What’s left to pay? They’ll review how much you still owe on your current plan, including any interest that’s built up.

- Are there early repayment charges? If you’re thinking about switching plans, they’ll check for any fees you might need to pay to leave your current deal.

With their help, you can figure out the best way forward—whether it’s borrowing more, tweaking your current plan, or moving to something new.

The goal is to make sure you still have access to the funds you need without added stress.

How Much Does Drawdown Equity Release Plan Cost?

When you’re considering a drawdown equity release plan, it’s essential to know all the costs involved. These expenses fall into three main categories: interest rates, fees, and other charges.

The interest rates are determined by your plan, lender, and loan-to-value ratio. Unlike traditional mortgages, you’ll only be charged interest on the money you withdraw from your reserve.

This approach helps manage the effects of compound interest on your loan, and it’s crucial to grasp how it can affect the overall cost.

Next, the fees cover various aspects of setting up the loan and releasing equity. These may include advisor fees, valuation fees, legal fees, and arrangement fees.

Finally, there are other charges to be aware of, such as early repayment charges and additional interest rates.

How to Repay a Drawdown Lifetime Mortgage?

One of the handy things about a drawdown lifetime mortgage is that you don’t have to make repayments right away.

In most cases, the loan and any interest are paid off when you pass away or move into long-term care, usually by selling your home.

But here’s the good bit: some plans let you make monthly interest payments if you’d rather keep the loan smaller over time.

This gives you a bit more control and flexibility to manage things in a way that works best for you.

So, whether you’re happy to let things run their course or prefer to chip away at the interest, you can find an approach that suits your situation and keeps things simple—no unnecessary stress needed!

The Pros and Cons of Drawdown Equity Release

Before jumping into a drawdown equity release plan, it’s good to know the ups and downs. Here’s a breakdown to help you weigh it up:

Pros

- You can take out your money in smaller chunks, giving you financial flexibility when you need it.

- Interest only applies to the money you’ve withdrawn, which can save you a lot in the long run.

- The cash you release is tax-free—handy for topping up your income or treating yourself!

- You get to stay in your home and still own it, which means you keep that sense of stability and security.

- No monthly repayments are required, which can make life less stressful.

- With smart planning, you can keep your total income below limits that might reduce your state pension.

- You’re in control of how much you withdraw, as long as it fits within your lender’s rules and terms.

Cons

- Interest rates can be higher than regular mortgages, so the amount you owe can grow quite quickly.

- If you want to pay the loan off early, you might face hefty penalties.

- The more money you withdraw, the less there might be to leave behind as inheritance—although this can be managed with proper planning.

- Without a ‘No Negative Equity Guarantee,’ there’s a risk your estate could owe more than your property is worth if house prices drop.

- Taking out equity might affect your eligibility for means-tested benefits.

- If you take out too much money too quickly, the debt can pile up fast, which could cause financial headaches later.

- Most lenders set limits on how much and how often you can withdraw, so it’s worth checking their terms.

Which Lenders Offer Drawdown Equity Release in the UK?

If you’re thinking about drawdown equity release, you’ve got a good number of options in the UK. Plenty of lenders are ready to offer plans that can work for different needs and lifestyles.

Here are some of the big names in the game:

- Aviva

- Legal & General

- LV=

- Pure Retirement

- Hodge Lifetime

- Canada Life

- Just Group

- Retirement Advantage

Each lender has its own terms, features, and perks, so it’s worth taking a closer look to find the one that matches what you’re after.

But here’s the thing: don’t rush in. Take your time to read through the details, understand the fine print, and figure out what works best for you.

Since these plans can vary a lot, it’s a smart move to talk to a financial adviser. They’ll help you compare options, avoid any surprises, and find the plan that ticks all the boxes for your financial goals and lifestyle.

After all, this is about making your money work for you—so let’s get it right!

Alternatives to Drawdown Mortgages in the UK

Drawdown mortgages aren’t your only option for unlocking equity in your home. Here are some other choices to think about, each with its own perks and possibilities:

- Lump Sum Lifetime Mortgages. With this option, you get all the money in one go, instead of accessing it in smaller amounts over time. This could be a great choice if you need a big chunk of cash upfront, like for major home renovations or a once-in-a-lifetime holiday.

- Home Reversion Plans. This one’s a bit different. You sell a share of your home to a provider in exchange for a lump sum or regular payments. The good news? You still get to live there rent-free for the rest of your life. It’s worth considering if you’re not keen on taking out a loan.

- Retirement Interest-Only Mortgages (RIOs). With a RIO, you pay only the interest on the loan, not the amount you borrowed (the principal). The loan itself gets repaid when you sell your home, move into care, or pass away. If you’ve got a steady income during retirement, this might be a sensible option.

- Downsizing. If your current home feels a bit too big or costly to maintain, downsizing could be the answer. By selling your house and moving to a smaller, more affordable property, you can free up cash without taking on any debt. Plus, less cleaning!

Key Takeaways

- A drawdown lifetime mortgage lets you take out small amounts of money when you need it, instead of borrowing everything at once, so you save on interest.

- You can keep extra money in a “reserve” and take it out later, but there are some rules, like the smallest amount you can take each time.

- To qualify, you need to be at least 55 years old and own a house in the UK worth at least £70,000. You’ll also need to pay off any other loans on the house.

- The process includes talking to an expert, picking the right plan, filling out forms, getting your house valued, and working with a lawyer to make sure everything is fair.

- How much money you can get depends on your age, how much your house is worth, and some rules from the lender. Older people can usually borrow more.

- There are costs, like interest, fees to set up the loan, and possible charges if you want to pay it off early, so it’s important to understand these before deciding.

- Other options include taking all the money at once, selling part of your house for cash, moving to a smaller house, or getting a loan where you only pay the interest.

The Bottom Line

Drawdown equity release isn’t just about the numbers—it’s about shaping your financial future in a way that works for you.

Picking the right provider, understanding the costs, and planning a strategy that fits your lifestyle are all key steps.

Feeling overwhelmed? Don’t worry, you don’t have to figure it all out on your own. A specialist mortgage adviser can help make the process much easier.

They’ll cut through the confusing stuff, explain everything clearly, and find options tailored to your needs.

With their expertise, you can feel confident about the choices you’re making.

Not sure where to begin? Just fill out a quick form, and we’ll connect you with a specialist in equity release. They’ll help you get the best deal and guide you every step of the way.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How do I choose a drawdown equity release provider?

It’s crucial to select the right provider, and consultation with a professional can help you make an informed choice. When considering providers, research their reputation, financial stability, membership with regulatory bodies, interest rates, and customer support. Look for a provider that aligns with your specific needs and financial goals.

How do the costs of drawdown plans compare to lump sum plans?

Drawdown plans generally don’t cost more than lump sum plans, as interest is only paid on the money you’ve withdrawn. It’s an aspect worth considering if you’re deciding between the two.

Is drawdown equity release the right option for me?

Determining if drawdown equity release suits you requires careful thought about your personal and financial situation. Professional advice can guide you through this decision.

How are drawdown lifetime mortgages taxed?

Drawdown lifetime mortgages are not usually taxable, but other factors may influence this. Consultation with a financial advisor or tax professional is wise.

Can I Move House with a Drawdown Lifetime Mortgage?

Moving with a drawdown lifetime mortgage is possible, but restrictions may apply. Understanding these will help you decide if this option is viable for you.