- What are Interest-Only Lifetime Mortgages?

- When is an Interest-Only Mortgage a Good Idea?

- The Pros and Cons of Interest-Only Lifetime Mortgages

- Interest-Only Lifetime Mortgage Calculator

- How to Get an Interest-Only Lifetime Mortgage

- Eligibility Criteria for Interest-Only Lifetime Mortgages

- What Are the Interest Rates for Interest-Only Lifetime Mortgages?

- Which Providers Offer Interest-Only Lifetime Mortgages?

- Exploring Options Beyond an Interest-Only Lifetime Mortgage

- Key Takeaways

- The Bottom Line

Should You Get an Interest-Only Lifetime Mortgage?

If you’ve heard about interest-only lifetime mortgages but aren’t quite sure what they are, don’t worry—we’ve got you covered.

These loans let you borrow money against your home and only pay the interest while you’re alive.

This guide will explain how they work, what makes them different, and when they might be a good fit for your financial goals.

Whether you’re just curious or ready to dive in, we’ll make everything simple and easy to understand.

What are Interest-Only Lifetime Mortgages?

Interest-only lifetime mortgages work like a regular lifetime mortgage—you borrow money against your home—but with a twist.

Instead of letting the interest pile up, you pay it off as you go. This keeps the total amount you owe steady, rather than growing over time.

Because of this, they’re often called retirement interest-only (RIO) mortgages, as they’re designed with older homeowners in mind.

Your home acts as security for the loan, and when you pass away or move into long-term care, the sale of your property pays off the remaining balance.

The big difference between these and standard interest-only mortgages? The “lifetime” part. This loan lasts as long as you do, giving you more flexibility and peace of mind.

When is an Interest-Only Mortgage a Good Idea?

An interest-only lifetime mortgage can be a handy option if you’re looking to keep your finances in check while staying flexible.

Imagine trimming down your monthly payments without watching your loan amount creep up over time—that’s exactly what this type of mortgage offers.

It’s also a solid choice if leaving an inheritance is high on your list of priorities.

By covering just the interest, you’re protecting your home’s value, which could mean more for your loved ones later on.

If you think your property’s value will climb in the future, or if you simply like the idea of feeling on top of your money game, this could be the perfect solution for you.

The Pros and Cons of Interest-Only Lifetime Mortgages

While this may be a good option for most homeowners looking to release cash from their home. It’s crucial to weigh up the pros and cons before making a final decision. Let’s break it down for you:

Pros:

- You can keep the amount you owe the same by paying off the interest as you go.

- Interest rates are typically fixed for life, so you know how much you will have to pay each month

- You retain ownership of your home and enjoy any growth in its value.

- The money you release is tax-free and you can use this for any purpose, such as home improvements, debt consolidation, or retirement expenses.

- You don’t have to repay the loan until you die or move into care.

- You can take the mortgage with you if you move.

Cons:

- The equity you release can reduce what you leave for your family.

- It could affect your eligibility for means-tested benefits.

- You may have to sell your home if you can no longer afford the interest payments.

- There may be additional monthly costs.

- There may be early repayment charges if you decide to repay the loan early.

- Interest-only lifetime mortgages can be more expensive than other types of mortgages.

Interest-Only Lifetime Mortgage Calculator

When considering an interest-only lifetime mortgage, understanding how much equity you can release is key.

Many factors can affect this, including the amount of equity you own, your age, credit score, type of property, and the lender you choose.

You can use our equity release calculator to get an estimate of how much you could release.

Keep in mind, these are just estimates, and you should consult a specialist equity release mortgage advisor for accurate and tailored figures.

A specialist advisor can provide insights beyond what a simple calculator can offer, assisting you in making the best decision for your financial situation.

How to Get an Interest-Only Lifetime Mortgage

Securing an interest-only lifetime mortgage might feel like a complex process, but by following these steps, you can navigate it with ease and confidence.

- Speak to a lifetime mortgage expert. A lifetime mortgage expert can help you understand your options and choose the right mortgage for your needs.

- Evaluate your eligibility. Not everyone is eligible for an interest-only lifetime mortgage. You will need to be over 55, have a certain amount of equity in your home, and meet other requirements.

- Start your application. A broker can help you with this process. They will find a lender, assess your finances, and help you with the paperwork.

- Have your property valued. The lender will need to value your property to assess the risk of the loan.

- Receive your offer. Once the lender has approved your application, you will receive an offer with the terms of the mortgage.

- Work with a solicitor. A solicitor will review the mortgage documents and ensure that they are in your best interests.

- Complete the mortgage. Once you have agreed to the terms of the mortgage, the lender will release the funds to your solicitor.

- Manage your mortgage. You will need to make interest payments on your mortgage, and you may also need to make capital repayments.

By following these steps, you’re well on your way to securing an interest-only lifetime mortgage.

Remember, the guidance of a skilled mortgage broker and solicitor is invaluable in this process, ensuring that everything goes smoothly for you.

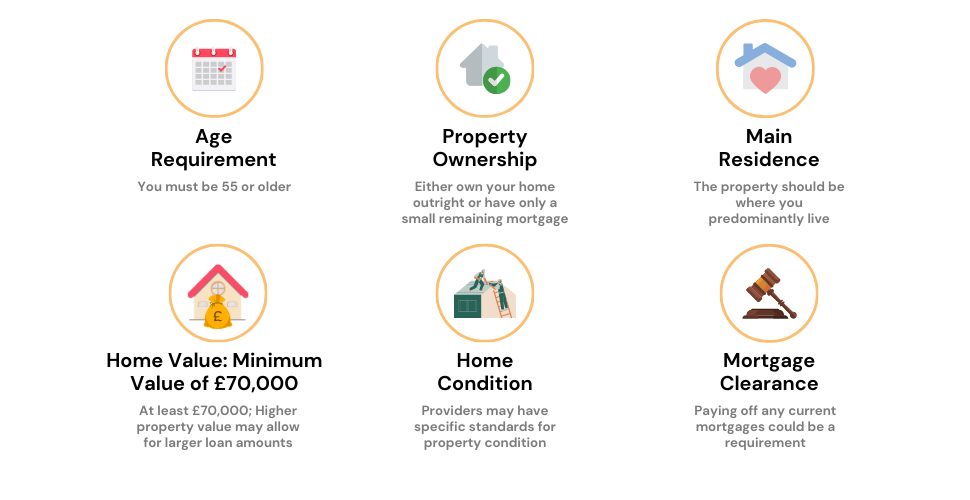

Eligibility Criteria for Interest-Only Lifetime Mortgages

The eligibility criteria for interest-only lifetime mortgages can vary by provider, but they typically include the following:

- You must be over 55 years old.

- You must own your own home outright or have a small mortgage remaining.

- Your home must be worth at least £70,000.

- You must be able to afford the interest payments.

- You must be in good health.

Note that these general eligibility criteria may vary by provider. Always ask your provider or a mortgage broker to understand their specific requirements.

What Are the Interest Rates for Interest-Only Lifetime Mortgages?

If you get an interest-only lifetime mortgage, the interest rate is often set and won’t change. It’s based on how much money you borrow. Some lenders might let the rate change with the market, but most will fix it.

Having a fixed rate is good because your payments stay the same. But it’s really important to get the best deal you can.

Otherwise, you might end up paying more over the lifetime of your loan.

Currently, the rates for these mortgages are between 6% and 8%. The exact rate you get can change based on different things like your age and how much of the house’s value you want to borrow.

Talking to an expert can help you understand what rate you might get. They’ll look at your specific situation and help you find the best deal.

Which Providers Offer Interest-Only Lifetime Mortgages?

Interest-only lifetime mortgages are special loans that let you borrow money while only paying the interest. Here are some well-known lenders offering these:

- Nationwide: They provide fixed or variable interest-only loans for older homeowners. You can borrow up to £500,000, but the loan must not exceed half the home’s value.

- Tipton Building Society: They offer these loans with a 60% maximum LTV. To qualify, you’ll need a pension that meets their requirements.

- Stonehaven: Their plan lets you borrow between £10,000 and £750,000 using your home’s value.

Some smaller lenders also have interest-only lifetime mortgages, but they don’t always advertise these deals.

Speaking to a specialist broker can help you uncover all your options and find the best fit for you.

Remember, lenders’ offers and rules might have changed since this was written.

It’s always a good idea to double-check directly with lenders or ask a broker for the latest details. They’ll make sure you’re getting the most up-to-date and suitable deal for your needs

Exploring Options Beyond an Interest-Only Lifetime Mortgage

An interest-only lifetime mortgage might be suitable for some, but it’s not the only path to access funds during retirement. Here’s a quick rundown of alternatives:

- Downsizing – If equity release doesn’t fit your needs, consider downsizing your home. Consult an equity release guide for more insights.

- Continuing to Work or Shifting to Part-Time – Delaying retirement or shifting to part-time work might give you the extra cash you need.

- Selling Valuable Assets – If you have valuable items that are no longer needed, selling them could provide additional funds.

- Enhanced Lifetime Mortgage – For those with certain health conditions, this mortgage may enable unlocking more cash, possibly at better rates.

- Roll-Up Lifetime Mortgage – This option doesn’t require monthly payments; the loan and interest are covered by your home’s sale when you’re no longer living there.

- Drawdown Lifetime Mortgage – It’s like a roll-up but allows taking the loan in instalments, keeping cash interest-free until needed.

- Flexible Lifetime Mortgage – You have the option to make voluntary payments, reducing your loan amount.

- Home Reversion – You can sell part or all of your property to your equity release provider, obtaining tax-free cash.

Key Takeaways

- Interest-Only Lifetime Mortgages allow you to pay off interest over time, keeping the amount you owe the same, suitable for pensioners or later-life individuals.

- This type of mortgage offers fixed interest rates and tax-free money release, but it may affect benefits eligibility and have higher interest rates.

- Currently, the average rates for interest-only lifetime mortgages are between 6% and 8%, depending on various factors. This includes your age and property value.

- Several known lenders offer these mortgages, and there are other alternatives like downsizing and different types of lifetime mortgages.

- Speaking with a specialist is critical to understand the intricacies and securing the best deal for an interest-only lifetime mortgage.

The Bottom Line

Let’s face it, lifetime mortgages can feel like a puzzle with way too many pieces. They’re not exactly the kind of thing you want to figure out on your own, especially when your finances are on the line. One small slip-up could cost you a lot—yikes!

That’s why having a pro in your corner is such a game-changer. They’ll handle the heavy lifting, breaking down all the confusing terms, finding options that suit you, and even scoring you the best possible interest rate.

Basically, they’re your go-to guide from start to finish.

If you’re scratching your head wondering where to find someone like this, don’t worry—we’ve got you covered.

Just fill out this quick form, and we’ll hook you up with a top-notch mortgage specialist. They know the market inside out and will help you sort everything without the stress.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What happens to my home at the end of an interest-Only lifetime mortgage?

At the end of an interest-only lifetime mortgage or upon the homeowner’s death, the borrowed capital is repaid, usually through the sale of the property.

The sale typically occurs after death or if the homeowner moves into long-term care. Any remaining equity goes to the estate or beneficiaries. Specifics can vary, so consult with your lender or a mortgage advisor.

Can I qualify for an interest only lifetime mortgage at any age?

No, eligibility for an interest-only lifetime mortgage typically starts at 55 years old. Some providers may have different age requirements, so it’s advisable to consult with a mortgage advisor or lender for specific information tailored to your situation.