What Mortgage Can You Get for £400-£500 a Month?

“Is a £400-£500 mortgage possible?” 🤔

This might be a question that pops in your head when budgeting your finances to buy a home.

The good news is, you can definitely make it happen—but it takes some planning.

To make it work, you’ll need to be smart about your money. Factors like how much you can save for a deposit, interest rates, and the length of your mortgage term will all make a difference.

Luckily, this guide got you covered. 😃

We’ll show you how to make the most of your money and find the best mortgage deal for you.

Let’s get started.

How Much Mortgage Can I Get for £400 a Month in the UK?

The amount you can borrow depends on a few things: the interest rate, the mortgage term, and your deposit.

For example, if you borrow for 25 years at 4.5% interest, £400 a month might get you a mortgage of around £71,964.

But if interest rates go up to 6%, you might only be able to borrow about £62,083.

These are just estimates. How much you can actually borrow depends on your finances, like your credit score and job.

What Mortgage Can I Get for £500 a Month in the UK?

If your budget stretches to £500 a month, you have a bit more flexibility.

For the same 25-year term and a 4.5% interest rate, you could potentially borrow up to £89,955. But remember, interest rates can change.

If they go up to 6%, you might only be able to borrow about £77,603.

That extra £100 a month can make a big difference. It could mean the difference between a small flat and a family home.

How Much Mortgage Could I Get?

Figuring out how much mortgage you can get isn’t just about your budget – it’s also about what lenders will offer you.

Most UK lenders look at your income and might lend you up to 4.5 times what you earn each year.

So, if you make £30,000 a year, you could maybe borrow up to £135,000.

But this can change based on other things like your debts, credit score, and if you’re buying with someone else.

Remember, these are just rough figures.

To find out exactly what you can borrow, try using a mortgage calculator online or talk to a good mortgage advisor.

What Factors Impact My Mortgage Payment?

There are a few things that can change how much your mortgage costs each month. Understanding these will help you get the best deal.

- Interest rate – This is like the cost of borrowing money. Lower rates mean you can borrow more without paying loads each month. For example, if interest rates are low, you could borrow nearly £90,000 with a £500 monthly payment. But if rates are higher, you might only be able to borrow around £77,000. So, keep an eye on interest rates and try to get a good deal.

- Your deposit – How much you save up before buying a home matters. A bigger deposit usually means better interest rates. This could save you money each month or let you borrow more.

- How long you borrow for – This is called the mortgage term. A longer term means lower monthly payments but more interest over time. A shorter term means higher payments but less interest in the long run.

- The type of mortgage – There are different kinds of mortgages. Some mean you only pay the interest each month, but you have to pay back the whole loan at the end. Others mean you pay off the loan bit by bit.

- Your credit score – This shows how good you are at managing money. A good credit score usually means better interest rates, so your monthly payments will be lower.

How to Get the Best Rates and Make Your Money Go Further

Finding the right mortgage within your £400-£500 a month budget isn’t just about looking at the numbers. It’s also about making strategic decisions that can help you stretch your money further.

Shop Around

Don’t just pick the first deal you see.

Compare different lenders to find the best rate for you.

You can do this yourself or use a whole-of-market mortgage broker to find exclusive deals. They can even negotiate better terms for you.

To get started, contact us, and we’ll connect you with a top broker for a free, no-obligation consultation.

Consider Government Schemes

Struggling to find a mortgage within your budget?

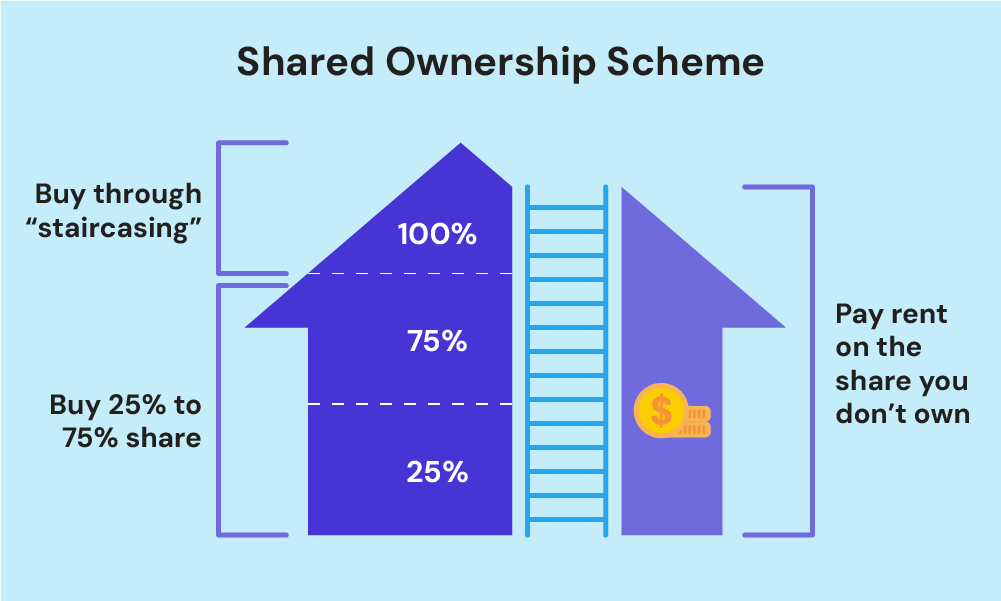

Government schemes like Mortgage Guarantee Scheme or Shared Ownership are designed to help you.

For instance, Shared Ownership lets you buy part of a property and pay rent on the rest, easing your monthly costs.

Increase Your Deposit

If you can, increase your deposit.

Even an extra 5% can transform the mortgage terms, lowering both your interest rate and monthly payments.

Improve Your Credit Score

Before you apply, take steps to improve your credit score. Pay off debts, avoid new credit applications, and ensure your credit report is spotless.

A higher score could be your ticket to a better deal.

Key Takeaways

- Your monthly mortgage payment depends on your deposit, interest rate, mortgage term, credit score, and overall finances.

- At 4.5% interest, £400 a month might allow you to borrow around £71,964, while £500 a month could increase that to £89,955.

- Higher interest rates will reduce the amount you can borrow, so keeping an eye on rates is crucial.

- To improve your chances, save up for a bigger deposit, improve your credit score, and use a mortgage broker to find the best deals.

The Bottom Line: What Mortgage Could I Get?

Getting a mortgage with monthly payments between £400 and £500 is definitely possible. But there are a few things to think about.

Your deposit, credit score, and mortgage terms – all play a part in how much you can borrow.

Interest rates are also important – they affect how much your mortgage costs each month.

To get the best deal, it’s a good idea to shop around and use a whole-of-market mortgage broker. They can help you find the right deal for you.

Remember, the mortgage market changes all the time. So, it’s worth keeping an eye on things and getting advice.

Whether you’re buying your first home or looking to move, there’s a mortgage out there to suit your needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is it worth extending my mortgage term to lower monthly payments?

Extending your mortgage term can lower your monthly payments, but it also means you’ll pay more in interest over the life of the loan.

It’s essential to weigh the short-term benefits against the long-term costs.

Can a broker help me find a mortgage within my budget?

Yes, a mortgage broker can help you find the best deals within your budget, negotiate better terms, and guide you through the mortgage process.

They can be particularly helpful if you have a limited budget or less-than-perfect credit.

Are there buy-to-let mortgages with payments of £500 a month?

Yes, it’s possible to find a buy-to-let mortgage with payments around £500 a month. But there are a few things to consider.

You’ll probably need a big deposit, a good interest rate, and to borrow the money over a longer period.

To find the best deal, it’s a good idea to compare different lenders or talk to a mortgage broker. They can help you figure out what’s possible.