- Can You Get a Mortgage If You’re Renting?

- How Rent Arrears Affect Mortgage Applications

- How Can You Improve Your Chances of Getting a Mortgage with Rent Arrears?

- What Is a Renterâs Mortgage?

- How Much Rent Can I Afford in the UK?

- How Do Rent Payments Compare to Mortgage Payments?

- Can You Pay Rent and a Mortgage at the Same Time?

- What If Youâre Paying Rent but Canât Get a Mortgage?

- Key Takeaways

- The Bottom Line

Does Renting Affect Your Mortgage Application?

In today’s housing market, many people find themselves renting for longer periods before making the leap to homeownership.

But what happens when your renting history includes missed payments? Can these rent arrears affect your ability to get a mortgage?

This article delves into how rent arrears could influence your mortgage application and what you can do to improve your chances of approval.

Can You Get a Mortgage If You’re Renting?

Yes, you can.

Renting itself doesn’t negatively impact your mortgage application. However, it’s essential to understand how your rental history is perceived by lenders.

Many renters believe that years of on-time rent payments will boost their mortgage chances

But this isn’t always true.

Here’s why:

No Automatic Credit Boost

Regular rent payments aren’t usually reported to credit agencies. So they don’t automatically improve your credit score.

But, if you or your landlord use a rent reporting scheme like the Rental Exchange Scheme, these payments can be recorded and might help your credit profile.

Potential Red Flags

On the flip side, if you’ve missed rent payments, this can be a big red flag for lenders.

Missed payments may lead to severe consequences, such as a County Court Judgment (CCJ), which can seriously damage your credit score and make getting a mortgage much harder.

How Rent Arrears Affect Mortgage Applications

Rent arrears are when you miss or pay your rent late. If you can’t pay your rent on time, it might show lenders that you have trouble managing your money.

This is a big problem for mortgage lenders because they need to know if you can keep up with your monthly mortgage payments.

Here’s how this can affect your mortgage application:

- Credit Score. If your landlord has reported your rent arrears to a credit agency or if a County Court Judgment (CCJ) has been issued for unpaid rent, this can lower your credit score. A lower score can limit your mortgage options and might lead to higher interest rates or stricter terms.

- Affordability Assessment. When assessing your mortgage application, lenders look at your overall financial stability. Rent arrears could signal that you’ve had trouble managing your finances. As a result, lenders might see you as a higher risk. This could lead to your application being declined or approved with less favourable conditions.

- Lender Perception. Even if your rent arrears don’t show up on your credit score, lenders might still ask about your rental history. Being upfront about past financial difficulties and explaining how you’ve improved can help. However, the arrears could still influence the lender’s decision.

How Can You Improve Your Chances of Getting a Mortgage with Rent Arrears?

If you’ve experienced rent arrears, all is not lost.

There are steps you can take to improve your chances of getting a mortgage:

- Clear Outstanding Debts. Before applying for a mortgage, work on clearing any outstanding debts, including rent arrears. Showing that you’ve resolved these issues can help rebuild your credit score and demonstrate financial responsibility.

- Build Your Credit Score. Focus on improving your credit score by making all payments on time, reducing your debt, and avoiding new credit applications in the months leading up to your mortgage application.

- Consider a Specialist Lender. Some lenders specialise in providing mortgages to individuals with adverse credit histories, including those with rent arrears. A mortgage broker can help you find the right lender for your circumstances.

- Save a Larger Deposit. A larger deposit can make you a more attractive borrower by reducing the lender’s risk. This can sometimes offset the negative impact of rent arrears on your mortgage application.

- Seek Professional Advice. Working with a mortgage broker who understands your situation can be invaluable. They can guide you through the process, help you find the best deals, and ensure your application is as strong as possible.

What Is a Renter’s Mortgage?

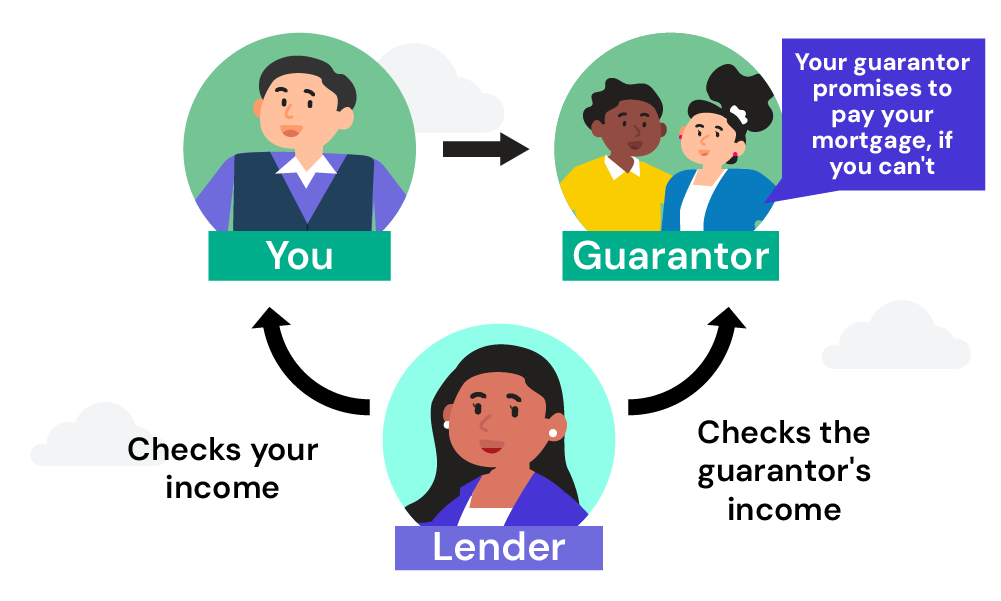

A renter’s mortgage is a type of mortgage designed for renters who want to become homeowners.

These options can include no-deposit mortgages or guarantor mortgages, which are helpful if you’re struggling to save for a deposit.

Some lenders offer special deals for renters with a solid history of on-time rent payments. But, rent payments alone won’t secure a mortgage.

Lenders will still look at your overall financial stability, credit score, and affordability before approving your application.

How Much Rent Can I Afford in the UK?

Knowing how much rent you can afford is key to avoiding arrears and keeping your finances in check.

A good rule of thumb is that your rent shouldn’t exceed 30% of your gross monthly income.

But, in expensive areas like London, many people end up spending 40% or more on rent.

To work out how much rent you can afford:

- Assess Your Monthly Income – Add up your total gross monthly income, including wages, benefits, and any other earnings.

- Apply the 30% Rule – Multiply your gross monthly income by 0.30 to find a reasonable rent amount.

- Consider Your Outgoings – Make sure to account for other essential expenses like utilities, transport, food, and debts, so you can comfortably afford your rent.

By sticking to these guidelines, you can lower the risk of falling into rent arrears and protect your credit score.

How Do Rent Payments Compare to Mortgage Payments?

Many renters think that paying rent on time for years should qualify them for a mortgage of the same amount. But, lenders assess mortgage affordability differently from rent.

- Income Focus: Lenders care more about your income and overall financial stability than your rent payment history. They need to be sure you can afford the mortgage repayments, even if interest rates rise.

- Long-term Affordability: Mortgage assessments look at the long-term costs of owning a home, such as maintenance, insurance, and possibly ground rent. This goes beyond the shorter-term focus of renting.

- Affordability Assessments: While your rent might be similar to a mortgage payment, lenders usually offer mortgages up to 4.5 times your income. They also consider how well you manage your current expenses, which could work in your favour if you’ve been budgeting well.

| Aspect | Rent Payments | Mortgage Payments |

|---|---|---|

| Income Focus | Less linked to income stability. | Strong focus on income and financial stability. |

| Long-term Affordability | Short-term, fewer responsibilities. | Includes long-term costs like maintenance and insurance. |

| Affordability Assessments | Rent alone isn’t proof of mortgage affordability. | Lenders assess overall financial management and income. |

Can You Pay Rent and a Mortgage at the Same Time?

Yes, you can, but it needs careful financial planning.

Some people choose to pay rent while also having a mortgage on a buy-to-let property.

This can be a good way to move towards homeownership, especially in areas with high property prices.

But, it’s important to make sure you can afford both payments.

If you’re thinking about this option, it’s a good idea to speak to a mortgage broker who can help you assess your finances and find the right mortgage for you.

What If You’re Paying Rent but Can’t Get a Mortgage?

If you’re paying rent but struggling to get a mortgage, you’re not alone.

Many renters face this due to high property prices, deposit requirements, or credit issues. Here’s what you can do:

- Improve Your Financial Profile. Work on boosting your credit score, saving a larger deposit, and reducing your debts. These steps can make you a more appealing borrower.

- Consider Alternative Mortgage Options. Explore government-backed schemes, shared ownership, or help-to-buy options that require smaller deposits.

- Seek Expert Advice. A good mortgage broker can help you find the best options and guide you towards a mortgage that fits your situation.

Key Takeaways

- Rent arrears can harm your mortgage application, especially if they result in a County Court Judgment (CCJ) or lower your credit score.

- Renting doesn’t automatically boost your mortgage chances, as rent payments are usually not reported to credit agencies.

- To improve your chances, clear any outstanding debts, build your credit score, save a larger deposit, and consider working with a mortgage broker.

- Lenders focus more on your income and long-term financial stability than on your rent payment history.

- It’s possible to pay both rent and a mortgage with careful financial planning, especially if you’re considering a buy-to-let property.

The Bottom Line

In short, don’t worry about your rent history. Even if you’ve missed rent payments, you can still get a mortgage.

It might be harder, but it’s possible.

You need to fix any financial problems and show that you’re responsible with money.

A good mortgage advisor can help you figure out how to do this. They can:

- Provide personalised advice tailored to your financial situation

- Guide you through the mortgage application process

- Find lenders who are more likely to approve your application

- Offer access to a wider range of mortgage products, even if you have a tricky credit history

If you want to save time and reduce stress, get in touch with us. We’ll connect you with a reliable broker who can help with your mortgage needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is the Rental Exchange Scheme (RES)?

The Rental Exchange Scheme, introduced by Experian, lets tenants have their rent payments included on their credit reports, which can help improve their credit score.

Here’s how it works:

- How It Works: You pay your rent to a service like Credit Ladder, which then passes it on to your landlord and reports the payment to Experian. If you pay on time, it can help build a positive credit history.

- Risks to Consider: While the RES can boost your credit score, it also has risks. Late or missed payments will be recorded and could harm your credit score. This is especially important if you rely on benefits like Universal Credit, which can sometimes be delayed.

Do mortgage lenders look at rental history in the UK?

UK mortgage lenders usually don’t check your rent history. But if your landlord has reported your rent payments to a credit agency, it can affect your credit score.

Lenders care more about your credit score, how much money you make, and if you’re financially stable.

Does rent count towards credit score in the UK?

Paying rent on time doesn’t usually help your credit score in the UK.

But if you or your landlord use a service called the Rental Exchange Scheme, your rent payments can be reported to a credit agency.

If you pay your rent on time, your credit score will go up. But if you miss rent payments, it will go down.

If you don’t use a rent reporting scheme, your rent payments won’t affect your credit score.

What should I avoid when applying for a mortgage in the UK?

When applying for a mortgage in the UK, avoid doing these things:

- Taking on new debt: Don’t borrow more money.

- Making late payments: Pay your bills on time.

- Applying for more credit: Don’t ask for more loans.

- Changing jobs: Stay in your current job.

- Overdrawing your bank account: Don’t spend more money than you have.

- Missing payments: Pay all your bills on time.

- Making large, unexplained deposits or withdrawals: Don’t make big money transfers without a good reason.

If you do any of these things, it might be harder to get a mortgage.

Can I use rental income to qualify for a mortgage in the UK?

Yes, you can use rental income to get a mortgage in the UK. This is especially good for buy-to-let mortgages. Lenders will look at your rental income to see if you can afford the mortgage.

But for residential mortgages, lenders usually focus on your main income, like your salary. They might not consider your rental income.