Mortgage Affordability: What If You’re Declined?

Getting a mortgage can be an exciting yet nerve-wracking experience.

You’ve found your dream home, saved up a deposit, and are ready to take the plunge into homeownership.

But what happens when your mortgage application is declined due to affordability issues?

Don’t worry – you’re not alone, and there may still be options available to you.

In this article, we’ll explain why mortgages are sometimes declined on affordability grounds, what you can do if this happens to you, and how to improve your chances of approval in the future.

We’ll also answer some common questions about mortgage affordability and provide key takeaways to help you through this process.

Why Was My Mortgage Declined on Affordability?

Since the 2008 financial crisis, lenders are more careful. They now apply stricter checks to make sure you can afford your mortgage repayments.

Here are some common reasons why your mortgage application might be declined:

Income vs. Loan Size

Most lenders use income multiples to decide how much they’ll lend you. Typically, they offer mortgages at 4.5 times your salary.

For example, if you earn £40,000 a year, the maximum mortgage you might get is £180,000.

If you apply for more than this, your application might be rejected.

Some lenders may offer higher multiples, up to 5 or 6 times your salary, but these are rare and usually have stricter requirements.

High Outgoings and Debt-to-Income Ratio (DTI)

Lenders don’t just consider your income; they also look at your expenses.

If your regular spending, including debt repayments, is too high compared to your income, this could lead to a rejection.

The debt-to-income ratio (DTI) is an important measure for lenders. A high DTI suggests you might struggle to manage more debt, making you a riskier borrower.

Most lenders prefer a DTI of 36% or less, with higher DTIs reducing your chances of approval.

Credit Issues

If you’ve had credit problems like missed payments, defaults, or CCJs, these can hurt your mortgage application.

Lenders may see you as a higher risk, especially if these issues are recent.

Depending on how serious the issues are, you might need a larger deposit, sometimes 15% or more, to balance the risk.

Income Types Considered

Not all lenders count every type of income. If you rely on commissions, bonuses, or freelance work, some lenders might not fully consider these.

Finding a lender who includes all your income sources can boost your chances of approval.

Property Issues

Sometimes, the property itself can cause problems.

If the home you want to buy or remortgage is non-standard, like one with a thatched roof or made from unusual materials, lenders may see it as a higher risk.

This could lead to a rejection if they think the maintenance costs might affect your ability to keep up with payments.

Deposit Size

A small deposit can make approval harder, especially if your credit score is low or your income is unstable.

Lenders might require a larger deposit to reduce their risk, particularly if your financial situation is more complex.

What Should You Do If Your Mortgage Is Declined?

If your mortgage is declined due to affordability, don’t worry. There are steps you can take to improve your chances next time.

Avoid Immediate Reapplications

Don’t rush to reapply right away. Multiple credit applications, including for car finance or credit cards, can make you look risky to lenders.

This can hurt your chances even more. Instead, work with a broker to find lenders that suit your situation.

Seek Professional Advice

Speaking with a mortgage broker is one of the best moves you can make.

They can give you advice tailored to your circumstances and help you find lenders more likely to approve your application.

Choose a broker with good reviews and qualifications like CeMAP to ensure you’re getting expert advice.

Improve Your Credit Score

If your credit history is an issue, there are ways to improve it.

Pay all your bills on time, reduce any existing debts, and avoid taking out new credit unnecessarily.

You can also use services like Experian Boost to help raise your credit score by adding additional financial information, such as utility payments.

Consider a Higher Deposit

If your income or credit history is a problem, a larger deposit might help.

A bigger deposit reduces the loan-to-value (LTV) ratio, making lenders more comfortable with approving your mortgage.

If possible, try to save more before reapplying.

Explore Different Lenders

Lenders aren’t all the same. Some specialise in mortgages for people with complex situations, like if you’re self-employed or have bad credit.

Also, don’t rely only on comparison websites for mortgage quotes. Not all lenders are listed, and the quotes may not be fully accurate.

A whole-of-market mortgage broker can help you find these lenders and guide you to the best options for your situation.

Can You Get a Mortgage Without Affordability Checks?

Some people think you can get a mortgage without affordability checks, but this isn’t true.

In the UK, all lenders must check affordability before offering a mortgage.

This ensures you don’t take on more debt than you can handle, which could lead to financial trouble or even losing your home.

In the past, there were “self-cert” mortgages where you could declare your income without proof. These have been removed because of the risks involved.

Now, all lenders must thoroughly check that you can afford the mortgage, even if your financial situation changes.

What Happens If You Can’t Remortgage Due to Affordability?

If you’re finding it hard to remortgage because of affordability, you’re not alone.

Many homeowners face this challenge, especially when interest rates rise or their financial situation changes.

But what happens if your remortgage application is declined?

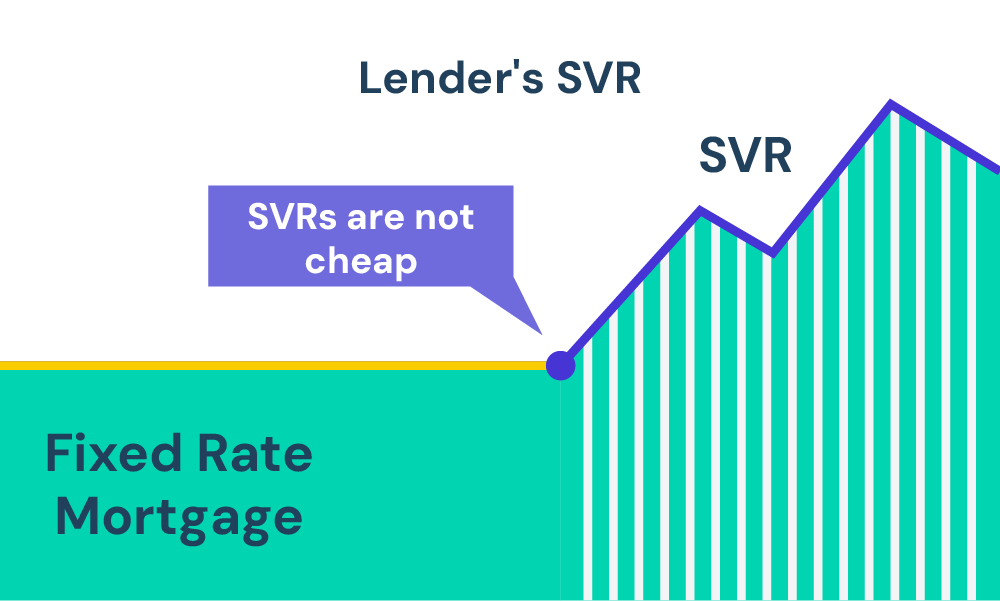

Standard Variable Rate (SVR)

If you can’t remortgage, your lender may move you onto their Standard Variable Rate (SVR) once your fixed-rate deal ends.

SVRs are usually higher than fixed rates, which could make your monthly payments much more expensive.

While this is worrying, there are still options to explore.

Extending Your Mortgage Term

One way to lower your monthly payments is by extending your mortgage term. By spreading the payments over a longer period, you can reduce your monthly costs.

However, this means you’ll pay more interest overall.

Switching to an Interest-Only Mortgage

Another option is switching to an interest-only mortgage, where you only pay the interest each month, not the capital.

This can lower your monthly payments significantly, but remember, you’ll still owe the full mortgage amount at the end of the term.

It’s usually seen as a temporary fix rather than a long-term solution.

Consider a Guarantor

If affordability is a major issue, you might consider adding a guarantor to your mortgage.

A guarantor is someone who agrees to cover your mortgage payments if you can’t.

This can make you a more attractive borrower to lenders, but it’s a big commitment for the guarantor, so think carefully before deciding.

Key Takeaways

- Mortgage affordability rejections are common, but they don’t mean you can’t get a mortgage.

- Understanding why you were declined is crucial for improving your chances of approval next time.

- Avoid reapplying immediately after a rejection to protect your credit score.

- Working with a mortgage broker can help you find lenders with criteria that match your financial situation.

- Consider options like a higher deposit, extending your mortgage term, or adding a guarantor if affordability is an issue.

The Bottom Line

Feeling overwhelmed after a mortgage rejection is completely normal. The good news is that there are still plenty of options to explore.

A good mortgage broker can provide the clarity and support you need, guiding you through alternative solutions and matching you with the right lender.

If you’re looking to save time and stress in your search for the right broker, get in touch with us. We will connect you with a reliable broker who can help you solve your specific mortgage situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a mortgage with an excellent credit score but still be refused?

Yes, even with an excellent credit score, other factors like high outgoings, low income, or unrecognised income sources can lead to a mortgage being declined.

What happens if I can’t remortgage due to affordability?

You may be moved onto your lender’s Standard Variable Rate (SVR), which can increase your monthly payments. Consider options like extending your mortgage term or switching to an interest-only mortgage to manage payments.

Can I get a mortgage without an affordability check?

No, UK lenders are required by law to conduct affordability checks to ensure you can manage the mortgage payments without financial difficulty.

Why would a remortgage be declined?

A remortgage can be declined for similar reasons as a new mortgage application, including low income, high outgoings, poor credit history, or changes in financial circumstances.

How can I improve my chances of mortgage approval after being declined?

Consider working with a mortgage broker, improving your credit score, saving a larger deposit, or exploring lenders that specialise in borrowers with complex financial situations.