- What’s an Islamic Mortgage?

- How Do Islamic Mortgages Work?

- What Types of Islamic Mortgages Are Available?

- Are Islamic Mortgages More Expensive Than Conventional Ones?

- Who Offers Islamic Mortgages in The UK?

- How Do You Apply For an Islamic Mortgage?

- Is an Islamic Mortgage Halal?

- Can Non-Muslims Get an Islamic Mortgage?

- What are The Pros and Cons of Islamic Mortgages?

- Are Islamic Mortgages Regulated in The UK?

- The Bottom Line

How To Get Islamic Mortgages: A Complete Guide

So, you’ve found your perfect home in the UK. The neighbourhood is spot-on, the price is right, and you can already picture your family settling in.

But there’s a catch – traditional mortgages don’t align with your Islamic beliefs.

It’s a common dilemma for many Muslims in the UK. You want to own a home, but you’re determined to do it in a way that honours your faith.

Here’s the good news: Islamic mortgages offer a solution.

These Sharia-compliant options are becoming more popular, making it possible for Muslims to buy a home without compromising their beliefs.

But what are Islamic mortgages? How do they work? And are they really halal?

In this guide, we’ll explain everything you need to know about Islamic mortgages, from how they’re structured to who offers them.

What’s an Islamic Mortgage?

Islamic mortgages, also known as halal mortgages, are designed to comply with Sharia law and help you achieve homeownership.

Here’s the key difference: Islamic mortgages don’t involve interest, which is forbidden under Islamic law. Sharia law prohibits riba (interest) because it’s seen as exploitative and unjust.

So, instead of interest, Islamic financial products use profit-sharing and leasing models.

These alternative structures let you buy a home without compromising your religious beliefs.

In the UK, the demand for Islamic mortgages is on the rise, with more banks and financial institutions offering these Sharia-compliant options.

Whether you’re Muslim or just interested in ethical financing, understanding how Islamic mortgages work can open new doors for your home-buying journey.

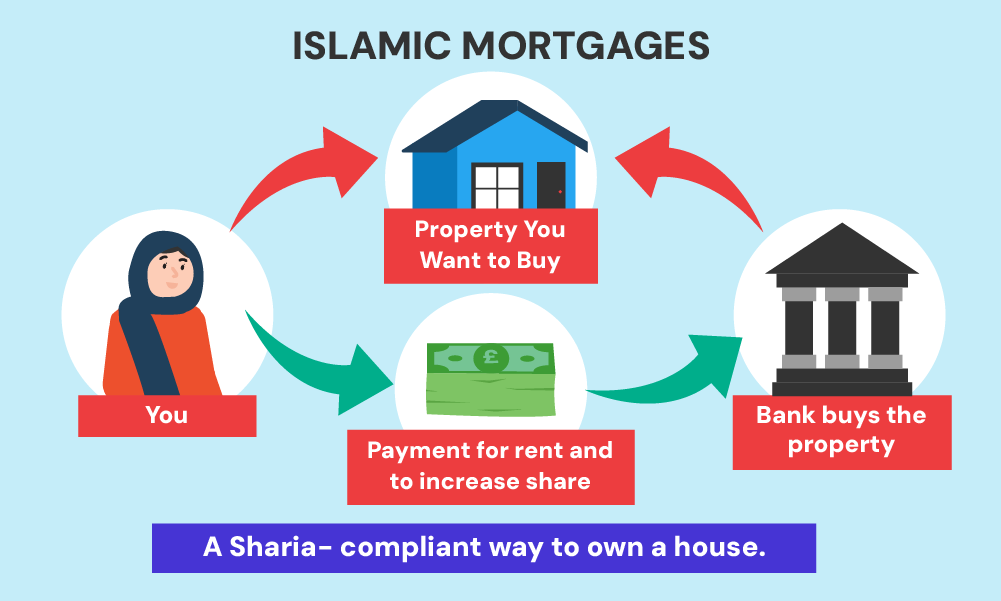

How Do Islamic Mortgages Work?

When you opt for an Islamic mortgage, you’re not actually getting a traditional loan.

Instead, you’re entering into a partnership with the bank or lender. Here’s how it typically works:

- The bank buys the property you want to purchase.

- You agree to buy the property from the bank over a set period, usually 25-30 years.

- You make regular payments to the bank, which include two components:

- A portion to buy the bank’s share of the property

- A rental fee for living on the property

As you make payments, you gradually increase your ownership of the property until you own it outright.

This structure allows you to finance your home purchase without paying or receiving interest, keeping it halal and Sharia-compliant.

What Types of Islamic Mortgages Are Available?

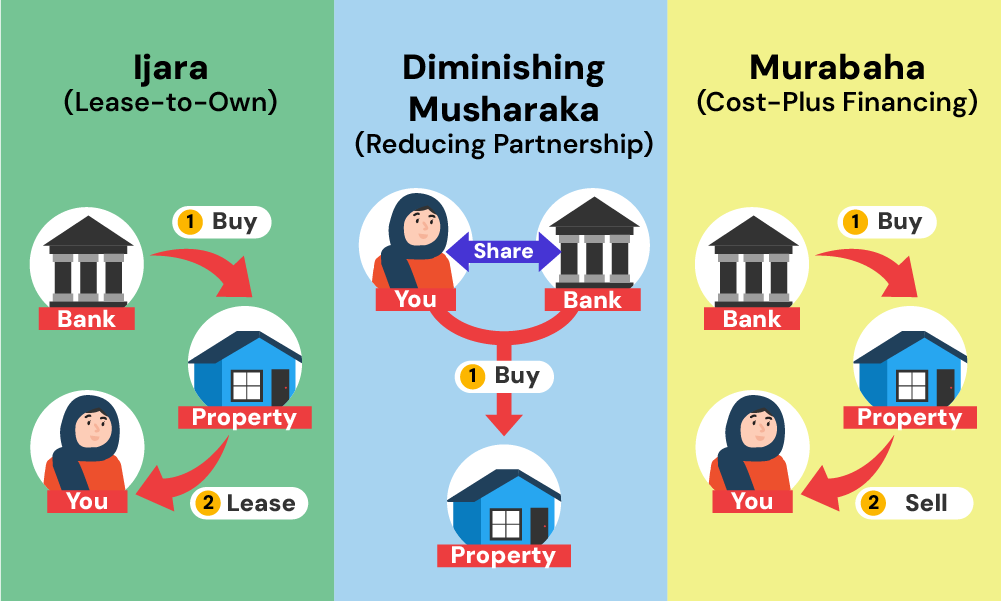

In the UK, you’ll typically find three main types of Islamic mortgages:

- Ijara (Lease-to-Own). The bank buys the property and leases it to you. Your monthly payments include rent and a contribution towards purchasing the property. At the end of the term, ownership transfers to you.

- Diminishing Musharaka (Reducing Partnership). You and the bank buy the property together. You gradually buy the bank’s share while paying rent on the portion you don’t own. Your ownership increases over time as the bank’s decreases.

- Murabaha (Cost-Plus Financing). The bank buys the property and immediately sells it to you at a higher price. You repay this amount in fixed instalments over the agreed term.

Each type has its nuances, so it’s worth discussing your options with a specialist Islamic mortgage advisor to find the best fit for your situation.

Are Islamic Mortgages More Expensive Than Conventional Ones?

You might be wondering if choosing an Islamic mortgage will cost you more. The truth is, it can vary.

Islamic mortgages can sometimes be more expensive due to their unique structure and the smaller number of providers, which means less competition.

However, as the market for Islamic finance grows in the UK, more competitive options are becoming available.

You might find that the costs are comparable to conventional mortgages, especially when you factor in the ethical and religious benefits.

When comparing costs, consider:

- The deposit required (often 20-25%, but some providers offer lower options)

- Monthly payments

- Fees and charges

- The overall cost over the full term

Remember, while the cost is important, it’s not the only factor. The peace of mind that comes from using a Sharia-compliant product can be invaluable for many Muslim homebuyers.

Who Offers Islamic Mortgages in The UK?

The UK has seen a growth in Islamic banking, with several institutions now offering Sharia-compliant mortgages. Some of the main providers include:

- Al Rayan Bank (formerly Islamic Bank of Britain)

- Gatehouse Bank

- Ahli United Bank

- United National Bank UK (UBL UK)

Additionally, some mainstream banks have started to offer Islamic mortgage products. It’s always worth checking with different providers, as the market is evolving rapidly.

When looking for an Islamic mortgage, consider working with a specialist mortgage broker who understands both Islamic finance principles and the UK property market. They can help you navigate the options and find the best deal for your circumstances.

How Do You Apply For an Islamic Mortgage?

Applying for an Islamic mortgage is similar to applying for a conventional mortgage in many ways. Here’s what you need to do:

- Check your eligibility – Ensure you meet the basic criteria (age, residency, income).

- Gather your documents – You’ll need proof of ID, address, income, and information about your expenses.

- Save for a deposit – Islamic mortgages often require a larger deposit, typically 20-25% of the property value.

- Get your finances in order – Make sure your credit score is good and your finances are stable.

- Speak to a specialist mortgage advisor – They can guide you through the process and help you find the best Islamic mortgage for your needs.

- Choose your product – Decide which type of Islamic mortgage suits you best.

- Submit your application – Provide all necessary information and documents to the lender.

- Property valuation – The lender will assess the property you want to buy.

- Receive an offer – If approved, you’ll get a mortgage offer detailing the terms.

- Complete the purchase – Work with your solicitor to finalise the deal and move into your new home.

Remember, the process can take several weeks, so start early and be patient.

>> More about Mortgage Applications

Is an Islamic Mortgage Halal?

This is a crucial question for many Muslim homebuyers. Islamic scholars generally agree that properly structured Islamic mortgages are halal (permissible under Islamic law).

Here’s why:

- They avoid interest (riba), which is forbidden in Islam.

- They’re based on partnerships or lease agreements, which are acceptable forms of transaction in Islamic finance.

- They involve shared risk between the bank and the buyer, aligning with Islamic principles of fairness.

However, it’s important to note that opinions can vary among scholars. Some argue that any form of mortgage is haram (forbidden) because it involves debt.

Others believe that Islamic mortgages provide a necessary alternative in non-Muslim countries where conventional mortgages dominate.

If you’re unsure, it’s always best to consult with a trusted Islamic scholar or financial advisor who can provide guidance based on your specific situation and beliefs.

Can Non-Muslims Get an Islamic Mortgage?

Absolutely anyone in the UK can apply for an Islamic mortgage, regardless of their religion.

These mortgages are Sharia-compliant, meaning they follow Islamic law, but that doesn’t exclude non-Muslims.

Some people who aren’t Muslim choose Islamic mortgages for two reasons.

One is that they like the ethical principles behind them. The other is that they find the terms themselves favourable.

Here’s what to consider if you’re thinking about an Islamic mortgage as a non-Muslim:

- Ethical financing: Islamic mortgages often align with ethical finance principles, which can appeal to socially conscious borrowers.

- Different structure: Understand that the way you’re financing your home purchase is fundamentally different from a conventional mortgage.

- Potential costs: Compare the overall costs with conventional mortgages to ensure it makes financial sense for you.

- Limited providers: You might have fewer options compared to the conventional mortgage market.

Remember, choose a mortgage that fits your financial situation and aligns with your values.

What are The Pros and Cons of Islamic Mortgages?

Like any financial product, Islamic mortgages have their advantages and disadvantages. Here’s a balanced view:

Pros:

- Sharia-compliant. Allows Muslims to buy homes without compromising their religious beliefs.

- Ethical. Based on principles of fairness and shared risk.

- Fixed payments. Often comes with fixed monthly payments, providing stability.

- No interest. You’re not paying interest, which some find more palatable.

- Government schemes. Many Islamic mortgages are eligible for government home-buying schemes.

Cons:

- Higher deposits. Often require larger deposits than conventional mortgages.

- Limited choice. Fewer providers and products compared to the conventional market.

- Potentially higher costs. Can be more expensive due to structure and limited competition.

- Complexity. The concepts can be more complex than traditional mortgages.

- Ownership transfer. In some structures, you don’t immediately own the property.

Weighing these factors against your personal circumstances and beliefs will help you decide if an Islamic mortgage is right for you.

Are Islamic Mortgages Regulated in The UK?

Yes, Islamic mortgages are regulated in the UK.

The Financial Conduct Authority (FCA) oversees Islamic financial products, including mortgages, ensuring they meet the same standards as conventional financial products.

This regulation means:

- You’re protected by UK financial laws and regulations.

- Islamic mortgage providers must be authorised and follow strict rules.

- You have access to the Financial Ombudsman Service if you have complaints.

- Your deposits are protected by the Financial Services Compensation Scheme.

This regulatory framework provides an extra layer of security and confidence when you’re considering an Islamic mortgage in the UK.

The Bottom Line

Islamic mortgages offer a viable path to homeownership for those seeking a Sharia-compliant option in the UK.

While they work differently from conventional mortgages, they’re designed to achieve the same goal – helping you buy your own home.

As with any major financial decision, it’s crucial to do your research, understand the terms, and seek professional advice to ensure you’re making the best choice for your circumstances.

Whether you’re Muslim or simply interested in ethical financing, Islamic mortgages are an option worth exploring in your journey to homeownership.

Need a broker? Get in touch. We’ll connect you with a qualified mortgage broker with experience with Islamic mortgages to help with your application.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Are there Islamic buy-to-let mortgages?

Yes, you can get Islamic buy-to-let mortgages in the UK. These mortgages follow Sharia law, so they avoid interest payments.

Instead, the bank buys the property and leases it to you, sharing the rental income. This arrangement is called Ijara. Make sure the terms fit your financial goals and understand the specific conditions of an Islamic buy-to-let mortgage.

Are there credit checks performed when getting Islamic mortgages?

Yes, lenders perform credit checks when you apply for Islamic mortgages.

They need to assess your ability to meet the mortgage payments, even though the mortgage structure is different from conventional ones. They review your credit history, income, and financial stability to decide your eligibility and terms.

How can I be sure my Islamic mortgage is totally halal?

To ensure your Islamic mortgage is halal, check that the lender follows Sharia law principles.

Look for certification from a recognised Sharia board or advisory body. These certifications mean Islamic scholars have reviewed and approved the mortgage.

You can also consult a trusted Islamic financial advisor to confirm the mortgage’s compliance. Always read the terms and conditions carefully and ask the lender any specific questions about the product’s adherence to Sharia principles.