- What Is a Joint Borrower Sole Proprietor Mortgage?

- How Does a JBSP Mortgage Work?

- Who Can Benefit from a JBSP Mortgage?

- What Are the Advantages of a JBSP Mortgage?

- Are There Any Drawbacks to Consider?

- Which Banks Offer JBSP Mortgages?

- What’s the Age Limit for a JBSP Mortgage?

- How Does Stamp Duty Work with JBSP Mortgages?

- How To Calculate Affordability for a JBSP Mortgage?

- What Should You Consider Before Applying for a JBSP Mortgage?

- Alternatives to Joint Borrower Sole Proprietor Mortgages

- The Bottom Line: Is a JBSP Mortgage Right for You?

Joint Borrower Sole Proprietor (JBSP) Mortgage Explained

Picture this: You’ve found your dream home, but your salary alone won’t secure the mortgage you need.

With soaring house prices and strict lending criteria, many first-time buyers find it challenging to secure a mortgage on their own. That’s where a Joint Borrower Sole Proprietor (JBSP) mortgage comes in.

This innovative mortgage option could be your ticket to homeownership, even if your income falls short of traditional requirements.

This guide explains everything you need to know about JBSP mortgages.

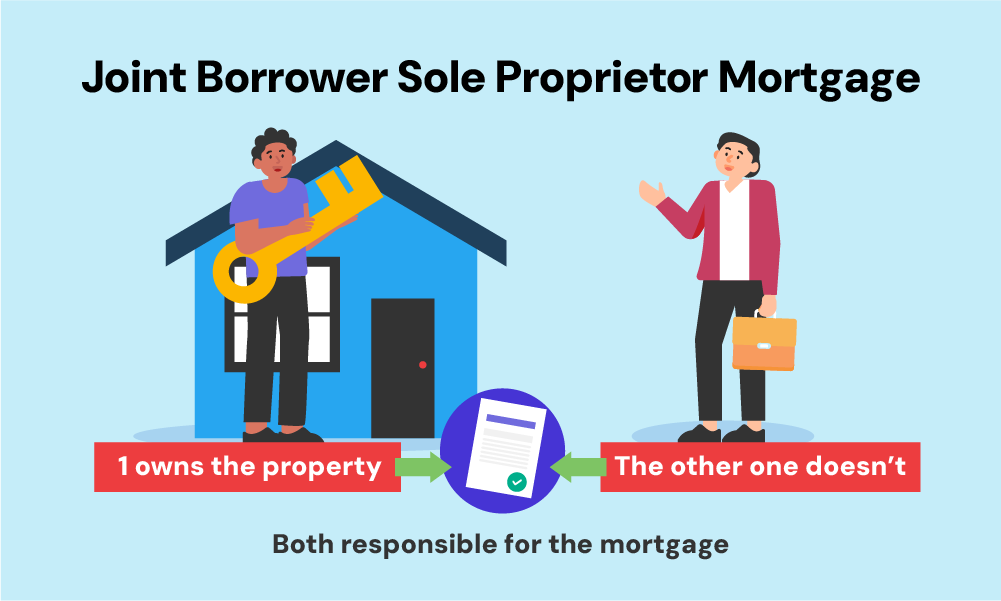

What Is a Joint Borrower Sole Proprietor Mortgage?

A Joint Borrower Sole Proprietor (JBSP) mortgage allows you to boost your borrowing power by adding up to three additional people’s incomes to your mortgage application.

The twist? While you’re all responsible for the mortgage payments, only you, as the sole proprietor, own the property.

It’s a win-win situation that’s gaining popularity among UK homebuyers.

How Does a JBSP Mortgage Work?

With a JBSP mortgage, you can rope in your parents, siblings, or even close friends to support your application. Their incomes are factored into the affordability assessment, potentially allowing you to borrow more.

Here’s the key: while all borrowers are on the hook for repayments, only YOU appear on the property deeds. This means you’re the sole legal owner of the home.

Your supporters are essentially lending their financial clout without claiming ownership rights.

It’s important to note that all borrowers undergo credit checks, and their existing financial commitments are considered.

So, choose your co-borrowers wisely!

Who Can Benefit from a JBSP Mortgage?

JBSP mortgages are a godsend for various situations:

- First-time buyers with modest incomes

- Young professionals early in their careers

- Self-employed individuals with fluctuating incomes

- Those with a less-than-perfect credit history

- Parents wanting to help their children onto the property ladder

If you fall into any of these categories, a JBSP mortgage could be your path to homeownership. 👍

What Are the Advantages of a JBSP Mortgage?

JBSP mortgages come with several perks that make them attractive to UK homebuyers:

- Increased borrowing capacity. By combining incomes, you can potentially secure a larger mortgage.

- Easier qualification. If you’re struggling to meet lending criteria alone, additional borrowers can strengthen your application.

- Stamp duty savings. As the sole proprietor, you may still qualify for first-time buyer stamp duty relief.

- Flexibility. You can include up to four borrowers, allowing for various family arrangements.

- Future independence. As your income grows, you can potentially remortgage in your name only.

Are There Any Drawbacks to Consider?

While JBSP mortgages offer numerous benefits, they’re not without potential pitfalls:

- Shared responsibility. All borrowers are liable for repayments, which could strain relationships if issues arise.

- Limited control for co-borrowers. Despite financial responsibility, co-borrowers have no legal rights to the property.

- Complexity. JBSP mortgages can be more complicated to set up and may require specialist advice.

- Impact on co-borrowers. Their involvement could affect their ability to secure other loans or mortgages.

- Exit strategy. Removing a borrower from the mortgage can be challenging if your circumstances don’t improve.

Which Banks Offer JBSP Mortgages?

While not all lenders offer JBSP mortgages, several major UK banks and building societies do. Some of the key players include:

- Barclays

- Nationwide

- Metro Bank

- Skipton Building Society

- Furness Building Society

Each lender has its own criteria and terms, so it’s worth shopping around or consulting a mortgage broker to find the best deal for your situation.

What’s the Age Limit for a JBSP Mortgage?

Age limits for JBSP mortgages can vary between lenders.

Generally, the maximum age at the end of the mortgage term is around 70-75 years old for the oldest borrower. This means if you’re including parents or older relatives, it could affect the length of the mortgage term available to you.

Some lenders may have more flexible policies, especially if the younger borrower can demonstrate they’ll be able to afford the mortgage on their own in the future.

It’s always best to check with individual lenders or consult a mortgage advisor for the most up-to-date information.

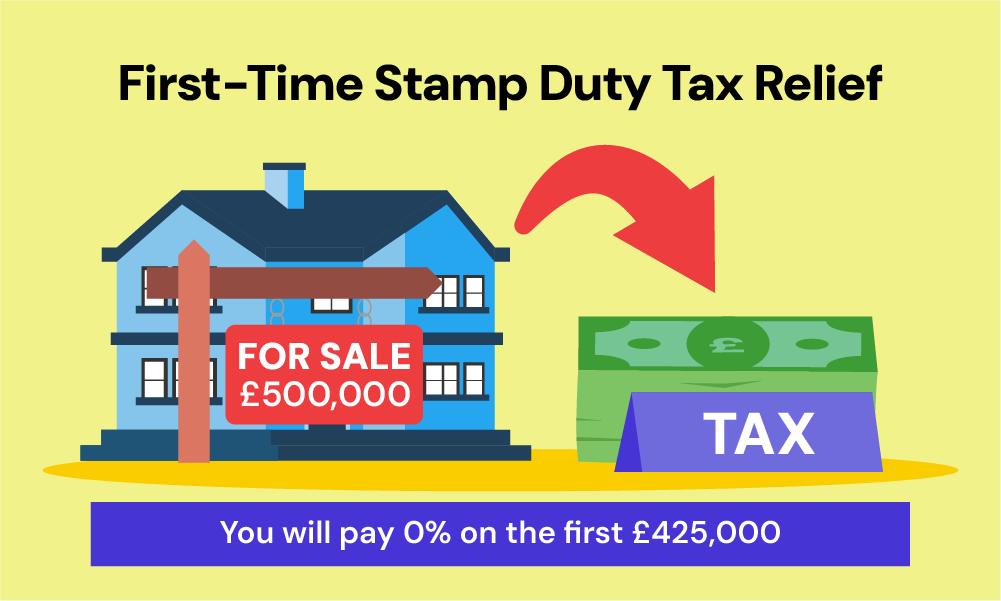

How Does Stamp Duty Work with JBSP Mortgages?

One of the major advantages of a JBSP mortgage is the potential stamp duty savings.

As the sole proprietor, if you’re a first-time buyer, you may still be eligible for stamp duty relief on properties up to £425,000 in England and Northern Ireland.

Even if your co-borrowers already own property, they won’t be liable for the additional 5% stamp duty surcharge that typically applies to second homes. This is because they’re not legally owning the property in a JBSP arrangement.

However, stamp duty rules can be complex and subject to change, so it’s always wise to seek professional advice to understand your specific circumstances.

How To Calculate Affordability for a JBSP Mortgage?

Calculating how much you can borrow with a JBSP mortgage isn’t too different from a standard mortgage, but it does involve a few extra steps:

- Add up all borrowers’ incomes

- Consider any existing financial commitments for all borrowers

- Factor in the deposit amount

- Use a mortgage calculator or speak to a lender to get an estimate

Most lenders will typically offer between 4-4.5 times the combined income, but this can vary. Remember, they’ll also assess affordability based on your outgoings and credit scores.

While online JBSP mortgage calculators can give you a rough idea, for a more accurate picture, it’s best to speak directly with a lender or mortgage advisor.

What Should You Consider Before Applying for a JBSP Mortgage?

Before you dive into a JBSP mortgage application, there are several important factors to consider:

- Trust and communication. Ensure all borrowers are comfortable with the arrangement and understand their responsibilities.

- Future plans. Consider how changes in circumstances might affect the mortgage in the long term.

- Legal advice. It’s wise to seek independent legal advice to understand the implications for all parties.

- Exit strategy. Discuss how and when co-borrowers might be removed from the mortgage.

- Impact on co-borrowers. Consider how being on your mortgage might affect their future borrowing capacity.

- Tax implications. Understand any potential tax consequences, especially for the non-owner borrowers.

- Insurance. Consider life insurance to protect co-borrowers in case of unforeseen circumstances.

By carefully considering these factors, you can ensure a JBSP mortgage is the right choice for you and your co-borrowers.

Alternatives to Joint Borrower Sole Proprietor Mortgages

If a JBSP mortgage is not right for you, here are alternatives you can choose from:

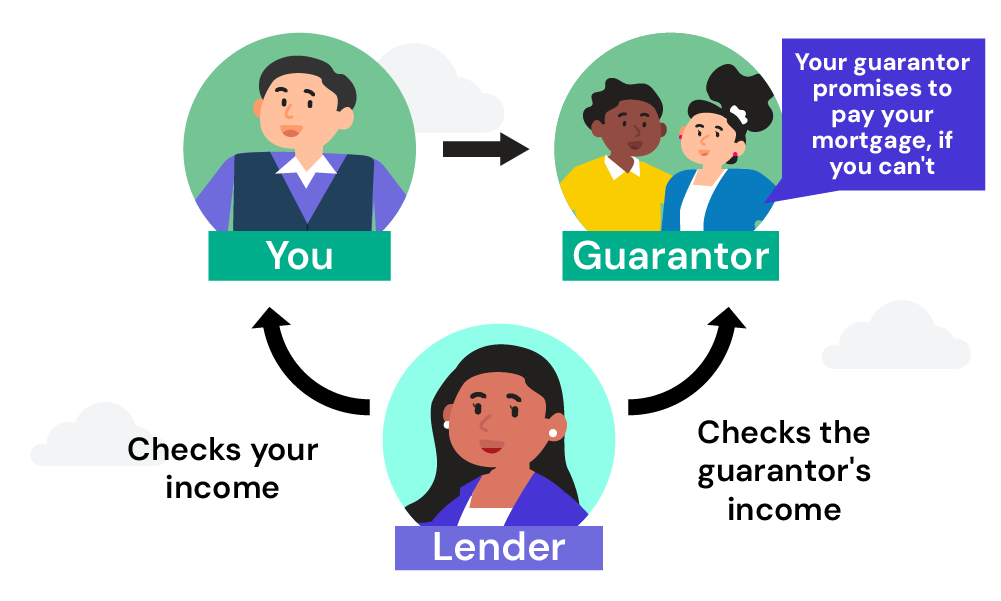

Guarantor Mortgages

A guarantor mortgage allows a family member or friend to act as a safety net, covering your mortgage payments if you default.

This setup doesn’t give the guarantor any ownership of the property, making it a good option for those who need financial backing without sharing ownership.

It’s perfect for borrowers with a solid support system willing to help but not interested in property rights.

Family Offset Mortgages

A family offset mortgage links your mortgage to a relative’s savings account.

The savings reduce the amount of interest you pay on your mortgage, effectively lowering your monthly payments.

This option is ideal for families looking to support each other financially while keeping their savings intact.

It’s a win-win: lower mortgage costs for you, and untouched savings for them.

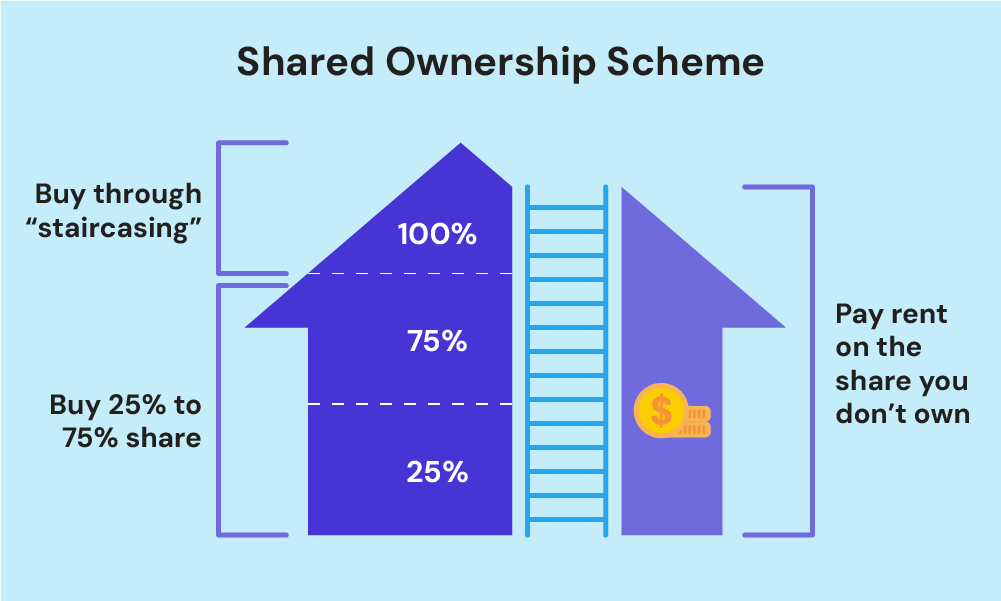

Shared Ownership

Shared ownership allows you to buy a portion of your home and pay rent on the rest. Over time, you can purchase more shares in the property.

This approach is perfect for those with limited funds for a deposit but who want to gradually increase their home ownership.

It’s a stepping stone towards full ownership without the immediate financial burden.

Springboard Mortgages

Springboard mortgages allow family members to deposit money into a savings account linked to your mortgage.

This deposit acts as security, enabling you to borrow more or secure a better interest rate.

It’s a great alternative for those who have family support but want to maintain clear financial boundaries and avoid joint borrowing complexities.

The Bottom Line: Is a JBSP Mortgage Right for You?

A Joint Borrower Sole Proprietor mortgage can be a game-changer for many UK homebuyers. It allows you to boost your borrowing power while keeping the ownership of your home.

But, let’s be clear: it’s not a one-size-fits-all solution. There are complexities and potential pitfalls to consider. Weigh the pros and cons carefully. Seek professional advice before diving in.

Every situation is unique. What works for one might not work for another. Explore your options, do the maths, and have honest conversations with your potential co-borrowers.

Here’s where a whole-of-market broker comes in. They can offer you access to a wide range of lenders and help you understand the intricate details of JBSP mortgages. This ensures you find the best deal tailored to your needs.

Looking for the right broker? Get in touch. We’ll arrange a free, no-obligation consultation with a qualified mortgage broker to help with your JBSP mortgage application.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a joint borrower sole proprietor mortgage with bad credit?

Yes, you can get a Joint Borrower Sole Proprietor (JBSP) mortgage with bad credit, but it might be tougher. Lenders will look at all borrowers’ credit histories.

If your credit score is poor, having co-borrowers with good credit can help. However, you may face stricter terms, higher interest rates, and need a larger deposit.

A whole-of-market broker can help find lenders who cater to bad credit situations.

What is the difference between a guarantor mortgage and a JBSP mortgage?

- Guarantor Mortgage – Here, a guarantor (usually a family member) agrees to cover the mortgage payments if you default. The guarantor’s income and assets are considered, but they don’t own the property.

- JBSP Mortgage – In a JBSP mortgage, up to four people can be borrowers, combining their incomes to boost borrowing power. All borrowers share payment responsibility, but only one is the legal owner of the property.

Do I need to pay additional stamp duty if I co-sign a JBSP mortgage for my son or daughter?

No, you don’t need to pay the additional 3% stamp duty surcharge if you co-sign a JBSP mortgage for your child.

Since you won’t be a legal owner of the property, the surcharge doesn’t apply. Your child, as the sole proprietor, may still qualify for first-time buyer stamp duty relief if eligible. Always check with a tax advisor.

Use the stamp duty calculator to find out how much you’ll owe.

>> More about Stamp duty for Buy to Let

What is the process for ending a JBSP mortgage?

To end a JBSP mortgage:

- Review the mortgage terms for any early termination fees.

- Ensure the sole proprietor can afford the mortgage alone, possibly through refinancing.

- Speak to your lender about removing additional borrowers from the mortgage.

- If approved, update legal documents and pay any associated fees.

- The lender might require a deed of release to officially remove co-borrowers.

Consult a mortgage advisor or solicitor for guidance.

What happens to a JBSP mortgage if the legal owner passes away?

If the legal owner of a JBSP mortgage dies:

- Executor Responsibility – The executor of the estate handles the property, usually selling it to pay off the mortgage.

- Continue Payment – Co-borrowers must keep up with mortgage payments until the debt is settled.

- Notify Lender – Inform the lender immediately to understand the required steps.

- Settle Mortgage – The property is typically sold, with proceeds used to pay off the mortgage. Any remaining funds go to the deceased’s estate.

Seek advice from a solicitor and financial advisor to manage the process.