- How Does the LIFT Scheme Work?

- Who is Eligible for the LIFT Scheme?

- Can You Increase Your Share in the Property?

- What Are the LIFT Scheme Thresholds?

- How Much Can You Borrow for a Mortgage?

- How Do You Apply for the LIFT Scheme?

- LIFT Scheme Lenders

- What Happens After You Buy a Home Through the LIFT Scheme?

- Can You Remortgage or Rent Out a LIFT Scheme Property?

- What is the Current Status of the LIFT Scheme?

- The Pros and Cons of the LIFT Scheme

- How Do You Find Out More About the LIFT Scheme?

- Alternatives to the LIFT Scheme

- Key Takeaways

- The Bottom Line

What is the LIFT Scheme in Scotland? A Complete Guide

The Low-cost Initiative for First Time Buyers (LIFT) scheme in Scotland helps first-time buyers and other eligible groups get onto the property ladder.

It’s a shared equity scheme where you buy a majority share of your home, and the Scottish Government owns the rest.

This scheme is perfect if you can’t afford a full house on your own. It’s aimed at people on lower to middle incomes.

Here, we’ll cover how the LIFT scheme works and how to apply.

How Does the LIFT Scheme Work?

When you buy a home through the LIFT scheme, you typically fund 60% to 90% of the property’s cost, based on your financial situation.

The Scottish Government covers the rest.

Although you hold full title to the property, the government’s share is secured by a ‘standard security,’ similar to a mortgage.

For example, if you buy 70% of a house, the government pays the other 30%. When you sell, they get back their 30%.

But, you can buy out their share earlier if you can afford it. This means you can start small and own more of your home as you earn more.

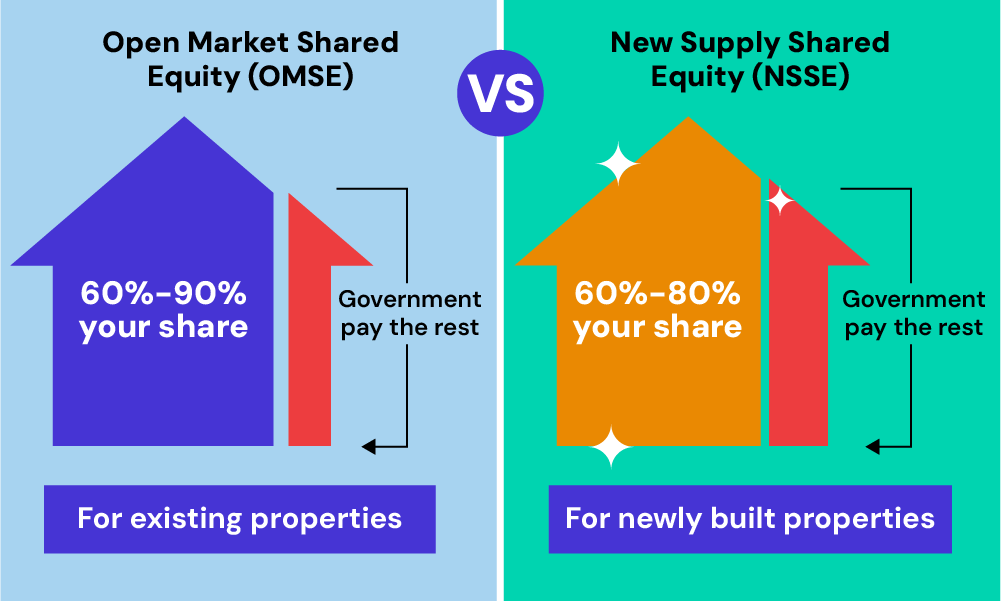

There are two (2) types of LIFT Scheme: the Open Market Shared Equity (OMSE) scheme and the New Supply Shared Equity (NSSE) scheme.

- OMSE Scheme – With OMSE, you buy an existing home. You choose from houses or flats already on the market, as long as it’s not too expensive. You usually buy between 60% and 90% of the home, and the government covers the rest. This scheme is paused as of 2024.

- NSSE Scheme – The NSSE scheme is for new builds from councils or housing associations. You’ll buy 60% to 80% of the home, and the government holds the rest. In some areas, a ‘golden share’ means the government keeps 20%, capping your ownership at 80%. This ensures affordable homes stay available in high-demand areas.

Choosing the right scheme depends on whether you prefer an existing home or a new build and your eligibility.

Who is Eligible for the LIFT Scheme?

LIFT isn’t just for first-time buyers. It’s also for people like you who:

- Are 60 or over

- Rent from the council or a housing association

- Have a disability and need a special home

- Are in the armed forces or have left in the last two years

- Are a widow, widower, or partner of someone who died while in the armed forces in the last two years

You can also use LIFT if you’ve owned a home before but things have changed, like a divorce or money problems.

LIFT helps people like you buy a home when it’s hard to do on your own.

Can You Increase Your Share in the Property?

Yes, with the LIFT scheme, you can increase your share in the property over time as your finances improve.

This process, known as “staircasing,” typically allows you to buy more of your home in 5% increments.

Eventually, you may be able to own 100% of the property by buying out the Scottish Government’s share.

However, in some areas with limited affordable housing, the government might keep a ‘golden share,’ limiting your ownership to 90% or 80% under specific LIFT schemes.

What Are the LIFT Scheme Thresholds?

When you apply for the LIFT scheme, you’ll need to be aware of the price thresholds, which vary by location and property size. These limits ensure the scheme is aimed at those who need help.

Thresholds are based on the number of habitable rooms (excluding kitchens and bathrooms) in the property.

It’s important to check the specific threshold for your area before applying, as exceeding this limit will disqualify you from the scheme.

How Much Can You Borrow for a Mortgage?

With the LIFT scheme, how much you can borrow depends on your income, financial commitments, and the property you want to buy.

Lenders typically offer up to 4.5 times your annual income, but this varies based on your financial situation.

The LIFT scheme allows you to buy a percentage of the property, with the Scottish Government covering the rest.

For example, if you buy 70% of a £150,000 property, you’d borrow £105,000, and the government would cover the remaining 30%.

Speak with a good mortgage broker to understand your borrowing capacity and find the best mortgage for you.

How Do You Apply for the LIFT Scheme?

Applying for the LIFT scheme is simple but requires some preparation. Here’s how you do it:

- Check Your Eligibility. Ensure your income meets the criteria, and the property you want is within the scheme’s price limit.

- Contact an Administering Agent. Apply through an agent like Link Homes for the Open Market Shared Equity (OMSE) scheme, or your local council/housing association for the New Supply Shared Equity (NSSE) scheme.

- Submit Your Application. Provide your financial details for assessment.

- Receive a Passport Letter. This confirms your approval and the maximum property price you can afford.

- Start House Hunting. Look for a property within your budget.

- Complete the Purchase. Secure a mortgage, handle legal steps, and finalise the purchase.

LIFT Scheme Lenders

The LIFT scheme partners with several lenders across Scotland, offering tailored mortgage options. These include:

- Bank of Scotland

- Barclays

- Capital Credit Union

- Glasgow Credit Union

- Halifax

- Leeds Building Society

- Lloyds Bank

- Nationwide

- NatWest

- Scottish Building Society

- Skipton Building Society

- TSB

- Scotwest Credit Union

Each lender offers different mortgage terms, so it’s important to compare their interest rates, fees, and conditions to find the best fit for you.

A seasoned mortgage broker can help you explore these options and find a lender familiar with the LIFT scheme’s specifics.

Make sure you fully understand the mortgage terms and how they align with the shared equity structure before committing.

What Happens After You Buy a Home Through the LIFT Scheme?

After buying a home through the LIFT scheme, your responsibilities are like any other homeowner’s. You’ll need to manage mortgage payments, insurance, and upkeep.

Remember, the Scottish Government owns a share of your home, which affects things if you want to remortgage or sell.

If you sell, the proceeds are split according to your ownership share.

For example, if you own 70% of the home, you’ll get 70% of the sale price, with the government receiving the remaining 30%.

Property value changes will also impact this split.

Can You Remortgage or Rent Out a LIFT Scheme Property?

If you want to remortgage your LIFT scheme property, you need permission from the Scottish Government.

You’ll need to submit a request through your local council or housing association.

Keep in mind, remortgaging must be on a repayment basis; interest-only options aren’t allowed.

As for renting out your home, it’s generally not allowed. The property must be your sole residence, and subletting would breach the terms of the shared equity agreement.

But, if your circumstances change, it’s advisable to contact the relevant authorities to discuss your options.

What is the Current Status of the LIFT Scheme?

Currently, the Open Market Shared Equity (OMSE) scheme is paused for new applications for 2024 to 2025.

This pause allows for a review and possible updates to the scheme.

While the Help to Buy schemes in Scotland have ended, the LIFT scheme is still an option for first-time buyers and priority groups.

It offers a practical solution to help you bridge the gap between your current finances and the cost of buying a home.

The Pros and Cons of the LIFT Scheme

The LIFT scheme helps you get on the property ladder, but like any scheme, it has its pros and cons. Here’s a quick rundown:

Pros

- Reduces upfront costs by allowing you to buy a share of the property.

- The Scottish Government’s share lowers your mortgage amount.

- No interest or monthly payments on the government’s share.

- Option to increase your ownership over time.

- Available to first-time buyers and priority groups.

- Potential to own 100% of the property eventually.

Cons

- Limited to specific property price thresholds.

- The government retains a share, affecting equity gains.

- Must repay the government’s share when selling.

- Renting out the property is not permitted.

- Remortgaging requires government approval.

- The OMSE scheme is currently paused for new applications.

- Ownership capped at 80% or 90% in some areas.

How Do You Find Out More About the LIFT Scheme?

To learn more about LIFT, you need to contact the right people.

If you’re interested in buying an existing home (OMSE), talk to Link Homes. They can tell you everything about applying if you qualify, and what’s happening with the scheme right now.

Remember, you can’t apply for OMSE at the moment.

If you want a new-build home (NSSE), contact your local council or the housing group building it. They can tell you about homes for sale, how to apply, and any changes to the scheme.

It’s important to keep checking for updates, as things can change. This will help you make the best decision.

Alternatives to the LIFT Scheme

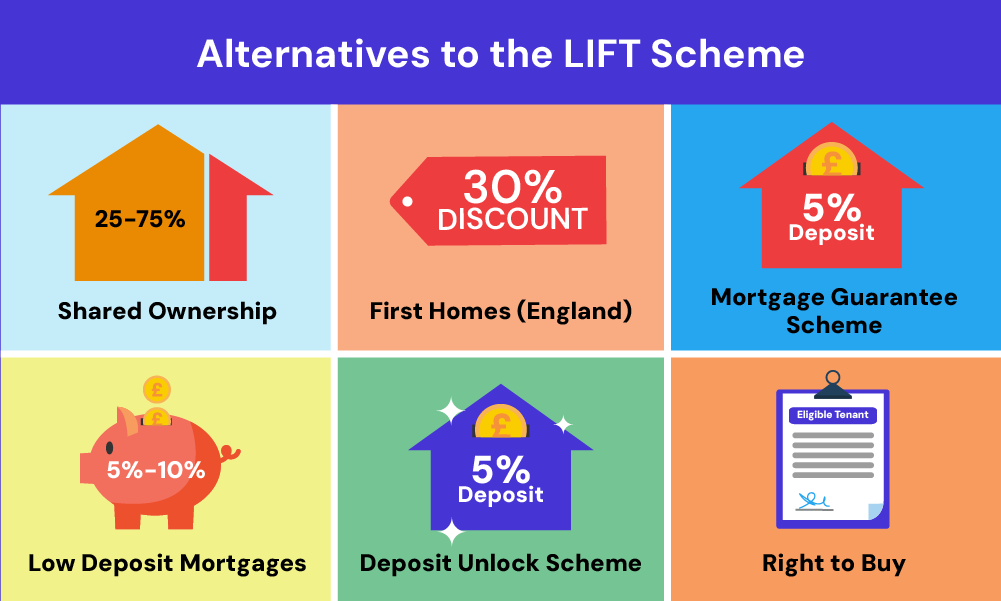

If you’re looking for alternatives to the LIFT scheme, here are a few options:

- Shared Ownership: Buy a portion of a property (25% to 75%) and pay rent on the rest, with the option to increase your share over time.

- First Homes (England): Offers a 30% discount on new-build homes for first-time buyers in their local area.

- Mortgage Guarantee Scheme: Helps buyers across the UK secure a mortgage with a deposit as low as 5%.

- Low Deposit Mortgages: Many lenders offer mortgages requiring just 5% to 10% as a deposit.

- Deposit Unlock Scheme: Purchase a new-build home with just a 5% deposit through participating builders.

- Right to Buy: Eligible tenants can buy their council or housing association home at a discount (available in England, Wales, and Northern Ireland). Note that this scheme is closed in Scotland.

Key Takeaways

- The LIFT scheme helps first-time buyers and eligible groups in Scotland buy a home by covering a share of the property cost.

- Choose between two schemes: OMSE for existing homes (currently paused) or NSSE for new-builds.

- Eligible groups include first-time buyers, social renters, disabled people, older adults, and certain armed forces members.

- You can buy 60% to 90% of a home under OMSE or 60% to 80% under NSSE, with the option to increase your share over time.

- To apply, check your eligibility, submit your application through an agent, and get a ‘passport letter’ detailing your budget.

The Bottom Line

The LIFT scheme offers a great opportunity to buy a home in Scotland, especially if you’re a first-time buyer or need extra financial help.

It provides a practical way to get on the property ladder with support from the Scottish Government.

To make the most of the scheme, assess your finances and long-term goals carefully. Understand the price thresholds, eligibility, and your responsibilities as a homeowner.

Consider working with a mortgage broker to find the best deals and make informed decisions.

Need a good broker? Get in touch with us. We’ll connect you with a qualified mortgage broker who can help you find the right mortgage and make the application process easier for you.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How much deposit do I need to apply for the lift scheme?

The exact amount depends on your finances and chosen lender. Generally, expect a deposit of at least 5% of your share of the property’s price.

For example, if you buy a 70% share of a £150,000 property, your share is £105,000. A 5% deposit would be £5,250. However, some lenders demand a larger deposit. Always check with your mortgage provider.

Your deposit helps secure your LIFT mortgage, showing financial commitment and potentially influencing interest rates.