- What is Furlough and How Does it Impact Mortgages?

- Does Furlough Affect Mortgage Applications?

- Which Lenders Accept Furlough Income?

- How Can You Improve Your Chances of Getting a Furlough Mortgage?

- What Documents Do You Need for a Furlough Mortgage Application?

- Can You Remortgage if You’ve Been Furloughed?

- What About Joint Mortgages with a Furloughed Partner?

- Should You Wait to Apply for a Mortgage After Furlough?

- What To Do After a Mortgage Decline Due to Furlough?

- The Bottom Line

Does Furlough Affect Mortgage Application?

If you’ve been on furlough during the COVID-19 pandemic, you might be wondering how it affects your chances of getting a mortgage.

The good news is that it’s possible to secure a mortgage after furlough, but there are some important factors to consider.

Let’s dive into what you need to know about furlough mortgages and how to improve your chances of approval.

What is Furlough and How Does it Impact Mortgages?

Furlough, part of the UK government’s Coronavirus Job Retention Scheme, allowed employers to keep staff on payroll while reducing their hours or pausing their work entirely.

While on furlough, you received up to 80% of your salary, capped at £2,500 per month. This reduction in income is what primarily affects your mortgage application.

Lenders are particularly interested in your income stability when assessing mortgage applications.

Being on furlough introduces an element of uncertainty that some lenders may view as risky.

However, each lender has its own criteria for assessing furloughed applicants, and some are more flexible than others.

Does Furlough Affect Mortgage Applications?

Yes, being on furlough can affect your mortgage application. But it doesn’t automatically disqualify you.

Here’s how it might impact your application:

- Reduced borrowing capacity. Lenders typically use your current income to calculate how much you can borrow. If you’re still on furlough, this could mean a lower mortgage offer.

- Increased scrutiny. Lenders may ask for additional documentation to verify your employment status and future income prospects.

- Limited lender options. Some lenders may be more cautious about approving mortgages for furloughed applicants, reducing your choices.

- Potential delays. Your application might take longer to process as lenders assess the impact of furlough on your long-term financial stability.

Which Lenders Accept Furlough Income?

The landscape of furlough mortgages is constantly evolving, but many lenders are willing to consider applications from those who have been furloughed.

Some of the more flexible lenders include:

- Nationwide – They may consider your full salary if you have a return-to-work date.

- Halifax – They might use your full salary if you’re back at work or have a confirmed return date.

- Barclays – They may consider your application if you’re back at work or have a return date within three months.

- NatWest – They might use your furloughed income but may require additional documentation.

Remember, lender policies can change quickly, so it’s best to consult with a mortgage broker who can provide up-to-date information on which lenders accept furlough income.

How Can You Improve Your Chances of Getting a Furlough Mortgage?

While being on furlough presents challenges, there are steps you can take to improve your mortgage prospects:

- Wait until you’re back at work. If possible, delay your application until you’ve returned to full-time employment. This can significantly boost your chances of approval.

- Get a return-to-work letter. If you’re still on furlough, ask your employer for a letter confirming your return-to-work date and full salary. This can reassure lenders about your future income stability.

- Save a larger deposit. A bigger deposit can offset some of the risks associated with furlough income, potentially opening up more lender options.

- Check your credit score. Ensure your credit report is in good shape. Address any issues before applying for a mortgage.

- Reduce existing debts. Lowering your debt-to-income ratio can improve your affordability in the eyes of lenders.

- Seek professional advice. A mortgage broker can help you navigate the complexities of furlough mortgages and find lenders most likely to approve your application.

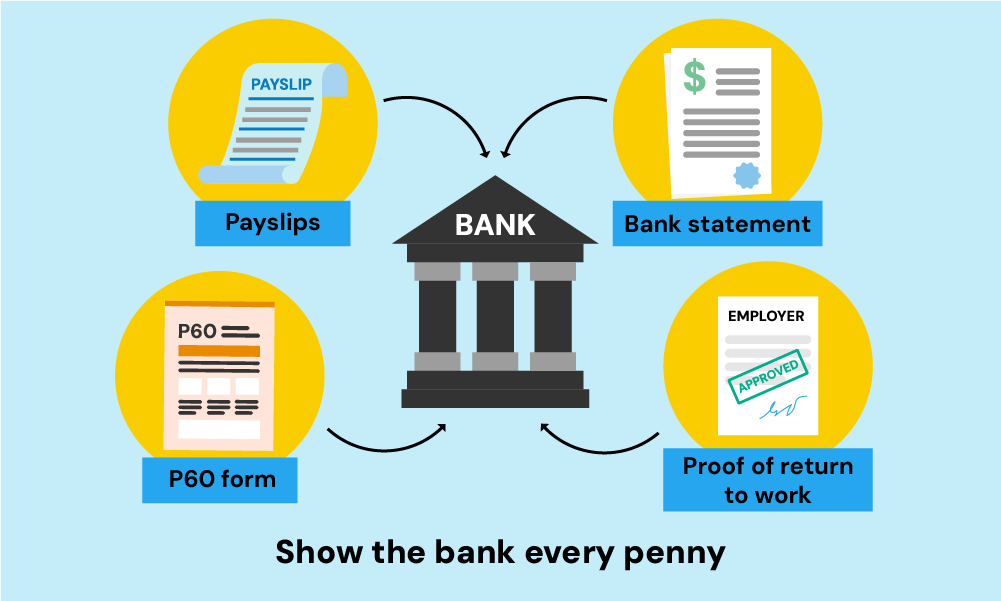

What Documents Do You Need for a Furlough Mortgage Application?

When applying for a mortgage after furlough, you’ll likely need to provide additional documentation.

Be prepared with:

- At least 3-6 months payslips for both pre-furlough and during furlough

- 3-6 months bank statements

- Your most recent P60 form

- A proof of return to work (employer letter with return date & salary)

- Furlough letters: Any official documentation related to your furlough period

- For self-employed: 2-3 years of SA302 or self-assessment tax returns

Ensure to show proof of income with every penny you earn. This will improve your chances of getting a mortgage, making you more attractive to lenders.

Can You Remortgage if You’ve Been Furloughed?

Remortgaging after furlough is possible, but it may be more challenging if you’re still on furlough or have recently returned to work.

Lenders will assess your current income and job stability when considering your remortgage application.

If you’ve returned to work, you might need to provide evidence of several months of full income before some lenders will consider your application.

If you’re coming to the end of your current mortgage deal, it’s worth speaking to your existing lender about product transfers. They may be more flexible as they already have a relationship with you.

What About Joint Mortgages with a Furloughed Partner?

If you’re applying for a joint mortgage and one partner has been furloughed, some lenders may only consider the non-furloughed partner’s income.

This could significantly reduce your borrowing capacity.

However, other lenders may be willing to consider both incomes, especially if the furloughed partner has a confirmed return-to-work date.

In this situation, it’s crucial to shop around and potentially seek the help of a mortgage broker who can identify lenders most likely to consider both incomes.

Should You Wait to Apply for a Mortgage After Furlough?

Whether to apply for a mortgage now or wait depends on your circumstances.

If you’ve recently returned to work, waiting a few months can demonstrate income stability to lenders.

However, if you’re confident in your job security and financial situation, and you find a lender willing to consider your application, there’s no reason to delay.

Keep in mind that mortgage rates and property prices can change, so waiting isn’t always beneficial. It’s about balancing your current situation with your long-term goals.

What To Do After a Mortgage Decline Due to Furlough?

Facing a mortgage decline due to furlough can be disheartening, but it’s important not to lose hope.

There are steps you can take to improve your chances and reapply successfully.

Here’s what to do next:

Understand the Reasons for Decline. First, ask the lender for specific reasons why your application was declined. This will help you address the issues directly and make necessary improvements.

Review Your Financial Situation. Take a close look at your current finances. Ensure that you have a stable income and that any outstanding debts are manageable. Reducing your debt-to-income ratio can significantly boost your application.

Improve Your Credit Score. Check your credit report for any errors or discrepancies and correct them. Pay off small debts, avoid taking on new credit, and ensure all payments are made on time to improve your credit score.

Save a Larger Deposit. A bigger deposit can make you a more attractive candidate to lenders. Aim to save at least 10-20% of the property’s value. This shows lenders that you are financially responsible and reduces their risk.

Obtain a Return-to-Work Letter. If you’re still on furlough, ask your employer for a letter confirming your return-to-work date and salary. This document can reassure lenders about your future income stability.

Consider a Different Lender. Not all lenders have the same criteria. Some may be more flexible with furloughed applicants. Research and consider applying to lenders known for their lenient policies towards furlough income.

Seek Professional Advice. A good mortgage broker can provide valuable insights and guide you to lenders who are more likely to approve your application. They can help you understand the market and find the best options available.

The Bottom Line

While being on furlough can complicate your mortgage application, it doesn’t make it impossible.

Many lenders are adapting their policies to accommodate furloughed applicants, recognising that furlough was a temporary measure during an unprecedented situation.

The key is to be prepared, gather all necessary documentation, and consider seeking professional advice.

A good mortgage broker can be invaluable in navigating the complexities of furlough mortgages and finding the right lender for your situation.

Remember, your financial situation is unique, and what works for one person may not work for another.

Take the time to assess your options, improve your financial position where possible, and don’t be discouraged if your first application isn’t successful.

With patience and perseverance, you can achieve your goal of homeownership, even after furlough.

Need a good broker? Get in touch. We’ll connect you with a qualified mortgage broker to help with your mortgage application after a furlough.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I pause mortgage payments?

Yes, you can pause mortgage payments through a process called a mortgage payment holiday.

This lets you temporarily stop or reduce your repayments for a specific period, typically up to six months.

However, interest will still accrue during this time, which may increase your total debt and extend your mortgage term.

To apply, contact your lender directly. Each lender has specific criteria and application processes, so check with them for exact requirements.

Keep in mind, taking a mortgage payment holiday could affect your credit rating. Consider all alternatives and speak with a mortgage advisor if needed.

Can I get a mortgage during a furlough with a bad credit score?

Getting a mortgage during a furlough with a bad credit score is challenging but not impossible. Many lenders are cautious about approving mortgages for furloughed workers, especially those with poor credit histories.

However, some lenders may still consider your application if you can show a confirmed return-to-work date and provide extra documentation to prove your income stability.

Lenders like Nationwide, Halifax, and Barclays might consider furloughed applicants based on individual circumstances.

Working with a mortgage broker can help identify lenders willing to work with your situation and provide guidance on improving your credit score to boost your chances of approval.

How much can I borrow for a mortgage after a furlough?

The amount you can borrow for a mortgage after a furlough depends on factors like your income, credit score, deposit amount, and the lender’s criteria.

Lenders will assess your affordability based on your current and projected future income to ensure you can manage the repayments comfortably.

Typically, lenders use a loan-to-income (LTI) ratio, ranging from 3 to 4.5 times your annual income, to determine the amount you can borrow.

Using online mortgage calculators provided by lenders can give you an estimate of how much you might be able to borrow.