- What is a Tier 2 Visa?

- What’s a Tier 2 Visa Mortgage?

- Can I Get a Mortgage with a Tier 2 Visa?

- What Are The Requirements?

- Is a Tier 2 Visa Mortgage Available for Bad Credit?

- Can I Get a Buy To Let Mortgages on a Tier 2 Visa Mortgage?

- What About Foreign National Mortgages?

- How To Apply for a Tier 2 Visa Mortgage?

- What Are the Alternatives if You Canât Get a Mortgage?

- Key Takeaways

- The Bottom Line

Tier 2 Visa Mortgages: What You Need to Know

If you’re a foreigner planning to settle in the UK long-term, buying a home is probably on your wish list.

But let’s be real: getting a mortgage here isn’t easy, especially if you’re on a Tier 2 visa.

Limited credit history, short residency, and the need for a large deposit makes it tough for you to get on the property ladder.

This article shows you how to overcome these challenges and buy a home in the UK.

Let’s get started!

What is a Tier 2 Visa?

A Tier 2 visa (now known as the Skilled Worker Visa) lets skilled workers from outside the European Economic Area (EEA) and Switzerland to work in the UK. It’s designed for roles that can’t be filled by someone already settled in the UK.

To get this visa, you need a job offer and a certificate of sponsorship from a UK employer. The visa usually lasts up to five years and can be extended.

You must also score at least 70 points on the UK’s points-based immigration system. The system considers factors like your salary, English skills, and education.

There might be specific criteria depending on the type of Tier 2 visa you need.

For more details, visit the UK government website.

What’s a Tier 2 Visa Mortgage?

A Tier 2 visa mortgage isn’t a special type of mortgage product but rather refers to a standard mortgage available to those holding a Tier 2 visa.

If you’re in good financial shape, you can likely get the mortgage you need. Lenders will look at your credit and affordability, just like they would for any borrower.

They’ll also check:

- how long you’ve lived in the UK

- how much time you’ve got left on your visa

Most lenders prefer you’ve been a UK resident for at least two years, which helps build up your credit history.

Some might ask for three years, but those stricter terms often come with better rates.

Can I Get a Mortgage with a Tier 2 Visa?

The short answer is yes, you can get a mortgage with a Tier 2 visa.

While the process may take a few extra steps compared to standard applications, many lenders are open to working with Tier 2 visa holders.

To boost your chances, show financial stability and a good credit history.

Lenders will check how long you’ve been in the UK, your job status, and how much time is left on your visa. You’ll need to provide:

- Proof of identity and residency

- Proof of your name and address

- Evidence of your income

- Details of your monthly expenses and any debt

Being organised and prepared can make the process smoother.

Getting help from a mortgage broker with experience in Tier 2 visa cases can also be a smart move.

They can help you gather the right documents, find suitable lenders, and make sure everything is submitted correctly.

What Are The Requirements?

To secure a mortgage on a Tier 2 visa, you’ll need to meet several key requirements:

1. UK Residency – Most lenders prefer you to have lived in the UK for at least two years. This time helps you build a credit history and show financial stability.

2. Employment Status – Continuous employment with a UK employer is crucial. It demonstrates you have a stable income, strengthening your application.

3. Deposit – A large deposit is important. Typically, you’ll need at least 10-25% of the property’s value. A larger deposit can increase your chances of approval and might get you better mortgage rates.

4. Credit History – Your credit history plays a vital role. Lenders will check your credit report from agencies like Experian, Equifax, and TransUnion to assess your reliability. A good credit score is important.

5. Visa Duration – The remaining time on your Tier 2 visa matters. Lenders generally prefer you to have at least six months to two years left on your visa, ensuring you have a stable status in the UK.

Is a Tier 2 Visa Mortgage Available for Bad Credit?

Yes, getting a mortgage with bad credit is tough, but not impossible. Specialist lenders are out there for people with bad credit histories.

If you have bad credit, you’ll need to put in more effort to show you’re reliable. This might mean a bigger deposit or proof of better financial habits.

Lenders look at your unique situation, including your income and deposit size. Bad credit can limit your mortgage options and lead to higher interest rates.

If you’re worried about costs, it might be wise to wait and improve your credit score.

In the UK, most credit issues disappear from your record after six years, opening up more options.

Talking to a good mortgage broker can help. They can guide you to the right lender and handle the tricky parts of your situation.

Good brokers have connections with both high street and specialist lenders, including some you can’t reach on your own.

To boost your chances, be organised and ready before you apply.

Can I Get a Buy To Let Mortgages on a Tier 2 Visa Mortgage?

Yes, you can get a buy-to-let mortgage on a Tier 2 visa. But the criteria are stricter than for residential mortgages.

You’ll need a larger deposit, often around 25% or more, and a solid plan showing how you’ll manage and profit from the property.

Lenders will scrutinise your financial stability and rental income potential closely.

They’ll also check your cash flow forecast to ensure the investment makes sense.

Each lender has different criteria, so it’s crucial to get the latest information and understand the deals on offer.

What About Foreign National Mortgages?

Foreign national mortgages are available to non-UK residents, including those on Tier 2 visas.

Typically, you’ll need to have lived in the UK for two to three years, hold a stable job, and have a good credit history.

A UK bank account is essential, and you may need a larger deposit.

To increase your chances:

- open and maintain a UK bank account,

- secure permanent employment in the UK,

- save for a substantial deposit, and

- build a strong credit history.

Lenders assess your financial stability and length of UK residency. A valid work permit or permanent residency status is also crucial.

How To Apply for a Tier 2 Visa Mortgage?

Here’s how you can do it:

1. Assess Your Financial Situation

Start by evaluating your financial health.

Make sure you have a stable income, a good credit score, and enough savings for a significant deposit.

Check your credit report from major agencies like Experian, Equifax, and TransUnion to spot and fix any issues.

2. Save for a Deposit

Aim to save at least 10-25% of the property’s value for the deposit.

A larger deposit not only improves your chances of getting approved but also gives you access to better mortgage rates.

3. Gather Necessary Documents

Prepare all the necessary documentation to support your mortgage application. These typically include:

- Proof of identity and visa status

- Proof of UK residency (utility bills or a rental agreement)

- Proof of income (payslips, employment contracts, or tax returns)

- Bank statements for the past three to six months

- A credit report

4. Consult a Mortgage Broker

Engage a mortgage broker, especially one experienced with Tier 2 visa holders.

A good broker can help you navigate the complexities of the application process, identify suitable lenders, and find the best mortgage deals tailored to your circumstances.

5. Research Lenders

Not all lenders offer mortgages to Tier 2 visa holders, so research and identify those that do.

Specialist lenders or those with more flexible criteria are often more accommodating. Your mortgage broker can assist in this step.

6. Get an Agreement in Principle

Obtain an Agreement in Principle (AIP) from your chosen lender.

An AIP is a statement from the lender indicating how much they might be willing to lend you based on your financial situation.

It’s not a formal mortgage offer but gives you an idea of your budget and shows sellers you’re serious.

7. Submit Your Application

Once you have an AIP and have found a property you wish to buy, submit your full mortgage application.

Ensure all your documents are up-to-date and accurately reflect your financial situation.

Your mortgage broker can help you complete and review the application to avoid any mistakes.

8. Wait for the Lender’s Decision

After submitting your application, the lender will assess your financial health, credit history, and the property’s value.

They may request additional information or documentation during this process. Be ready to provide any further details promptly.

9. Receive Your Mortgage Offer

If your application is successful, you’ll receive a formal mortgage offer.

Review the offer carefully, ensuring you understand the terms and conditions. Once satisfied, you can proceed with finalising the purchase of your property.

10. Complete the Purchase

Work with your solicitor to complete the legal aspects of the property purchase.

This includes conducting searches, arranging contracts, and handling the transfer of funds.

Once everything is in place, you’ll get the keys to your new home. 🏠

How to get a mortgage image

What Are the Alternatives if You Can’t Get a Mortgage?

If getting a mortgage feels out of reach, don’t worry. You still have other ways to move towards your dream home and improve your finances.

Continue Renting

Staying in your rental home lets you work on boosting your credit score and saving for a bigger deposit.

Use this time to manage your money well, pay down debts, and avoid taking on new credit.

Regularly check your credit report and fix any issues that could hurt your score.

Apply for a Joint Mortgage

Teaming up with a partner or family member who has a better credit history can increase your chances of getting a mortgage.

A joint application combines incomes and credit histories, giving lenders a better financial picture.

Both parties share repayment responsibilities, so clear agreements and understanding are crucial.

Seek a Guarantor Mortgage

With a guarantor mortgage, a family member guarantees your repayments, making your application more attractive to lenders.

The guarantor’s assets, like their home or savings, act as collateral, reducing the lender’s risk.

This requires careful consideration and agreement from everyone involved due to the significant responsibility it entails.

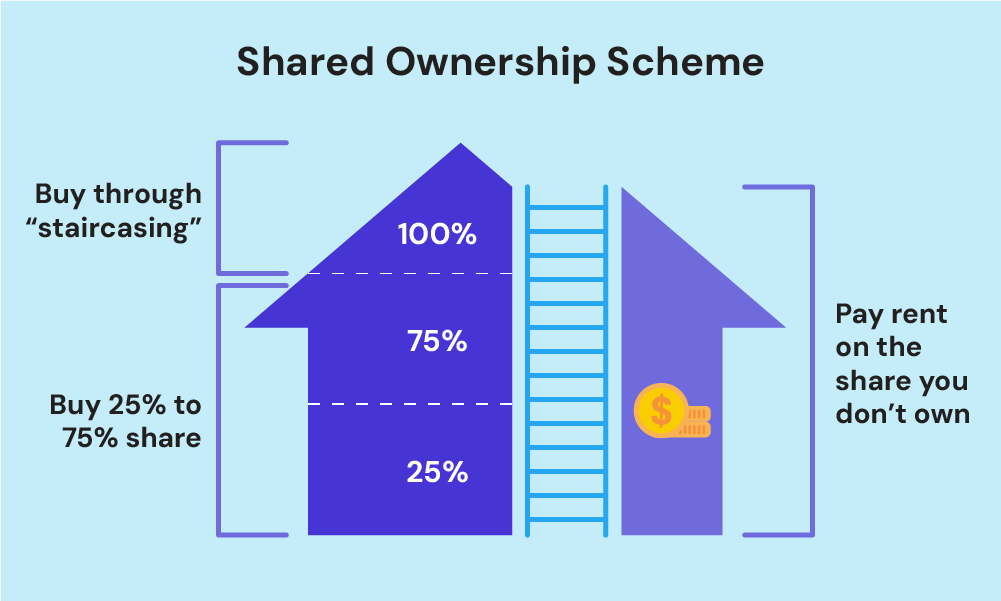

Explore Shared Ownership Schemes

Shared ownership schemes let you buy a share of a property (typically 25% to 75%) and pay rent on the remaining portion.

Over time, you can buy more shares until you own the property outright.

This approach lowers the initial deposit and mortgage amount needed, making homeownership more accessible.

Look Into Specialist Lenders

Specialist lenders cater to people with unique situations, such as poor credit histories or non-standard employment.

These lenders often have more flexible criteria than traditional banks.

A good mortgage broker with access to a wide range of lenders can help you find suitable options.

Improve Your Financial Situation

When other options aren’t feasible, focus on improving your financial health. Pay off debts, reduce your credit utilisation ratio, and save for a larger deposit.

Consistent financial management enhances your creditworthiness, making future mortgage approval more likely.

Key Takeaways

- A Tier 2 visa mortgage is a standard mortgage available to Tier 2 visa holders.

- To apply for a visa mortgage, you need to meet the lender’s criteria: at least two years of UK residency, stable employment, a large deposit (10-25%), good credit history, and sufficient time left on your visa.

- You can get a mortgage with bad credit, but it may require more effort and a larger deposit.

- You can get a buy-to-let mortgage on a Tier 2 visa, but the criteria are stricter, including a larger deposit and solid financial plan.

- Foreign national mortgages are available but require two to three years of UK residency, a stable job, a UK bank account, and a substantial deposit.

- If you can’t get a mortgage, consider continuing to rent, applying for a joint mortgage, seeking a guarantor mortgage, exploring shared ownership schemes, looking into specialist lenders, and improving your financial situation.

The Bottom Line

Securing a mortgage on a Tier 2 visa in the UK is entirely possible with the right preparation. However, there are only a few lenders offering this kind of mortgage.

To improve your chances, consult a good mortgage broker. They can provide valuable guidance and access to lenders who understand the unique challenges faced by Tier 2 visa holders.

Need a good broker? Get in touch with us. We’ll connect you with a qualified mortgage broker who can get you the best mortgage while on Tier 2 visa.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a mortgage with just a 5% deposit on a Tier 2 visa?

Yes, you can. Some lenders offer mortgages where you only need a 5% deposit if you’re on a Tier 2 visa.

Banks like Nationwide and HSBC do this, as well as some specialist lenders.

However, these deals aren’t as common and often come with stricter rules. You’ll usually need good credit, a steady job, and to have lived here for at least a year.

To find the best deal, it’s often a good idea to chat with a mortgage broker who knows the ropes with Tier 2 visa cases.