- Will a Personal Loan Affect My Mortgage Application?

- How Personal Loans Affect Mortgage Applications: An Example

- Hereâs What To Do If Your Loan Affects Your Mortgage

- Can I Use a Personal Loan as a House Deposit?

- Will Getting a New Loan Hurt My Mortgage Application?

- Should I Pay Off My Personal Loan Before Applying for a Mortgage?

- Can a Personal Loan Help Me Get a Mortgage?

- Can I Remortgage If I Have a Personal Loan?

- Key Takeaways

- The Bottom Line: What To Do If Your Mortgage Is Rejected

Can I Get A Mortgage If I Have A Loan? A Full Guide

You’ve got your eye on a new home, but there’s a personal loan hanging over you.

Maybe you took it out for some home improvements, to pay off other debts, or to cover an unexpected bill.

Now, you’re wondering—how will this loan affect your mortgage application? 🤔

In this article, we’ll explain exactly what you need to know about how personal loans can impact your mortgage.

We’ll cover the challenges, what lenders look for, and what you can do to improve your chances.

Ready?

Will a Personal Loan Affect My Mortgage Application?

Yes, a personal loan can affect your mortgage application.

When you apply for a mortgage, lenders aren’t just handing out money—they’re measuring risk. And every debt you carry adds weight to your overall financial health.

If the loan is recent or large, it raises a question: Are you stretching yourself too thin?

Lenders might think so, and that could mean a smaller mortgage offer or even a rejection.

But it’s not all doom and gloom.

If you’re on top of your personal loan—paying it off steadily, keeping your credit score strong—there’s still a path to mortgage approval.

It just might be a bit steeper.

Knowing how your debts affect your mortgage chances is key. And that’s why calculating your DTI ratios is crucial.

What’s the DTI Ratio?

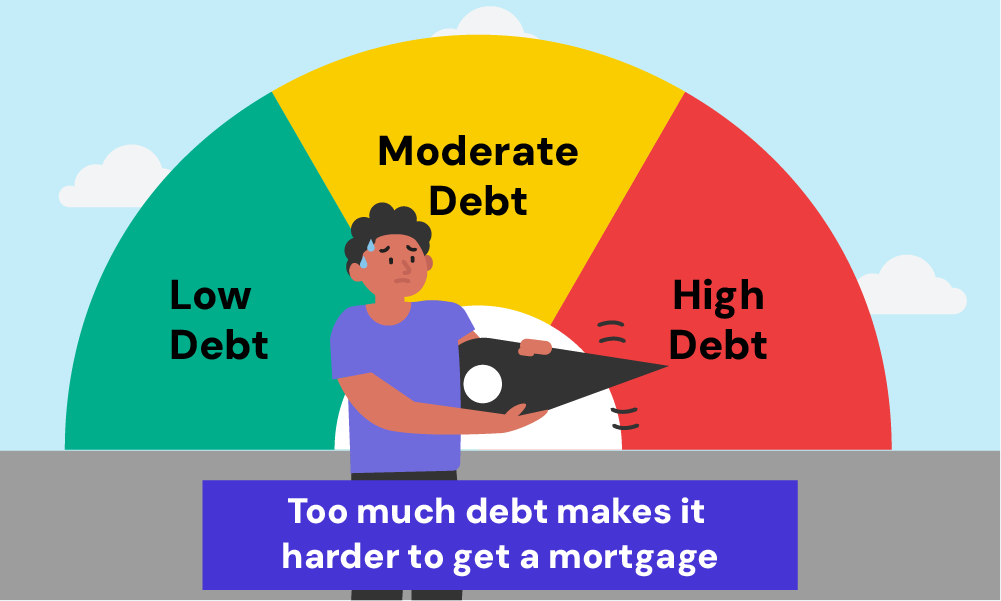

DTI ratio or debt-to-income ratio is a percentage that compares your monthly debt payments to your gross monthly income.

It shows how much of your income goes toward paying debts, helping lenders assess whether you can afford to take on a mortgage.

For instance, if your gross monthly income is £3,000 and your monthly debt payments, including your personal loan, total £750, your DTI ratio would be 25%.

Lenders generally prefer a DTI ratio of 36% or lower, with some willing to go up to 43% for borrowers with strong credit profiles.

The lower your DTI, the better your chances of securing a mortgage.

Use the debt-to-income ratio calculator to know where you stand and see how close you are to mortgage approval.

How Personal Loans Affect Mortgage Applications: An Example

Let’s say you’re ready to buy your first home. 🏡

Your monthly income is £3,000, but you’ve got some debts—£450 a month for the car loan, £150 for the credit card.

Now, there’s that personal loan you’ve just taken out, adding another £350 to your plate.

When you apply for a mortgage, the lender zooms in on your debt-to-income (DTI) ratio.

Before the personal loan, your monthly debt was £800, making your DTI ratio 25.7%. But with the new loan, your debt climbs to £1,250 a month, and your DTI ratio jumps to 41.7%.

You wanted to borrow £150,000 for your mortgage. But with a higher DTI and all those debts, the lender hesitates.

Instead of £150,000, they might offer £120,000.

Why? 🤔

Because they’re worried that you’re stretching your finances too thin. And that’s not the only downside.

With a higher DTI and multiple debts, you might not get the best interest rate. Instead of 3%, you could be looking at 3.75%.

Over 25 years, that extra percentage adds up—potentially costing you thousands more in interest.

So, what’s the bottom line? Every debt you carry—every loan, every credit card balance—has a ripple effect on your mortgage.

It can reduce how much you can borrow, push up your interest rate, and make that dream home a bit harder to afford. 😟

Here’s What To Do If Your Loan Affects Your Mortgage

If you’re concerned that a personal loan might trip up your mortgage application, you’re not alone.

But there’s a smart move you can make: talk to a mortgage broker.

A good broker doesn’t just fill out forms. They dig into your financial picture, helping you see how that loan might weigh down your chances.

They know the ropes and can suggest ways to boost your odds of getting approved.

But that’s not all.

They’ll also hunt down the BEST mortgage deals, tailored to your situation—debts and all.

A broker’s insight can be the difference between a yes and a no, especially when things get tricky.

In a world where the fine print can make or break your application, having a broker on your side isn’t just helpful—it’s essential.

Can I Use a Personal Loan as a House Deposit?

Short answer: you can, but it’s usually not a good idea.

Most lenders prefer you to save up for a deposit. It shows you’re good with money. Using a personal loan might look better than nothing if you’re going for a 100% mortgage, but that’s about it.

If you earn a good salary and don’t have many bills, some lenders might consider it. But they’ll worry about whether you can handle both the loan and mortgage payments.

Using a personal loan for a deposit adds to your debts. This could make it harder to get a mortgage and might mean you get a worse deal.

Will Getting a New Loan Hurt My Mortgage Application?

Yes, taking out a loan just before applying for a mortgage can be a bad idea. Lenders check your recent spending habits over the past 6 years.

If you’ve borrowed cash lately, it might look like you’re spending too much.

This is even worse if you’ve got lots of loans. Lenders might think you’re not stable.

To improve your chances, don’t get any new loans for at least six months before applying for a mortgage.

Should I Pay Off My Personal Loan Before Applying for a Mortgage?

Ideally, yes, paying off your personal loan before applying for a mortgage is a good idea. It means you owe less money overall, which can help you get a better mortgage deal.

Lenders like it when you don’t have lots of debt. However, don’t empty your savings to pay it off.

You’ll need money for a deposit. It’s better to keep making your loan payments on time and look after your credit score.

Can a Personal Loan Help Me Get a Mortgage?

Sometimes, yes. If you use it to pay off other debts with high interest rates, it might help your credit score and how much you can borrow for a mortgage.

But it only works if you can keep up with the personal loan payments.

If you can’t, it could actually harm your chances of getting a mortgage.

Can I Remortgage If I Have a Personal Loan?

Yes, you can still remortgage if you have a personal loan, but it might affect the mortgage deal you get. Lenders will check your finances, including your personal loan, when you apply.

If you can manage the loan payments and have built up some value in your home, you should be okay.

You could try putting your personal loan into your mortgage. This might mean lower monthly payments, but you’ll pay more interest in the long run.

But, don’t take out new loans before remortgaging as it could harm your chances of getting a good deal.

Think carefully about this before you decide.

Remortgage or Personal Loan?

Remortgaging and personal loans are two ways to borrow money.

A remortgage is when you switch your current mortgage for a new one, often with a different lender.

With a personal loan, you borrow a set amount and pay it back in regular chunks.

Choose to remortgage if:

- You need a large amount of money.

- You want to lower your monthly payments.

- You have built up equity in your home.

Choose a personal loan if:

- You need a small amount of money quickly.

- You have a good credit score.

- You don’t want to put your home at risk.

Important: It’s always a good idea to compare interest rates and terms from different lenders before making a decision.

Key Takeaways

- A personal loan can affect your mortgage application by increasing your debt, which might mean you can borrow less or face higher interest rates.

- Your debt-to-income ratio shows how much of your income you spend on debts. It helps lenders see if you can afford a mortgage.

- Using a personal loan for a deposit is usually a bad idea because it adds to your debt and could make getting a mortgage harder.

- Paying off your personal loan before applying can help, but don’t use up all your savings—you’ll need some for a deposit.

- If your mortgage is rejected due to a personal loan, work on improving your finances and try again with a different lender or with help from a mortgage broker.

The Bottom Line: What To Do If Your Mortgage Is Rejected

Don’t panic if your mortgage gets rejected because of a personal loan.

First, find out exactly why it was turned down. Your lender or a mortgage broker can help.

You might need to improve your finances, like paying off debts, saving more for a deposit, or fixing your credit score.

It might take a few months to sort things out. Focus on managing your money and don’t borrow any more.

Once your finances are better, try applying again, maybe with a different lender. Remember, different lenders have different rules, so keep trying.

A qualified mortgage broker can help find the right one. They’ll check your finances, compare deals from different lenders, and guide you through the process.

Using a broker can SAVE you time and hassle. They do the hard work of searching for good deals and filling out paperwork.

Plus, they know the mortgage market really well and can help you get the best deal.

To get started, reach out to us. We’ll connect you with a top mortgage broker to help with your mortgage application and GET the best deal.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can you put a personal loan into a mortgage?

Yes, you can combine your personal loan with your mortgage. This is called debt consolidation. You get a new mortgage for more than you owe now and use the extra money to pay off your personal loan.

This might mean lower monthly payments, but you’ll end up paying more interest overall. It’s a big decision, so get advice before doing it.

Can I take a personal loan to buy a house in the UK?

You can use a personal loan to help buy a house, but it’s usually not a good idea. Lenders prefer you to save up for a deposit.

Using a personal loan can make it harder to get a mortgage or mean you get a worse deal. It shows lenders you might have money problems. Think carefully before using a personal loan for a house.

When should I get a personal loan after buying a home?

It’s best to wait at least six months after moving in before getting a personal loan. This gives you time to settle into your new home and make sure you can handle the mortgage payments.

Waiting also helps you build value in your home, which could be useful later. If you need a loan sooner, make sure you can afford the extra payments.

Is it okay to get a personal loan and a mortgage at the same time?

You can, but it’s not a good idea. Getting both a personal loan and a mortgage at once can make you look like a bigger risk to lenders.

This could mean they offer you less money for your mortgage or charge you more interest.

If you must do it, get the mortgage first, then think about the personal loan once you’ve moved in and settled down.