£350,000 Mortgage Repayments Explained

Planning to take out a £350,000 mortgage and curious about the repayments?

Whether you’re a first time buyer or upgrading to something bigger, it’s a good idea to know exactly what you’re signing up for before you commit.

Interest rates, term lengths, deposits—these are just a few of the things that affect your monthly payments, and it’s worth understanding how they all fit together.

And, this guide has got you covered. 🙂

We’ll break down the numbers, explain your options, and help you find a repayment plan that works for your budget.

Let’s get started!

What Are The Monthly Repayments on a £350,000 Mortgage?

The amount you pay each month depends on a few key factors:

- the interest rate you get,

- the length of your mortgage term, and

- whether you go for a repayment or interest-only mortgage.

To make things easier, let’s use an example.

Let’s say you’ve got a 25-year repayment mortgage with an interest rate of 5%. Your monthly payments would be around £2,064, and over the full term, you’d end up paying £613,820 in total.

That’s a hefty sum, isn’t it? Most of that extra cost comes from interest.

Now, imagine you managed to secure a lower interest rate of 3% on the same 25-year mortgage.

Your monthly repayments would drop to around £1,660, and the total amount you’d pay back over time would be £498,000—that’s over £100,000 saved just by getting a better rate.

And this is how interest rates work: the lower your interest rate, the more money you save. These rates vary based on the Bank of England’s base rate, your credit score, deposit size, and lender rules.

Using the same example, if you extend your mortgage term to 30 years, with a 5% rate, your monthly repayments fall to £1,879.

It’s easier on your budget each month, but the total you’d repay rises to £676,440—more than an extra £60,000 compared to the 25-year option.

And here’s the thing: the longer your mortgage term, the higher the total interest you’ll pay.

For those thinking about an interest-only mortgage, you’d be looking at a much lower monthly repayment of £1,458 at 5%.

But don’t forget—you’re only paying off the interest each month, so the full £350,000 loan will still need to be repaid at the end.

As you can see, even a small change in the interest rate can make a big difference in what you pay.

That’s why it’s so important to get the best deal possible and consider what works for both your monthly budget and long-term plans.

If you’d like to see how these numbers apply to your specific situation, use our mortgage calculator. It’s quick, easy, and can help you figure out the best repayment plan for your needs.

Here’s an example of how interest rates, mortgage terms, and repayment option affects your monthly mortgage payment:

Repayment Mortgage Payments:

| Mortgage Term (Years) | 2% Rate | 3% Rate | 4% Rate | 5% Rate | 6% Rate | 7% Rate |

|---|---|---|---|---|---|---|

| 5 | 6,135 | 6,289 | 6,446 | 6,605 | 6,766 | 6,930 |

| 10 | 3,220 | 3,380 | 3,544 | 3,712 | 3,886 | 4,064 |

| 15 | 2,252 | 2,417 | 2,589 | 2,768 | 2,953 | 3,146 |

| 20 | 1,771 | 1,941 | 2,121 | 2,310 | 2,508 | 2,714 |

| 25 | 1,483 | 1,660 | 1,847 | 2,046 | 2,255 | 2,474 |

| 30 | 1,294 | 1,476 | 1,671 | 1,879 | 2,098 | 2,329 |

Interest-only Mortgage Payments:

- At 2% interest: 5 to 30-year term: £583 per month

- At 3% interest: 5 to 30-year term: £875 per month

- At 4% interest: 5 to 30-year term: £1,167 per month

- At 5% interest: 5 to 30-year term: £1,458 per month

- At 6% interest: 5 to 30-year term: £1,750 per month

- At 7% interest: 5 to 30-year term: £2,042 per month

What Salary Do I Need for a £350,000 Mortgage?

To secure a mortgage for £350,000, your salary needs to be in a specific range.

Most lenders cap your borrowing at about 4 to 4.5 times your annual income, which means you’d need to earn between £77,777 and £87,500.

What if you’re eyeing something a bit bigger, like a £400k mortgage?

In that case, the salary needed for a £400k mortgage in the UK jumps up to between £88,888 and £100,000.

But don’t stress if your income doesn’t quite hit those figures. If you’re buying with a partner, your joint earnings can help boost your borrowing potential.

There are also some lenders who’ll stretch to 5 or even 6 times your income, especially if you’re in a stable profession, like a doctor or lawyer.

Want to know exactly how much you could borrow based on your income? Try our mortgage affordability calculator to get a quick and easy estimate. It’ll help you see what’s possible, so you can plan with confidence.

How Much Deposit Do I Need for a £350,000 Mortgage?

When it comes to mortgages, the bigger your deposit, the better the deal you’re likely to get. This is all about something called the loan-to-value (LTV) ratio, which is simply the percentage of the property’s value you’re borrowing compared to the deposit you’re putting down.

Lenders usually ask for a deposit of 5% to 10%, so for a £350,000 house, you’ll need to save up between £17,500 and £35,000.

This gives you an LTV ratio of 90% to 95%, which many lenders will accept, especially for first-time buyers.

But if you’re able to put down 20% or more, you’re in the sweet spot.

With an LTV of 80% or lower, you’ll unlock some of the best mortgage rates available in the UK. That means lower monthly payments and less interest paid over time.

If saving a larger deposit seems tricky, don’t stress.

Some lenders still offer great deals with lower deposits, particularly if you’re a first-time buyer. However, a higher deposit almost always means a better deal, so it’s worth saving up if you can.

Want to see how your deposit impacts your mortgage? Try our LTV mortgage calculator to check your LTV ratio and discover what deals might be available to you.

Other Factors To Consider For £350,000 Mortgage

When you’re thinking about a £350,000 mortgage, it’s not just about the interest rates and repayment terms.

There are a few other things that can affect how much you’ll pay and how easily you can get approved.

Your Credit Score

Your credit score is a key factor in getting a good mortgage rate. The higher your score, the more likely you’ll be offered a better deal. Lenders prefer to see that you manage your money well.

If your credit score isn’t where you want it to be, don’t worry—it can be improved. Pay your bills on time, lower your debt, and avoid applying for new credit before your mortgage application.

Fixed vs. Variable Rates

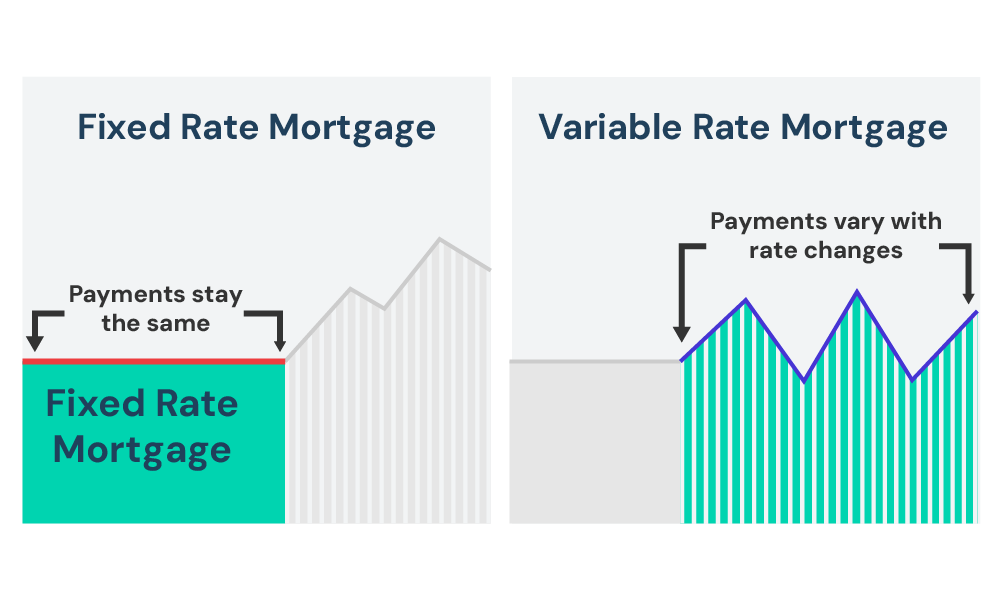

You’ll also need to decide between a fixed or variable interest rate. A fixed-rate mortgage gives you stability, with the same monthly payments for a set period—whether that’s 2, 5, or even 10 years. It’s ideal if you want to know exactly what you’ll be paying each month.

A variable-rate mortgage, on the other hand, can change depending on the Bank of England’s base rate. If rates drop, you could save money, but if they go up, so will your payments. It’s worth thinking about whether you’re comfortable with this kind of risk.

Property Type

The type of property you buy can also impact your mortgage. Lenders are usually more cautious with non-standard properties—like listed buildings, flats above shops, or homes with unusual construction.

These might require a larger deposit or fewer mortgage options. But if you’re buying a standard house or flat in good condition, you’ll have more choices and better rates.

What Other Costs Should I Keep in Mind?

When you’re thinking about a £350k mortgage, the monthly repayment isn’t the only number to keep in mind. Here are a few other costs that could sneak up on you:

- Arrangement fee: £0-£2,000 (some lenders let you add this to your loan)

- Valuation fee: £250-£1,500, depending on the property

- Solicitor’s fees: A few hundred to several thousand pounds

- Stamp duty: Only if you’re not a first-time buyer (use a handy stamp duty calculator to check your rate)

And don’t forget about the ongoing costs like buildings insurance, life insurance, and any fees if you use a mortgage broker.

Key Takeaways

- Your monthly repayments on a £350,000 mortgage depend on the interest rate, term length, and whether it’s repayment or interest-only.

- To get a £350,000 mortgage, you’ll generally need a salary between £77,777 and £87,500.

- A 5-10% deposit for a £350,000 house means saving between £17,500 and £35,000. A 20% deposit or more unlocks better mortgage deals.

- Factors like your credit score, fixed or variable rates, and property type can affect your mortgage terms.

- Be mindful of extra costs like arrangement fees, valuation fees, solicitor fees, and insurance.

The Bottom Line

You’re likely wondering how to make sense of all the factors—interest rates, repayments, and mortgage terms—to find what works best for you.

Getting the right mortgage can save you a lot of money, but with so many decisions to make, it can feel a bit overwhelming.

This is where a mortgage advisor can really help:

- They’ll find the best deals to suit your situation

- Help you avoid costly mistakes

- Save you time by handling the research and negotiations

- Guide you on improving your chances of securing better terms

If you’re looking to save time and stress in your search for the right broker, get in touch with us. We’ll connect you with a reliable broker who can help with your specific mortgage needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is a 10-year or 30-year mortgage better?

It depends on your financial goals. A 10-year mortgage comes with higher monthly payments, but you’ll pay less interest overall. A 30-year mortgage offers lower monthly payments, but you’ll end up paying more interest over time.

If you prefer to pay off your mortgage faster and save on interest, a shorter term might be better. But if you need to keep your monthly budget lower, a longer term could be the right choice.

How much mortgage should I get for a £350,000 house?

For a £350,000 house, you’ll typically need a mortgage of £315,000 to £332,500, depending on the size of your deposit.

Most lenders require a deposit of 5-10%, meaning you’d need to save at least £17,500 to £35,000. The larger your deposit, the smaller your mortgage, and the better rates you’re likely to get.

How do I get the best mortgage deal?

To get the best mortgage deal, compare different lenders and interest rates. Improving your credit score, saving a larger deposit, and choosing the right mortgage type (fixed or variable) will help.

Speaking to a good mortgage broker is also a good idea, as they have access to deals that might not be available directly to the public and can find the best option for your circumstances.

Can I get a £350K mortgage with bad credit?

Yes, it’s possible to get a £350K mortgage with bad credit, but it might be more challenging. Lenders may offer you a higher interest rate or ask for a larger deposit to reduce their risk.

Working with a specialist mortgage broker can help you find lenders who are more flexible with bad credit. Improving your credit score before applying can also increase your chances of getting approved with better terms.