- What is a Reverse Mortgage?

- How Do Reverse Mortgages Work?

- Eligibility: Who Can Get Reverse Mortgages?

- The Pros and Cons of Reverse Mortgages

- How Much Can I Get in Reverse Mortgages?

- How to Get a Reverse Mortgage?

- Different Types of Reverse Mortgages

- Reverse Mortgages: What Happens After Death?

- Providers of Reverse Mortgages

- Avoiding Scams Related to Reverse Mortgages

- Alternatives to Reverse Mortgages

- Key Takeaways

- The Bottom Line

Is a Reverse Mortgage Right for You? A Guide in 2024

Retirement should be about relaxation, not money worries. But, for many homeowners, the pension pot only goes so far. If you’re feeling the pinch, your property could offer a solution: a reverse mortgage.

Sound complex? It doesn’t have to be.

In this guide, we’re simplifying reverse mortgages. You’ll discover what they are, how they work, the good, the bad, and everything in between. We’ll even walk you through the process of getting one in the UK.

What is a Reverse Mortgage?

A reverse mortgage is a financial agreement where a homeowner unlocks equity in their home in exchange for regular payments or a lump sum of money. This concept is also known as an equity release scheme. But what exactly does ‘equity release’ mean?

Equity is the value of your property after any outstanding mortgages or other debts secured on it have been deducted. To ‘release’ this equity means you’re freeing up some of this value and turning it into a cash amount.

The beauty of a reverse mortgage is that the homeowner retains the right to live in the property until they die or choose to sell it. The reverse mortgage is then repaid when you either die, move into a long-term facility, or sell your home.

How Do Reverse Mortgages Work?

Understanding how a reverse mortgage works can feel overwhelming, but let’s break it down into manageable steps:

First, imagine you agree to a loan with a lender, using your house as collateral. A reverse mortgage, however, turns this scenario on its head, hence the term ‘reverse’.

Unlike a standard mortgage where you pay the lender, the lender pays you, freeing up a portion of your home’s equity as cash.

You don’t need to undergo the typical affordability assessment and credit checks because your property guarantees the loan.

Once the agreement is in place, you can receive the loan amount in regular payments or as a lump sum, whichever suits your needs better.

Over time, the loan accrues interest. You won’t have to worry about repayments as long as you live in the house – the interest simply gets added back into the loan, bumping up the amount owed.

In terms of eligibility, if you own a home outright and live there for at least six months of the year, you’re likely a strong candidate for a reverse mortgage, or a ‘lifetime mortgage’ as it’s commonly referred to in the UK.

Flexible Reverse Mortgages

Suppose you’re still working, relatively young, and want to balance unlocking some of your home’s equity while also protecting your children’s inheritance. In that case, a flexible reverse mortgage could be a perfect fit.

This option allows you to make monthly repayments, which means if you’re keeping up with the interest each month, your account balance won’t increase.

So, when it’s time for repayment, you’ll only owe the initial amount you borrowed.

Regardless of the specific type of reverse mortgage you opt for, repayment typically happens once you decide to sell the house or after you pass away.

But here’s some reassuring news: thanks to the “no negative equity” guarantee, the amount you owe will never exceed your home’s value.

In essence, a reverse mortgage gives you a way to tap into your home’s equity without selling your home, all while providing flexible options to fit your lifestyle and plans.

Eligibility: Who Can Get Reverse Mortgages?

Eligibility for a reverse mortgage is primarily based on age and property value. Typically, to be eligible:

- You must be 55 years or older (some lenders may have different age requirements).

- You must own a property (in the UK) that has a substantial amount of equity.

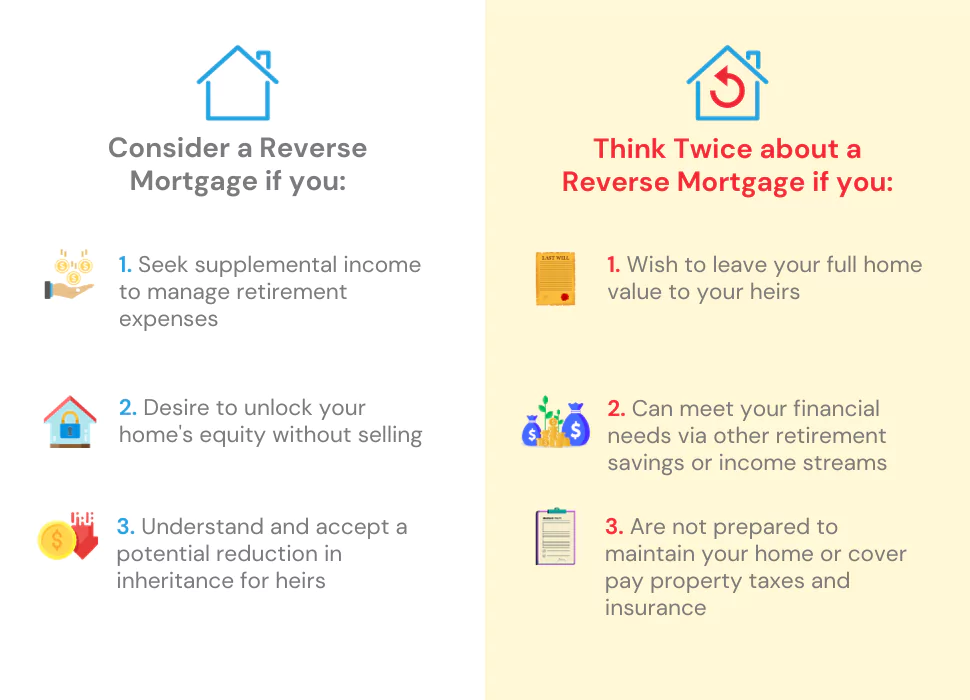

It’s essential to note, however, that while many can technically qualify for a reverse mortgage, it’s not a suitable solution for everyone.

The Pros and Cons of Reverse Mortgages

To help you more in deciding whether this is a suitable option for you, here are the pros and cons you can consider:

Pros:

– Extra income. A reverse mortgage boosts your retirement income, ideal if you’re rich in property but low on cash.

– Asset to cash. You can turn your home value into ready cash for retirement needs.

– Tax-free cash. The reverse mortgage funds are tax-free and there are no spending rules.

– Keep some inheritance. Some of your property value can be safeguarded for your heirs.

– Move if needed. You can shift to another house while holding a reverse mortgage if it makes financial sense.

– Stay put. You continue living in your home.

– Safeguard. A ‘no-negative equity’ guarantee means you won’t owe more than your home’s worth, even if house prices dip.

Cons:

– Rising debt. Compounded interest can mean your debt grows over time, impacting your estate value.

– Lower inheritance. What you can leave for your heirs may shrink.

– Higher rates. Interest rates are generally steeper than for other UK mortgages.

– Missing safeguards. If your lender isn’t part of the UK Equity Release Council, you won’t have eviction or repossession protection.

– Inheritance tax. Gifting borrowed equity to a family member might attract inheritance tax.

– Loan rules. Not following loan terms like home maintenance or tax payments can make your loan due.

– Legal and other fees. Setting up a reverse mortgage may come with costs.

How Much Can I Get in Reverse Mortgages?

The amount you can borrow in reverse mortgage hinges on several factors:

- Your Age and Life Expectancy.

- Your Home Value.

- The Interest Rates.

- Your Current Mortgage Balance.

- The Type of Payment you choose.

- Closing costs (Total Fees Payable or Completion Costs)

Age and Life Expectancy

Generally, the older you are, and the lower your life expectancy, the more you can borrow.

Home Value

The value of your home directly affects your potential loan amount. The more valuable your property, the larger the loan you could access. Notably, you might be able to release a portion of equity between 40% to 60% of your home value. This depends on your financial status and a third-party property evaluation.

Interest Rates

Interest rates also play a vital role. If they are low, you’re likely to be able to borrow a higher amount due to the reduced interest accumulation over the loan term.

Current Mortgage Balance

If you have a significant outstanding balance on your primary mortgage, your lender may require you to pay it off using the proceeds from your reverse mortgage. This requirement can limit the available funds from your reverse mortgage.

Payment Type

The chosen payment plan influences your loan amount. For instance, a line of credit payment option might avail more funds compared to a lump sum or monthly payment.

Closing Costs

Similar to standard mortgages, reverse mortgages come with closing costs. These costs can be covered using the loan proceeds. Therefore, higher closing costs might result in a reduced loan amount. In general, closing costs range from 2% to 6% of your home’s value.

With these factors, reverse mortgage calculators can be handy tools. They use these factors to provide an estimate of the loan amount.

How to Get a Reverse Mortgage?

Getting a reverse mortgage isn’t overly complex, but it does require careful consideration. Here are the steps to obtaining a reverse mortgage:

- Consider your needs – Determine why you need a reverse mortgage and whether it’s the best solution for your circumstances.

- Seek advice – Consult with a financial advisor or a reverse mortgage broker to understand the product and its implications.

- Choose a provider – Review various lenders and the products they offer. Make sure to understand the terms, interest rates, and any fees associated with the mortgage.

- Apply – Once you’ve made a decision, you can apply for the reverse mortgage. You’ll need to provide documentation about your property and personal circumstances.

- Property appraisal – The lender will arrange an appraisal to determine the value of your property.

- Legal advice – Obtain legal advice to ensure you fully understand the agreement before you sign.

- Completion – Once all parties are satisfied, the lender will issue the funds as agreed.

Different Types of Reverse Mortgages

There are three main types of reverse mortgages to consider:

1. Drawdown Reverse Mortgage – You can take out small amounts of money whenever you need it.

- Pros: Very flexible.

- Cons: It can cost more in interest over time.

2. Lump Sum Reverse Mortgage – You get one big payment.

- Pros: Good for big expenses like paying off a mortgage or fixing up your home.

- Cons: Interest starts right away and can make your debt grow quickly.

3. Enhanced Reverse Mortgage – If you have health or lifestyle issues that might shorten your life, you can use this to get more money out of your house.

- Pros: Allows you to release more equity.

- Cons: Has the same downsides as the lump sum option.

Reverse Mortgages: What Happens After Death?

A reverse mortgage loan is typically repaid when the homeowner sells their home, moves out permanently, or passes away. If the homeowner dies:

- The heirs can sell the home and use the proceeds to pay off the loan.

- They can keep the home but must repay the reverse mortgage loan. They can do this through refinancing or from other funds.

Providers of Reverse Mortgages

There is a wide range of reverse mortgage providers, including traditional banks, building societies, and specialised lenders. Each lender has distinct criteria:

- Age Caps: Different lenders have various age requirements.

- Loan-to-Value Ratios: Lenders have different policies about how much of your home’s value they’re willing to loan.

- Early Repayment Charges: The conditions for early repayment can vary between providers.

| Lender | Typical Mortgage Rate | Age Cap | Other Details |

|---|---|---|---|

| Natwest | 3.56% | Over 55 | 65% LTV; No arrangement fee. |

| Liverpool Victoria | 4.7% | Over 55 | 30% LTV; Partial repayments allowed. |

| Halifax | 3.55% | Over 60 | 70% LTV |

| More2Life | 5.94% | 55-84 | 46.7% LTV; Fixed early repayment charges. |

| Standard life | 4.17% | 55-84 | 44% LTV; Partial repayments allowed. |

Given the varying terms and conditions, understanding these before you proceed is essential. Keep in mind that some lenders may offer more favourable rates than others.

Considering the complexity of reverse mortgages and their impact on your finances, it’s advisable to consult with a financial advisor or reverse mortgage broker for tailored advice.

Avoiding Scams Related to Reverse Mortgages

Unfortunately, scams related to reverse mortgages do exist. Protect yourself by:

- Research: Know your lender. Ensure they’re reputable and regulated by the Financial Conduct Authority (FCA).

- Be cautious: Be wary of pressure selling, aggressive marketing tactics, or offers that seem too good to be true.

- Check for Equity Release Council membership: Members of the Equity Release Council adhere to a strict code of conduct which guarantees your protection.

Alternatives to Reverse Mortgages

Before deciding on a reverse mortgage, consider other options that may suit your situation:

- Waiting. If you can, hold off on releasing equity until your property value increases. More value equals more equity.

- Downsizing. Selling your property and moving to a smaller, more affordable one could release a good amount of capital.

- Refinancing. Refinancing your current mortgage could potentially offer lower interest rates or more favourable terms.

- Cutting Expenses. Evaluate your budget and reduce unnecessary expenses. You may find you can comfortably live within your means without needing to release equity from your home.

Key Takeaways

- A reverse mortgage is a special type of loan, specifically designed for homeowners aged 55 or over. This loan allows you to convert part of your home’s equity into cash.

- The amount available from a reverse mortgage depends on various factors such as age, property value, interest rates, and existing mortgage balance. You can choose from different types of reverse mortgages to fit your needs.

- Reverse mortgages are typically repaid when the homeowner passes away or decides to sell the home. But, it’s crucial to remember that while they provide financial relief, they can also impact the value of inheritance left to heirs.

The Bottom Line

In summary, a reverse mortgage can be a beneficial way to use the equity in your home to enhance your retirement. But it’s not the perfect solution for everyone. Always chat with a trusted mortgage advisor before deciding.

Are you thinking about whether a reverse mortgage is right for you? Let us make it easier. Our team is adept at pairing individuals with experienced brokers who can provide guidance tailored to your situation.

Why not get in touch with us today and be connected to a seasoned broker? Simply fill out this quick form. And we’ll match you for free with a good broker who will help you find the solution that’s just right for you.

Get Matched With Your Dream Mortgage Advisor...

Frequently Asked Questions

Is a reverse mortgage expensive?

Like any financial product, reverse mortgages come with associated costs. These include arrangement fees, interest rates, and potential valuation and legal fees. It’s vital to understand all associated costs before proceeding.

Can I get a reverse mortgage on any type of property?

It depends. While some property types may be eligible, others may not. Lenders typically assess applications individually, and some may be hesitant to offer a reverse mortgage for non-standard construction homes. For more details, refer to our guide on equity release for non-standard constructions.

Does a reverse mortgage pay off your mortgage?

Yes, if you have an existing mortgage on your home, the proceeds from the reverse mortgage are first used to pay that off. Any remaining funds can be used as you see fit.

What is the difference between a reverse mortgage and a second mortgage?

A reverse mortgage and a second mortgage are different types of loans. A second mortgage or home equity loan requires you to make monthly repayments and is usually for a fixed term.

On the other hand, a reverse mortgage does not require monthly payments, and the loan is repaid when the borrower sells the home, moves out, or passes away.