- What is a BNO Visa Mortgage?

- Can You Get a Mortgage in the UK with a BNO Visa?

- What Do You Need to Qualify?

- What Are the Mortgage Options for BNO Visa Holders?

- What Are the Key Challenges for BNO Visa Holders?

- How To Apply for a BNO Visa Mortgage?

- How Can a Mortgage Broker Help?

- Key Takeaways

- The Bottom Line

Can You Get a BNO Visa Mortgage in the UK? A Full Guide

With the introduction of the British National Overseas (BNO) visa, many Hong Kong nationals are exploring the possibility of purchasing property in the UK.

This guide will walk you through the steps, requirements, and options for getting a UK mortgage as a BNO visa holder, making the process easier to understand.

Whether you’re looking to buy a home to live in or an investment property, this guide will cover everything you need to know about BNO visa mortgages.

What is a BNO Visa Mortgage?

A BNO visa mortgage is for those with a British National Overseas (BNO) visa, mostly for people from Hong Kong.

Launched in 2021, the BNO visa allows Hong Kong citizens to live, work, and study in the UK. This visa also makes it possible for you to apply for a mortgage in the UK.

The process may be different from a regular mortgage application, and you might find fewer lenders compared to UK citizens.

While you will be treated similarly to British nationals, factors like how long you’ve lived in the UK and your UK credit history can affect your options.

Can You Get a Mortgage in the UK with a BNO Visa?

Yes, you can apply for a mortgage in the UK with a BNO visa, and you’re often treated like a British national.

The process may have some extra steps due to certain requirements.

Many lenders prefer you to have lived in the UK for at least 12 months, which might be difficult if you’ve just arrived or are still in Hong Kong.

While there may be fewer banks or building societies willing to lend, specialist lenders offer more flexible options.

Some may not require a UK credit history and can consider your application as soon as you arrive.

Your time in the UK, credit history, and employment status will be important factors when applying for a mortgage.

What Do You Need to Qualify?

To qualify for a mortgage as a BNO visa holder, you need to meet these requirements:

- Age: You or your partner must be at least 18 years old.

- Visa Status: Lenders will check your BNO visa and how much time is left on it. Most want you to have at least 1–2 years remaining. If you have a 30-month or five-year visa, this should be enough when you arrive in the UK.

- Employment: You’ll need proof of stable income. Lenders prefer you to have been employed full-time in the UK for at least three months, with payslips or a letter from your employer. If you’re not yet employed in the UK, it may be harder to qualify, though some lenders might accept overseas income. Having a permanent UK job will boost your chances.

- Deposit: A deposit of at least 25% is usually needed. As a foreign national, you’ll often need a higher deposit than UK citizens. The bigger your deposit, the better mortgage deals you’ll likely get.

- Proof of Address: You’ll need to show proof of your address, whether in the UK or Hong Kong. This can be done with utility bills or bank statements.

- Other Factors: Some situations, like being self-employed, over 75, buying a non-standard property, or having bad credit, can make it harder to get a mortgage. But, specialist lenders may be more flexible with your credit history as a foreign national.

What Are the Mortgage Options for BNO Visa Holders?

BNO visa holders have access to a range of mortgage options.

The type of mortgage you can get will depend on your circumstances, such as how long you’ve been in the UK and your employment status.

What Types of Mortgages are Available?

- Residential mortgages – These are the most common mortgages for those looking to buy a home to live in. BNO visa holders can apply for a residential mortgage, and lenders may offer flexible terms based on your employment and visa status.

- Buy-to-let mortgages – If you’re looking to invest in UK property, buy-to-let mortgages are available for BNO visa holders. You’ll need to put down a deposit of at least 25%, and the lender will assess whether the rental income will cover the mortgage payments.

What Are Your Repayment Mortgage Options?

When applying for a mortgage as a BNO visa holder, you’ll typically have two main repayment options:

- Capital Repayment Mortgage – This is the most common option. Your monthly payments go towards both the interest and the loan amount. Over time, you’ll gradually reduce what you owe, and by the end of the term, the mortgage will be fully paid off.

- Interest-Only Mortgage – With this option, your monthly payments cover only the interest on the loan. At the end of the term, you’ll still owe the full amount you originally borrowed. Lenders offering interest-only mortgages will require a solid repayment plan to clear the debt at the end of the mortgage term, such as savings or selling the property.

Some lenders also allow overpayments, where you pay more than the required amount each month, reducing your mortgage term and interest paid.

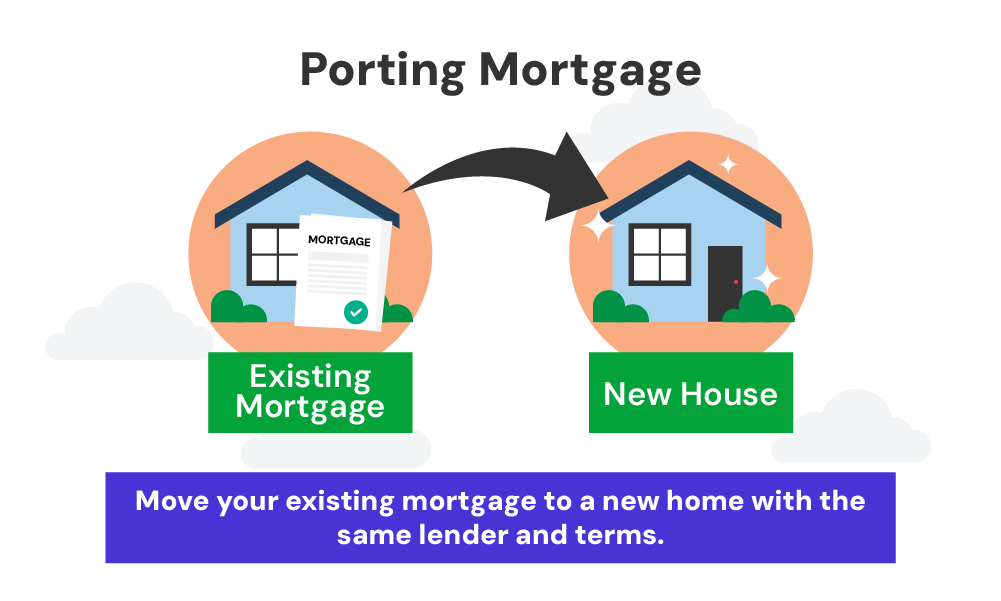

Additionally, portable mortgages let you transfer your mortgage to a new property without penalty if you move, though this depends on the lender’s approval.

Which Lenders Offer BNO Visa Mortgages?

There are several UK lenders who are willing to work with BNO visa holders. However, each lender has its own criteria.

Some may require you to have lived in the UK for a specific period, while others may approve your application as soon as you arrive.

It’s important to work with a mortgage broker who can match you with the right lender for your situation.

Government Schemes for BNO Visa Holders

Although there are no specific government schemes designed solely for BNO visa holders, you can still access the general schemes available to UK nationals:

- Shared Ownership: This scheme allows you to buy a portion of a property (typically between 25% and 75%) and pay rent on the remaining share. Over time, you can increase your ownership share. It’s a good option if you can’t afford to buy 100% of a property outright.

- First Homes Scheme: This scheme offers a discount of 30% to 50% on the market value of a new-build home, making it easier for first-time buyers to purchase property in their local area.

These schemes can make homeownership more affordable, even if you’re a BNO visa holder.

Speak with a mortgage broker to see which scheme works best for your situation.

What Are the Key Challenges for BNO Visa Holders?

Although BNO visa holders can access mortgages in the UK, there are a few key challenges to be aware of.

- Time in the UK. Many lenders prefer you to have lived in the UK for at least 12 months, and some even require two or three years. If you’ve just arrived, your choices may be limited, but some specialist lenders can offer mortgages straight away.

- Credit History. If you’ve recently moved, you may not have a UK credit history yet, which can make approval harder. Lenders want to see evidence of good financial behaviour. A mortgage broker can guide you on how to improve your credit score if needed.

- Employment. Having a stable job is important. Lenders often ask for a full-time employment contract or payslips showing at least three months of income. Without this, your mortgage application could be delayed.

- Non-Standard Properties. If you’re buying a non-standard property like a prefab or steel-framed house, it can be tougher to get a mortgage. Lenders prefer homes built with standard materials like bricks and mortar.

How To Apply for a BNO Visa Mortgage?

1. Open a UK Bank Account

If you haven’t already, you’ll need to open a UK bank account. This is essential as lenders prefer to see your income and savings in a UK-based account.

2. Prepare Your Documents

Get your paperwork in order before applying. You’ll need:

- Proof of identity (passport and BNO visa)

- Proof of income (wage slips or employment contract)

- Proof of address (utility bills or bank statements from the UK or Hong Kong)

- Proof of deposit (showing the funds you’ll use for the deposit)

3. Secure Employment

Most lenders require you to have full-time employment in the UK.

Make sure you’ve been employed for at least three months and have wage slips to prove your income.

4. Work with a Specialist Mortgage Broker

It’s a good idea to consult a mortgage broker who specialises in BNO visa holders.

They can match you with lenders that offer the best deals for your situation and handle the paperwork.

Brokers often have access to lenders who may not require a UK credit history or long residency.

5. Submit Your Application

Once you’ve gathered all the necessary documents and chosen the right lender, it’s time to apply.

Your broker will help you with the application, ensuring all your documents are correct and complete.

6. Wait for Approval

The lender will review your application, considering your visa status, employment, deposit, and other factors.

Once approved, you’ll receive your mortgage offer.

How Can a Mortgage Broker Help?

As a BNO visa holder, getting a mortgage can feel tricky, but a specialist broker can make it easier. They can:

- Help you find lenders who work with BNO visa holders.

- Make sure you meet all the eligibility requirements.

- Save you time by matching you with the right lender, avoiding unnecessary credit checks and rejections.

- Use their market knowledge to get you better mortgage rates.

Using a good broker is a good idea, especially if you’ve just moved to the UK or aren’t familiar with the mortgage process.

Key Takeaways

-

- BNO visa holders can apply for UK mortgages, but the process may differ from UK citizens.

-

- You need a deposit of at least 25%, proof of stable income, and 1-2 years remaining on your visa.

-

- Lack of UK residency, limited credit history, and buying non-standard properties can make approval harder.

-

- You can choose between residential and buy-to-let mortgages, with repayment options including capital repayment or interest-only.

-

- Government schemes like Shared Ownership and the First Homes Scheme are available to BNO visa holders.

The Bottom Line

In conclusion, BNO visa holders have plenty of opportunities to secure a UK mortgage, whether for residential or investment purposes.

While the process may come with its challenges, understanding the requirements and working with a knowledgeable mortgage broker can simplify your journey.

If you want to save time and avoid stress on finding the right broker, get in touch. We’ll connect you with a trusted broker who can help you with your mortgage.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How does my visa status affect my mortgage application?

Your BNO visa status will be considered by lenders. They will check how long is left on your visa and may require at least 1-2 years remaining.

Can I apply for a mortgage before arriving in the UK?

While it’s possible to apply for a mortgage from Hong Kong, it’s often easier to secure a mortgage once you’ve arrived and are employed in the UK.

What if I don’t have a UK credit history?

A lack of UK credit history can make it more difficult to get a mortgage. Working with a mortgage broker can help you find lenders who are more flexible with recent arrivals.

Can I get a buy-to-let mortgage as a BNO visa holder?

Yes, buy-to-let mortgages are available to BNO visa holders, though you’ll need a minimum 25% deposit, and lenders will assess the rental income potential of the property.