- What Are Bank Statements?

- How Many Bank Statements Do You Need for a Mortgage?

- Why Do Mortgage Lenders Need Bank Statements?

- What Do Mortgage Lenders Look for on Bank Statements?

- Which Mortgage Lenders Don’t Ask for Bank Statements?

- Tips To Improve Your Bank Statements for a Mortgage Application

- How To Deal With Mortgage Rejections Over Bank Statements

- The Bottom Line

Mortgage Bank Statements: What You Need to Know

Are you planning to apply for a mortgage in the UK? You’ll likely need to provide bank statements as part of your application.

But why do lenders need them, and what are they looking for?

This comprehensive guide will walk you through everything you need to know about bank statements for mortgage applications.

What Are Bank Statements?

Bank statements are financial documents that summarise your account activity over a specific period, usually monthly or quarterly.

It includes details such as:

- Your account information (name, account number, etc.)

- Opening and closing balances

- Deposits (including your salary, transfers, and any other income)

- Withdrawals (cash, debit card transactions, direct debits, standing orders)

- Any fees or charges from the bank

- Interest earned or paid

Bank statements serve as an official record of your financial activity, providing a clear picture of your income, spending habits, and overall financial health.

And when it comes to applying for a mortgage, these documents become your financial CV, showcasing your money management skills to potential lenders.

How Many Bank Statements Do You Need for a Mortgage?

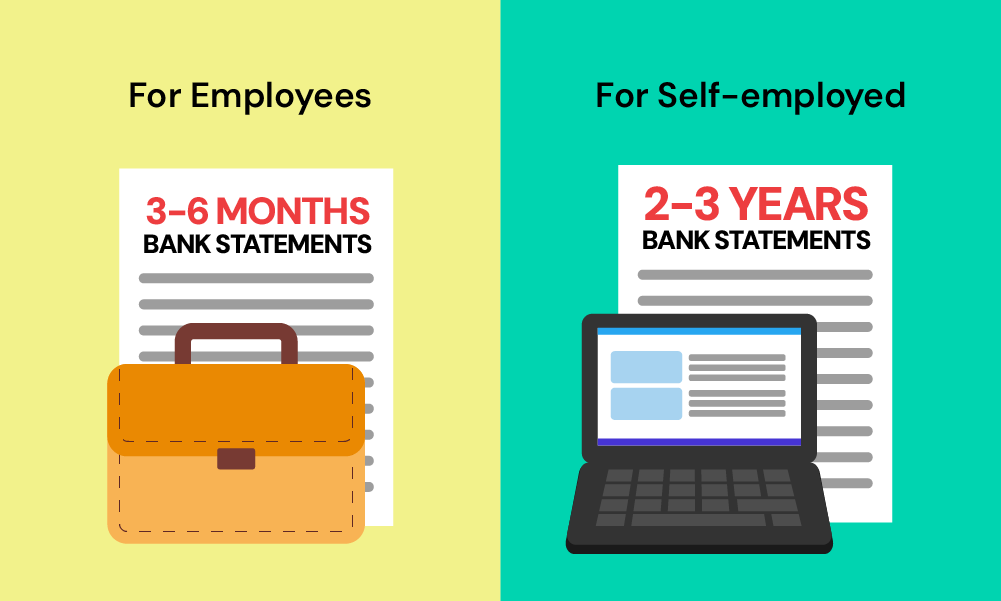

Most UK mortgage lenders typically request 3-6 months of bank statements. However, the exact number can vary depending on the lender and your individual circumstances.

If you’re self-employed, you might need to provide more extensive documentation, including up to three years of accounts.

Why Do Mortgage Lenders Need Bank Statements?

You might be wondering, “I’ve got a good job and a decent credit score. Why do lenders need to scrutinise my bank statements?”

Well, mortgage lenders aren’t just being nosy. There’s a purpose behind it, all centred on risk assessment.

When you apply for a mortgage, you’re essentially asking a lender to trust you with a huge sum of money – often hundreds of thousands of pounds. 💷

Naturally, they want to be sure you’re a safe bet. ✅

Your bank statements help them evaluate your financial health and ability to keep up with payments.

Here are specific reasons lenders ask your bank statements:

- To verify your income – They’ll check if your salary matches the amount you’ve declared on your application.

- To assess affordability – By reviewing your spending habits, lenders can determine if you can afford the mortgage repayments.

- To confirm your deposit: – They’ll want to see that you have the funds available for your deposit and that they’ve been in your account for a while.

- To check for risk factors – Lenders will look for potential red flags like excessive gambling, payday loans, or unexplained large deposits.

What Do Mortgage Lenders Look for on Bank Statements?

Handing over your bank statements to a mortgage lender might feel invasive. But what are they really looking for? 🧐

Let’s uncover the details.

- Regular Income – Lenders seek a steady income stream. For most UK employees, this means monthly salary from your employer. If you’re self-employed or have multiple income sources, they’ll examine the consistency and frequency of your earnings.

- Affordability – Can your income comfortably cover your outgoings? Lenders are ensuring you have enough left each month to manage mortgage payments.

- Existing Financial Commitments – Regular outgoings like rent, loan repayments, credit card bills, and subscriptions are all under scrutiny. Lenders use this information to calculate your debt-to-income ratio and assess your ability to take on a mortgage.

- Spending Habits – Your statements reveal a lot about how you manage money. Frequent splurges on luxury items or regular gambling can raise concerns, while consistent savings or investments are viewed positively.

- Overdraft Usage – Occasional overdraft use isn’t a deal-breaker, but frequent or long-term reliance can suggest financial strain. Try to stay in the black as much as possible in the months leading up to your application.

- Bounced Payments – Returned direct debits or standing orders are red flags. They indicate that you’re struggling to meet your financial commitments. Make sure you have enough funds to cover all your regular payments.

- Large or Unusual Transactions – Significant deposits or withdrawals that don’t fit your normal patterns will be questioned. Lenders might ask for explanations to ensure they’re not from undisclosed loans or illegal sources.

- Savings Behaviour – Regular transfers to savings accounts demonstrate good financial discipline and the ability to set money aside—a positive sign for mortgage payments.

- Payday Loans – These are often viewed negatively as they can indicate financial difficulties.

- Account Conduct – Lenders will look at how you manage your account overall. Do you stay within your agreed limits? Do you manage your finances responsibly?

Remember, lenders aren’t expecting perfection. They understand that unexpected expenses arise and finances can get tight.

What they’re looking for is an overall pattern of responsible financial management.

If there are any issues or unusual transactions in your statements, don’t panic. It’s better to provide an upfront explanation.

Maybe you received a large cash gift for your wedding or had an expensive car repair. Context can make ALL the difference.

Learning what lenders are looking for can help you present your finances in the best light possible.

It might mean cleaning up your spending habits for a few months before applying, or being prepared with explanations for any potential red flags.

Remember, your bank statements tell your financial story – make sure it’s one that showcases you as a responsible and capable borrower.

Which Mortgage Lenders Don’t Ask for Bank Statements?

In the UK, some mortgage lenders are ditching bank statements for applicants. This includes Santander, Halifax, and Virgin Money.

These lenders are turning to alternative methods like affordability calculators and credit scoring to assess if you can afford the mortgage.

For instance, Santander tells brokers not to send bank statements unless absolutely necessary.

Similarly, Halifax uses credit scores and affordability tools instead of statements. Virgin Money might ask for them in specific cases, but they’re not always required.

This shift simplifies the application process by cutting down on paperwork.

But remember, even without bank statements, these lenders will still thoroughly check your financial health to make sure you can handle the mortgage repayments.

Tips To Improve Your Bank Statements for a Mortgage Application

If you’re planning to apply for a mortgage in the near future, here are some steps you can take to optimise your bank statements:

- Keep Your Account in the Black. Stay out of your overdraft. Consistent positive balances tell lenders you’re in control.

- Trim Non-Essential Spending. Cut back on luxuries and non-essentials. A leaner spending pattern shows prudence.

- Steer Clear of Gambling Transactions. Even small bets can raise eyebrows. Skip the flutter and keep your finances squeaky clean.

- Tackle Your Debts. Reduce outstanding loans or credit card balances. Less debt means more reliability.

- Save Regularly. Make a habit of saving. Regular deposits into your savings account are gold stars on your financial report card.

- Keep Your Income Stable. Avoid job changes or shifts in income sources. Stability is key during this period.

- Automate Your Finances. Set up direct debits for bills and savings. Automation ensures you never miss a payment and consistently save.

- Mind Your Subscriptions. Review and cancel any unused subscriptions. Fewer recurring expenses mean a healthier financial profile.

- Clarify Large Transactions. If you’ve got big deposits or withdrawals, be ready to explain. Transparency builds trust.

- Be Prudent with Credit. Avoid applying for new credit lines. Each inquiry can ding your credit score and raise questions.

By taking these steps, you’ll not only polish your bank statements but also craft a financial narrative that shouts, “I’m a safe bet.”

Remember, it’s not just about the numbers; it’s about the story they tell. Make it one of responsibility and foresight.

How To Deal With Mortgage Rejections Over Bank Statements

Rejection stings. But it’s not the end of the road. Here’s how to bounce back stronger:

- Get clarity. Ask your lender for specific reasons behind the decline. Knowing the exact issue is the first step to fixing it.

- Review Your Bank Statements. Go through your statements with a fine-tooth comb. Look for red flags like overdrafts, missed payments, or unusual transactions. Knowledge is power.

- Address the Issues. Found the problem? Now, tackle it head-on. Clear outstanding debts, stop unnecessary spending, and maintain a positive balance. Start improving your bank statements – small changes can make a big difference over time.

- Get Professional Advice. The smartest way to deal with a mortgage rejection is by getting help from a good mortgage broker. Their expertise can provide tailored solutions and improve your chances next time.

Remember, every setback is a setup for a comeback.

Use this opportunity to refine your financial narrative, showing lenders you’re not just a number, but a responsible, reliable borrower.

Your perseverance and improved financial health will make a compelling case next time around. 😀

The Bottom Line

Bank statements are more than just numbers; they’re your financial narrative. They tell lenders who you are and how you handle your money.

By understanding what lenders seek and refining your statements, you can significantly boost your chances of mortgage approval.

Whether you’re stepping onto the property ladder for the first time or looking to remortgage, being prepared can make all the difference.

If you have any concerns, don’t hesitate to seek advice from a qualified mortgage broker who can guide you through the process and help you present your finances in the best possible light.

Need a good broker? Get in touch. We’ll connect you with a qualified mortgage broker who can secure the best deal for you.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What if you don't have enough bank statements for a mortgage?

If you don’t have enough bank statements for a mortgage, you can provide alternative financial documents like pay stubs, tax returns, or statements from other accounts.

Explain your situation in a letter to your lender, demonstrating consistent income and savings through other means.

Consult your mortgage lender or broker for possible solutions, or consider finding a lender with more lenient requirements.

Being proactive and transparent can help resolve the issue.

Can you get loans with bank statements only?

While some lenders offer loans based primarily on bank statements, these are typically short-term or payday loans with high interest rates.

For a mortgage, lenders will require additional documentation such as proof of income, identification, and details of the property you’re looking to buy.

What should you do if you're worried about your bank statements?

If you’re concerned that something in your bank statements might negatively impact your mortgage application, it’s best to speak with a mortgage broker before applying.

They can assess your situation, suggest ways to improve your financial picture, and match you with lenders who might be more flexible about certain issues.

Remember, every lender has different criteria, and what might be a problem for one could be acceptable to another.

A good broker can help you navigate these differences and find the best mortgage for your circumstances.