Buying a Bungalow in the UK: All You Need to Know

Thinking about buying a bungalow? Maybe you want to downsize, start a family, or need more accessibility to fit your lifestyle.

Bungalows are perfect for these reasons. They’re ideal if you want a simpler, more manageable space, a safe home for children, or something that fits your mobility needs.

With spacious layouts and room to expand, they offer both comfort and flexibility.

In this article, we’ll walk you through the mortgage process. You’ll learn how to secure financing for standard and non-standard bungalows, like Woolaway, Dorran, or Colt types.

We’ll cover what lenders expect and how to boost your chances of approval, so you can make the process as smooth and stress-free as possible.

What Is a Bungalow House?

A bungalow is a small house with all the rooms on one floor. This makes it great for people who want to avoid stairs or prefer a cosy, easy-to-manage space.

Bungalows can be detached, semi-detached, or even have an upstairs room or two.

In the UK, they are usually set on their own plots, often with lovely gardens.

Bungalows were originally designed for warmer climates but have adapted well to British weather.

With a bit of care, many of these homes, especially the older ones, are still standing strong and keeping people comfortable, although some need more attention than others.

The Pros and Cons of Buying a Bungalow House

Let’s be honest, everything has its ups and downs – bungalows are no different. Here’s a breakdown of their pros and cons:

Pros

- Convenience – No stairs mean easier living, especially for the elderly or those with mobility issues.

- Spacious layout – Bungalows often have bigger rooms compared to other types of homes since there’s no need to stack rooms vertically.

- Outdoor space – Many bungalows have bigger plots, which means more garden space. Perfect if you love gardening or want space for a summer barbecue.

- Potential for expansion – If one storey isn’t enough, many bungalows can be extended upwards or outwards.

Cons

- Higher Prices – Despite being single-storey, bungalows are often expensive. They are in high demand, and their larger plots can push up the price.

- Not Ideal for Large Families – If you have a big family and need more bedrooms, a single-storey home might feel cramped unless you plan to extend.

- Older Features – Bungalows tend to be older properties, which means outdated features or construction methods, such as Woolaway or Dorran construction – more on that later.

Can You Get a Mortgage for a Bungalow House?

Yes, you can get a mortgage for a bungalow. But hold your horses; there’s a bit more to it if the bungalow falls under what’s known as non-standard construction.

A non-standard construction means a property built using materials or methods that are not common, such as concrete panels, timber frames, or prefabricated components.

Bungalows like Woolaway, Dorran, and Colt properties are considered ‘non-standard’ by mortgage lenders.

If the bungalow you’re buying is one of these, getting a mortgage can be harder and may need more effort. Here’s a breakdown of each type:

For Woolaway Bungalows

Woolaway bungalows were built using prefabricated concrete panels, usually after the war, when the goal was to build houses quickly.

They’re named after W Woolaway & Sons Ltd, the Devon-based company that constructed them.

While they offered a quick housing solution back in the day, there are now a few drawbacks.

Woolaway construction isn’t your typical bricks-and-mortar situation, meaning these homes can have poor insulation and can be hard to heat – not quite the warm and cosy dream.

That’s why getting a mortgage for a Woolaway construction is trickier than with a standard home. Lenders may be hesitant because of the construction type and its flaws.

But, a PRC certificate, which is a certificate proving the structure has been reinforced to meet modern standards, can help.

Without it, your chances are slim, but with it, you’ll have a much better shot at getting a Woolaway construction mortgage.

For Dorran Bungalows

These were another type of post-war prefab house made from precast concrete panels – built fast to meet the high demand for housing.

The trouble with Dorran construction is that these bungalows are also quite challenging to mortgage.

Why? Because the concrete panels aren’t the most durable and tend to degrade over time.

Many lenders won’t even consider lending against them unless you have a PRC certificate showing the structure has been fixed up to standard. It’s a bit of extra work, but it can make a world of difference.

For Colt Bungalows

If you’re dreaming of a Colt bungalow, you might be looking at a charming timber-frame property, often referred to as a “flat-pack” home.

They can be fantastic and very eco-friendly, especially if you’re into sustainability.

Some Colt homes are entirely made of timber, while others might feature brick cladding for extra insulation.

However, due to their non-standard timber construction, some lenders get a bit nervous.

Timber doesn’t have quite the same durability as bricks, which makes them a slightly riskier bet for lenders.

The good news is, if the bungalow is well-built and properly insulated, you can still get a mortgage for it. The key is to ensure you’re working with a lender that’s familiar with this type of home.

How To Get a Mortgage for a Bungalow House?

Here’s how to increase your chances of getting that all-important mortgage approval:

1. Speak to a Specialist Broker

If your bungalow is a non-standard type, like a Woolaway, Dorran, or Colt bungalow, your first port of call should be a specialist mortgage broker.

They’ll know exactly which lenders to approach and how to put your best foot forward. A good broker is worth their weight in gold when it comes to these sorts of properties.

2. Get Your Documents in Order

Lenders like to know what they’re working with, so gather all your paperwork early. You’ll need the following documents when applying for a mortgage for a bungalow house:

- Proof of income (such as payslips or tax returns)

- Proof of identity (like a passport or driving licence)

- Proof of address (such as utility bills)

- Bank statements (usually for the last 3-6 months)

- PRC certificate (if applicable for non-standard construction)

- Details of any other financial commitments (like loans or credit cards)

3. Save for a Deposit

The bigger your deposit, the better your chances of getting a mortgage.

Most lenders will ask for at least 10% of the property’s value, but if your bungalow is non-standard, you may need to save more.

A larger deposit shows the lender that you’re less of a risk.

4. Check Your Credit Score

Your credit score plays a big role in whether you get approved for a mortgage. Check your credit score early and work on improving it if needed.

Pay off debts, avoid missed payments, and don’t apply for too much credit before your mortgage application.

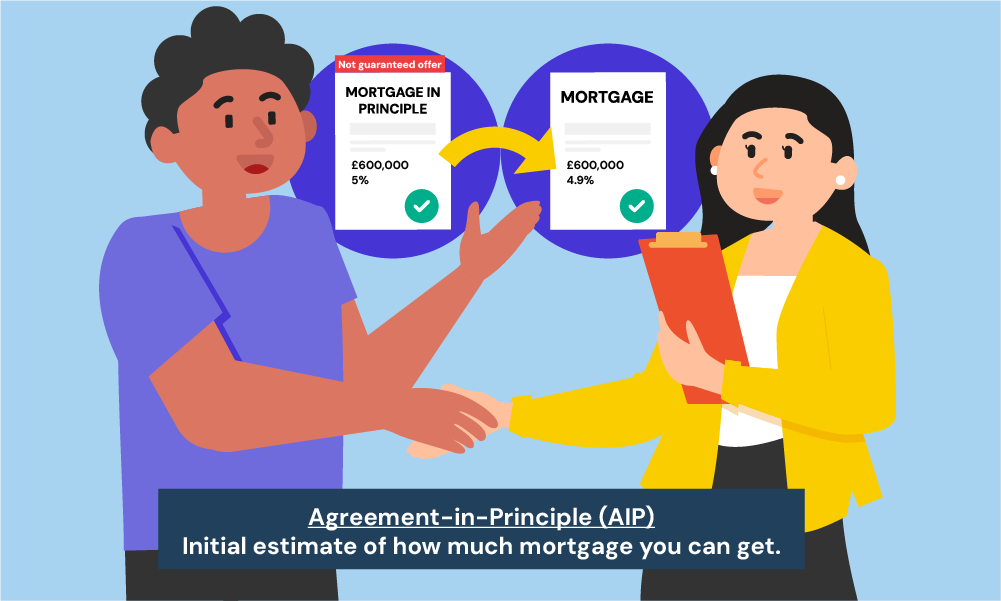

5. Get a Mortgage in Principle

A mortgage in principle (MIP) is an agreement from a lender stating how much they’re willing to lend you based on your current financial situation.

Getting an MIP early shows sellers you’re serious and can make the buying process quicker and smoother. It also gives you a good idea of your budget.

But, keep in mind that an MIP is not a guarantee, and it is not mandatory to have one to buy a property.

3. Find the Right Lender

Some lenders won’t deal with non-standard properties, but others will. Your broker will help you find the right lender for your situation.

Key Takeaways

- Bungalows are charming, accessible, and can be good investments, but they come with their own set of challenges, especially if they’re non-standard construction.

- Woolaway, Dorran, and Colt bungalows are popular non-standard bungalows that might need additional structural improvements or certificates to make them mortgageable.

- Getting a PRC certificate is essential if you’re buying a Woolaway or Dorran bungalow.

- Specialist mortgage brokers can help you find lenders who are comfortable with non-standard construction homes.

The Bottom Line

Bungalows are lovely one-level homes that work well for many people, especially if you want an easy-to-manage space with some charm.

But if you’re looking to buy a Woolaway, Dorran, or Colt bungalow, you need to be aware of the challenges of getting a mortgage for non-standard properties.

The key is to do your research, get the right certifications, and work with experts like specialist mortgage brokers.

A specialist broker can make things easier for you. Here’s what they can do:

- Find mortgage options you may not discover on your own.

- Negotiate better interest rates and terms with lenders familiar with non-standard properties.

- Save you time by handling the paperwork.

- Boost your chances of mortgage approval.

- Offer guidance and personalised financial advice.

With a good mortgage broker, you can focus on what really matters without the stress of sorting out the mortgage yourself.

We can help you find the right broker. Just contact us, and we’ll connect you with a qualified broker to secure the best mortgage for your bungalow.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is a PRC certificate for mortgages?

A PRC (Precast Reinforced Concrete) certificate is a document that shows a previously non-standard construction – like Woolaway or Dorran – has undergone essential structural repairs and now meets modern standards. It’s often required to get a mortgage on these properties.

Can I get a mortgage for a Woolaway bungalow even with bad credit?

Yes, you can, but it may be more challenging. Working with a specialist broker can help you find lenders who are more willing to take on higher-risk applicants, even if your credit isn’t perfect.

Are bungalow houses a good investment?

Generally, yes. Bungalows tend to hold their value well, especially as they’re in high demand and fewer are being built. However, keep in mind the challenges if the bungalow is non-standard construction.

Can I get a buy-to-let mortgage for a bungalow house?

Absolutely. Just like residential mortgages, buy-to-let mortgages are available for bungalows. The main thing to consider is the property’s condition, especially if it’s a Woolaway, Dorran, or Colt bungalow, as these may need additional work or certifications to be rentable.