- A Quick Recap of the Help To Buy: Equity Loan Scheme

- Can You Remortgage with a Help to Buy Loan?

- How Do LTV and Help to Buy Loan Affect Your Remortgage Options?

- Do I Need Approval to Remortgage My Help to Buy Home?

- Steps to Secure a Help to Buy Remortgage

- Fees Associated with Remortgaging

- Calculate Your Help to Buy Remortgage

- Is Paying Off the Equity Loan Required for Remortgaging?

- Can You Use a Remortgage to Pay Off the Equity Loan?

- What Are Your Options if You Can’t Repay the Loan?

- Which Lenders Offer Help to Buy Remortgages?

- The Bottom Line: Get Ahead with Professional Remortgage Guidance

How To Remortgage a Help to Buy Home: A Complete Guide

If you’ve stepped onto the property ladder using the UK’s Help to Buy scheme, you might be wondering what happens when your initial mortgage deal draws to a close.

The answer? It’s time to consider remortgaging.

Far from a mere formality, remortgaging can be a golden opportunity to reassess your financial situation and find a deal that better suits your needs.

Whether you’re nearing the end of a fixed-term mortgage or simply curious about your options, this article is your go-to guide for all things remortgaging under the Help to Buy scheme.

From the need-to-knows to the how-tos, we’ve got it all covered. Strap in, as we delve deep into how to make the most of your Help to Buy remortgage opportunities.

A Quick Recap of the Help To Buy: Equity Loan Scheme

The Help to Buy scheme made it easier for first-time homeowners to get on the property ladder. The government lent up to 40% of the home’s purchase price, with only a 5% deposit required from you.

Even better, the loan was interest-free for the first five years.

If you were house-hunting in London, you could borrow up to 40% due to the city’s higher property prices, compared to around 25% elsewhere.

Please note that the Help to Buy scheme is now closed to new applications as of October 31, 2022. All ongoing transactions must be completed by May 31, 2023.

If you are already in the scheme and are considering remortgaging, there are various options available to you, which we will explore later.

Can You Remortgage with a Help to Buy Loan?

Absolutely, you can—and you probably should—remortgage if you initially bought your property using a Help to Buy loan.

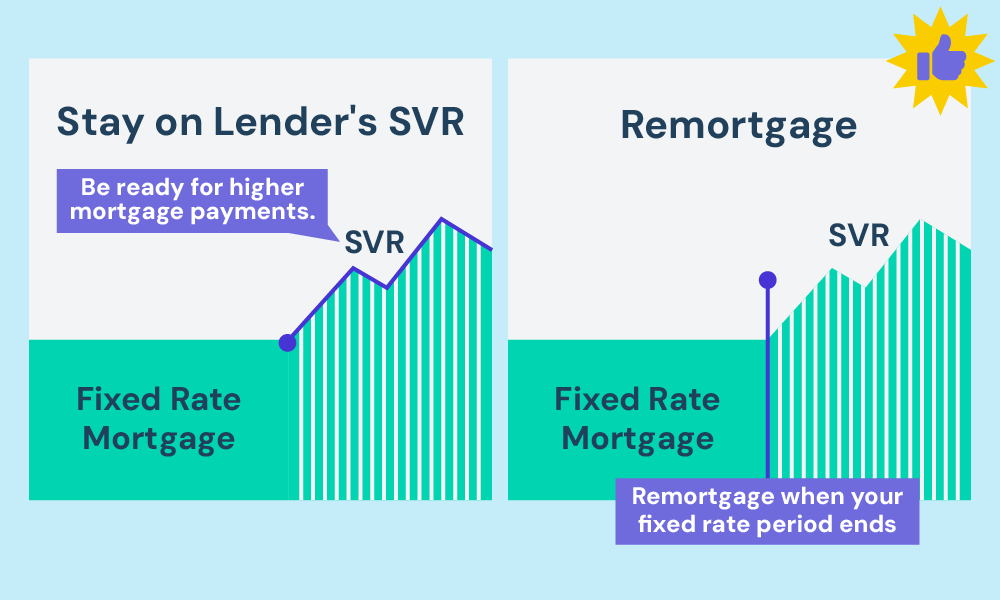

Why? Well, when your fixed-term or tracker mortgage deal ends, you’ll automatically roll onto your lender’s Standard Variable Rate (SVR).

While SVRs can sometimes offer reasonable rates, more often than not, they’re pricier than what you could secure through a remortgage.

Choosing between staying with your lender’s SVR or remortgaging is a critical decision.

To put it simply, staying on the SVR is like playing roulette with your finances; rates can go up at any time, and you’re not locked in.

Remortgaging, on the other hand, can offer you a more stable, often cheaper, rate and potentially better terms.

How Do LTV and Help to Buy Loan Affect Your Remortgage Options?

When you’re considering remortgaging, one acronym will come up often: LTV, or loan-to-value ratio.

This crucial number represents how much you’re borrowing compared to your property’s current market value.

The lower the LTV, the more attractive you are to lenders, which usually means you’ll get better mortgage deals.

Now, let’s talk about the elephant in the room: the 20% government loan that you got under the Help to Buy scheme. This adds a layer of complexity to the remortgaging process.

Normally, your LTV ratio would just include your mortgage balance. But under Help to Buy, you also have to consider this 20% loan, which could affect your LTV and, by extension, your remortgage options.

Because you owe this money back to the government when you sell your home, lenders will factor it into their calculations.

To make it clearer, let’s look at this example:

Imagine you bought a house for £300,000. You took a loan of £240,000 from the bank and another £60,000 as a Help to Buy loan from the government.

Now, you’ve paid some money back, so you only owe the bank £230,000. But don’t forget, you still owe £60,000 to the government.

When it’s time to get a new mortgage deal, the bank looks at how much you still owe compared to your house’s worth. This is called the Loan-to-Value ratio, or LTV for short.

Here’s how the numbers stack up:

| Description | Standard Mortgages | With Help To Buy |

|---|---|---|

| Home Value | £300,000 | £300,000 |

| Remaining Mortgage Balance | £230,000 | £230,000 |

| Help to Buy Loan | No | £60,000 |

| Total Amount Owed | £230,000 | £290,000 (Remaining Mortgage + Help to Buy Loan) |

| LTV (Loan-to-Value) | 76.7% (Remaining Mortgage / Current Property Value) | 96.7% (Total Amount Owed / Current Property Value) |

In the standard mortgage scenario, your LTV would be 76.7%, making you an attractive prospect for remortgaging at good rates.

But with the Help to Buy scheme, your LTV would shoot up to 96.7% because of the additional £60,000 you owe to the government. This makes getting a good new mortgage deal a bit trickier.

A Quick Tip:

If this sounds complicated, a specialist mortgage broker can guide you. They can help you understand how the Help to Buy scheme impacts your remortgaging options and can find you the best deals.

To get started, make a quick enquiry through our free broker-matching service to speak to the right expert.

Do I Need Approval to Remortgage My Help to Buy Home?

Yes, you do need permission to remortgage a Help to Buy property. One key document you’ll need is the Deed of Postponement.

This legal document establishes the repayment hierarchy if you sell your home: it states that the mortgage lender gets paid back first, followed by the government’s equity loan.

Usually, a solicitor or conveyancer will arrange this deed for you. They will handle the legal aspects, ensuring that everything is in place for your remortgage.

Before taking any steps, consult with a legal expert to secure this essential document.

Keep in mind that some solicitors or conveyancers may charge additional fees for facilitating the Deed of Postponement, so it’s wise to clarify these costs upfront.

Steps to Secure a Help to Buy Remortgage

Starting your journey to remortgage a Help to Buy property might feel a bit daunting but don’t worry, you’re not alone. Here’s a straightforward guide to getting it right.

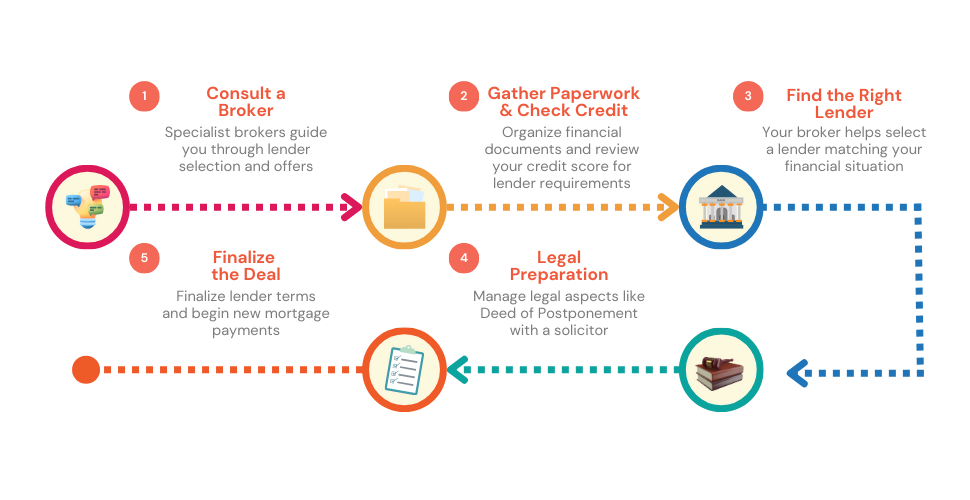

Step 1: Start with a Specialist Mortgage Broker

The first step is to talk to a specialist mortgage broker. They know the ins and outs of remortgaging under the Help to Buy scheme.

A broker can tell you which lenders are most likely to say yes and offer you the best deals. They’ll look at your situation and help match you to a lender who fits your needs.

Step 2: Gather Your Paperwork and Check Credit Reports

Next, get your paperwork in order. Here’s a list of some common paperwork you may need:

- The last three months’ payslips for employed individuals

- Last two to three years’ tax returns (SA302 forms) for the self-employed

- Audited business accounts for the last two to three years if self-employed

- The last three months’ personal and business bank statements

- Latest statement of your current mortgage showing outstanding balance and terms

- Valid passport or driver’s license for identity verification

- Recent utility bill, council tax bill, or additional bank statement as proof of address

- Credit report as required by some lenders

Make sure to also pull your credit report to see where you stand.

If there are errors, sort them out right away. Your credit score will influence the kind of deal you can get.

Step 3: Find the Right Lender

Once you’ve gathered all your info, your mortgage broker will help you find a lender. Each lender has different criteria and offers different rates.

You want to find one that matches your current financial situation. Your broker will do most of the heavy lifting here, presenting you with options that make sense for you.

Step 4: Get the Legal Stuff Sorted

Remember the Deed of Postponement we talked about earlier? You’ll need to get that in place.

Consult a solicitor or conveyancer to handle the legal aspects. Some might charge extra for this service, so check that beforehand.

Step 5: Finalise the Deal

Once you’ve picked a lender and sorted out the legal bits, you’re ready to finalise the deal. Your new mortgage will pay off your old one, and you’ll start making payments under the new terms.

Congratulations, you’ve successfully remortgaged your Help to Buy property!

Fees Associated with Remortgaging

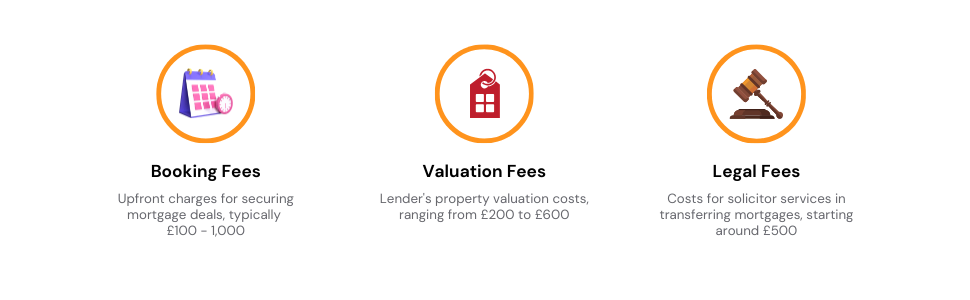

Remortgaging isn’t just about securing a new loan; you also need to factor in various fees that come with the process. Let’s break down some of the main ones you’ll encounter.

First up, booking fees. These are charges you pay upfront to secure a specific mortgage deal. They can range from a few hundred to a thousand pounds, so be sure to account for this in your budget.

Next, you have valuation fees. The lender will assess the value of your property to determine how much they’re willing to lend you. This fee varies depending on your home’s value but expect to pay anywhere from £200 to £600.

Lastly, don’t forget about legal fees. You’ll need a solicitor to handle the legal aspects of transferring your mortgage. Legal costs can differ widely but generally start at around £500.

So, when you’re crunching the numbers for your remortgage, remember to include these fees to get a clear picture of the total cost involved.

Calculate Your Help to Buy Remortgage

Your ability to release equity for repaying your Help to Buy loan largely hinges on your Loan-to-Value (LTV) ratio. Lenders frequently offer remortgages up to 90% LTV, and in some instances, even 95%, to help you free up capital.

Use the remortgage calculator below to gauge your new mortgage payments once you’ve unlocked capital to clear your Help to Buy debt.

However, keep in mind that this calculator serves as a guide, not a guarantee.

For a more precise and reliable figure tailored to your needs, it’s advisable to consult a mortgage broker.

Is Paying Off the Equity Loan Required for Remortgaging?

You don’t have to pay back the equity loan to remortgage. However, many lenders prefer that you do. One reason is that, after five years, you start paying interest on the equity loan.

Lenders factor this additional cost into their affordability assessment when you apply for a new mortgage.

Therefore, settling this debt can make you more attractive to lenders and open up a wider range of mortgage options for you.

Can You Use a Remortgage to Pay Off the Equity Loan?

Absolutely, you can use a remortgage to pay off your equity loan. If you don’t have substantial savings but have built up equity in your home, you can leverage that to pay down the loan.

This can be particularly beneficial to sort out before interest kicks in after the loan’s five-year interest-free period. But bear in mind, this will increase your mortgage debt, affecting your long-term financial health.

So before you take this step, make sure you can comfortably handle the higher monthly payments. A mortgage broker can provide invaluable help here.

They can identify lenders more willing to accommodate complex financial situations, like carrying an equity loan.

You can also pay back just part of the loan, known as staircasing. The smallest amount you can repay at one time is 10% of your home’s value.

What Are Your Options if You Can’t Repay the Loan?

If you find it tough to repay the equity loan, don’t panic. One path is a product switch, where you change your mortgage deal without borrowing more.

Although you’ll have fewer choices, it’s better than defaulting on your loan. That’s where a specialist broker comes in handy. They offer advice tailored to your situation and can identify deals you might not have found yourself.

Which Lenders Offer Help to Buy Remortgages?

A variety of lenders, both mainstream and specialist, provide Help to Buy remortgage options. Mainstream lenders such as Barclays and HSBC are reliable choices, offering stable rates and established reputations.

On the other hand, specialist lenders like Precise Mortgages may be more accommodating if you have unique or complicated financial circumstances.

Opting for a specialist lender can give you a distinct advantage when you’re looking to remortgage a Help to Buy property.

The Bottom Line: Get Ahead with Professional Remortgage Guidance

Remortgaging a Help to Buy property comes with its own set of complexities. You’ll have to consider things like loan repayment, lender preferences, and various fees.

These aren’t straightforward matters and making the right choice can save you a lot of money in the long run.

A mortgage broker who specializes in Help to Buy remortgages can be your ace in the hole.

With their targeted expertise, they can swiftly identify the best deal that suits your unique circumstances, sparing you the hassle and potentially saving you a lot of money. That’s the value you get when we match you with the right broker.

So, don’t go it alone. Reach out to us now, and we’ll pair you with an expert mortgage broker who specialises in Help to Buy remortgages.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is it mandatory to repay my Help To Buy loan to remortgage?

No, repayment is not mandatory. Note though that some lenders may hesitate to grant a new loan if the Help To Buy one remains outstanding. Also, keep in mind that after five years, you’ll begin accruing interest on the loan.

All lenders will consider this during their assessment. While repayment is not mandatory, it can broaden your options and boost your borrowing power.

Can I switch to a different lender when remortgaging my Help to Buy property?

Certainly. Just like with any remortgage, you can explore different lenders and their offers to find a deal that best suits your needs.

Can I remortgage if I’m in negative equity?

Unfortunately, remortgaging is not possible in this case. Negative equity occurs when the value of your property falls below the outstanding balance of your mortgage. Lenders require sufficient equity in your property to qualify for a deal.

Can I use my Help to Buy equity loan to fund a world tour?

Unfortunately not. The Help to Buy equity loan is specifically designed to assist with the purchase of a property, not to fund your globetrotting adventures. Its purpose is to help you get onto or move up the property ladder.

Can I use my Help to Buy equity loan to start a business?

The Help to Buy equity loan is primarily intended for residential property purchases, not for funding business ventures. However, once you have remortgaged your property and repaid the equity loan, you may secure additional capital that could be used to launch a business.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.