- Should You Consider Remortgaging Your Interest-Only Mortgage?

- Who Qualifies for an Interest-Only Remortgage?

- Assessing Your Interest-Only Remortgage

- The Pros and Cons of Remortgaging to an Interest-Only Mortgage

- Steps to Secure an Interest-Only Remortgage

- Current Interest Rates for Interest-Only Remortgages

- Can I Release Equity from My Home Through Remortgaging?

- Getting an Interest-Only Buy to Let Remortgage

- Exploring Alternatives: What If Remortgaging Isn’t Your Best Move?

- Key Takeaways

- The Bottom Line

How Do Interest-Only Remortgages Work: A Full Guide

If you own a home in the UK and have an interest-only mortgage, you’ll eventually have to decide what to do next.

Once your current deal ends, you’ll need a plan—otherwise, you could face higher costs or even risk losing your home.

So, what are your options? An interest-only remortgage could help lower your monthly payments, giving you more breathing room for other expenses.

But it’s not just about signing new paperwork. Remortgaging is a big financial move, and making the wrong choice could cost you more in the long run.

A quick Google search might give you some ideas, but that’s not enough to make a smart decision. Speaking to an expert can help you find the best deal for your situation.

This guide will explain how interest-only remortgages work, what options you have, and what to consider before making a decision.

Should You Consider Remortgaging Your Interest-Only Mortgage?

Absolutely, remortgaging on interest-only terms isn’t merely an option; it’s a sensible move many homeowners make.

Though your current lender might dangle a new offer, scanning the broader market could unearth more favourable terms. A host of lenders might offer better rates that align with your financial situation.

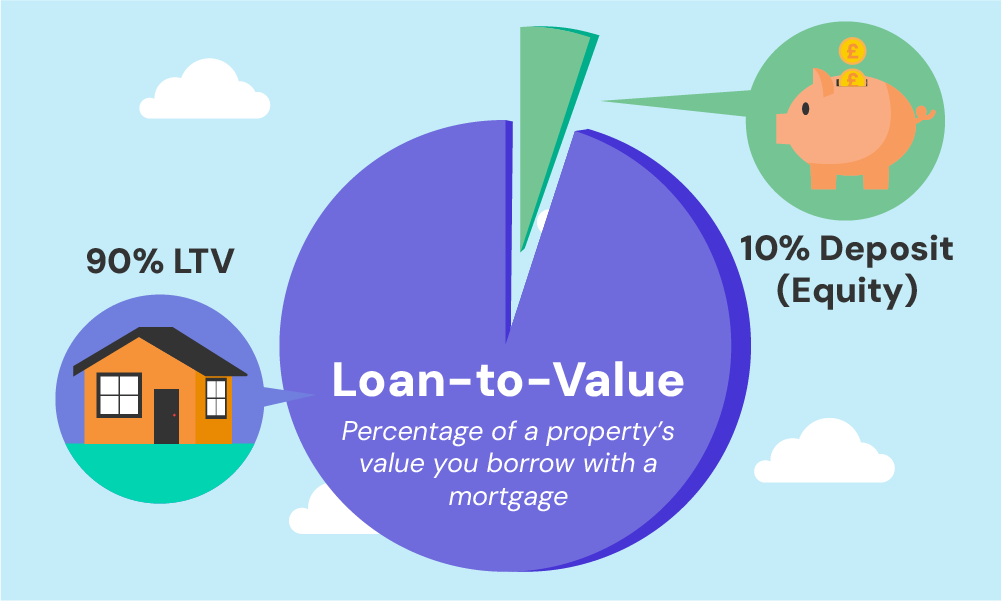

Your home’s increased value and a favourable loan-to-value (LTV) ratio can further tilt the scales in your favour, possibly lowering your interest rates.

Additionally, revisiting your financial status is important.

Life changes like a pay rise or settling other debts could redefine your mortgage options. Switching to a repayment mortgage, which covers both capital and interest, could now be within your reach.

Who Qualifies for an Interest-Only Remortgage?

If you’re looking into an interest-only remortgage, you’ll find that the eligibility rules are mostly similar to those for a traditional repayment mortgage. But, there are a few specific points you need to consider:

- Equity in Your Home. One crucial factor is the amount of equity you’ve built up in your home. Not only does this equity give you access to better deals, but it also acts like a deposit, making you a less risky prospect to lenders.

- Repayment Strategy. In an interest-only remortgage, you only pay the interest each month. That means you’ll still owe the original amount at the end. Lenders want to see that you have a solid plan to pay this off, whether it’s through savings, investments, or plans to sell your home.

While your credit history and employment status are also important, they’re not the end-all, be-all. If you’ve had some credit issues or recently switched to self-employment, don’t worry.

Many specialist lenders have similar criteria for interest-only and repayment mortgages, and some offer options for unique circumstances.

Assessing Your Interest-Only Remortgage

Opting to remortgage for an interest-only deal is no light decision. Lower monthly payments may seem enticing. However, a detailed financial assessment is essential.

Compile a full picture of your income and outgoings. Next, consult a good mortgage advisor to explore your choices.

If you’re curious about how your monthly payments could change, use the mortgage repayment calculator below for a cost comparison between a repayment mortgage and an interest-only option.

Bear in mind, that both paths have their ups and downs. Grasping them fully before diving in is vital.

The Pros and Cons of Remortgaging to an Interest-Only Mortgage

As mentioned earlier, while there are upsides, there are also downsides to going down the interest-only route.

If done wisely, remortgaging to an interest-only mortgage could offer some notable benefits. However, it also comes with its share of drawbacks that you should be aware of.

Pros

- Secure a lower interest rate to make your monthly payments more manageable.

- Extend your loan term to reduce monthly payments and improve financial manageability.

- Unlock your home’s equity for multiple uses like home improvements or investments.

- Gain increased financial flexibility if you own a high-value property.

Cons

- Limited options for those with higher loan-to-value ratios.

- Must outline a clear repayment strategy to qualify, especially for interest-only options.

- Risk going into negative equity without a robust repayment plan and falling property values.

- Encounter stricter lending criteria when opting for an interest-only remortgage.

The choice to remortgage to an interest-only mortgage involves careful consideration of various factors.

Always consult with a good mortgage advisor to fully understand your options and the potential impacts on your financial future.

Steps to Secure an Interest-Only Remortgage

After weighing the pros and cons, you may be ready to proceed. Starting your Interest-only remortgage journey can be daunting, but don’t worry. Here’s a clear guide to getting it right.

Step 1: Speak to a Specialist Broker First

Talking to a broker who knows all about interest-only remortgages is a smart move. They can help you understand your options and find a deal that suits you.

Plus, they can often get you better rates than you’d find on your own.

To get started, simply drop your details into this form and let us pair you with one of our remortgage brokers for a free and no-commitment chat.

Step 2: Understand Your Loan-to-Value (LTV) Ratio

Your LTV ratio shows how much of your home you own compared to how much you owe.

It’s simple to find: divide your mortgage amount by your home’s value, then multiply by 100. A lower LTV can get you better deals, so know your number.

Step 3: Check Your Credit Reports

Your credit score matters when remortgaging. Make sure to look at your credit reports for any mistakes. If you find any, sort them out before you apply to make sure you get the best rate.

>> More about Improving Your Credit File

Step 4: Shop Around for Lenders

Don’t just stick with your current lender. Look at other lenders to see if they offer better rates or terms. Sometimes smaller banks or specialist lenders can give you a better deal.

>> More about Remortgage Brokers

Step 5: Get Your Paperwork Ready

To expedite the application process, it’s crucial to have all the necessary documents at hand. Here’s a list of some common paperwork you may need:

- The last three months’ payslips for employed individuals

- Last two to three years’ tax returns (SA302 forms) for the self-employed

- Audited business accounts for the last two to three years if self-employed

- The last three months’ personal and business bank statements

- Latest statement of your current mortgage showing outstanding balance and terms

- Valid passport or driver’s license for identity verification

- Recent utility bill, council tax bill, or additional bank statement as proof of address

- Credit report as required by some lenders

Note: This list is not exhaustive; lenders may ask for additional documents based on circumstances. But, having these documents ready can make the application process quicker and easier.

By focusing on these five steps, you’ll be in a strong position to make the best choice for your financial future when it comes to remortgaging your interest-only home loan.

Current Interest Rates for Interest-Only Remortgages

Before making any decisions, it helps to get a rough idea of the interest rates available.

At the time of writing, rates for interest-only remortgages typically range from around 4% to 6% for fixed deals, depending on the lender and your loan-to-value (LTV) ratio.

But, interest rates change all the time, so what’s available today might not be an option tomorrow.

Rather than trying to keep up with shifting rates on your own, a mortgage broker can do the hard work for you. They have access to the latest offers and can help you find a deal that suits your situation.

Can I Release Equity from My Home Through Remortgaging?

Yes, you can release equity through an interest-only remortgage.

Equity is the money you’ve effectively built up in your home—it’s the value of your property minus what you still owe on your mortgage.

In this type of remortgage, you only pay the interest on your loan. That can free up cash that you might use for other things, like making home improvements.

There are some requirements you’ll usually need to meet. These typically include having a stable income, a strong credit score, and at least 20% equity in your home.

Another option to consider is a ‘part and part‘ mortgage. This is a blend of repayment and interest-only types.

You repay some of the money you borrowed and pay interest on the rest. It offers a bit more flexibility in managing your mortgage and might be useful if you’re trying to release equity.

It’s essential to consult with professionals to understand all of your options and how this could impact your finances.

Note: Using home equity for other activities, like home renovations or investments, carries its own set of risks. If these ventures fail, you risk losing money while still owing the original loan amount.

>> More about Remortgage for Equity Release

Getting an Interest-Only Buy to Let Remortgage

If you’re looking to remortgage a buy to let property on interest-only terms, you’re in luck. You’ll usually find more lenders willing to work with you compared to a residential mortgage.

But don’t rush—consider if switching to a repayment mortgage might be better for you. By doing this, you could benefit from lower interest rates while also reducing the mortgage balance, not just the interest.

On the flip side, if you’re struggling with repayments on your existing repayment mortgage, switching to an interest-only buy to let mortgage could ease your financial stress.

Exploring Alternatives: What If Remortgaging Isn’t Your Best Move?

While remortgaging has its perks, it isn’t for everyone. If remortgaging doesn’t suit your needs, you’ve got other options for managing your mortgage. Here are some alternative strategies:

Equity Release Schemes

If you’re over 55, equity release lets you access your home’s value without selling it.

You get a lump sum, a steady income, or both, which you can use as you like. Just keep in mind that this option can be costly in the long run.

Retirement Interest-Only (RIO) Mortgages

For older homeowners, a RIO mortgage allows you to make monthly payments covering just the interest.

The loan’s balance is paid off when you sell your home, move into care, or pass away. It’s a way to keep monthly costs down while staying in your home.

Selling the Property

Sometimes it makes sense to just sell up. If your home’s value has surged, selling could wipe out your mortgage and even leave you with extra cash. Consider this option if your location or housing needs have changed.

Liquidating Other Assets

If you have savings, stocks, or other assets, you might choose to liquidate these to tackle your mortgage. This option avoids the need to refinance and can be quicker, but weigh it carefully against potential tax implications.

Extending Your Term

Another way to reduce monthly payments is to negotiate a longer term with your current lender. This will spread the cost over more years, reducing your monthly bill. However, you’ll likely end up paying more in interest over time.

So if remortgaging doesn’t quite fit your situation, don’t worry. You have a variety of options that can still help you manage your mortgage effectively.

Key Takeaways

- If you have an interest-only mortgage, you’ll need a plan for when your current deal ends to avoid higher costs or financial risks.

- Remortgaging on interest-only terms can help lower your monthly payments, but it’s essential to weigh the long-term impact on your finances.

- Your home’s value, loan-to-value ratio (LTV), and financial situation can affect your chances of getting better remortgage rates.

- If remortgaging isn’t the right fit, alternatives like equity release, selling your home, or switching to a different mortgage type may be worth considering.

The Bottom Line

Interest-only remortgages can be tricky, and making the wrong choice could end up costing you more in the long run.

That’s where a mortgage broker comes in. They know the ins and outs of interest-only deals and can help you find the best option for your situation—saving you time, effort, and possibly a lot of money.

If you’re thinking about handling it on your own, just know there’s an easier way.

Get in touch with us today, and we’ll connect you with an expert remortgage broker who can guide you through the process.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How will I settle the balance when the term ends?

At the end of an interest-only mortgage term, you’ll still owe the initial loan amount. To settle this, you need a repayment plan, which could involve using savings, selling investments, or leveraging pension funds. Consulting a financial adviser can help you choose the best strategy for your situation.

What if I am unable to repay the capital at the end of the term?

It’s important to address the situation right away and look into your options. Here are a few considerations to bear in mind:

- Speak with your lender. Tell your lender about your financial situation and ask if you can extend the term or change the repayment option. Some lenders might be open to collaborating with you to find a solution that works to address your problem.

- Consult a professional. Consult a financial advisor or mortgage expert who can offer guidance. They can help you look into refinancing, downsizing your home, or using other assets to pay off the outstanding mortgage.

- Consider selling the property. Sometimes, selling is the only answer. By selling the property and using the proceeds to settle outstanding debt, you can prevent more severe financial consequences.

- Seek government support. Look into government programs or other initiatives designed to help homeowners sort out their mortgage payments. Check out your neighbourhood resources or speak with housing authorities.

Should I consider an interest-only remortgage as a long-term financial solution?

You should carefully assess diverse situation-specific factors and do your sums before deciding. It’s critical to evaluate your long-term objectives, financial stability, and capacity to handle payments to come. If you’re having second thoughts about a remortgage, we generally recommend getting help from a professional so they can determine whether or not the plan is suitable for you.

What are the risks of not having a repayment plan in place?

Not having a well-established repayment plan can pose significant risks. It can lead to lower investment returns and difficulty saving enough to repay the loan, which in turn can jeopardise your financial stability.

What if interest rates rise during the repayment phase?

Rising interest rates can pose an additional challenge for borrowers, intensifying the financial strain. It’s crucial to consider potential interest rate spikes and their impact on your mortgage payments. Study the market or seek expert guidance to avoid the risks.