- How Does a Probate Process Work?

- Should You Get a New Mortgage on Your Inherited Property?

- How to Remortgage an Inherited Property in Probate

- How Can You Use Remortgaging to Buy Out Co-Owners?

- How Does a New Mortgage Impact Inheritance Tax?

- Can You Rent Out a Property You’ve Inherited?

- Can You Tap Into Equity on an Inherited Property?

- Pitfalls to Avoid

- The Bottom Line: Simplify Remortgaging with Professional Help

How To Remortgage an Inherited Property: A Complete Guide

Losing a loved one is hard enough.

On top of the emotional toll, there’s a stack of paperwork to deal with, like funeral arrangements and going through probate.

Once you get past these steps, you’re faced with a series of financial question: What should you do with the property you’ve inherited?

It’s a lot to think about, especially if you’re unfamiliar with financial terms like ‘remortgage.’

This article is here to help. We’ll break down what remortgaging an inherited property means and why it’s crucial to understand both the financial and legal aspects before making any decisions.

From pondering a remortgage to fund costly repairs, to assessing if you can take over the existing mortgage, we’ll cover a range of scenarios to guide you through this often confusing period.

You’ll come away better equipped to handle the complexities of managing an inherited property’s mortgage in a way that’s financially sound for you.

How Does a Probate Process Work?

When someone passes away, their assets—like property—don’t just automatically go to their family or next of kin.

Usually, there is a legal process called probate. This process must happen before any distribution takes place.

In the probate process, the court first verifies that the will is authentic and not a forgery. Next, the court grants the named executor the legal right to manage the deceased person’s assets.

From here, the executor takes several steps:

- Distributes funds to those named in the will, following its instructions.

- Takes charge of any property, which may involve selling it or potentially remortgaging it.

- Uses money from the estate to pay off existing debts, such as loans or unpaid bills.

By completing these tasks, the executor ensures that the entire process is conducted fairly and legally.

Once probate concludes, you can then consider other financial options, like taking out a mortgage on a property you’ve inherited.

Should You Get a New Mortgage on Your Inherited Property?

If there is an outstanding mortgage balance on your inherited property, you could decide to remortgage to leverage the property’s full potential.

This essentially means securing a new, better-suited mortgage deal on your inherited property. But you can do this only once you go through all probate procedures.

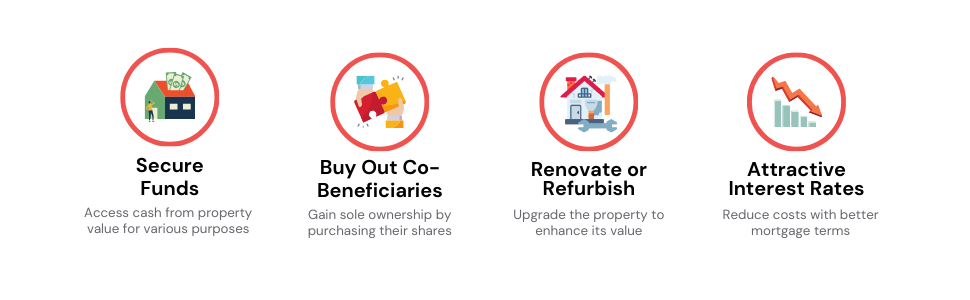

Brits remortgage a property in probate for several reasons. Let’s take a look at some of the most popular:

- To Secure Funds. Remortgaging can allow you to access the property’s value in the form of a lump sum of cash. This money can be used for anything from investing in new projects to paying off debts.

- To Purchase Additional Shares or Buy Out Co-Beneficiaries. When multiple beneficiaries inherit a property, it is common for some to buy out the shares of others. Remortgaging can provide the funds needed to do this and become the sole owner of the property.

- To Renovate or Refurbish A Property. In some cases, you may remortgage the property to pay for renovations or upgrades. This can increase the property’s value. For example, if you inherit a tired family home that has great potential, remortgaging can help you transform it into a showstopper.

- To Capitalise on Attractive Interest Rates. Remortgaging the existing deal could help you secure better interest rates, and potentially lower your monthly payments.

As attractive as all this sounds, you cannot initiate your remortgage application until you’ve sorted out your probate.

No lender will engage in these transactions until the probate is finalised, which can take several months. During this time, consult with a remortgage broker to understand your options and plan your next steps.

How to Remortgage an Inherited Property in Probate

Inheriting a property that’s in probate comes with its unique challenges. If you’re considering remortgaging such a property, it’s crucial to know the steps involved. Here’s how to go about it:

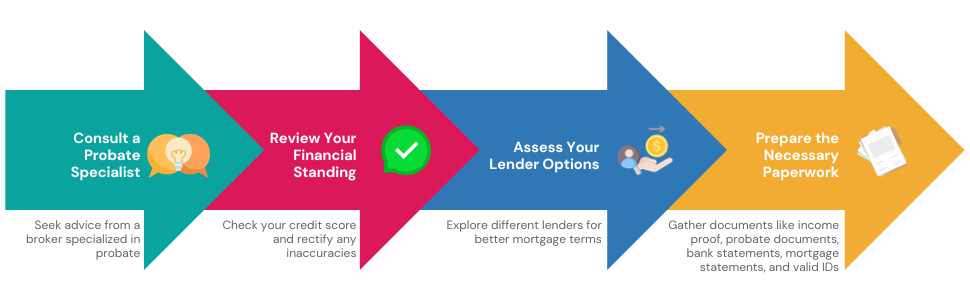

Step 1: Consult a Probate Specialist

Firstly, it’s advisable to speak with a broker who specialises in remortgaging properties in probate. They can offer tailored advice, potentially finding you better rates than going it alone.

To get started, simply reach out to us. We’ll pair you with a remortgage broker for a free and no-obligation chat.

Step 2: Review Your Financial Standing

Your credit score is pivotal in securing a remortgage. Ensure you check your credit report for any inaccuracies and rectify them to boost your chances of getting a favourable rate.

Step 3: Assess Your Lender Options

Don’t automatically stick with the lender of the inherited mortgage. Explore other lenders who may offer better terms or rates.

Sometimes smaller or specialised lenders could offer you a better deal tailored to probate properties.

Step 4: Prepare the Necessary Paperwork

To speed up the application, gather all the essential documents. For an inherited property in probate, you may need:

- Recent payslips or income proof

- Probate documents confirming your legal standing

- The last 3 months’ bank statements

- Existing mortgage statements showing remaining balances and terms

- Valid IDs for identity verification

- Proof of address, such as a utility bill

- Credit report, as required

Please note, that this list may not cover every requirement; each lender has their unique criteria, especially for properties in probate.

By following these steps, you’ll be better positioned to remortgage an inherited property in probate, allowing you to make well-informed financial decisions.

How Can You Use Remortgaging to Buy Out Co-Owners?

If you’ve inherited a property with others, such as family members, you might be wondering how to become the sole owner. One way to achieve this is through remortgaging.

- First, have a solicitor draft a letter of intent to make your wish to buy out the other owners official.

- Next, consult a mortgage broker. They can assess your finances to make sure you can take on the new mortgage alone. Your broker can also guide you in choosing the right remortgage deal for your situation. Typically, you’ll need at least a 5% deposit for this process. But to get the best deals, we recommend having at least 10% to 20%

- Once you’ve secured your remortgage, inform the Land Registry via your solicitor that you’re the new homeowner.

- Finally, you’ll pay the other owners their agreed share from the funds you gained from remortgaging. Now you can enjoy sole ownership of your property.

How Does a New Mortgage Impact Inheritance Tax?

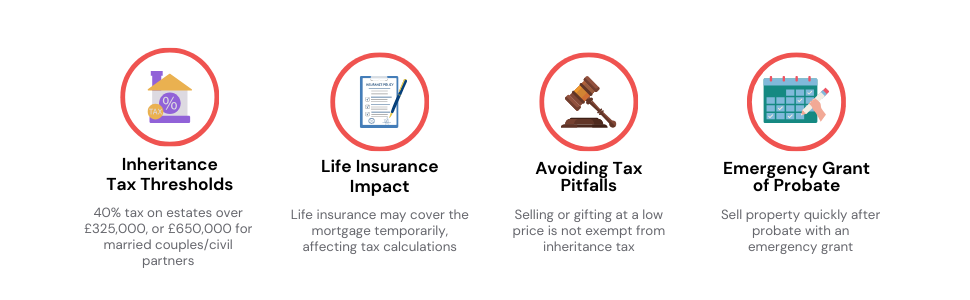

When you inherit a property, you might have questions about inheritance tax and how a new mortgage fits into the picture.

If you’ve gone through probate, you should already know what your tax responsibilities are.

Executors of the will make sure all tax matters are sorted properly. For example, if the person who passed away had life insurance, that policy might cover the mortgage for a while.

In the UK, inheritance tax kicks in at 40% for estates worth more than £325,000.

If you’re inheriting from a married couple or civil partners, that limit doubles to £650,000 upon the second person’s death.

Also, remember you can’t dodge this tax by selling or gifting the property to family members at a low price.

If you’re thinking about selling, there’s something called an ’emergency grant of probate.’ This allows you to sell the property just two weeks after it’s legally yours.

Can You Rent Out a Property You’ve Inherited?

If you don’t plan on moving into the inherited property, you might be thinking about renting it out. If there’s no existing mortgage, you can free up some money from the home’s value, which could be handy for fixing it up.

But hold on, you’ve got to think this through.

Let’s say the property isn’t in great shape. Some mortgage providers might say no to lending you money. In this case, you might look into a short-term loan (bridging finance) to do the refurbishments.

After sprucing it up, you can switch to a regular mortgage to repay the short-term loan. Just remember, it’s crucial to talk to an expert before making any big moves.

But, if you already have a mortgage on the property, you’ll need to change it to a buy-to-let mortgage. Different rules apply here.

For example, some lenders care more about how much rent you’ll collect than how much money you make. For these mortgages, lenders usually want you to:

- Earn at least £25,000 a year

- Put down a minimum 20% deposit

- Ensure the rent will cover a minimum of 125% of your monthly mortgage payments

- Have some experience as a landlord

Don’t worry if you fall short on some of these requirements. Many buy-to-let lenders offer a degree of flexibility, and a good broker can help find one that’s a match for your unique circumstances.

Tips for New Landlords

If you’ve decided to rent out the property, there are a few things you should know. You’ve got legal responsibilities, like making sure the place has an energy performance certificate, a gas safety certificate, and smoke alarms on each floor.

You also need to protect your tenant’s deposit in a legal scheme. It’s a lot to handle, especially if you’re new to this. Some people find it easier to hire a letting agent to manage these things.

Financially speaking, you’ve got choices. Some landlords prefer interest-only mortgages to keep their monthly payments low and improve cash flow.

But keep in mind, with this type of mortgage, you won’t own the property outright at the end. You’ll still owe the loan amount. At that point, many landlords sell the property to pay off the mortgage.

One last thing: make sure you can afford the mortgage even if the property is empty for a while. Lenders think about this too, but it’s good to have your backup plan.

Can You Tap Into Equity on an Inherited Property?

If you’ve inherited a property, you might be wondering what your options are, especially when it comes to equity.

Whether the home you’ve inherited already has an equity release plan or you’re considering setting up a new one, here’s what you need to know.

>> More about Remortgaging to Release Equity

What Happens If the Inherited Property Had an Equity Release?

Typically, when a homeowner sets up an equity release, the lender gets repaid by selling the property after the homeowner passes away. The rest of the proceeds then go to whoever inherits the home.

If you find yourself in this situation and don’t want to sell the property, you do have some alternatives:

- Use any available assets from the deceased’s estate to pay off the equity loan.

- Pay off the equity release with your funds.

- Buy the property outright from the estate.

How Can You Release Equity on an Inherited Property?

Maybe you’ve inherited a home and see the potential for improvement, or perhaps you’re considering using its value to invest in another property.

Once you’ve got the legalities of probate sorted, you can release equity from the inherited property just like you would with any other home.

In other words, you can apply for an equity release to free up some of the property’s value, which you can then use for anything from home renovations to acquiring another piece of real estate.

Pitfalls to Avoid

In the process of dealing with an inherited property and its equity, it’s easy to slip up. Here are some common mistakes and how you can steer clear of them:

- Skipping Legal Advice. Don’t underestimate the value of professional advice. A solicitor can help you understand complex inheritance laws and protect your interests.

- Ignoring Tax Implications. Inheritance tax, capital gains tax and other fiscal considerations are vital. Consult a tax advisor to understand what you owe and when you owe it.

- Forgetting Ongoing Costs. Owning a property isn’t just about the mortgage. Remember the council tax, maintenance, and other ongoing costs. Factor these into your financial planning.

- Rushing Decisions. Whether it’s selling the property, renting it out, or releasing equity, take your time. Make informed choices rather than impulsive ones.

The Bottom Line: Simplify Remortgaging with Professional Help

When it’s time to remortgage, you’ll need to dig deep into the details.

Scour the market for lenders offering the best rates, keep an eye on the housing market, and take note of interest rate predictions. It can be a lot to handle on your own.

If it starts to feel overwhelming, remember that professional remortgage brokers are always ready to lend a hand.

This is important stuff—you’re securing your debt against your property, after all. So, it’s crucial to get it right.

Working with a specialised broker makes a world of difference when you’re dealing with remortgages on inherited properties. These experts assess your financial situation alongside the details of the property in probate.

This lets them offer you advice tailored just for you, including which mortgage type and lender would be your best fit. You’ll save time, money, and avoid unnecessary stress.

Want to get your remortgaging sorted with less hassle? Fill out a quick form or reach out to us directly. We’ll match you with a remortgage broker who understands your specific needs and can offer personalised advice.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is probate always necessary?

Not always. If, for instance, the estate’s value is below £5,000, the bank may require only the death certificate as proof.

Can I remortgage a property if it’s in negative equity?

Unfortunately, it’s impossible to remortgage a property in negative equity.

Negative equity occurs when the outstanding mortgage debt on the property is higher than its current market value. In such a situation, most lenders are hesitant to approve a remortgage as it increases their risk.

How do lenders assess my affordability for a mortgage on an inherited property?

Lenders consider various factors to assess your borrowing power, including loan-to-value ratio, income, debt-to-income ratio, age, and credit history. Some lenders also use affordability stress tests to evaluate your ability to handle potential interest rate spikes.

How long does the probate process usually take?

The duration of the probate process can vary depending on the complexity of the estate, any potential disputes, and the efficiency of the executor. It can take several months to a year or more.

Do I need a solicitor to handle probate?

While it’s not mandatory to hire a solicitor, the probate process involves complex legal and financial aspects that can be extremely hard to manage on your own. Seeking professional guidance from a solicitor can help ensure a smoother process and minimise the risks.

Are there any ways to minimise inheritance tax during probate?

There are various strategies and exemptions available to minimise inheritance tax during probate. These may include tax allowances, setting up trusts, or gifting assets within specific limits. It’s generally best to consult a tax professional to explore your best options.

How does probate impact a property's market value?

While in probate, the property is usually valued at its current open market value, not accounting for other variables like potential higher offers. This often results in buyers securing a better deal than they might under different circumstances.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.