- What is a Second Home Mortgage?

- Benefits of Owning a Second Home

- What Deposit Is Required for a Second Home Mortgage?

- How Much Can I Borrow for a Second Property?

- What are the Current Second Home Mortgage Rates?

- How Second Home Mortgage Rates Are Set

- Practical Tips on Finding the Best Second Home Mortgage Rates

- Top Second Home Mortgage Lenders in the UK

- Remortgaging a Second Home Mortgage

- Using Second Home Equity

- How to Find Professional Mortgage Advice in the UK

- The Bottom Line

How To Find the Best Mortgage Rates for Your Second Home

Purchasing a second home can be an excellent investment opportunity or a chance to own a relaxing holiday retreat.

However, financing a second property comes with some unique considerations.

This comprehensive guide will walk you through everything you need to know about getting the best rates on second home mortgages in the UK.

What is a Second Home Mortgage?

A second home mortgage is a loan used to purchase an additional residential property that you do not occupy as your primary residence.

Second homes may include vacation homes, rental investment properties, pied-a-terres in the city, or any other secondary dwellings.

Lenders classify second home mortgages differently than primary residence loans.

You’ll usually need a larger down payment and meet stricter eligibility requirements. Interest rates also tend to run higher than first-time homebuyer products.

Benefits of Owning a Second Home

There are many advantages to purchasing a second property:

- Generate rental income – Letting out your second home can provide extra monthly cash flow. Opt for a buy-to-let mortgage to finance investment properties.

- Diversify your assets – Real estate acts as a hedge against inflation. A second home adds diversity to your investment portfolio.

- Enjoy a holiday retreat – Buy a tranquil cottage or beachside condo for weekends away from the hustle and bustle.

- Receive tax breaks – In some cases, you may qualify for tax deductions on second homes. Consult an accountant to understand how to maximise savings.

- Build equity – As you pay down your mortgage, you gain equity that can be tapped in the future via refinancing or lines of credit.

While rewarding, second homes do involve greater expenses. Make sure to factor in mortgage payments, insurance, taxes, maintenance, and other carrying costs.

What Deposit Is Required for a Second Home Mortgage?

Most lenders require a minimum down payment of 20-25% for second homes and vacation properties. Some may ask for as much as 30-40% down.

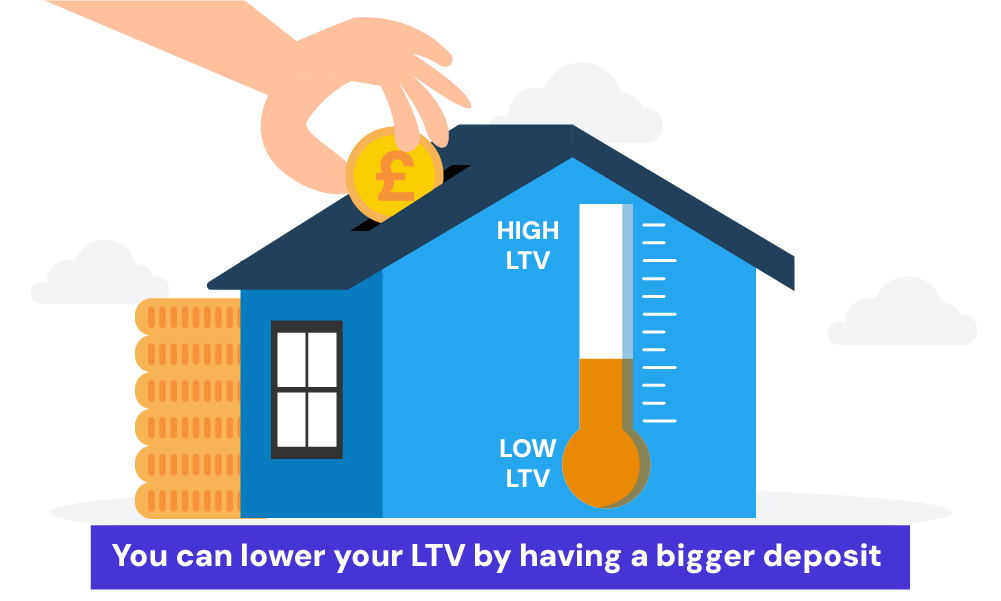

The more you can put as a deposit, the better mortgage rate you will likely qualify for. With a lower loan-to-value ratio, banks see you as less of a risk and offer lower interest rates.

You may even score discounted deals reserved for those with 40% or more to put down. Shop around with multiple providers to find the best products for your specific situation.

How Much Can I Borrow for a Second Property?

Lenders calculate how much you can borrow based on your income, existing debts, and credit history.

When applying for a second home, affordability criteria are stricter than primary residence mortgages. Banks will scrutinise that you can comfortably make payments on both your current home loan and the new second mortgage.

As a general rule, your total loan obligations, including both mortgages, should be manageable within your financial means.

It’s important to carefully evaluate your income against all your debts to ensure you can meet the affordability standards before submitting a second home loan application.

What are the Current Second Home Mortgage Rates?

If you’re thinking about getting a mortgage for a second home in the UK, the interest rates usually fall between 4% and 6%.

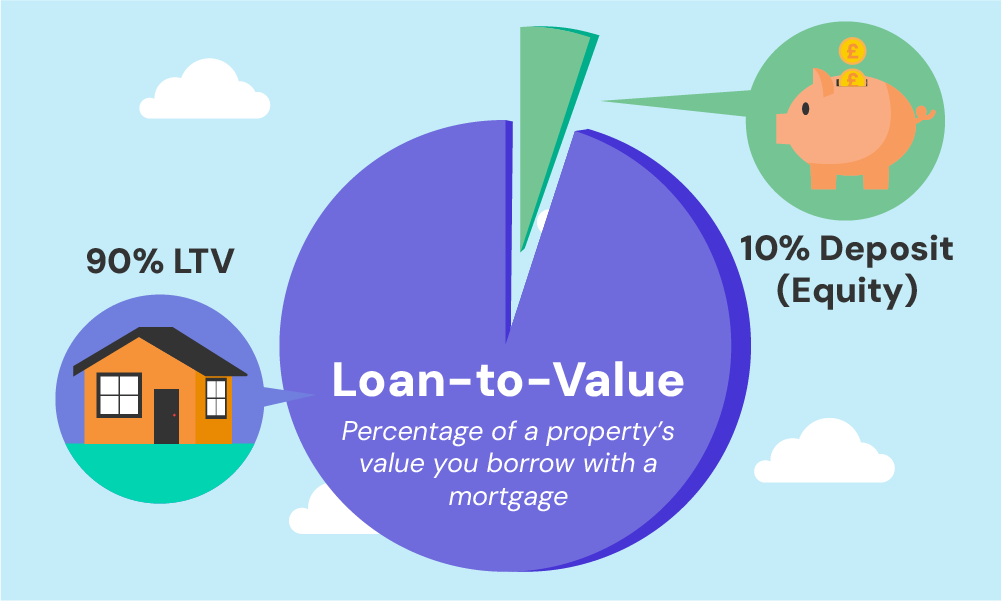

The exact rate depends on a few things, like how much you’re borrowing compared to the home’s value (this is called the loan-to-value ratio) and the type of deal you pick.

For example:

- Two-year fixed-rate mortgages tend to have slightly higher rates, closer to the upper end of the range.

- Five-year fixed-rate mortgages might offer slightly lower rates.

Since these mortgages are for a second property, the rates are often a bit higher than what you’d pay for your first home. But if you can put down a bigger deposit, it could help you get a better deal.

You’ll also need to think about whether you want a fixed-rate deal (where the interest stays the same for a set time) or a variable-rate deal (where the interest can go up or down).

Most second home mortgages last around 25 years, but paying it off sooner could save you money on interest.

It’s worth shopping around or speaking to a broker to find the best rate for your situation.

How Second Home Mortgage Rates Are Set

When you’re looking at getting a mortgage for a second home, it’s key to understand how lenders decide the interest rates.

Several elements come into play, impacting how much you’ll pay in interest.

Your Financial Profile

The better your credit score and the lower your debt compared to your income (known as your debt-to-income ratio), the more likely you are to get a favourable interest rate.

Lenders see a strong financial history as a sign you’re a reliable borrower.

The Loan-to-Value Ratio

This is about how much you’re borrowing concerning the value of the property.

If you’re borrowing a smaller percentage of the property’s value (meaning you have a lower loan-to-value ratio), you pose less risk to the lender.

In general, lenders prefer this ratio to be under 80% for second homes, which can lead to lower interest rates.

The Size and Duration of the Loan

Both the amount of money you’re borrowing and how long you’re borrowing it for affect your rate. Larger loans and those with longer payback periods often have higher interest rates.

The Type of Property

The kind of property you’re buying can also influence your rate.

For instance, some lenders might view certain types of properties, like condos, as higher risk. If the property is expected to generate rental income, this too can impact the interest rate.

Economic and Market Factors

Finally, broader economic factors play a role. These include the overall health of the economy, the policies of the Bank of England, and the housing market itself.

For example, changes in the Bank of England’s base rate can influence mortgage rates. Out of all the factors, these are the ones you have the least control over.

Practical Tips on Finding the Best Second Home Mortgage Rates

As discussed, second home mortgages typically come with higher interest rates than primary residence loans. But, you can still find competitive deals if you shop around.

Follow these tips to secure the lowest rate on your second property purchase:

- Increase your deposit – The more you can put down, the better your rate will be. Aim for at least 25-30% if possible.

- Improve your credit – Lenders offer better rates to borrowers with higher credit scores. Pay down debts and resolve any issues on your report.

- Compare mortgage products – Look at fixed rate, adjustable rate, and tracker rate mortgages to find the best fit. Fixed rates offer stability while trackers follow the Bank of England base rate.

- Work with a broker – An experienced whole-of-market mortgage broker has access to exclusive second home products not available directly from lenders.

- Consider specialist lenders – Niche providers catering to holiday lets and buy-to-lets may feature lower rates than high street banks.

- Pick a shorter term – The faster you can pay off your second mortgage, the less interest you will pay overall.

Mortgage rates constantly shift based on financial market conditions. Monitor rate changes and lock in deals promptly when attractive options emerge.

Top Second Home Mortgage Lenders in the UK

When you’re considering a second home mortgage in the UK, it’s important to know about the top lenders offering these services.

Here are five specialist lenders that provide second home mortgages, each with their unique offerings and deposit requirements:

- Barclays – Known for its robust financial services, Barclays requires a 20% deposit for second home mortgages. They offer a range of mortgage products suitable for various needs.

- HSBC – Another leading global bank, HSBC also asks for a 20% deposit. They are known for their competitive rates and comprehensive service offerings.

- Metro Bank – With a slightly lower deposit requirement of 15%, Metro Bank offers flexible mortgage options for second homes. Their customer-centric approach makes them a preferred choice for many borrowers.

- Nationwide – This building society requires a 15% deposit and is known for its competitive rates and extensive range of mortgage products.

- NatWest – NatWest stands out with a particularly low deposit requirement of just 5% for those with a good income, making it an attractive option for second home mortgages.

Other notable mentions include Newcastle and Skipton, each requiring a 25% deposit, and Santander for Intermediaries, requiring a 15% deposit.

Each of these lenders offers unique advantages, and their requirements and terms can vary.

Therefore, it’s advisable to research and compare these options to find the best fit for your specific financial situation and second home aspirations.

Remortgaging a Second Home Mortgage

If you already own a second home but want to find a better mortgage rate, you may qualify to remortgage

Remortgaging lets you switch to a different loan product with lower interest.

You can also use second home refinancing to:

- Withdraw equity to fund renovations or other investments

- Consolidate debts into your mortgage at a lower rate

- Switch from variable to fixed interest for stability

- Extend your repayment term to lower monthly payments

To qualify for second home remortgaging, you’ll need sufficient equity, usually at least 20-25% loan-to-value.

Remortgaging costs money in fees, so make sure to calculate projected savings to ensure refinancing makes financial sense.

Using Second Home Equity

As you pay down your mortgage principal, you build equity in your property. This equity can provide access to cash if needed, via two main options:

- Remortgaging – Refinancing allows you to cash out a portion of equity above your original loan amount. You receive funds as a tax-free lump sum but must make higher monthly repayments.

- Second-charge loans – Specialist lenders offer second-charge loans secured against your existing property. This works like a second mortgage. You receive a lump sum but repay it plus interest over an agreed term.

Tapping equity can help finance home improvements, businesses, debt consolidation, or other expenses. However, taking cash out reduces the equity cushion protecting your investment.

How to Find Professional Mortgage Advice in the UK

If you need advice for your second home mortgage, it’s vital to consult a qualified professional. Here’s how you can find a reliable mortgage advisor in the UK:

- Check Qualifications – Make sure the advisor holds qualifications like the CeMAP (Certificate in Mortgage Advice and Practice), a standard in the UK.

- Verify FCA Regulation – Ensure the advisor or their firm is authorised and regulated by the Financial Conduct Authority (FCA). You can check their status on the FCA’s online register.

- Look for Recognized Professional Body Membership – While the Association of Mortgage Intermediaries (AMI) membership is a plus, it’s more crucial that the advisor belongs to a recognized body, such as the Financial Services Compensation Scheme (FSCS), for added consumer protection.

- Seek Independent Advisors – Opt for independent advisors who can access the entire mortgage market, offering a broader range of products than those tied to specific lenders.

- Read Reviews and Recommendations – Research the advisor’s client feedback. Websites like Trustpilot or local forums can provide insights into their service quality.

- Take Advantage of Free Initial Consultations – Many advisors, including the brokers we worked with, offer free initial consultations. This is a great opportunity to assess their expertise and the services they provide, with no obligation to proceed.

By following these steps, you can find a professional mortgage advisor in the UK who will offer you comprehensive, personalised advice for your second home mortgage.

The Bottom Line

When you’re thinking about buying a second property, it’s important to plan carefully. Getting a mortgage for a second home often involves more costs and stricter rules, but it can be a great opportunity.

In this guide, we’ve covered the essentials of second home mortgages, from how much deposit you’ll need, to figuring out what you can afford and finding the best mortgage rates.

A skilled mortgage broker is key in this process. They can simplify things for you, helping you find the best mortgage for your situation. This not only saves you time but also money, bringing you closer to owning your dream second home.

If you want an easy way to do this, just get in touch. We’ll put you in contact with a professional mortgage broker who knows all about second home mortgages and will help you every step of the way.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How many second home mortgages can I get?

Most lenders will provide financing for up to two residential properties. However, there is no limit on how many buy-to-let mortgages you can obtain. Portfolio landlords regularly own 10 or more rented properties.

What stamp duty do I pay on a second home?

You will pay the standard residential stamp duty bands, plus an additional 3% surcharge for owning more than one home. Additional property stamp duty does not apply if replacing your main residence.

Can I rent out my second home?

It depends on your mortgage terms. Most standard second home products prohibit letting. Opt for a buy-to-let mortgage if you plan to rent out the property, either long-term or as a holiday let.

Can I get a joint second mortgage?

Yes, you can apply for a joint second mortgage with a partner, family member, or friend. Both names will appear on the deed. All applicants undergo affordability assessments and are liable for payments.

Can I use Help to Buy for a second property?

No, the Help to Buy scheme is strictly for first-time buyers purchasing a primary residence, not second homes. However, some lenders do offer 5% deposit mortgages without Help to Buy for creditworthy borrowers.

Is a second home mortgage right for you?

Deciding to opt for a second home mortgage largely depends on circumstances and preferences. There are multiple options to finance a second property.

You might consider using equity from your first home, securing a loan against investments, or even paying outright in cash.

For those with the financial means, the choice often hinges on the mortgage deal available for the second home.

If the interest rate and terms offered are favourable, it might be more beneficial to go for the mortgage rather than using your cash reserves.