- What is an Affordability Check?

- How Does It Work?

- Why Are Affordability Checks Important?

- What Happens if You Donât Pass an Affordability Check?

- Can You Pass an Affordability Check with Bad Credit?

- The Risks of False Information During an Affordability Check

- How To Ace Your Loan’s Affordability Check

- Key Takeaways

- The Bottom Line

Everything You Need to Know About Affordability Checks 2025

Taking out a loan is a significant step for you and the lender. It hinges on your ability to handle repayments throughout the loan period.

That’s why understanding affordability checks is important.

In the UK lending scene, this tool stands as your ally, helping you gauge how comfortably you can manage a loan.

This article explores what an affordability check is and why it matters for your financial journey.

What is an Affordability Check?

Imagine you are set to borrow some money.

The lender wants to make sure that you can pay it back without any stress.

This is what an affordability check is all about – a way to see if you can comfortably manage to repay the loan considering your current financial situation.

Lenders have the responsibility to conduct a deep analysis to find out if the loan terms are aligned with your circumstances.

They want to prevent any chance of lending irresponsibly, which might result in you grappling with a loan that’s beyond your means.

How Does It Work?

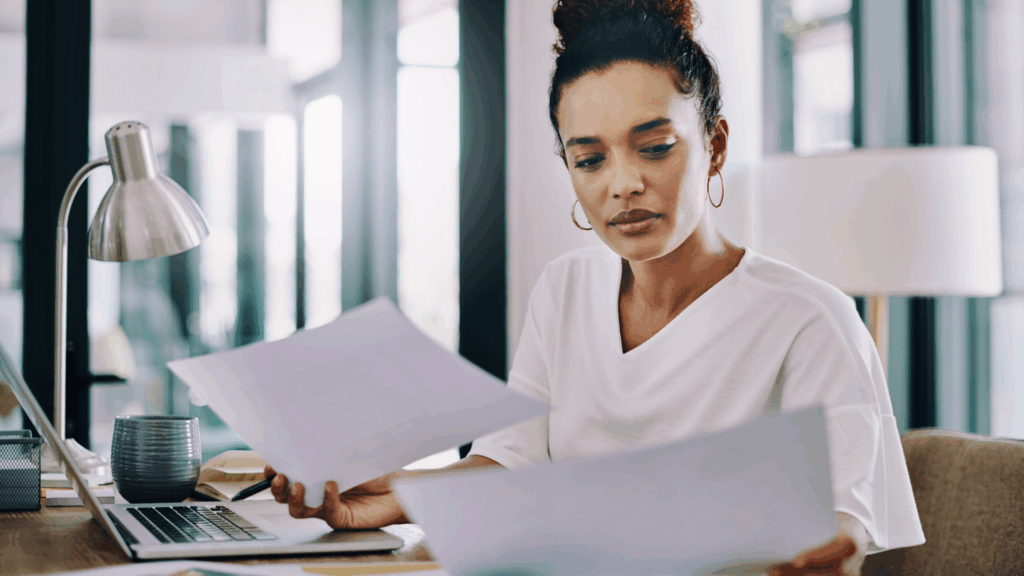

When you decide to apply for a loan or enter into any credit agreement, lenders need to conduct an affordability check.

This is a two-step process that evaluates your income and your regular household expenditures.

Income Assessment

During this phase, the lender will ask you to share details about your earnings and regular household expenses. This helps them calculate the leftover amount from your monthly income, determining what you can spare to make regular repayments.

As a part of this assessment, you’ll be asked to provide some documents, such as:

For Salaried Individuals:

- Recent payslips (last three)

- The latest P60

- Bank statements (last three months)

For Self-Employed Individuals:

- Tax year overviews

- Audited accounts from the last two to three years

- Bank statements (last three months) for both business and personal accounts

Additionally, if you have other sources of income like part-time jobs, pensions, or child support, you’ll need to furnish proof for those as well.

Outgoings Assessment

Next up is understanding your monthly outgoings. Your monthly expenses mustn’t be so burdensome that adding a loan repayment to it would strain your finances.

Here, you’ll need to share details of your monthly bills, including utilities, council tax, phone bills, and insurance policies.

Furthermore, details on any ongoing financial commitments such as credit card dues, car finance agreements, or personal loans will be needed. They will also consider any school fees or childcare costs that are a part of your regular expenditures.

Credit Check: Your Financial Footprint

A crucial part of this process is the credit check. This allows lenders to gauge the risk involved in lending money to you.

Your credit score acts like a report card of your financial behaviour. A high score usually means you are a dependable borrower, often resulting in favourable loan terms and interest rates.

Why Are Affordability Checks Important?

You might wonder why there’s so much emphasis on affordability checks. The main goal here is to prevent you from falling into financial distress due to the loan.

It aims to safeguard you from the repercussions of managing a loan that you can’t afford, avoiding the strain it could put on your daily living costs or leading to missed repayments.

Responsible lenders aim to ensure that you can:

- Repay the loan punctually and in full.

- Manage repayments without needing to borrow additional funds.

- Avoid any financial difficulties during the repayment period.

- Keep up with your existing financial commitments without faltering.

What Happens if You Don’t Pass an Affordability Check?

If the affordability check reveals that you are unable to manage the repayments of the loan you requested, most lenders will hesitate to offer you the loan.

While it isn’t a set rule, sometimes, depending on your specific situation, they might suggest a smaller loan amount with easier repayment terms, but it’s not a guarantee.

In many cases, individuals find themselves unable to pass affordability checks because they are already grappling with managing other debts.

If you notice a pattern of failing affordability checks, it might be an indicator that you need to reassess your financial strategy and contemplate whether taking on additional debt is the right move for you.

Can You Pass an Affordability Check with Bad Credit?

Yes, there’s a possibility.

It’s essential to note that your credit score is a significant component of the affordability check.

In the UK, you’ll find lenders who are focused on assisting borrowers who have less-than-perfect or poor credit scores.

The term “bad credit” encompasses a variety of scenarios. It might be a history of loan defaults, a bankruptcy record, or even a single late payment in the past.

Sometimes, having no credit history can also impact your credit profile negatively.

The silver lining here is that there are lenders who specialise in offering loans to individuals with bad credit, assessing them based on their current financial habits.

They tend to focus more on your present financial management skills, your income stream, and whether you are capable of managing the monthly repayments, rather than just your credit score.

However, pinpointing these lenders can be somewhat tricky, making it prudent to collaborate with renowned credit brokers in the UK to connect with suitable lenders for bad credit loans.

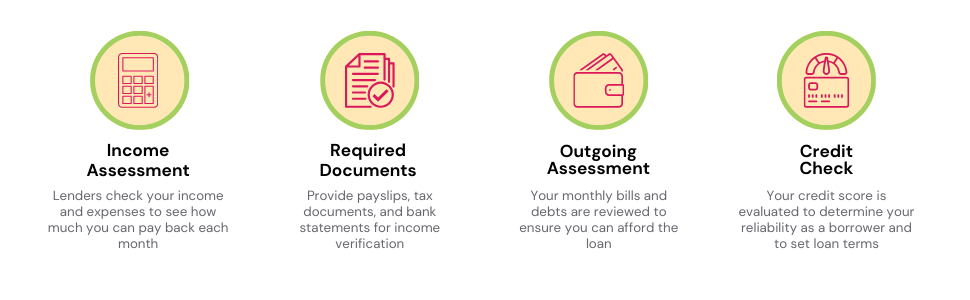

The Risks of False Information During an Affordability Check

You may want to inflate your income or omit expenses during an affordability check to borrow more or get loan approval.

However, this is a grave mistake.

Doing so often worsens your financial situation by leading you to borrow more than you can afford. It’s important to be transparent and give accurate details to lenders during this assessment.

Lying on loan applications can mark your profile, affecting future loan chances.

Remember, many lenders use fraud prevention systems that detect discrepancies in past loan applications.

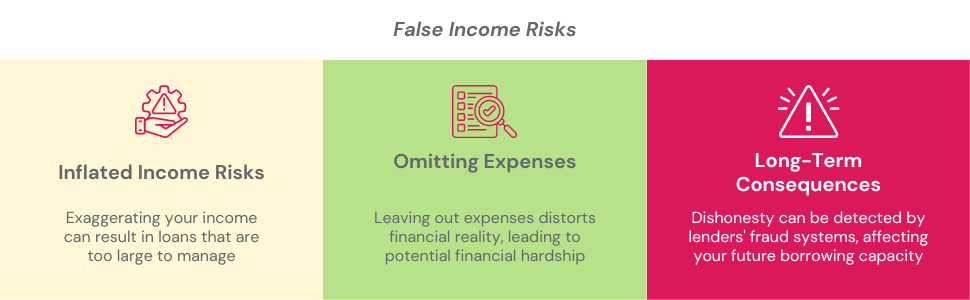

How To Ace Your Loan’s Affordability Check

If you’re gearing up to apply for a loan, you’ll want to make sure you pass the affordability check with flying colours.

Don’t worry; we’ve got your back!

Here’s a comprehensive guide on how to successfully ace an affordability check.

Understand Your Finances Inside Out

First, you need to have a solid grasp of your finances. Make a detailed list of all your monthly income and expenses.

This way, when you sit down to apply for the loan, you’ll have all the necessary information at your fingertips.

You’d know exactly how much you can comfortably afford to pay back each month without straining your budget.

Boost Your Credit Score

Your credit score plays a significant role in the affordability check.

Start by checking your credit score to know where you stand. You can check your score through agencies like Experian, Equifax, and TransUnion.

If your score isn’t up to par, don’t panic. You can boost it by paying your bills on time, reducing the amount you owe on credit cards, and avoiding taking out new loans for a while.

Remember, small, steady steps can lead to a big improvement over time!

Be Honest and Transparent

When it’s time to fill out the loan application, be completely honest. If you try to fudge the numbers, you might end up with a loan that’s too big to handle.

Besides, giving false information can get you flagged, making it harder to secure loans in the future.

Seek Professional Advice

If you’re feeling unsure, it’s always a good idea to seek professional advice.

A loan advisor can help guide you on the best way to approach a loan application, ensuring you’re well-prepared to ace that affordability check.

Choose the Right Lender

Remember, not all lenders are created equal. Some might offer loans to individuals with bad credit, while others might specialise in different loan types.

Take your time to research and find a lender who matches your financial profile and can offer you the best terms.

Prepare the Necessary Documentation

Make sure you have all the necessary documentation ready. This can include proof of income, recent bank statements, and details of your monthly expenses.

Having all the documents ready will show the lender that you are responsible and well-prepared, increasing your chances of passing the affordability check.

Consider Potential Guarantors

In some cases, having a guarantor can boost your chances of passing an affordability check, especially if your credit score isn’t stellar.

A guarantor is someone who agrees to back up your loan and steps in to make repayments if you can’t. Discuss this option with potential guarantors well in advance.

Demonstrate Stability

Lenders prefer borrowers who show stability in their residence and job.

If you’ve been in your current job and home for a considerable period, it showcases stability, which can be a positive point during the affordability check.

By following these tips, you’ll be well-prepared to ace the affordability check for a loan in the UK.

Remember, securing a loan is a significant step, and being well-prepared can pave the way for a smooth and successful application process.

Good luck!

Key Takeaways

- Understand your monthly income and expenses thoroughly before applying for a loan.

- Maintain up-to-date documentation of your financial situation, including proofs of various income streams and regular outgoings.

- Enhance your credit score by maintaining healthy financial behaviour and meeting your existing credit obligations timely.

- Choose the right lender who understands your financial profile and offers suitable loan terms.

- Be honest and transparent during the application process to avoid jeopardising future loan prospects.

- Seek professional advice if unsure, to navigate the loan application process effectively.

The Bottom Line

Securing a loan is indeed a monumental step, and passing the affordability check is crucial in this process.

In the UK, this involves a comprehensive assessment of your income, outgoings, and credit score.

Being well-prepared and transparent can greatly ease your journey.

Remember, the goal is to secure a loan that aligns with your financial capabilities, preventing any undue strain on your finances in the future.

Ready to make your loan application a success? Connect with us today, and we’ll pair you with a broker who will guide you every step of the way, helping you to secure the best deal that suits your financial circumstances.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is an affordability check the same as a credit check?

No, an affordability check is not the same as a credit check. While a credit check assesses your credit history and score, an affordability check evaluates your current financial situation to determine if you can comfortably repay a loan.

It usually considers your income, expenses, and other financial commitments. It’s a tool lenders use to promote responsible lending and prevent borrowers from facing financial strain.

Is it easier to get a loan if I have a full-time job?

Yes, being in full-time employment can potentially make it easier to secure a loan. Lenders often see steady employment and a stable income as signs of financial stability, which can increase your chances of approval.

However, other factors, such as your credit score and debt-to-income ratio, also play significant roles in the approval process.