- What Should You Know About Home Extensions?

- How Much Does a Home Extension Cost in the UK?

- How to Finance an Extension? 6 Ways

- Do You Need Planning Permission for a Home Extension?

- Do You Need a Lawful Development Certificate for a Home Extension?

- How Much Value Does a Home Extension Add?

- How Much Can You Borrow for a Home Extension?

- Should You Hire an Architect for Your Home Extension?

- The Bottom Line

6 Ways to Finance a Home Extension in 2025: A UK Guide

Picture this: your living room is filled with toys, bags, and work papers everywhere. It feels like your house is getting smaller by the day.

The kids are growing, and so is the stuff they need. You glance at your partner over dinner, and you both think the same thing: We need more space.

Moving might seem like the obvious solution, but it’s expensive, stressful, and hard to leave behind a home you love.

Here’s another idea: instead of moving, why not make your home bigger? A home extension could give you the space you need without the hassle of moving.

This guide will break down how much it might cost, ways to pay for it, and what permissions you’ll need to get started.

What Should You Know About Home Extensions?

If you’re thinking about adding more space to your home, there are a few popular types of extensions you can choose from. Let’s break them down:

- Single-storey extension. This adds one floor to the back of your house, usually extending into your garden.

- Double-storey extension. Like a single-storey one, but with an extra floor to match your house.

- Simple single-storey extensions. These include things like conservatories or orangeries, which are smaller and easier to build.

- Basement conversions. Instead of building up, you expand downwards. This can be tricky and expensive.

- Wrap-around extensions. This is an “L”-shaped addition that stretches around the back and side of your house, giving you lots more space.

How Much Does a Home Extension Cost in the UK?

Figuring out the cost of a home extension can be tricky.

On average, you might pay between £2,000 and £3,000 per square metre, and for something like a basement conversion, it could be as much as £5,000 per square metre.

The total cost will depend on things like where you live and the details of your project.

You’ll also need to think about extra costs like:

- Architect fees: Usually about 7% of the total building cost.

- Site survey: This might cost around £500.

- Planning permission application: Normally a little over £200.

- Insurance: You may need extra cover during and after the work.

- Furnishing: Decorating and setting up the new space can add to the cost.

Even though it might seem expensive, a well-planned extension can make your home worth more, which could help balance out the costs.

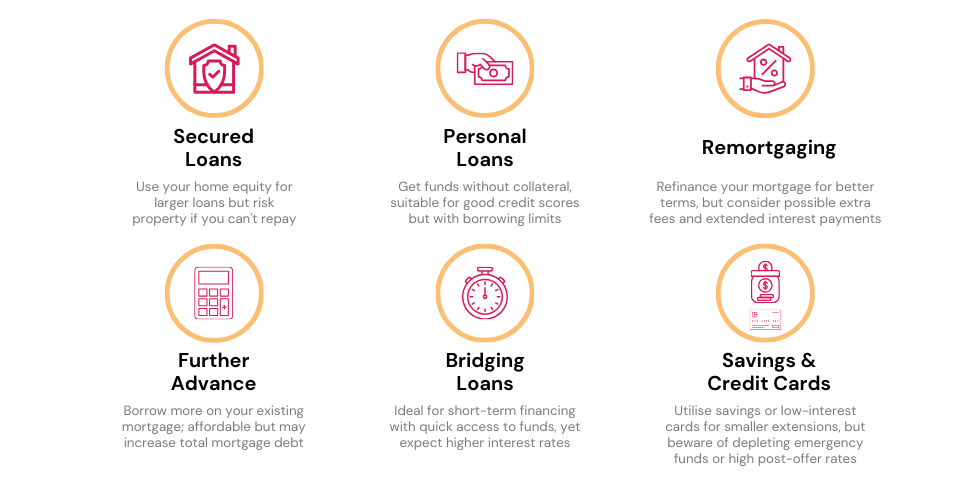

How to Finance an Extension? 6 Ways

Sorting out the money for a home extension doesn’t have to be tricky. There are a few ways to fund your extension, depending on what works best for you.

Let’s look at some popular options in the UK.

Secured Loans

If you own a lot of your home outright, a secured loan could work for you. These are also called homeowner loans or second-charge mortgages.

It’s a loan that’s separate from your main mortgage, and you can get it from your current lender or another one.

Pros:

- Usually cheaper than personal loans.

- You don’t need perfect credit to qualify.

- You can spread payments over a long time, making monthly costs smaller.

- You can borrow a lot if your home has enough value.

Cons:

- Your home is at risk if you can’t pay it back.

- You’ll need enough value in your home to borrow the amount you want.

- Interest rates can change if they’re not fixed, which might raise your payments.

- Paying over many years means you’ll pay more interest in total.

Personal Loans or Unsecured Loans

Don’t want to put your home on the line? A personal loan could be a better choice. These loans don’t use your house as security, but you’ll need a good credit score to get one.

Pros:

- Monthly payments are fixed, so it’s easier to plan your budget.

- You can pick how long you want to pay it back, usually between 1 and 5 years.

- Interest rates are often lower than what credit cards charge.

Cons:

- You might not be able to borrow enough if your extension costs more than £30,000.

- Paying the loan off early could mean extra charges.

Remortgaging

If your current mortgage is about to end or you’re on a Standard Variable Rate (SVR), remortgaging might save you money.

This means getting a new mortgage to replace your old one, often at a better rate.

Pros:

- You could get a lower interest rate by staying with your lender or switching to a new one.

- It can help you combine debts into one monthly payment.

- Extending your mortgage term can lower monthly costs.

Cons:

- There are usually upfront fees to arrange a new mortgage.

- Your home is still at risk if you miss payments.

- Stretching out payments lowers monthly costs but increases the total interest you’ll pay.

Further Advance

This means asking your current mortgage lender for extra money on your existing loan. It might change your loan terms or interest rate, so check the details carefully.

Pros:

- It can be cheaper than getting a personal loan.

- You stay with your current lender, which might save on fees.

Cons:

- Your mortgage debt might go up, sometimes at a higher rate than your original loan.

- Spreading costs over many years means you’ll pay more overall.

Bridging Loans

These are short-term loans that can help if you need money quickly. They’re often used to buy property but could work if you’re improving your home before selling.

Pros:

- You can borrow up to 70-75% of your home’s value if it’s mortgage-free.

- It gives you time to improve your home’s value before locking in a long-term loan.

- You only pay the interest until the loan is repaid.

Cons:

- Interest rates are high, so costs can add up fast.

- Initial fees can be expensive, though sometimes taken from the loan itself.

Using Savings and Credit Cards

If you’ve got savings or a credit card with a good deal, these could be easy ways to pay for your extension.

Pros:

- Using savings means no interest or repayments to worry about.

- A low or zero-interest credit card could save money if you pay it off quickly.

Cons:

- Spending your savings might leave you short in an emergency.

- Once the credit card offer ends, interest rates can shoot up, making it more expensive.

Do You Need Planning Permission for a Home Extension?

If you’re planning to extend your house, you’ll probably need to ask your local council for permission first. This is called planning permission. They check your plans to make sure they follow the rules and won’t cause problems for your neighbours or nearby nature.

But for smaller changes, like adding a loft conversion, you might not need permission. These projects are often allowed under something called “permitted development rights.”

Do You Need a Lawful Development Certificate for a Home Extension?

You don’t have to get a Lawful Development Certificate for your extension, but it’s a smart idea. This certificate proves that your extension was built legally when it was made.

Why is this important? If you ever want to sell your house, the certificate shows buyers that your extension followed the rules at the time.

It can save you a lot of hassle because building rules sometimes change, and buyers like knowing everything is above board.

How Much Value Does a Home Extension Add?

Adding an extension to your home doesn’t just give you more room; it can make your house worth more too. How much it adds depends on what kind of extension you build.

For example, adding a new bedroom with an en suite bathroom could boost your home’s value by 10-12%. A conservatory might add around 5-7%.

But keep in mind, sometimes the cost of building the extension might be more than the extra value it brings. The value increase also depends on how well the new space is used.

How Much Can You Borrow for a Home Extension?

How much you can borrow to pay for an extension depends on a few things, like how much equity you have in your home, the lender’s rules, your finances, and your credit score.

Here’s a simple example:

Let’s say your home is worth £175,000, and you still owe £100,000 on your mortgage.

This means you have £75,000 in equity. If a lender allows you to borrow up to 80% of your equity, you could borrow £60,000.

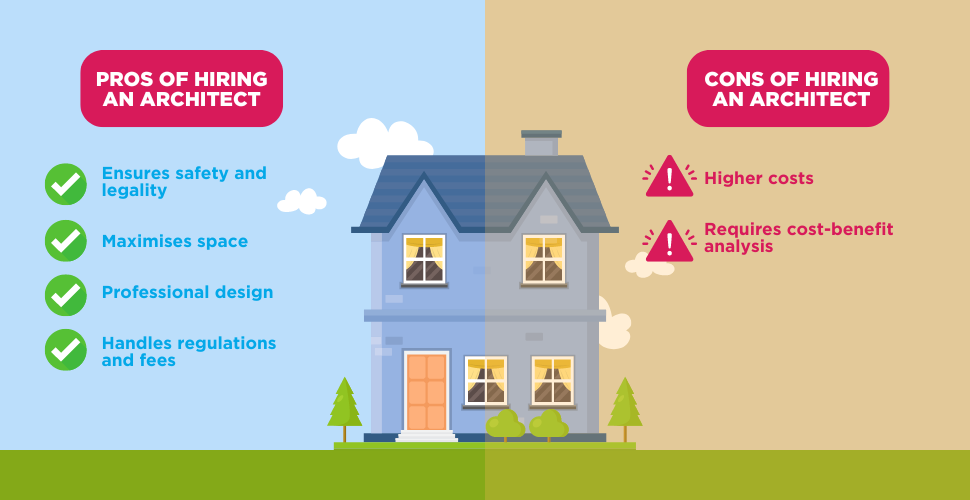

Should You Hire an Architect for Your Home Extension?

Deciding whether to hire an architect for your home extension is up to you, but it’s often a good idea.

Extensions can be tricky since they change how your house looks and works, and an architect can make sure everything is safe, legal, and designed well.

They can help you use your space wisely and make sure the project is done properly. Architects also know about building rules and can guide you through any fees you might need to pay, like planning and building control fees.

Yes, hiring an architect will cost more, but their help can make a big difference. Weighing the cost against the benefits can help you decide what’s best for your project.

The Bottom Line

Starting a home extension is a big deal. It takes time, effort, and money, so the choices you make now will affect how comfy your home is and its future value.

Talking to a loan broker at this stage can be super helpful. They can sort out the financial side, save you money, and help you get the best loan for your plans.

Remember, a home extension isn’t just about having more room. It’s about making your life better and creating a space your family will love. Think of it as an investment in your future, giving you a home that works for everyone without needing to move.

Ready to get started? Fill out the form, and we’ll connect you with a loan broker who can guide you through the process and help you make the right choices.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Do I need to notify my mortgage company about building an extension?

You don’t need to formally notify your mortgage company when you build an extension. But, if you plan to snag a new mortgage deal soon and wish to borrow more, informing them might be a smart move.

Building an extension often boosts your property’s value, potentially allowing you to borrow more by expanding your current mortgage with your existing lender.