Can Second-Time Buyers Get 95% Mortgages?

So, you’re ready to move again.

Perhaps your family’s growing or a new job calls, but you’ve hit a snag: your deposit is smaller this time.

If you’re in this situation, you’ve likely searched countless lenders on the internet to find 95% mortgage deals in the UK. With few options, strict lending rules, and high-interest rates, we get this can be a LOT stressful and frustrating.

And for that, we’ve got you covered.

In this guide, we’ll show you how you can secure a 95% LTV mortgage as a second-time buyer in the UK.

Who Are Second-Time Buyers?

Second-time buyers are people who are looking to sell their first home and buy a new one.

You might need more room because your family is growing, or you might be moving for a new job. Whatever the reason, you’re not new to this process.

What Makes the Second Time Around Different?

Going through the home-buying process for the second time might feel less daunting.

You’ve done this before, so you know what to expect, which can ease a lot of the stress and uncertainty.

Most of the time, you’ll still need to come up with at least a 10% deposit for your next home, similar to your first purchase. But, having a history of mortgage payments could work in your favour.

Lenders might see you as a lower risk, which could make getting your next mortgage a bit smoother.

However, before we get deeper, we’ve got one big question for you…

Are You Ready for a Second Purchase?

Buying the second time around still comes with its own set of hurdles.

You’ll need to navigate the application process again. While you might be familiar, it’s impossible not to go through it without a present challenge, especially if your financial situation has changed.

So before you dive into buying a second home, it’s important to take a close look at where you stand financially and what you’ve learned from your first purchase.

Ask yourself these three simple questions:

- Can I afford the additional costs? (Beyond the mortgage, remember to consider maintenance, taxes, and any potential increase in living expenses.)

- How has my financial situation changed? (Reflect on any new debts, changes in income, or other financial commitments since your first purchase.)

- What are my long-term goals for this property? (Think about whether you’re looking for more space, a better location, or an investment, and how this purchase aligns with your plans.)

Remember, the most important factor is ensuring you’re financially stable and ready for the commitment of another mortgage.

Taking stock of your finances will help you decide if you’re truly ready to take on another mortgage.

Exploring 5% Deposit Schemes for Second-Time Buyers

For many second-time buyers, using the equity built up in their first home is the go-to strategy for funding the deposit on their next property.

However, what happens if the market has shifted and your property’s value has decreased, leaving you with less equity than expected?

Fortunately, there are options available to help.

Several schemes are designed to assist buyers, including second-time buyers, in securing a new home with a deposit as low as 5%.

These include:

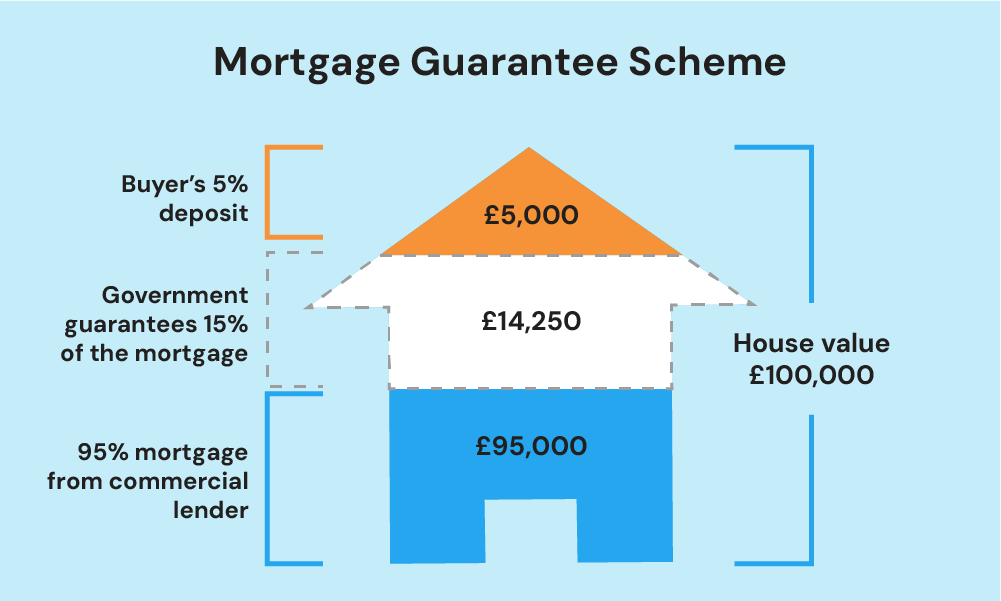

Mortgage Guarantee Scheme

Launched in 2021, The Mortgage Guarantee Scheme helps you buy a home with just a 5% deposit by offering lenders a safety net.

Here’s how: The scheme works similarly to 95% mortgages, the only difference is that the government promises to cover about 15% of the lender’s losses.

This is to encourage more lenders to offer high-LTV mortgages for those who have a small deposit in the UK.

For example, if you buy a house for £200,000 with a 5% deposit (£10,000), you would take out a mortgage for £190,000.

If things didn’t go as planned, and you defaulted on your repayments, the government will shoulder up to 15% (£28,500) of the 190,000 mortgage.

This helps your lender feel more secure, as they only need to worry about £161,500 of the loan. In return, it also makes it easier for you to get a mortgage.

But, there are a few boxes you need to tick to qualify:

- You are buying a residential property in the UK. (not a second home or buy-to-let)

- You have a deposit of 5% to 9%. So you can get 95% and 91% mortgage LTV.

- You’re buying a property worth £600,000 or less.

- You’re applying for a repayment mortgage. (not interest-only)

- You can pass the lender’s affordability assessment.

- You must be an individual, not a corporation.

Forces Help to Buy

For those serving in the armed forces, the Forces Help to Buy scheme provides an extra boost, making it easier to gather a deposit for your home.

Specific lenders are on board, offering tailored mortgage options that recognise the unique circumstances of military life. This support is a token of appreciation for your service, helping you and your family settle into a place you can call your own.

To qualify, you must be regular service personnel who:

- Has completed the minimum service requirement

- Is not a reservist or a member of the Military Provost Guard Service

- Have more than 6 months left to serve at the time of application

- Meets the right medical categories

Deposit Unlock Scheme

The Deposit Unlock Scheme is here to help you get into a brand-new home with a smaller upfront cost.

With just a 5% deposit, you can secure a new build from developers taking part in the scheme.

Remember, though, there are caps on how much the property can be worth, ensuring the scheme helps those it’s meant to.

This scheme was created as an alternative to the Help to Buy program. It was set up by a group of 17 property developers who are part of the Home Builders Federation (HBF). They worked with Gallagher Re, an insurance company, to start this scheme.

It allows banks to offer mortgages covering 95% of a new home’s price, for homes costing up to £750,000.

To use this scheme, you need to:

- Be buying a new build property.

- Need a loan that’s £750,000 or less.

- Buy a home from builders and banks that are part of this scheme.

- Not own another home when you complete the purchase.

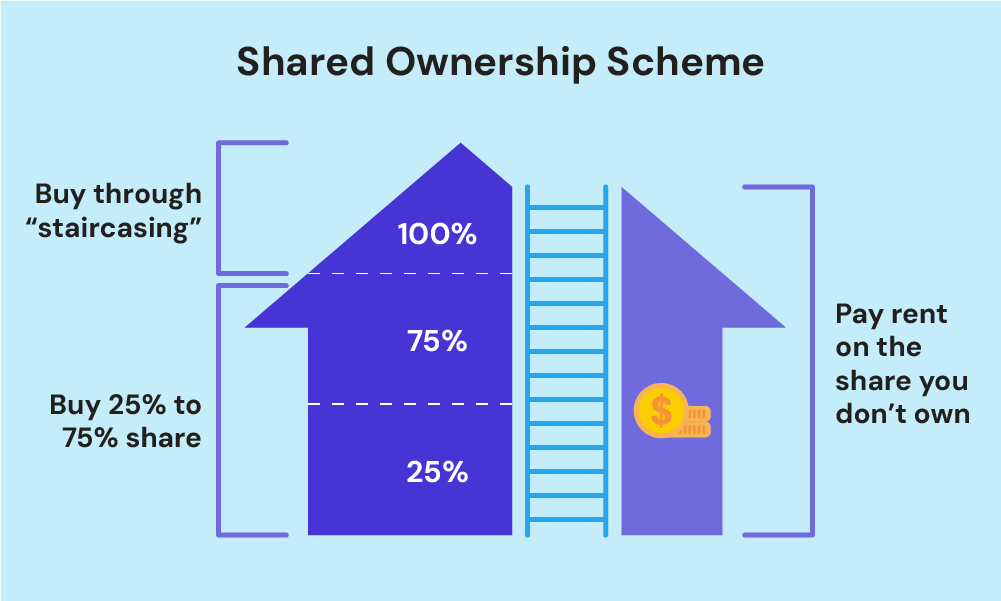

Shared Ownership

Shared Ownership lets you buy a part of your home – usually around 10% to 75%, and rent the rest. This is a great option if you can’t afford to buy a house outright or you have a small deposit.

To fund your share, you must be eligible for a mortgage and have at least a 5% to 10% deposit.

So, if your shared ownership home starts at £100,000, and you have a £5,000 deposit. You must be able to secure a 95,000 mortgage loan. You’ll need to pay rent to your landlord (usually the housing association or developer).

This scheme provides the flexibility to increase your share over time, ultimately reducing how much rent you pay.

To be eligible, you must be:

- Your household income must be £80,000 a year or less (£90,000 in London).

- You can’t afford the full deposit and mortgage for a home that meets your needs.

- One of these must be true: You must be a first-time buyer, a previous homeowner who can’t afford a new home, forming a new household, or an existing shared owner looking to move.

Lenders Participating in 5% Deposit Schemes

Several lenders are known to participate in schemes designed to facilitate 95% LTV mortgages. These include:

- HSBC

- Barclays

- Virgin Money

- Santander

- Natwest

- Lloyds

- Accord

- Nationwide

- Newcastle Building Society

- Halifax

- Pepper Money

Each lender has its criteria and interest rates, which can vary widely. The interest rates tend to be on the higher side due to the perceived risk of lending such a high proportion of the property’s value.

This is why consulting with a mortgage broker can be beneficial. They can help you sift through the options, compare rates, and find a mortgage that suits your financial situation.

With their knowledge of the market, they can also potentially unlock deals that reduce the cost of borrowing, despite the low deposit.

Alternative 95% LTV Mortgages

Besides the government-backed schemes, there are other paths to securing a 95% Loan-to-Value (LTV) mortgage. These include:

- Standard 95% Mortgages. Some lenders offer traditional 95% LTV mortgages outside of government schemes. These products are available based on the lender’s criteria and your creditworthiness.

- First Homes Scheme. Aimed at first-time buyers and key workers in England, this scheme offers homes at a discount of at least 30% – 50%compared to the market price. The discount remains with the property to help future first-time buyers.

- Right to Buy/Right to Acquire. For council and housing association tenants, these schemes offer the chance to buy your home at a discount. The discount amount depends on various factors, including how long you’ve been a tenant.

- Family Springboard Mortgages. These products allow family members to help you onto the property ladder by providing security, such as savings or equity in their own home, instead of giving you a cash deposit.

- Guarantor Mortgages. A family member or friend guarantees to cover the mortgage payments if you’re unable to, potentially allowing you to borrow more with a smaller deposit.

Each option has its own set of eligibility criteria and considerations. It’s essential to research thoroughly or consult with a mortgage broker to understand which path best suits your financial situation and homeownership goals.

Key Takeaways

- Second-time buyers are those selling their first home to purchase a new one, often for more space or a better location.

- While the buying process may feel less overwhelming, you’ll still need at least a 10% deposit and to assess your financial situation.

- Schemes like the Mortgage Guarantee Scheme, Forces Help to Buy, Deposit Unlock, and Shared Ownership can help with deposits as low as 5%.

The Bottom Line

As a second-time buyer, securing a mortgage with a 5% deposit has its own set of hurdles. The main issue is that not many lenders offer these kinds of loans because they consider them more risky.

This could mean you face higher interest rates since lenders want to make sure they’re covered.

To get through this, it’s important to know your finances and show you can handle the loan.

One of the best moves you can make is to team up with a reliable mortgage broker. These experts can be a huge help in your journey.

They offer personalised advice, find you exclusive 95% mortgage deals, and make the whole mortgage process a lot less daunting. They can help you save time, stress, and potentially money.

Feeling overwhelmed? Reach out to us. We’ll connect you with your ideal mortgage broker who can guide you through finding the perfect mortgage for your situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Are there 95% LTV buy-to-let mortgages available in the UK?

No, 95% LTV mortgages are generally not available for buy-to-let properties in the UK. Buy-to-let mortgages typically require a larger deposit, often around 25%, due to the higher risk associated with rental investments.

Can I get a self-employed mortgage with only a 5% deposit?

Yes, it’s possible to get a mortgage with a 5% deposit if you’re self-employed. However, you’ll need to provide solid proof of your income, such as two or three years of accounts or tax returns, to reassure lenders of your ability to make repayments.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.