- How Does a Debt Management Plan Work?

- Can I Get a Mortgage with a Debt Management Plan?

- How Much Can I Borrow if Iâve Had a DMP?

- Can You Get a Mortgage with Bad Credit and a DMP?

- Mortgage Deposit Requirements and Debt Management Plans

- How a Settled DMP Can Improve Your Mortgage Chances

- Working with a DMP Mortgage Specialist

- Key Takeaways

- The Bottom Line

Getting a Mortgage with a Debt Management Plan

Sorting out your finances back on track after a Debt Management Plan (DMP) feels like a big win, but the thought of applying for a mortgage can still be daunting.

Will lenders give you a chance? Is it even possible with a DMP in your history?

This article gives you the facts. It explains what debts a DMP covers, how it can affect your borrowing power, and what you can do to boost your chances of approval.

If you’re ready for a fresh start and want to make progress towards homeownership, this guide can help you take that next step with confidence.

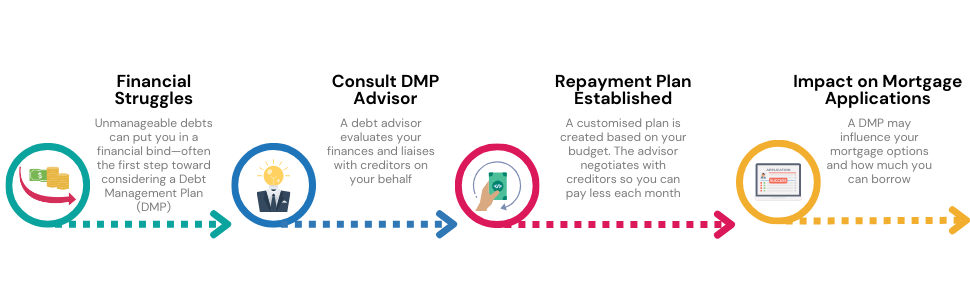

How Does a Debt Management Plan Work?

A debt management plan (DMP) is a way to help people manage their debts more effectively. It works by reducing the amount you owe into manageable monthly payments, which can help you regain control of your finances.

A DMP can be a lifeline for people who feel their debts are spiralling out of control.

To set up a DMP, you will need to work with a debt advisor or DMP practitioner. This professional will act as an intermediary between you and your creditors, arranging a repayment plan that fits within your budget. This allows you to repay your debt at a more manageable and affordable rate

By understanding how a DMP works, you can better understand how it may impact your chances of securing a mortgage.

If you have a DMP, you will need to disclose this to lenders when you apply for a mortgage. Many lenders will still consider your application, and some may even offer you a mortgage if you have a settled DMP.

What Debts Can a Debt Management Plan Settle?

A Debt Management Plan targets non-priority debts. These encompass:

- overdraft facilities

- personal lending

- loans from banks or building societies

- borrowed funds from friends or relatives

- dues from credit cards, store cards, or payday loans

- catalogue, home credit, or in-store credit debts.

What Debts are not Covered by a Debt Management Plan?

A Debt Management Plan does not cater to priority debts. These involve:

- court penalties

- TV Licence

- Council Tax

- bills for gas and electricity

- child support and maintenance payments

- Income Tax, National Insurance and VAT

- mortgage or rent, including any loans secured against your property

- hire purchase agreements, especially if they finance essential items.

Can I Get a Mortgage with a Debt Management Plan?

While it’s possible, the process is not easy. You might face:

- Higher interest rates compared to standard mortgages, as lenders may see you as a higher risk.

- A limited choice of lenders willing to consider your application.

- A requirement for a larger deposit, as lenders may want extra security.

- Stricter lending criteria, including detailed checks on your income and outgoings.

- Lower borrowing limits, as lenders might restrict how much they’re willing to lend.

- Extra fees or charges for specialist mortgage products.

- The possibility of rejection if your credit history is still poor or your DMP is too recent.

- A longer process, as some lenders take more time to assess applications with a DMP.

Lenders have different views on Debt Management Plans (DMPs).

Some see them as risky, while others are more open, especially if your finances are improving.

Specialist lenders can be a big help. They’re usually more flexible and consider the bigger picture—your income, credit score, deposit amount, and details of your DMP.

This is where a good mortgage advisor can really make a difference. They can match you with lenders who are more likely to accept you and help you avoid multiple rejections.

This is key because too many applications—or being turned down—can leave marks on your credit file, making it harder to borrow later.

That said, even with specialist help, there’s no guarantee you’ll find the right mortgage.

Your chances will depend on your financial position, the lender’s criteria, and whether you meet their requirements.

How Much Can I Borrow if I’ve Had a DMP?

A common guidepost suggests that having a DMP could limit you to borrowing up to 4x your annual income. But, this isn’t a hard and fast rule.

With a larger deposit and the absence of severe credit issues, you might even be able to borrow up to five times your annual income.

If your DMP is still active, lenders will factor it into your affordability assessment as a monthly outgoing.

But keep in mind, each lender evaluates your DMP as an expenditure differently, based on their unique scoring system. Therefore, choosing the right lender can mean the difference between borrowing an adequate amount or falling short.

For self-employed individuals, the situation can be even more complex. Mainstream lenders may offer limited options due to the perceived instability of self-employed income.

But, specialist lenders understand the unique challenges of self-employment and can offer more flexibility. This is especially true if you have been self-employed for a year or more.

>> More about DMP Calculator

Can You Get a Mortgage with Bad Credit and a DMP?

A debt management plan (DMP) can be the result of financial difficulties, which can lead to borrowers having other credit issues alongside their DMP.

You can still get a mortgage even if you have CCJs, defaults, delayed payments, bankruptcy, IVAs, or repossession alongside your DMP.

There are specialist lenders who cater to people with adverse credit histories, but your options may be limited if you have other credit issues. If your credit problems are severe, your choices could be even more restricted.

It would be impractical to give you a personalised answer without examining your mortgage needs and credit history. But, experienced mortgage advisors are available to discuss your situation in more detail.

Mortgage Deposit Requirements and Debt Management Plans

As with all mortgages, the more substantial your deposit, the more lenders you can access and possibly at better rates. But, what if your financial past has left you with a smaller deposit?

Let’s take a scenario where you have a 5% deposit. While this might seem minimal, it’s still feasible to get a mortgage even with a DMP in your credit history.

To make this possible, you could consider Mortgage Guarantee Scheme. But, this option usually requires a clean credit file.

In more complex situations where you’ve encountered other credit issues such as County Court Judgements (CCJs) or defaults, you may need a higher deposit – around 15-20% to sway lenders in your favour.

Before making any mortgage application, a smart move would be to examine your credit file. This will give you an understanding of what lenders see when assessing your application and help you fine-tune your strategy.

How a Settled DMP Can Improve Your Mortgage Chances

Once your debt management plan (DMP) is settled, your path to getting a mortgage becomes much clearer. Lenders are more likely to approve your mortgage application if your DMP is no longer active, and you may even be able to get a better interest rate.

Settling your DMP frees up your monthly income, which can increase your borrowing power. If your DMP has been settled for over three years, you will have a wider range of lenders to choose from.

Some lenders may even offer you attractive rates, which could save you money on your mortgage.

But, if you have any new credit problems after completing your DMP, this could complicate your mortgage application.

Lenders may be less likely to approve your application, and you may have to pay a higher interest rate. You may also have to put down a larger deposit.

Working with a DMP Mortgage Specialist

For anyone who’s had a DMP, we can’t emphasise enough the value of consulting with a mortgage specialist.

These professionals possess a comprehensive understanding of the market and are well-versed in debt solutions. They can efficiently guide you through the process and increase your chances of approval.

A specialist can assess your unique circumstances, understand your needs, and match you with lenders best suited to your specific criteria.

Remember, mortgages can be complicated, but with an expert on your side, you are better placed to deal with them.

Key Takeaways

- Mortgages are possible with a Debt Management Plan (DMP), but stricter rules, higher interest rates, or a larger deposit may apply, especially if the DMP is still active.

- Settled DMPs improve your chances. After three years, more lenders are likely to consider your application, and you may qualify for better rates.

- Larger deposits (15–20%) can open up more options, though some lenders might accept smaller deposits (5%) if your credit record is strong.

- Specialist mortgage brokers can help find lenders open to DMP cases, but success isn’t guaranteed, and some options may not fit your situation.

The Bottom Line

Getting a mortgage with a DMP—whether it’s active or settled—can feel overwhelming.

You might be worried about rejection, struggling to figure out where to start, or unsure which lenders might even consider your application.

Here’s the good news: you don’t have to tackle it alone.

A specialist broker can make the process simpler, guiding you step by step and matching you with lenders who understand your situation.

We know this can feel like a lot, but our free service is here to help.

Let us connect you with an expert who’ll do the hard work for you—saving you time, stress, and unnecessary setbacks.

Get in touch today and take the first step towards owning your dream home. 🏡✨

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a mortgage if I've made late payments during my DMP?

Yes, but this may limit your options. You may need at least 25% or more for a deposit to increase your access to lenders. They may want an explanation and will assess your application on a case-by-case basis.

Does settling the DMP improve my chances of getting a mortgage?

Absolutely! A settled DMP signals to lenders that you are capable of managing your finances responsibly. But, you don’t need to settle your DMP before applying for a mortgage.

Does a DMP appear on my credit file?

Your debt management plan (DMP) will not appear on your credit file, but your outstanding debts will. These will typically remain on your credit file for six years. You will also need to declare your DMP at the start of your mortgage application.

Can I get a mortgage from a high-street lender with a DMP?

Yes, but it can be challenging. Some high street lenders may be reluctant to approve a mortgage if you have an active DMP or one that has recently been settled.

Does a DMP affect my mortgage affordability?

Yes, an active DMP can reduce the amount you can borrow as it affects your monthly income and outgoings. Once the DMP is settled, your borrowing power increases.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.