- What is a Debt Relief Order?

- Why are Dates Important for a DRO?

- When Can You Apply for a Mortgage After a DRO?

- How Much Can You Borrow Post-DRO?

- Self-Employment and DRO

- What Happens if There’s a Restriction on My DRO?

- Bad Credit and Its Impact on Mortgage Applications After DRO

- Checking Your Credit Reports to Prepare for Mortgage Application

- Specialist Advice for DRO-related Mortgages

- Key Takeaways

- The Bottom Line

How To Secure a Mortgage With Debt Relief Order?

Starting fresh after a Debt Relief Order (DRO) can feel a bit tricky, especially if owning your own home is part of the plan.

Maybe you’re eager to give your family a solid place to settle, swap rent payments for mortgage repayments, or finally take a step towards a future that feels secure and yours to build.

It’s a big goal, and having a DRO in your past might make it seem out of reach.

But here’s the thing: while a DRO can make the process more challenging, it doesn’t slam the door shut.

With a bit of planning and the right mindset, getting that “mortgage approved” stamp is still possible.

This guide is here to help you figure out what’s ahead, how to get yourself ready, and what steps can boost your chances of success.

What is a Debt Relief Order?

A Debt Relief Order (DRO) is a form of help provided to individuals with low income and minimal assets who cannot repay their debts. It’s a helping hand from the UK government to those swamped with debt.

It essentially provides a break, usually for 12 months, during which your creditors can’t demand money, and you’re exempt from making payments towards most of your debts.

For instance, imagine you’re unable to repay a debt of £10,000. In such a scenario, you might apply for a DRO.

If approved, this means you won’t have to make payments towards this debt for 12 months. After this period, if your financial situation is still tight, the debts included in the DRO are generally written off.

While a DRO can offer considerable relief, it also poses challenges, especially when it comes to larger-scale borrowing like a mortgage in the future.

Why are Dates Important for a DRO?

Dates are not only critical for remembering birthdays or anniversaries, but they also play an indispensable role in the context of a Debt Relief Order.

The two most significant dates are when the DRO was registered and when it was discharged. These two markers in time can greatly influence your future borrowing capabilities.

Firstly, let’s understand why these dates matter.

When you register a DRO, it is essentially a declaration that you can’t afford to repay your debts. Lenders, including mortgage providers, are naturally cautious about lending to individuals with a history of debt struggles.

The date you’re discharged from a DRO is also vital. It’s the point when you’re officially released from the debts included in your DRO.

But it’s crucial to know that while you’re under a DRO, typically for 12 months, you’re not allowed to borrow more than £500 without informing the lender about your DRO.

These constraints extend to mortgages as well, which are considered large sums of money. So, while under a DRO, and for a certain period after discharge, applying for a mortgage is not advisable.

When Can You Apply for a Mortgage After a DRO?

It really depends on the lender, as each one has its own rules.

Most lenders prefer you to wait six years after your DRO has been discharged, but some might look at your application earlier.

That said, getting approved right away isn’t guaranteed—it’ll come down to your financial situation and whether you meet the lender’s requirements.

Waiting at least 12 months after your discharge can make things easier, but it doesn’t guarantee you’ll get a great deal.

A DRO usually leaves a mark on your credit file that sticks around for a while, and even after a year, it can still affect your options.

You might face:

- Higher interest rates as lenders could see you as a risk.

- Fewer mortgage choices

- Bigger deposit

- Stricter lender checks

- Lower borrowing limits

- Longer approval times

- Rejections

Mainstream lenders may be harder to access, leaving you to rely on specialist lenders, who often charge higher fees.

That’s why it’s important to take your time to rebuild your credit and show financial stability. Speaking to a specialist adviser can help you find lenders more likely to consider your application.

How Much Can You Borrow Post-DRO?

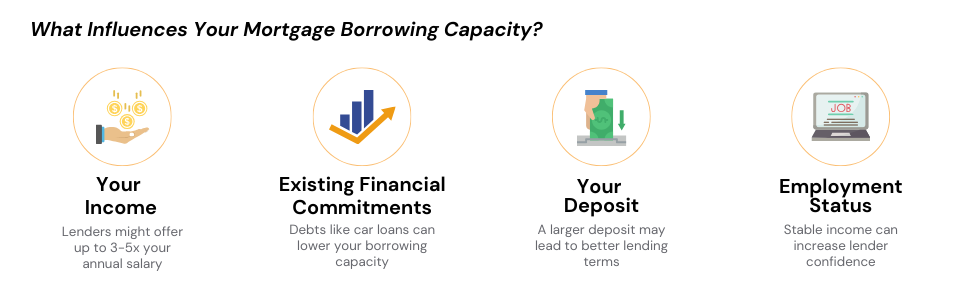

The mortgage amount you can borrow will depend on a variety of factors. Let’s delve into them:

Your Income

Lenders look at your annual income as a measure of your ability to repay the loan. Usually, they might offer to lend up to three times your annual income. In some cases, they might even extend it to five times your income.

For instance, if your yearly income is £30,000, you could potentially borrow up to £90,000 or, in some cases, up to £150,000.

Existing Financial Commitments

Any existing financial obligations, like car loans or other debts, could affect how much you can borrow. Lenders need to be sure you can comfortably afford the mortgage payments along with your other financial commitments.

For example, if you earn £40,000 annually but have an existing car loan that takes up £10,000 each year, the lender might consider your effective income as £30,000 for the mortgage calculation.

Your Deposit

The size of your deposit can impact your borrowing capacity. A larger deposit could potentially open up more favourable lending terms.

Suppose you’ve managed to save a 20% deposit on a home that costs £200,000. In this case, you’ve got £40,000 upfront, which may improve the lenders’ willingness to lend more.

Employment Status

If you’re self-employed, it might be a bit more challenging as you’re seen as a higher risk. But, if you’ve got more than three years of accounts showing steady income, it could help convince the lenders about your loan repayment ability.

Self-Employment and DRO

Being self-employed can bring added layers of complexity when trying to secure a mortgage, particularly after a DRO. Here’s what you need to be aware of:

Detailed Financial Records.

- Lenders like to see a steady income stream. As a self-employed individual, providing proof of this might be trickier. Typically, you’ll need to show a minimum of two years’ worth of accounts to give lenders confidence in your earnings.

Business Performance

- The lenders will look into your business’s health. The more profitable your business, the more likely they are to lend.

Debt to Income Ratio

- This ratio is key in assessing your loan eligibility. If your business debts are high relative to your income, it could affect your chances of obtaining a mortgage.

What Happens if There’s a Restriction on My DRO?

A Debt Relief Restriction Order (DRRO) is something that you might face if the Insolvency Service found your behaviour during your DRO to be dishonest or blameworthy.

This order could extend the restrictions of a standard DRO from 1 year up to a maximum of 15 years. But how does it affect your mortgage applications?

- Wait It Out – During a DRRO, you’re still bound by the restrictions of a normal DRO, which includes a prohibition from borrowing large sums of money. It means you’ll have to wait until the DRRO period is over to apply for a mortgage.

- Full Disclosure – Honesty is crucial. If you’re under a DRRO, you’re legally obliged to tell the lender. Not doing so could lead to severe penalties.

- Proactive Measures – Show lenders that you’ve taken steps to improve your financial situation. Even if you’re under a DRRO, actions such as saving a substantial deposit or clearing minor debts could boost your chances once the restriction period ends.

So, whether you’re self-employed or under a DRRO, a mortgage after a DRO isn’t an impossibility. It may take a bit of patience, planning, and proactive measures, but owning your own home could still be within reach.

Bad Credit and Its Impact on Mortgage Applications After DRO

After a DRO, it’s no surprise that your credit might take a bit of a hit. Here’s a glimpse into what that could look like:

- Possible Credit Issues After-DRO:

- Missed payments

- High levels of existing debt

- County Court Judgements (CCJs)

- Default notices

But fret not, these issues don’t spell the end of your homeownership dreams. Here’s what you can do:

Steps to Mitigate These Credit Issues:

- Stay Prompt. Commit to paying your current debts on time. It’s a simple but powerful way to rebuild trust with lenders.

- Reduce Debt. Even a small reduction in your existing debt can be viewed positively by potential lenders.

- Seek Professional Advice. Speaking with a financial adviser can provide tailored strategies to improve your credit score.

Checking Your Credit Reports to Prepare for Mortgage Application

Peeking into your credit report might seem like a daunting task, but it’s a step you simply can’t skip. Here’s why you should check credit reports before applying:

- To spot any errors or mistakes.

- To understand what lenders will see when they look you up.

- To be aware of any factors that could lead to a declined application.

Tips on Using Credit Reports:

- Know Your Score. Familiarise yourself with your credit score. A higher score usually means better loan terms.

- Dispute Errors. If something looks wrong, don’t hesitate to challenge it. Mistakes do happen.

- Monitor Regularly. Check your report regularly, especially in the months leading up to your mortgage application.

Pro Tip: Your credit report is basically a summary of how you’ve handled money in the past—it’s like your financial report card.

Keeping it in tip-top shape can really help when you’re trying to snag a great mortgage deal. So, take a good look at that report, and make sure it’s looking its best.

Every little effort gets you closer to that dream home!

Specialist Advice for DRO-related Mortgages

After a DRO, getting a mortgage isn’t just about picking a house and signing papers. Here’s why you need expert advice:

- Unmatched Expertise. Experienced brokers know which lenders might approve you despite a past DRO. They have

- Tailored Help. Everyone’s situation is different. Specialists give advice suited just for you.

- Save Time. Professionals help you avoid mistakes, making your application process smoother and faster.

So don’t go it alone; the right help can make all the difference!

Key Takeaways

- Getting a mortgage after a DRO is possible, but it’s harder. Most lenders require six years after discharge, though some might consider you sooner with a larger deposit.

- Shortly after a DRO, you may need a 30% deposit, but this could drop to 5-10% after six years. Saving for a bigger deposit improves your chances.

- Rebuilding your credit is essential. Pay off debts, check your credit report for errors, and keep a strong financial track record to show lenders you’re reliable.

- A specialist broker can help find lenders open to DRO cases, but success isn’t guaranteed, and you might face higher interest rates or stricter terms.

The Bottom Line

It’s no secret that applying for a mortgage after a DRO can feel overwhelming. A part of you might be wondering if any lender will even give you a chance.

The truth is, it’s possible—but it takes planning. Building a bigger deposit, improving your credit score, or working with a specialist broker can all make a real difference in turning things around.

The key is knowing where to begin. That’s where speaking to a broker who understands DRO cases can save you time and energy. They’ll know which lenders are open to working with you and help you build a plan that suits your situation.

If you’re ready to take the next step, get in touch. We’ll connect you with a good broker who can simplify the process and help you move closer to owning your home.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What are the conditions of a Debt Relief Order?

To apply for a DRO, you must be unable to pay debts, have qualifying debt under £20,000, have less than £50 spare each month after household expenses, have assets worth less than £1,000 (excluding certain items and vehicles), not be a homeowner, and not have had a DRO in the last six years.

What is the difference between a DMP and a DRO?

A DMP is an informal agreement to repay non-priority debts over time, while a DRO is a more drastic form of insolvency suitable for people with lower debt and few assets. A DRO freezes debts for a year and if the financial situation doesn’t improve, the debts are written off.

What debts cannot be included in a DRO?

Debts that cannot be included in a DRO include student loans, social fund loans, confiscation orders, child support and maintenance arrears, court fines, compensation for death and injury, and some types of car finance.

Will a DRO affect my partner's mortgage?

Yes, if you apply for a mortgage jointly, your partner’s options may be limited by your compromised credit history. Yet, if the DRO is only in your name and your partner applies for a mortgage on their own, their eligibility should not be affected.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.