- Can I Get a Mortgage if I’m Self-Employed for 2 years or Less?

- How To Get a Mortgage with Less Than 2 Years of Accounts?

- What Documents Do You Need to Show Lenders?

- How Much Can You Borrow with Two Years of Accounts?

- Other Eligibility Criteria

- Lenders Willing to Assess Your Application

- Interest Rates: What Can You Expect?

- Key Takeaways

- The Bottom Line: For Your Next Stepsâ¦

Mortgages for Self-Employed with 2 Years of Accounts

If you’re self-employed in the UK, you’re in good company with 4.31 million others.

But what if you’re fairly new to this and want to buy a home? Can you get a mortgage with only two years of accounts?

Don’t worry, we’ve got you covered.

This article is a complete guide that answers these questions. We’ll tell you what you need to prepare and how to boost your chances of getting that mortgage approval. You don’t have to be a long-time business owner to own a home.

So stick around, as we break down the must-know tips and share resources that can help you out.

Can I Get a Mortgage if I’m Self-Employed for 2 years or Less?

Yes, you can.

While many lenders might want to see three years of healthy accounts to gauge your ability to repay the loan, that’s not a hard rule. Several lenders, often specialists in the field, are open to less documentation.

To avoid dings on your credit report from rejected applications, consult a good broker who specialises in mortgages for the self-employed. They can point you to the right lenders who are more flexible with their requirements.

How To Get a Mortgage with Less Than 2 Years of Accounts?

Here’s how you can get a mortgage with 2 years of accounts:

1. Consult a Specialist Broker

Applying for a mortgage when you’re self-employed is already a bit tricky, and it becomes even more so with fewer than three years of accounts.

A specialised broker can guide you on how much you can borrow and what to include in your application, boosting your approval odds.

2. Get Your Documents Ready

You’ll need to gather your SA302 forms, compile your accounts and income forecasts, and update your CV.

The more complete your application is, the higher your chances of getting approved. Prepare these in advance to make the process smoother.

3. Choose the Right Lender

When you have just a couple of years’ worth of accounts, the risk of application rejection is higher.

Work with your broker to identify a lender who is more likely to approve your application based on your unique circumstances. Your broker can also inform you about which lenders offer the best rates for those with fewer years of self-employed accounts.

So, if you’re part of the self-employed community and looking to own your home, know that mortgages for self-employed with 2-year accounts are within reach.

Make sure you work with a specialist broker and prepare thoroughly to make the process as seamless as possible.

What Documents Do You Need to Show Lenders?

When you’re aiming to get a mortgage with 2 years of self-employment accounts, you’ll need to have some key documents at the ready.

The biggies are your self-assessment tax returns, also known as SA302, and your tax year overviews. You can grab these from your HMRC online account.

In addition to the primary documents, lenders may also request the following:

- Finalised accounts for the duration of your self-employment

- Projections for your income in the forthcoming year

- Business bank statements spanning the previous 3 to 9 months

- References to attest to a solid employment history

- An up-to-date CV

Having these documents lined up and ready will strengthen your application and speed up the process.

A Quick Note on Verifying Your Documents

While not mandatory, getting an accountant to vouch for your finalised accounts and income projections can be a real boost. Lenders usually feel more comfortable with verified figures, especially when you’re looking for mortgages for self-employed with 2-year accounts. Think of it as a little extra polish on your application that could make a big difference.

How Much Can You Borrow with Two Years of Accounts?

The amount you can borrow hinges on what the lender thinks you can afford to pay back. As a sole trader or partner in a business, the lender will examine the “total income received” from the SA302 forms you’ve submitted.

They may also look at your share of the net profit for the past two years. If you’re a director of a limited company, the focus shifts to your salary plus any dividends you’ve earned.

Most lenders take your total income and multiply it by 4 to 4.5 as a rough guideline for your borrowing limit. However, some may go as far as offering 5 or even 6 times your earnings.

To get a rough estimate of how much you could borrow, use the self-employed mortgage calculator.

[Embedded Self-Employed Calculator]

Other Eligibility Criteria

If you’re applying for mortgages for self-employed with 2-year accounts, it’s important to tick as many boxes as possible when it comes to other eligibility requirements.

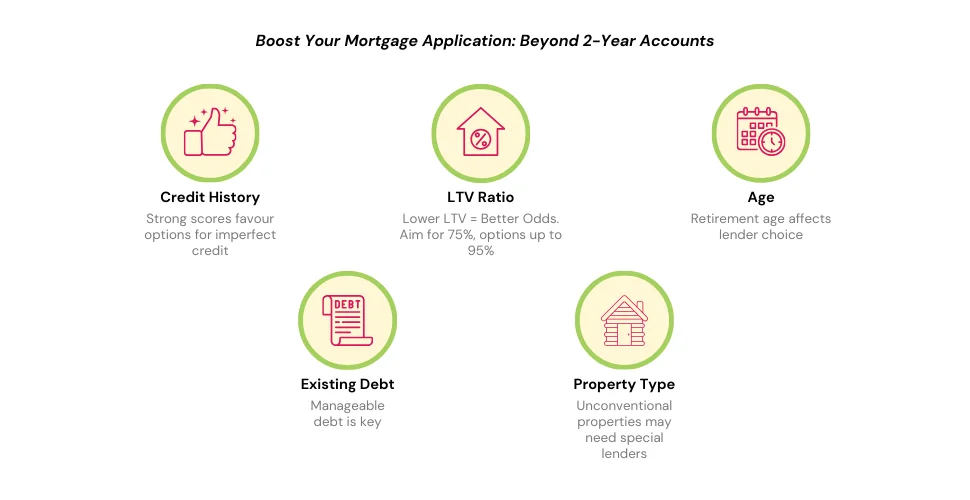

Here are some other aspects that lenders will scrutinise:

- Your Credit History – A strong credit score can compensate for your limited years of accounts. But don’t lose heart if your credit is less than perfect; some lenders specialise in helping self-employed individuals with less-than-stellar credit.

- Loan to Value Ratio (LTV) – A larger deposit and lower LTV can help balance the perceived risk associated with a short employment history. While aiming for a 75% LTV is advisable, some lenders might offer mortgages with up to 90% or 95% LTV.

- Your Age – Generally, age isn’t a major concern for lenders unless you’re approaching retirement. If your mortgage term will extend into your retirement years, your choice of lenders may be more limited.

- Existing Debt – Debt won’t automatically disqualify you, but it does limit the range of lenders willing to consider your application. The nature and amount of your debt will be key factors.

- Property Type – Standard properties usually don’t pose issues, but if you’re considering something unconventional like a concrete home or a thatched cottage, you’ll likely need a specialist lender.

Meeting these additional criteria can not only strengthen your application but can also expand your options among lenders.

Lenders Willing to Assess Your Application

When it comes to mortgages for self-employed with 2-year accounts, not all high street banks are out of reach. Institutions like Barclays, HSBC, and Natwest have shown a willingness to look at accounts covering just two tax years.

However, for a broader range of choices, better rates, and flexible terms, specialist lenders catering to the self-employed can be your best bet.

Some, like Kensington Mortgages, require only a year’s trading history and are open to those with bad credit scores. Aldermore Bank also needs just a year of financial records and offers loans up to 85% LTV.

Note that the most favourable rates from these specialist lenders often come via brokers, so consider consulting one for tailored advice. Do bear in mind that lending criteria can change, so it’s crucial to stay updated.

Interest Rates: What Can You Expect?

Currently, interest rates range from about 2.5% to 5.5%, whether you’re self-employed or not. If you can demonstrate reliability despite a shorter trading history, you shouldn’t be at a disadvantage compared to more established self-employed borrowers.

Specialist lenders often offer competitive rates and more flexible terms for the self-employed, as compared to traditional high-street options. For personalised advice on securing the best rates, it’s advisable to consult with a mortgage broker.

Key Takeaways

- You can get a mortgage with 2 years of self-employed accounts, although many lenders prefer three years.

- Prepare necessary documents such as SA302 forms, tax year overviews, and business bank statements. Consider having an accountant verify these.

- Work with your broker to identify the right lender for you. High-street banks like Barclays, HSBC, and Natwest, as well as specialist lenders like Kensington Mortgages and Aldermore Bank, may be options.

- Your borrowing amount will be based on your lender’s assessment of your income. Lenders usually multiply your earnings by 4 to 4.5 times to determine this.

- Pay attention to other eligibility factors like credit history, loan-to-value (LTV) ratio, age, existing debt, and property type.

- Expect interest rates to range from 2.5% to 5.5%. Specialist lenders often offer competitive rates to self-employed individuals with shorter trading histories or less-than-perfect credit.

The Bottom Line: For Your Next Steps…

Getting a mortgage while self-employed with just 2 years of accounts can be tricky, but it’s doable. The key is to get expert advice that’s right for you.

Talk to a specialised mortgage advisor. They’ll do more than find lenders who might say yes to you. They’ll look at your whole money picture, including how your business is doing, how long you’ve been at it, and your credit score.

The advisor will also think about the exact house you want to buy. This makes sure you line up with lenders that are not only likely to say yes but might also offer you better loan terms. This could save you a lot of money in the long run.

Ready to go? Fill out our quick online form. We’ll connect you to an advisor who knows how to help self-employed people like you. They’ll show you mortgage options based on how much money you make.

Get Matched With Your Dream Mortgage Advisor...

Frequently Asked Questions

Is an accountant needed for a two-year self-employed mortgage application?

Having an accountant can be beneficial for compiling the required paperwork and their verification can bolster your mortgage application. However, it’s not strictly necessary to have one if you’ve been self-employed for only two years or less.

Can I get a mortgage if I've been self-employed for just one year?

Yes, you can get a mortgage with just one year of accounts, but your options will be more limited in terms of lenders. A specialist broker can guide you to lenders who cater to applicants like you.

Can I use government schemes to help me buy a home?

Some government schemes may be available to self-employed individuals, but eligibility requirements will vary.

Can I get a mortgage if I'm a freelancer or contractor?

Yes, freelancers and contractors can also get self-employed mortgages. The requirements may differ slightly, so consulting a specialist broker is advised.