- Can You Get a Mortgage after Repossession?

- How Significant Is the Date of Your Repossession?

- How Do Lenders View Those Whoâve Experienced Repossession?

- What Happens Before and After a Repossession?

- How Much Debt Was Left After Your Repossession?

- How Does Repossession Reasons Affect Mortgage Application?

- The Impact of Repossession on Your Credit File

- Key Takeaways

- The Bottom Line

How To Get a Mortgage After Repossession? A Complete Guide

Repossession can leave a mark—not just on your credit file but on your confidence too.

You might be holding back from applying for a mortgage because you’re worried about being turned down. It’s hard to know who to trust or where to begin.

And you’re worried lenders will only see your past mistakes.

Don’t worry—it’s not the end. This guide will show you how repossession affects your chances of getting a mortgage.

You’ll learn what lenders look for, how to rebuild your credit, deal with outstanding debts, and find lenders who specialise in helping people like you.

Can You Get a Mortgage after Repossession?

Yes, you might get a mortgage after a repossession, but it can be challenging.

Success depends on various factors, like your current financial situation, mortgages available, and what the lender is looking for.

High-street lenders often play it safe and might not approve applications from people with a repossession in their history.

But don’t lose hope—specialist lenders are more flexible and willing to help people who’ve had credit issues. They’ll still assess your situation carefully, but they’re much more open to giving you a chance.

This is where a specialist broker can make a big difference. Think of them as your guide—they’ll connect you with lenders who are more likely to consider your application.

That said, you’ll need to show that you’re financially stable and ready to handle the commitment of a mortgage.

How Significant Is the Date of Your Repossession?

The time since your repossession is the most important thing lenders will consider. The longer it has been, the more likely you are to get a mortgage.

For example, if your property was repossessed last week, you should wait at least a year before applying for a mortgage. You may also have to pay higher fees if your repossession was recent.

Here’s a brief summary that sheds light on how repossession timelines could impact your mortgage application:

| Repossession Date | Deposit Needed | Potential for Mortgage |

|---|---|---|

| Less than 1 year ago | N/A | Nearly impossible |

| 1-2 years ago | approx 35% – 40% | Very challenging |

| 2-3 years ago | approx 30% – 35% | Challenging |

| 3-4 years ago | approx 15% – 20% | Possible |

| 4-5 years ago | approx 10% | Highly likely |

| 5-6 years ago | approx 10% or less | Highly likely |

| Over 6 years ago | 5% | Extremely likely |

How Do Lenders View Those Who’ve Experienced Repossession?

Typically, lenders review several factors when considering mortgage applications following repossession:

Repossession Details

The specifics of your repossession, including the date and the amount involved, are important. A recent repossession or a large outstanding debt might discourage lenders.

After-Repossession Credit Profile

How have you managed your finances since the repossession? Lenders would be interested in your financial behaviour after the event. A cleaner credit profile since the repossession can help.

Current Financial Status

Lenders will take a close look at your current financial position. A stable income, a secure job, and a consistent record of meeting credit commitments can tip the scales in your favour.

It’s important to gather information and prepare yourself before applying for a mortgage. Lenders have the final say on whether they’ll offer you a loan.

Hence, by understanding these criteria, you can tailor your application to stand a better chance of securing a mortgage after repossession.

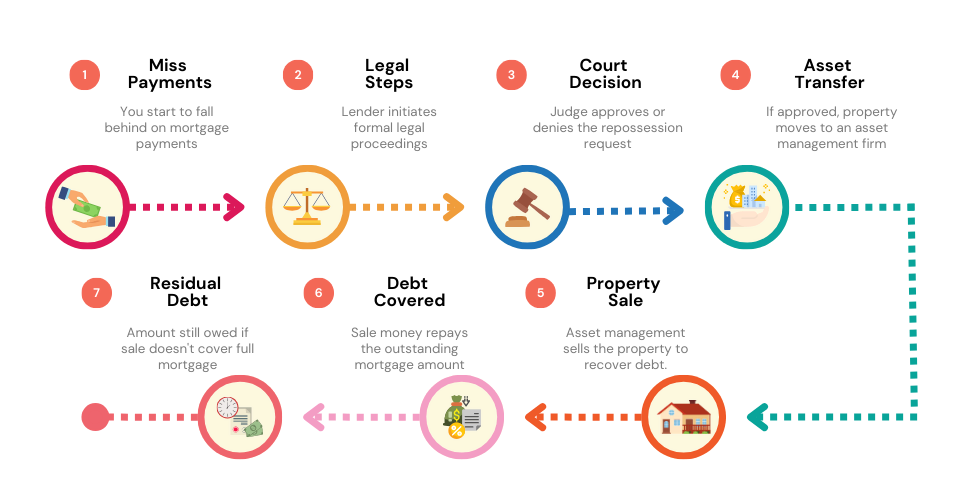

What Happens Before and After a Repossession?

Before repossession, lenders usually try to work out payment solutions with borrowers. If these attempts fail, formal proceedings start, potentially leading to court.

If a judge agrees to repossession, the property is usually transferred to an asset management company. They sell the property to recover the debt.

After the sale, the money is used to repay the outstanding mortgage. If the sale doesn’t cover the whole mortgage, a residual debt remains. This is the amount still owed to the lender.

For example, if the mortgage was £200,000, and the property sold for £180,000, the residual debt is £20,000. Your lender can pursue this residual debt, often for up to 12 years.

It’s essential to understand this process as it can help you manage any potential difficulties more effectively.

How Much Debt Was Left After Your Repossession?

The sum you defaulted on will significantly influence lenders’ decisions. It’s fairly straightforward – the larger the debt defaulted, the higher the risk you appear to potential lenders.

Therefore, a substantial repossession debt can create hurdles in securing a mortgage.

As with our example earlier, after a property is repossessed and sold, there might be a remaining debt, which is the difference between the mortgage amount and the selling price of the property. This is what we call an outstanding debt.

An outstanding debt is a repossession debt, and it will be a critical factor when you apply for a new mortgage. Having this amount can make getting mortgage approval more challenging.

Nonetheless, it’s important not to lose hope. Here are some tips on how to approach this situation:

- Settle the Outstanding Debt. If possible, try to clear the outstanding debt. Lenders are likely to look more favourably at applicants who have settled their past debts.

- Maintain a Clean Credit Profile. Pay your existing credit obligations on time. Show lenders that you’re now able to manage your financial commitments responsibly.

- Consult with a Specialist Mortgage Advisor. This can be a game-changer. Specialist mortgage advisors have the expertise and knowledge to help applicants who have been repossessed. They understand the requirements of different lenders and can guide you in crafting an application that will appeal to potential lenders.

How Does Repossession Reasons Affect Mortgage Application?

Your reasons for house repossession play a crucial role in your mortgage application. These reasons can range from financial hardship to being a victim of fraud.

No matter the reason, lenders will take it into account when assessing your eligibility.

But, it’s important to note that some lenders may not be as considerate of the circumstances surrounding your repossession.

They may see repossession as a sign of high risk, regardless of the underlying reasons. This is where evidence and expert advice can make a difference. Being able to provide documentation to support your reasons for repossession can help.

Additionally, a specialist mortgage advisor can help present your application effectively, thereby enhancing your chances of mortgage approval.

The Impact of Repossession on Your Credit File

Your credit history following a repossession can significantly impact your mortgage application. Additional credit issues such as County Court Judgements (CCJs), Individual Voluntary Arrangements (IVAs), bankruptcy, defaults, or late payments on other credits can create further complications.

Despite these challenges, showing financial stability and recovery can increase your chances of getting a mortgage.

Proving that you’re now managing your finances responsibly can make a significant difference. This could include anything from timely credit card payments to responsible financial management.

Remember, if you’ve had credit issues since your repossession, don’t despair. There are always ways to improve your situation and increase your chances of securing a mortgage.

Key Takeaways

- You can get a mortgage after a repossession, but it’s challenging. Specialist lenders are more open to consider your application, especially if you work with a specialist broker.

- The time since repossession is important. The longer it’s been (ideally 4–6+ years), the better your chances, as lenders view recent repossessions as higher risk.

- Factors like your deposit size, outstanding debt after repossession, and your financial stability (e.g., steady income and clean credit history) strongly influence approval chances.

- A specialist broker can guide you to lenders willing to consider your circumstances, but success depends on how well you meet lender criteria, mortgage availability and financial recovery.

The Bottom Line

Getting a mortgage after house repossession may seem like a tall order, but it’s not an unattainable goal. Several factors come into play in this process:

- The date of your repossession

- How your credit history has unfolded after repossession

- Your current financial standing

- The reasons behind your repossession

- Any additional credit issues

While some lenders may hesitate to offer a mortgage to those with a repossession history, others may be more understanding. Every lender has a unique set of criteria, and it’s about finding the one that is willing to consider your application.

Repossessions, late payments, CCJs, and IVAs may show on your credit file, but don’t forget – you still have room to demonstrate your financial stability and recovery.

The onus is on you to make a compelling case for your borrowing potential. And remember, your repossession date, the passage of time, and an improved credit history can all work in your favour.

Seeking a mortgage after repossession can feel like treading unfamiliar territory. That’s why specialist mortgage advisors can play a crucial role in guiding you through this process.

They can offer tailored advice, help you understand your standing with potential lenders, and assist in presenting your case effectively.

Looking for guidance tailored to your circumstances? Feel free to enquire with us, and we’ll match you with a broker who understands your unique situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is a voluntary repossession of a house in the UK?

A voluntary repossession is when a homeowner chooses to hand back the keys to their property to the mortgage lender. This usually happens when the homeowner can’t afford to keep up with the mortgage payments. It’s a difficult decision, and the property is still repossessed, but it can be seen as a last resort to control the situation.

What will happen if I stop paying the mortgage?

If you stop paying your mortgage, the lender will contact you to find out why. You may be able to arrange a new payment plan.

But if you can’t reach an agreement and continue to miss payments, the lender may start the repossession process. This could eventually lead to the sale of your home to cover the debt. It’s crucial to contact your lender as soon as possible if you’re having trouble making payments.

How many mortgage payments can you miss before repossession in the UK?

Typically, if you miss three or more mortgage payments, your lender can start the repossession process. But, lenders often don’t want to repossess homes and will work with you to find a solution.

If you’re struggling, contact your lender immediately to discuss your options. Each case is unique, so it’s essential to get advice tailored to your situation.

Where are house repossessions recorded?

House repossessions are recorded in the Land Registry and by credit reference agencies like Experian and Equifax. Local news outlets may also report repossessions. This information can influence a person’s ability to secure future credit.