- How Much Do You Need for a Mortgage Deposit?

- What Are the Additional Costs?

- How Can I Save For A Deposit Faster?

- Where Should You Save for a Mortgage Deposit?

- Beyond Saving: Ace Your Mortgage Application

- What If I Can’t Save a Big Enough Deposit?

- Beginning Your House-Hunt

- Key Takeaways

- The Bottom Line: How to Choose a Mortgage

How To Save For A Mortgage Deposit?

Saving for a deposit on your first home can be tough, but a clear plan will help you reach your goal.

Your first step? Figure out how much you need to save. 💷

In the UK, a typical mortgage deposit is at least 5% of the house price.

With average UK house prices sitting at £282,000, this means you’ll need to save at least £14,100. And the bank will lend you the rest with a mortgage. However, this depends on your income, the type of property, and location.

Generally, the lower your income, the smaller the mortgage you’ll qualify for. You can use our mortgage affordability calculator to see how much mortgage you might get.

Once you have an idea of your borrowing power, it’s time to make a plan. 📝

This guide will cover everything you need to know:

- How much to save

- Extra costs to consider

- Ways to save more efficiently

- The best savings accounts for your deposit

- Tips to improve your chances of getting a mortgage

We’ll also help you if you’re struggling to save and give you tips for house-hunting.

Let’s get started!

How Much Do You Need for a Mortgage Deposit?

We mentioned you’ll typically need at least 5% of the house price to save for a deposit.

But the final amount can change depending on the mortgage lender’s view of your finances. They’ll look at your income, credit history, and the type of property you want.

In some cases, they might ask for a bigger deposit, especially if your finances aren’t great or the house seems risky.

It’s always best to check with different lenders to see their exact requirements.

To get an idea of how much you need, research house prices in your area. Use websites like Zoopla, Rightmove, or government house price indexes.

Finally, talk to local estate agents for expert advice on your chosen area.

What Are the Additional Costs?

Saving for a mortgage isn’t just about the deposit – there are other expenses to consider:

- Stamp Duty. This tax depends on the property price and if you’re a first-time buyer. Check our guide for details, but as an example, a first-time buyer paying £450,000 would expect around £1,250 in stamp duty.

- Valuation Fee. This confirms the property value for the lender. It costs £0-£1,500 depending on the property and lender.

- Survey. A more thorough check for property issues is recommended. There are three main options:

- Condition Report: £250 (basic check)

- Homebuyer Report: £400-£1,000 (more detailed)

- Building Survey: £600-£1,500 (most in-depth)

- Legal Fees. You’ll need a solicitor to handle the legal side of buying a house. Expect to pay £850-£1,500 plus VAT, with additional fees of £300-£500 for things like Land Registry charges.

- Mortgage Fees. Lenders charge £0-£2,000 to set up the mortgage. You can sometimes add this to the mortgage but will pay interest on it.

- Broker Fee (optional). If you use a mortgage broker, they might charge £300-£500 to find you the best deal. Some work on commission and don’t charge upfront.

- Removal Costs. Moving your stuff costs £100-£1,500+ depending on how much you have and how far you’re going.

- Insurance. You’ll need building insurance (around £100-£200 a year) and probably contents insurance (around £50-£100 a year) too. The cost varies based on the property’s size and location.

- Initial Mortgage Payment. Be prepared to pay an upfront mortgage payment covering the time from buying to your first regular payment. This is usually around one month’s mortgage amount.

- Repairs and Improvements. Budget for some initial repairs or improvements, at least £1,000-£2,000.

- Ongoing Costs. Remember, your bills (gas, electricity, water, council tax) and commuting costs might change. You’ll also need to furnish and decorate your new place, so factor that in too.

How Can I Save For A Deposit Faster?

Once you’ve determined your ideal monthly savings target, it’s time to create a plan to achieve it. Here are some ideas to help you save for a deposit more quickly:

Reduce Your Bills & Unnecessary Spending

Reduce your bills and unnecessary spending to save money.

- Switch to cheaper energy tariffs if your landlord permits.

- Unplug unused appliances and use energy-efficient light bulbs to lower your electricity bill.

- If you live alone, check if you qualify for a 25% council tax discount.

- Shop around for better mobile phone and broadband deals.

- Compare home, car, and health insurance policies for better deals.

- Consider a water metre if you use less than average water, as it could be more cost-effective.

It’s also wise to review your monthly subscriptions and memberships to check if you can cut these expenses.

Cancel those you rarely use, like unused gym memberships, streaming services, and magazine subscriptions. Put the money saved towards your deposit fund.

Cut Everyday Costs

Small changes to your everyday spending can add up. Look at your bank statements to see where you can save.

For example, if you spend £10 on lunch every workday, that’s £50 a week or £2,600 a year. Packing your lunch could save you this amount and significantly boost your deposit fund.

Earn Rewards on Spending

Loyalty cards and cashback credit cards reward you for your purchases with points or money back.

Just remember to pay your balance in full each month to avoid interest charges. Using these cards responsibly can also improve your credit score.

Regularly paying your balance in full shows lenders you manage credit well, which can benefit you when you apply for a mortgage in the future.

A higher credit score may qualify you for better mortgage rates and terms, potentially saving you thousands of pounds over the life of your loan.

Consider Changing Your Living Situation

If possible, move in with family or friends to save on rent. This can significantly increase the amount you can save each month.

If that’s not an option, consider renting a cheaper place or sharing accommodation.

Increase Your Income

This is another way to boost your deposit savings.

Look for ways to earn extra money, such as a part-time job, freelancing, or selling items you no longer need. Extra income can help you reach your savings goal faster.

Keep in mind that you may have to submit a self-assessment tax return and pay income tax on any extra money you have coming in.

Save into High-Interest Accounts

Regular savings accounts and ISAs (Individual Savings Accounts) typically offer better interest rates than standard accounts.

This means your money grows quicker. Choose an account with terms that suit your needs.

To boost your deposit fund without impacting your regular budget, consider saving windfalls like bonuses, tax refunds, or unexpected cash directly into your high-interest account.

Automate Your Savings

Set up a direct debit from your current account to your savings account. This ensures you consistently save a set amount every month without forgetting.

Automating your savings reduces the temptation to spend the money.

Use Saving Apps

There are budgeting and saving apps available to help you manage your money more effectively. These apps can take several approaches.

Some automatically round up your purchases and stash the extra pennies in a savings pot, while others analyse your spending habits and suggest achievable savings goals.

But, it’s important to remember that most of these apps don’t offer interest on your saved money.

So, once you’ve built up a decent amount, it’s wise to transfer it to a high-interest account to make the most of your savings.

Where Should You Save for a Mortgage Deposit?

Save your deposit in an account that beats inflation.

You want an account that offers an interest rate that’s higher than inflation. Otherwise, your money will lose value over time.

Here are some options to consider:

1. High-Interest Savings Accounts

High-interest savings accounts are a popular choice for those saving for a mortgage deposit.

These accounts typically offer better interest rates compared to regular savings accounts, helping your savings grow faster.

Many banks in the UK offer specific savings accounts designed for first-time buyers, such as the First Home Saver Accounts.

2. Lifetime ISAs (LISAs)

The Lifetime ISA is a special type of ISA designed to help people save for their first home or for retirement.

You can deposit up to £4,000 each year, and the government will add a 25% bonus to your savings, up to a maximum of £1,000 per year.

The funds in a LISA can be withdrawn tax-free when buying your first home, provided the property value does not exceed £450,000.

3. Cash ISAs (Individual Savings Accounts)

Cash ISAs are another excellent option for saving for a mortgage deposit.

The main advantage of a Cash ISA is that the interest earned is tax-free. In the UK, you can save up to £20,000 per tax year in an ISA.

Some banks offer Help to Buy ISAs or Lifetime ISAs, which are specifically designed for first-time homebuyers and provide government bonuses on your savings.

3. Regular Savings Accounts

Regular savings accounts require you to deposit a fixed amount each month.

These accounts often offer higher interest rates than standard savings accounts but usually come with restrictions on how much you can deposit and withdraw each month.

This can help instil a disciplined saving habit, which is crucial when saving for a significant goal like a mortgage deposit.

4. Stocks and Shares ISAs

If you’re comfortable with a higher level of risk and have a longer time frame for saving, you might consider a Stocks and Shares ISA.

This option allows you to invest in the stock market, which can potentially offer higher returns than savings accounts or cash ISAs.

However, the value of your investments can go down as well as up, so it’s crucial to consider your risk tolerance and investment horizon.

5. Fixed-Rate Bonds

Fixed-rate bonds can offer higher interest rates than savings accounts in exchange for locking your money away for a set period, typically ranging from one to five years.

While this option can be beneficial for earning higher interest, it’s essential to ensure that you won’t need to access these funds until the bond matures.

Beyond Saving: Ace Your Mortgage Application

While you’re busy saving for a deposit, you can also take steps to boost your chances of getting a mortgage when you apply.

Here’s how:

- Show a steady income. Mortgage lenders favour borrowers with a reliable income from long-term employment.

- Build a good credit history. A strong credit score shows you manage money responsibly.

- Get on the electoral roll. Being registered at your current address proves residency.

- Be prepared. Having all your paperwork organised streamlines the mortgage application process.

What If I Can’t Save a Big Enough Deposit?

Even if you budget perfectly, saving for your deposit can still feel impossible. The good news is there are options:

- Guarantor Mortgages. A parent or family member can guarantee your mortgage payments if you can’t make them. This allows a smaller deposit. They might even use their own property or savings to strengthen your application.

- Gifted Deposit. Get money from a family member or friend towards your deposit. This lowers what you need to save yourself. Remember, it must be a genuine gift with no expectation of repayment. You might need written confirmation from the giver.

- 95% Mortgages. Put down just a 5% deposit with these mortgages. The interest rates will likely be higher, but it’s an option if you can handle the bigger repayments.

- Government Schemes. Several schemes can help first-time buyers. Shared Ownership lets you buy part of a property and rent the rest, reducing the upfront cost. The First Homes scheme offers discounted properties. The Mortgage Guarantee Scheme helps lenders offer 95% mortgages with a government guarantee.

- Joint Mortgages. If you’re struggling to save a deposit on your own, you could consider applying for a joint mortgage with a partner, friend, or family member. Combining your finances allows for a bigger deposit and better mortgage chances.

Beginning Your House-Hunt

When you’re ready to start looking for a home, you likely have a few preferred areas in mind.

Research house prices, quality of life, schools, and other factors in these locations to find the best fit for your needs.

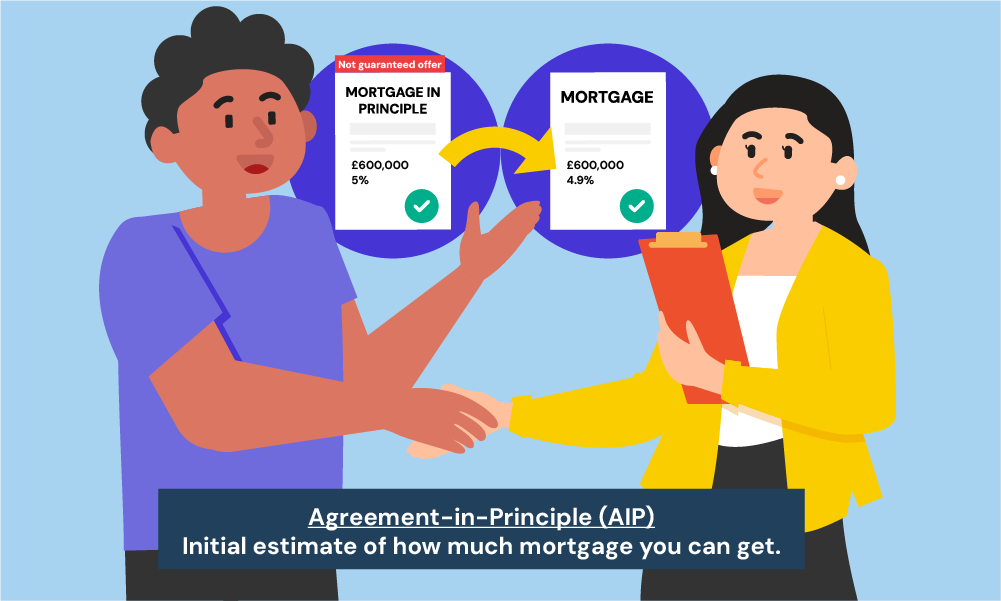

Before attending viewings, register with estate agents and consider obtaining a mortgage agreement in principle (AIP).

An AIP indicates that a lender is willing to provide you with a mortgage up to a specified amount, helping to confirm your budget and demonstrating your seriousness as a buyer.

Key Takeaways

- You usually need at least 5% of the house price as a deposit, but the exact amount depends on your finances and the lender’s requirements.

- Saving for a mortgage deposit involves more than just the deposit itself—there are extra costs like stamp duty, valuation fees, surveys, legal fees, and insurance.

- Reducing your bills, unnecessary spending, and everyday costs can help you save faster, along with earning extra money or moving in with family.

- High-interest savings accounts, ISAs, or fixed-rate bonds are good places to save your deposit, as they help grow your savings faster.

- Automating your savings and using budgeting apps can make saving easier and more consistent.

- If you can’t save enough, options like guarantor mortgages, gifted deposits, 95% mortgages, government schemes, and joint mortgages can help make buying a home possible.

The Bottom Line: How to Choose a Mortgage

Saving for a mortgage deposit takes patience, discipline, and a good plan. Finding the right mortgage deal is not different – it pays to be informed.

With a variety of mortgage options available, seeking professional advice is key. Don’t automatically choose your current bank – their deals might not be the cheapest or most suitable.

Here’s what we recommend: talk to an independent mortgage adviser, also known as a broker. Look for a whole-of-market broker who searches all available deals, not just a limited selection.

Want to find your perfect mortgage? Get in touch with us. We’ll connect you with a whole-of-market broker who will guide you through the process, secure great rates, and prepare you for your application.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Where is best to save for a mortgage?

High-interest savings accounts, Cash ISAs, and Lifetime ISAs are excellent options in the UK.

Lifetime ISAs are especially beneficial for first-time buyers due to a 25% government bonus on contributions up to £4,000 per year.

What is the best age to be mortgage-free?

Financial advisors suggest aiming to be mortgage-free by retirement age, around 60 to 65 years old.

This provides financial security and reduces living expenses during retirement. Extra payments and refinancing can help achieve this goal.