What Credit Score Do You Need For A Mortgage In The UK?

Applying for a mortgage can feel like one big guessing game when it comes to your credit score.

How high does it really need to be? Is there a magic number that will unlock the best rates? 🤔

You’ve probably heard lenders just want to see an “excellent” rating. But what actually constitutes excellent differs across the major credit agencies.

A score of 800 could be superb according to one…and merely average according to another.

The reality is no two mortgage lenders evaluate credit scores precisely the same way. Their scoring models and criteria are unique.

What one deems a dealbreaker, another may easily overlook based on the rest of your financial profile.

Instead of stressing about a specific number, it’s better to know the general ranges that most mortgage lenders use to categorise applicants.

This will help you see where you stand and identify areas for improvement, if necessary.

This guide will explain the different credit score ranges. You’ll learn the most important factors that affect mortgage approvals, not just your credit score.

We’ll also provide practical tips to improve your creditworthiness, fix past mistakes on your credit report, and show lenders you’re a reliable borrower with low risk who is a good investment for them.

Let’s get started!

What is a Credit Score?

Your credit score is a number that represents how reliable you are when it comes to borrowing money and making repayments.

It’s calculated based on your credit history–things like credit card payments, past loan repayments, missed bills, etc.

The higher the score, the better.

Credit reference agencies like Experian, Equifax and TransUnion each use their own scoring systems. So the number you see can vary between them.

What Credit Score Do I Need for a Mortgage?

There’s no single “magic number” that guarantees mortgage approval. But generally, here are the scoring ranges you need to aim for:

| Credit Status | Experian | Equifax | TransUnion |

|---|---|---|---|

| Excellent | 961-999 | 811-1000 | 781 – 850 |

| Very Good | – | 671-810 | – |

| Good | 881-960 | 531-670 | 721 – 780 |

| Fair | 721-880 | 439-530 | 661 – 720 |

| Poor | 561-720 | 0-438 | 601 – 660 |

| Very Poor | 0-560 | – | 300-600 |

An “excellent” credit score puts you in the best position to get approved for the most competitive mortgage rates.

But even with a “poor” score, you may still be able to get a mortgage – it just might have higher interest rates.

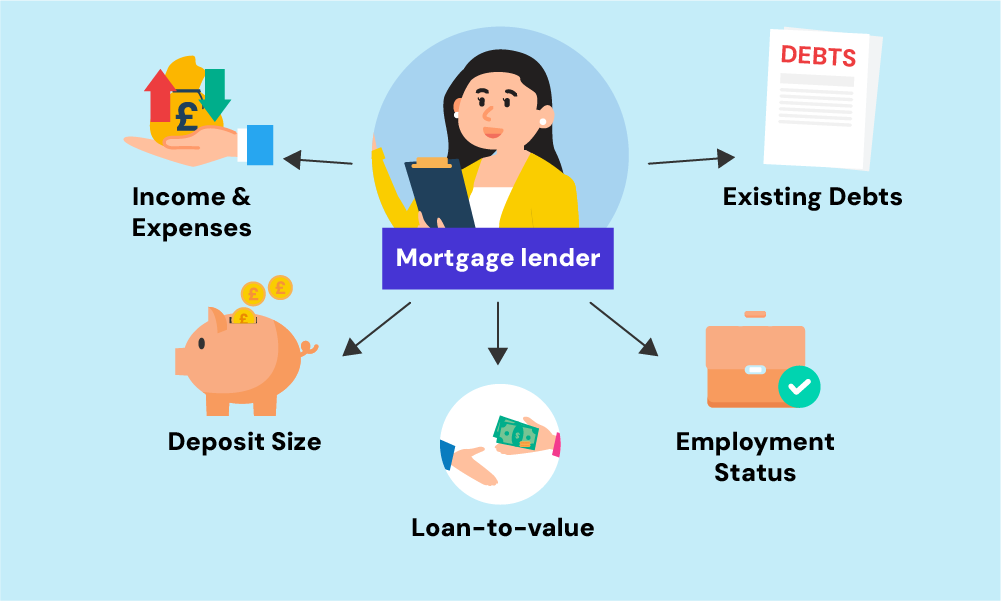

Other Factors Mortgage Lenders Consider Besides Your Credit Score

While your credit score is very important, it’s not the only thing mortgage providers look at.

They’ll also consider:

- Your income and outgoings

- How much your deposit is

- Your employment status

- The amount you want to borrow (loan-to-value ratio)

- Any other existing debts you have

So even with an excellent credit rating, you could be declined if your income isn’t high enough to afford the repayments. Conversely, a low score doesn’t necessarily mean a rejection – especially if you have a large deposit, high income and no other debts.

What Can Hurt Your Credit Score For a Mortgage?

There are certain things that can really damage your credit score and chances of mortgage approval:

- Missed or late payments on credit cards, loans, etc.

- Applying for too much credit in a short space of time

- County Court Judgements (CCJs) or bankruptcy

- Not being on the electoral roll at your current address

- Existing debt close to your credit limits

To boost your chances of mortgage success, it’s wise to minimise these before applying.

How Can I Check & Improve My Credit Score for a Mortgage?

You can get a free copy of your credit file from various CRAs such as Experian, Equifax, and TransUnion

You can also get a free financial health check here to identify areas for improvement before a mortgage application.

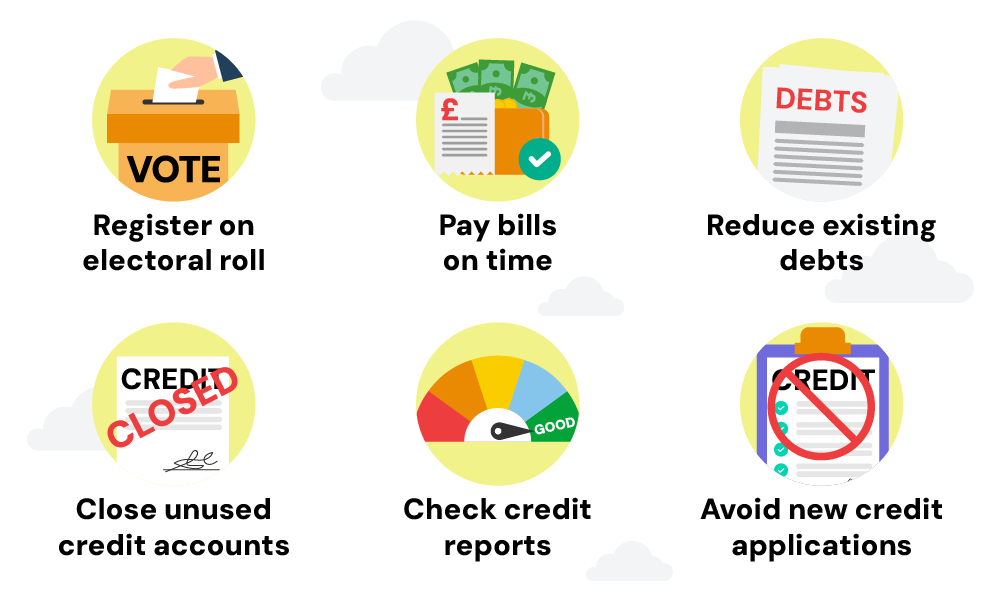

If your score needs improving, here are some tips:

- Register on the electoral roll at your current address

- Pay all bills on time, every time

- Pay down existing debts as much as possible

- Don’t apply for other new credit in the 6-12 months beforehand, as hard credit checks can lower your score and affect your mortgage approval.

- Fix any errors on your reports with the relevant lenders

- Close any unused credit accounts

Following these steps shows lenders you’re a responsible borrower – making you a lower mortgage risk.

Do All Mortgage Lenders Use Credit Scoring?

Not all mortgage providers use strict credit scoring models when assessing applications.

Some take a more holistic view, looking at the individual circumstances around any adverse credit, rather than just a numerical score.

Your age, reasons behind any credit issues and their severity are factored in. You may still be approved if the problems were isolated historical incidents.

The Bottom Line

At the end of the day, every mortgage application is unique. The “required” credit score can vary considerably based on your individual financial situation.

That’s why it’s wise to speak to an experienced mortgage broker. They’ll look at your credit reports, income, debts and future plans to recommend suitable lenders and give you the best chance of approval success.

With their expert advice and by taking proactive steps to maximise your credit score, getting that dream mortgage is an absolutely achievable goal.

Need a broker? Get in touch with us. We’ll connect you with a qualified mortgage broker who can find the BEST mortgage deals and help with your mortgage application.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a mortgage with a 450 credit score in the UK?

It is highly unlikely to get a mortgage with a 450 credit score in the UK. Lenders typically consider this a very poor credit rating, making it difficult to qualify for a mortgage.

Improving your credit score and addressing any financial issues can increase your chances of approval.

Can I get a mortgage with a credit score of 550?

Getting a mortgage with a credit score of 550 is challenging but not impossible. Some lenders specialise in offering mortgages to those with poor credit, but you may face higher interest rates and less favourable terms.

Improving your credit score before applying can help you secure better mortgage conditions.

What is the minimum credit score for a mortgage in the UK?

The minimum credit score required for a mortgage in the UK varies by lender. Generally, a score of 620 or higher is needed to qualify for most standard mortgage products.

However, some lenders might consider applicants with lower scores if they meet other criteria, such as a larger deposit or stable income.

Do you need a good credit score to buy a house in the UK?

While having a good credit score makes it easier to get a mortgage with favourable terms, it is not strictly necessary to buy a house in the UK.

Some lenders offer products for those with less-than-perfect credit, though these often come with higher interest rates and stricter terms.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.