Bridging the Gap: How 100% Bridging Loans Can Help

Think of your financial journey as a road trip. You’re cruising along, but then you hit a gap in the road—a mortgage you need to secure quickly.

A bridging loan is like a sturdy, temporary bridge that helps you cross this gap. But what if you can’t afford the ‘toll fee,’ or in real-world terms, don’t have a large deposit on hand?

That’s where a 100% bridging loan comes into play, covering the full span of the gap.

This guide will serve as your roadmap, showing you how to navigate the qualifications and risks associated with these all-encompassing loans.

Can You Get a 100% Bridging Loan?

The quick answer? Yes, you can. But:

- You must have additional assets, often in the form of property, to back your loan.

- It’s highly likely you’ll need the assistance of a broker to scout out willing lenders, as not many are open to the risk.

- Expect the loan to be more expensive because of the added risk factor to the lender.

Remember, even with these conditions, there’s no guarantee you’ll get the loan you seek. Various factors, such as the type of property, its location, your exit strategy, and more, play a role.

Want a more tailored answer? We suggest you have a talk with an expert bridging loan advisor for a free, no-obligation consultation.

To get started, simply get in touch. We’ll match you with the right bridging loan advisor to help you get a 100% bridging loan deal.

Is a 100% LTV Bridging Loan Right for You?

Before diving in, it’s crucial to evaluate whether a 100% LTV bridging loan suits your needs. You need to weigh several important factors:

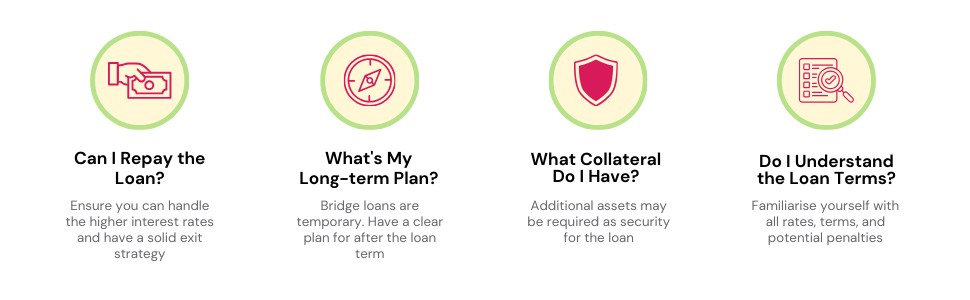

Can You Repay the Loan?

Bridge loans are short-term by nature, and meant to be paid back within a specific period. Due to this, they generally have higher interest rates compared to traditional, long-term loans.

Make sure you can cover these costs and have a robust exit strategy for loan repayment. With a 100% LTV bridging loan, the stakes are even higher because you’re borrowing the full property value without any equity.

What’s Your Long-term Plan?

Bridge loans serve as a temporary solution to a longer-term financial arrangement. What’s your plan after the loan term expires? Are you thinking of refinancing through a conventional mortgage? Or perhaps you’re planning to sell another property?

Make sure you have a clear roadmap for your financial journey.

What Collateral Do You Have?

With a 100% LTV bridging loan, you’ll need more than just the property in question as collateral. Lenders want to minimise their risk, so they’ll look for additional assets that can act as security. The more valuable and liquid your collateral, the better your chances of loan approval.

Understand the Loan Terms

Always read the fine print. Get a handle on interest rates, repayment terms, and any extra fees or penalties.

Different lenders have different conditions, so pick one that aligns with your needs. Speaking to a bridging loan advisor can save you time and potential regret later on.

Calculate Your Repayments: Know Before You Owe

High-interest rates are given with 100% LTV bridging loans.

Use our handy bridging loan calculator below to get an idea of your possible monthly payments and total interest costs. Tweak the LTV or loan term to see how it affects your repayment.

Although the calculator provides a good starting point, don’t rely solely on it. It’s always smart to consult a specialist broker who can validate the calculations and guide you to the best deal available.

The Risks of Choosing a 100% LTV Bridging Loan

Bridging loans can be a real lifesaver when you’re in a financial crunch. But like anything, they have downsides. And these downsides become more significant when you opt for a 100% LTV loan.

Here are the main risks to consider:

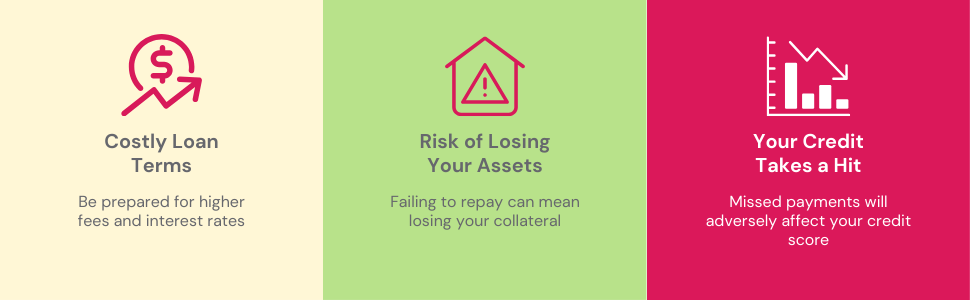

> Costly Loan Terms

100% LTV bridging loans often have higher fees and interest rates than other types. So be sure to check if your budget can handle these extra costs.

> Risk of Losing Your Assets

If you can’t pay back the loan, you stand to lose more than just the property you wanted to buy. Any other assets you’ve put up as collateral are also at risk.

> Your Credit Takes a Hit

Falling behind on payments or failing to repay the loan will hurt your credit score. A lower score can make getting another loan harder and more expensive in the future.

Making a choice to go with a 100% LTV bridging loan is a big decision. Don’t go it alone. Talk to an expert bridging loan advisor who can help you understand all the ins and outs.

What You Need to Qualify

Before applying, you need to get your paperwork in line. Here’s what lenders typically look for:

- Financial Statements

- Credit Reports

- Tax Returns

- Income Information

- Details of the Asset(s) You’re Offering as Collateral

Because it’s a 100% LTV loan, lenders are extra cautious. Be ready to provide more information at any point.

Before applying, you also have to get your collateral assessed. Lenders may ask for additional security like:

- Extra Properties

- High-value items like Jewelry or Art

- Cars or Other Valuable Vehicles

- An Investment Portfolio

How Much Will It Cost?

Bridging loans already have higher interest rates than long-term loans, like mortgages. Since you’re going for a 100% LTV, be prepared for even higher costs. These could come in the form of:

- Higher Interest Rates

- Setup Fees

- Appraisal Fees

- Underwriting Charges

You’ll likely pay a percentage of the total loan amount in fees. So yes, it will cost you more, but that’s the price for the extra flexibility and speed a bridging loan offers.

>> More about Bridging Loans Costs

What You Should Think About Before Hitting ‘Apply’

The allure of 100% financing for your property can be strong, but it’s crucial to be aware of the risks and commitments involved. Here’s what you should think about before hitting ‘apply’

- Understand that repayment periods are short, usually between 6 to 36 months. Make sure your financial plan accommodates this tight schedule.

- Expect higher interest rates, often starting at 0.4% per month and possibly going up to 2%. The rates are even higher for 100% LTV loans.

- Prepare for rigorous lender scrutiny. You’ll need thorough financial documentation and may even need to offer additional assets as collateral.

- Consult an experienced mortgage advisor for personalised advice. They can help you secure better terms and navigate the loan process smoothly.

The Bottom Line

Securing a 100% LTV bridging loan presents its own unique challenges, as not all lenders are willing to offer such high-value loans. This is where the expertise of a broker becomes invaluable.

Brokers specialising in bridging loans have extensive networks of lenders, some of whom are willing to consider a 100% LTV scenario. Rather than approaching lenders on your own, it’s smarter to seek advice from those who know the ropes.

Ready to take the next step? Simply, fill out this quick form. And we’ll set up a free, no-obligation chat with a seasoned bridging loan expert who can fast-track your path to the financing you need.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I use a bridging loan for a house deposit?

Absolutely. If you’re expecting funds from selling your current home or receiving a bonus, you can use a bridging loan to make a down payment on a new property. You can then pay off the loan once that money comes through.

Is it easier to get a 90% LTV bridging loan than a 100% LTV one?

Indeed. While 70-75% LTV is standard for bridging loans, some lenders offer up to 80% or 90% LTV. These loans are generally easier to secure than 100% LTV loans, though fewer lenders offer them.

Can I get a 100% LTV bridging loan from a mainstream lender?

Typically not. Most providers of 100% LTV bridging loans are specialist lenders who mainly work through brokers. These lenders can usually provide better rates and terms.

What's the standard LTV for a bridge loan?

Bridge loans most commonly have an LTV range of 70 to 80%. If you’re looking for a 100% LTV bridge loan, you’ll likely need to offer extra collateral.

What interest rate can I expect on a bridging loan?

Interest on bridging loans isn’t usually paid monthly like traditional mortgages. Instead, it’s often rolled into the final payment. Interest rates depend on the lender’s terms and can vary widely. They’re usually quoted as monthly rates and tend to be higher than standard mortgage rates.

What's the highest amount I can borrow with a bridging loan?

The amount you can borrow with a bridging loan generally ranges from £5,000 to an impressive £25 million. However, this amount varies by lender and hinges on your financial situation and the value of your collateral.

For major property projects or acquisitions, some lenders may offer loans into the millions. Consulting with a broker who specialises in bridging loans is a key step in determining the maximum amount you can borrow.