- What Is Auction Finance?

- How Does Auction Finance Work?

- Why Buy a Property at Auction?

- Are You Eligible for Auction Finance?

- What You Need for the Application

- What Can You Buy with Auction Finance?

- What Will Your Interest Rate Be?

- What Fees Come Along with Auction Finance?

- How Much Deposit Do You Need?

- How Much Can You Borrow?

- How Do You Apply for Auction Finance?

- What Are Other Options Besides Auction Finance?

- The Bottom Line

Auction Finance: How To Buy an Auction Property in 28 Days

Securing a property at auction is a race against the clock.

Why? As soon as you win a bid, you must pay a 10% deposit immediately. Then you have just 28 days to pay the rest.

Traditional mortgages or bank loans often fail to meet these tight deadlines, putting your deposit and dream property at risk.

If you’re short on time, auction finance is your go-to option. These short-term loans can be arranged within 28 days. But how do you secure auction finance, and how can you avoid pitfalls?

This comprehensive guide will discuss the process, walk you through the application steps, and share key tips for landing a solid deal.

What Is Auction Finance?

Auction finance is a specialised type of bridging loan created for buying property at auction. Unlike traditional mortgages that take a long time to process, auction finance is designed to fit the 28-day payment window that most property auctions require.

If you win the bid, you’ll need to pay 10% of the total property price right there and then.

The remaining balance must be paid within the next 28 days. If you can’t meet this deadline, you’ll lose your deposit and the chance to own the property.

How Does Auction Finance Work?

Auction finance offers a fast, short-term loan that’s usually based on interest only, meaning you don’t have to make monthly payments.

The application process is quick, often completed within 14 days, which works well within the 28-day auction time frame.

To apply successfully, you’ll need a substantial deposit and a plan for repaying the loan, known as an exit strategy. Loan terms commonly last between 1 to 18 months, but some extend up to 36 months.

An exit strategy is your plan for paying back the loan when the term ends. This could involve shifting to a traditional mortgage, selling the secured property, or disposing of another asset.

Knowing your exit strategy is crucial for securing auction finance, as it assures lenders that you have a plan in place to repay the loan.

Features You Should Know:

- Max loan to value (LTV) goes up to 85%

- Interest rates start from 0.43% a month

- Both 1st and 2nd charges, even 3rd charges considered

- Loan terms span from 1 to 36 months (a maximum of 12 months for regulated loans)

- Time to complete ranges between 5 days and 3 weeks

Why Buy a Property at Auction?

Here are some awesome benefits of buying at auction:

- Grab a Bargain – You might snag a property at a steal of a price.

- Quick Closures – You close the deal fast and the seller can’t back out.

- Transparent Bidding – You see everyone else’s bids, so you know exactly what’s happening.

- Know Before You Go – The legal pack is ready before the auction, so you’re not walking into unknown territory.

- Big Savings – Properties at auction can be a lot cheaper—sometimes 30% less than market value.

Are You Eligible for Auction Finance?

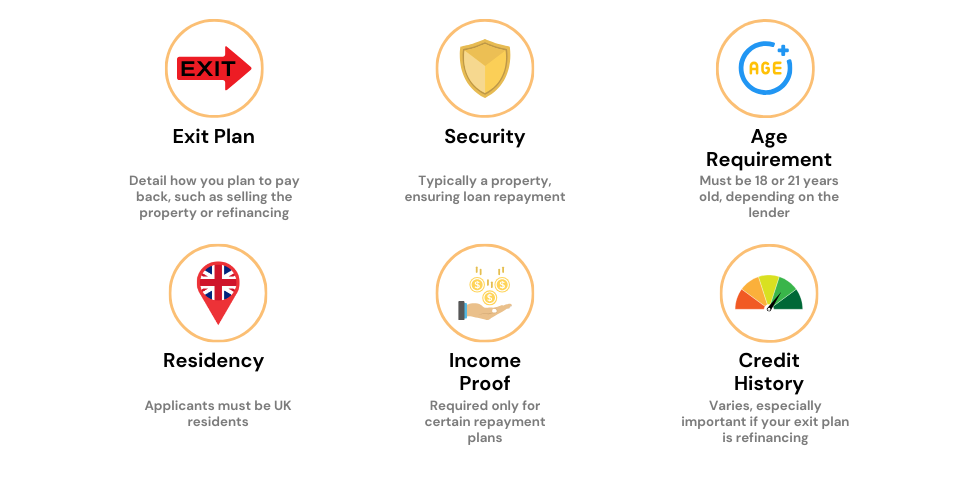

When assessing your eligibility for auction finance, lenders look at several factors:

- Exit Strategy. The stronger your plan for selling or remortgaging the property, the better your chances of landing a good deal. If you’re considering a development project, having experience will likely work in your favour.

- Deposit. While most lenders require a deposit between 10-25%, putting down more can land you a lower interest rate.

- Credit Score. A clean credit history can improve your chances, but a less-than-perfect credit score isn’t a complete deal-breaker, as long as it doesn’t jeopardise your exit strategy.

- Experience in Property. Although first-time buyers can get auction finance under the right circumstances, having prior experience with similar property transactions boosts your eligibility. Owning other properties can also serve as extra security, making you even more creditworthy.

- Age Requirements. Minimum applicant age is 18 years, with no maximum age limit.

- Geographical Scope. Available across England, Scotland, Wales, and Northern Ireland.

- Property Types. Both residential and commercial properties or land are acceptable.

Individuals, partnerships, LLPs, Ltd companies, offshore companies, foreign nationals, and pension funds can all apply for auction finance.

Remember, auction finance is unregulated, giving lenders the freedom to evaluate each application individually. So, even if you don’t tick every box, don’t worry—there may still be options available for you.

What You Need for the Application

Obtaining auction finance isn’t a walk in the park; you’ll need to furnish the following information:

- Property Specifics – The property’s details and address

- Auction Details – A copy of the auction sale particulars

- Repayment Plan – Details of your exit strategy

- Personal Details – Your name, address, and date of birth

- Future Plans – What you intend to do with the property

What Can You Buy with Auction Finance?

Auction finance isn’t just for purchasing your dream house; it’s a versatile financial tool with a broad range of applications.

Fancy buying a retail space? You can do that. Have your eye on a ramshackle property that needs a facelift? Auction finance has got you covered.

Types of Properties You Can Purchase:

- Residential Properties

- Retail Units

- Property in a Poor State of Repair

- HMOs (Houses in Multiple Occupations)

- Semi-Commercial Property

- Land: Whether it comes with planning permission or without, you’re sorted.

- Farms: Tailor-made for agricultural enterprises.

- Leisure Complexes for recreational or business ventures.

- Hotels and Guest Houses

- Pubs

- Care Homes for those looking to invest in the healthcare sector.

- Shops

- Offices

What Will Your Interest Rate Be?

When it comes to auction finance, interest rates generally hover between 0.43% and 0.85% per month. But that’s not the whole story.

The amount you can borrow relative to the property’s value, known as the loan-to-value (LTV) ratio, plays a crucial role in determining your rate.

If you’re borrowing less than 50% of the property’s value, you stand a good chance of securing those appealing low rates.

The reason is simple: the more equity you have in the property, the less of a risk you pose to lenders, making them more likely to offer you a favourable rate.

Now, let’s talk about how lenders usually charge this interest. They typically employ one of three methods:

- Monthly – In this case, you’ll make interest payments each month, with the principal amount due at the end of the term.

- Rolled Up – The interest is accumulated monthly and then added to your original loan amount. You’ll need to pay this total at the end of the term.

- Retained – Here, the lender estimates your total owed amount at the start, adding your monthly interest payments to your loan amount. This interest is essentially ‘borrowed,’ often for a specified period, and then the entire sum is due at the end.

Lastly, if you’re in the market for residential property, you’ve got another reason to celebrate. Interest rates are often lower for homes compared to commercial properties or land.

What Fees Come Along with Auction Finance?

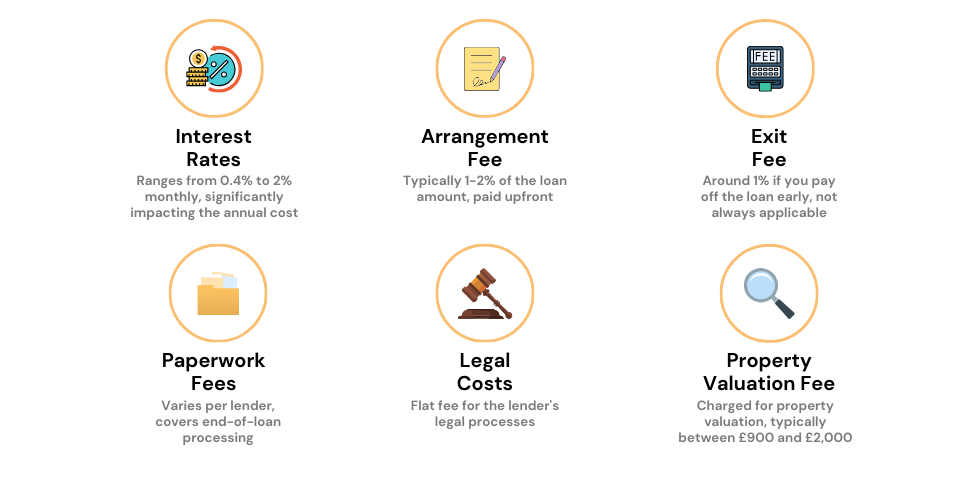

Going for auction finance isn’t just about the interest rates. There are other fees you’ll need to factor in:

- Lender Arrangement Fee – Usually, you’ll pay around 1-2% of the loan amount. This fee can often be tacked onto your loan.

- Lender Exit Fee – Some lenders might charge you an exit fee, equivalent to one month’s interest when you pay off your loan. But, good news—it’s becoming a rare practice.

- Broker Fees – While we don’t charge for our services, some brokers might. These fees generally range between £500 and 1.5% of the loan amount.

- Valuation Fee – Sometimes, a chartered surveyor will need to inspect your property. Alternatively, an electronic valuation could save you some cash.

- Legal Fees – Get ready to pay the lawyers! You’re responsible for covering both your legal fees and those of the lender.

>> More about The Costs of Bridging Loans

How Much Deposit Do You Need?

To secure a property at an auction, you’ll usually need a minimum of a 10% deposit. If you can’t manage that, another asset with similar value could serve as your security.

The more you can put down as a deposit, the better your odds of getting a good interest rate.

How Much Can You Borrow?

With auction finance, loans start at £25,000 and there’s no cap on how much you can borrow.

Typically, you can borrow up to 80% of the property’s value, but with extra collateral, you could even go up to 100%. Planning some renovations? In certain cases, you might qualify for up to 85% LTV.

Remember, with auction finance, you have the flexibility and speed to secure almost any type of property. So, start planning and make your next big move!

To get an idea of your future repayments, use our handy calculator below. Change the LTV or loan term to see how it affects your repayment.

[Embedded Auction Finance Calculator]

Although the calculator provides a good starting point, don’t rely solely on it. It’s always smart to consult a specialist broker who can validate the calculations and guide you to the best deal available.

How Do You Apply for Auction Finance?

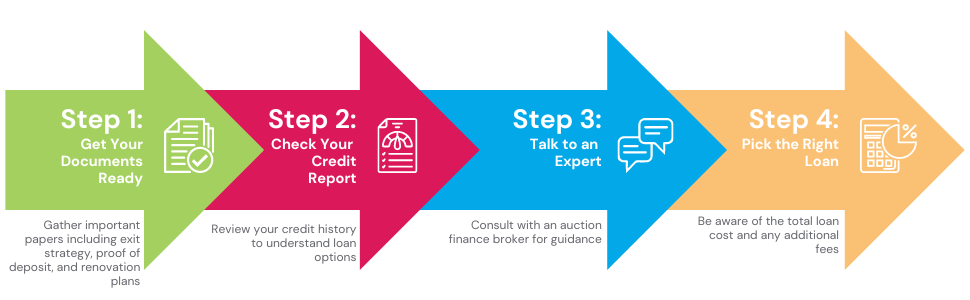

If you’re eyeing a property at auction, take a step-by-step approach to applying for auction finance. Plan out the property you want to buy, how much you can afford, and what you’ll need to borrow.

Here’s a quick guide to make sure you’re on track:

- Get Your Documents Ready. Gather all the important papers you’ll need. This includes your exit strategy, proof of deposit, and your plans for the property. If renovations are in the picture, jot down your budget and work plans.

- Check Your Credit Report. Your credit history can affect your loan options. Download your credit report so you and your broker can go through it together.

- Talk to an Expert. Consult with an experienced auction finance broker. They’ll guide you through your options and help you land the best deal.

- Pick the Right Loan. Understand the total cost of your loan, and be aware of any hidden fees or early repayment penalties.

What Are Other Options Besides Auction Finance?

You could also look into residential mortgages, buy-to-let mortgages, or commercial mortgages.

These might be cheaper but come with a catch—they usually won’t finalise within the 28-day auction window. So, always have a Plan B ready if you’re considering other financing routes.

The Bottom Line

Choosing the right auction finance broker can make or break your chances of not only getting approved but also securing a deal that’s favourable for you.

Brokers often have areas where they shine, be it in commercial properties, assisting first-time buyers, or dealing with land purchases. The trick lies in pairing up with a broker who’s a dab hand at what you specifically need.

Keen to proceed? First, get in touch with us.

We provide a broker-matching service that sets you up with an expert tailored to your needs. From there, we’ll arrange a free, no-obligation consultation to put you on the fast track to the financing you’re after.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How fast can I get auction finance?

You can expect a quick turnaround with auction finance. Most applicants receive their funds in as little as 5 to 21 days.

In some special cases, you can even secure your financing in less than a week. This expedited process is usually possible when you have all your necessary documents ready and an experienced broker to guide you through the quick approval process.

Is 100% auction finance an option?

Certainly, you can secure 100% auction finance if you’re willing to use another property as extra security. Remember that most auction houses require a 10% deposit immediately after a successful bid, so plan accordingly.

Is auction finance accessible for first-time buyers?

Yes, first-time buyers can access auction finance. However, proceed with caution as buying a property at auction carries inherent risks.

Do I require a valuation report for auction finance?

While most lenders ask for a valuation report, there are exceptions. Some lenders might rely on the auction purchase price or a desktop ‘AVM’ valuation to decide on the loan amount.

Can I make a conditional bid at auction?

In theory, yes. But keep in mind that you’ll usually need to pay your deposit right away. If you win a bid at an auction, you can secure auction finance within the typical 28-day timeframe, assuming your application doesn’t hit any snags.

Can auction finance be used for repossession auctions?

Yes, as long as you have a viable exit strategy for the asset or property you’re bidding on. Auction finance is flexible and can be used for any legal transaction.

Is auction finance suitable for car purchases?

Yes, it’s possible to use auction finance to buy a car, provided you can show a viable exit strategy. However, remember that the loan would need to be secured against a property, not the car. If you’re considering financing a car purchase at auction, consult a specialist advisor to explore all available options.