Bridging Loans Calculator: Know How Much You Can Borrow

So you’ve found the perfect property, and now you need to secure the funds quickly.

Bridging loans can be your financial lifesaver, offering you anywhere from £5,000 to £25 million.

However, the amount you can borrow hinges on factors like your property’s value and your own financial health. Our bridging loan calculator takes the guesswork out of the equation, providing you with a tailored estimate in no time.

Keep reading to find out more.

How Much Can You Borrow with a Bridging Loan?

Use our handy calculator below to get a rough guide of your borrowing amount.

It’s simple – just enter some basic information and you’ll get an instant, personalised estimate.

And yes, it’s that quick: takes less than 30 seconds!

[Embedded Calculator for Bridging Loans Calculator]

But hold on, this is just your first step. Calculators are great tools, but they can’t account for everything.

Maybe you’re considering buying a fixer-upper, or you’re trying to secure a property before someone else snatches it up. Lenders often look at the reason behind the loan, so having more context could be crucial.

That’s why talking to a bridging finance broker can make a world of difference. They’ll take your unique situation into account and give you a clearer picture of what your bridging loan might look like.

To get started, simply send an inquiry. We’ll set up a free and no-obligation chat with the right loan broker who can give you the full picture of your loan options.

How To Make the Most of Our Bridging Loan Calculator?

Our Bridging Loan Calculator isn’t just easy to use; it’s downright friendly. You won’t need to enter any personal details to get started.

Here’s a quick guide:

- Input the amount you want to borrow.

- Choose the term length for your repayment.

- Add vital info about your finances, like your property value and existing mortgage balance.

Once done, the calculator instantly delivers a full breakdown: estimated monthly repayments, interest rates, and any upfront costs you might face.

Feel free to run the numbers as many times as you’d like to find the loan amount and term that work best for you. If the calculator can’t generate a loan option based on your details, it’ll flag what might be the issue, allowing you to adjust and explore other solutions.

Key Points to Remember:

- Be Accurate – The more precise you are with your details, the better your estimate will be.

- Not One-Size-Fits-All – While our calculator provides general guidance, each lender may have unique criteria. For more nuanced advice, speaking to an advisor could be invaluable.

- It’s Just a Guideline – Don’t forget, these numbers are purely estimates. For exact figures and customised options, consult a bridging loan advisor.

Bridging Loans: Costs, Rates, and Calculations Explained

What Are Bridging Loans?

Bridging loans are your quick-fix solution when you need cash fast, especially when you’re trying to buy one property but haven’t yet sold another. These loans are usually short-term, making them a versatile tool to ‘bridge the gap’ in your finances.

But remember, these are secured loans. That means you need to put up something valuable—usually a property—as a guarantee.

So before you leap in, think it through.

How Much Does a Bridging Loans Cost?

With bridging finance costs, you need to look at two main things: the interest rate and any extra fees. Here’s an overview:

> Bridging loan interest rates

Bridging loans generally come with higher interest rates compared to traditional mortgages.

Why?

They’re riskier for lenders and are designed to be short-term. You might find rates starting from 0.4% to 2% per month, but this can vary based on your situation.

> Factors Affecting Your Interest Rate

As discussed, the rate you’ll get isn’t random. It depends on several factors:

- Your Loan-to-Value (LTV)

- Your exit strategy (how you plan to repay the loan)

- The property’s condition

These are just the starting points that lenders look at when setting your rate.

How Is Bridging Loan Interest Calculated?

Bridging loan interests are often shown as monthly rates. That’s because these loans are short-term, usually lasting between 12 and 18 months. You’ll pay interest based on your monthly balance.

If you manage to pay off your loan earlier, say in 6 months, you’ll only pay interest for those 6 months—even if your original term was 12 months.

The best part? Most lenders won’t slap you with a fee for paying early. (No early repayment fees!)

What About Interest Calculation Methods?

When it comes to bridging loans, interest can be handled in one of three ways:

- Monthly Payments – Just like an interest-only mortgage, you pay the interest each month, and it doesn’t get added to your loan balance. But you’ll need to show you can afford these payments.

- Rolled-Up – Here, the interest is calculated monthly and added to your loan balance. This means your outstanding balance grows over time.

- Retained – In this option, you borrow the interest upfront for a set period. Once you pay back the loan, any unused interest is returned to you.

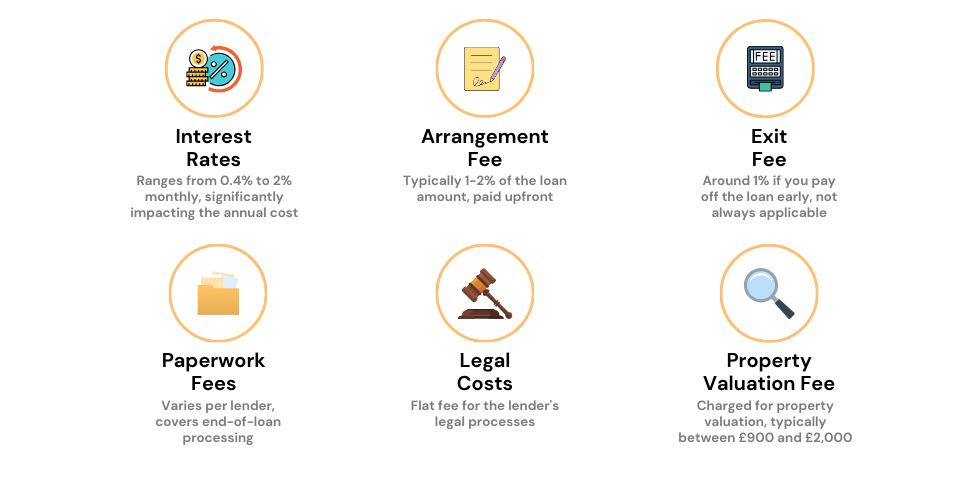

What Bridging Loan Fees and Costs Are There?

Apart from the interest rates, you need to budget for budget for various fees. These costs can differ based on your lender and financial circumstances, but here are some typical fees you should be ready for:

- Arrangement Fee – For setting up the loan, lenders usually charge an initial setup fee, often around 1-2% of the loan’s total amount. This fee can often be incorporated into the loan itself.

- Administrative Fee – After securing the loan, expect an admin fee from your lender. This fee commonly stands around £145.

- Valuation Fee – Before giving you the loan, lenders will want a valuation of the property you’re using as collateral. The cost for this service varies, but it can range from £900 to over £2000, based on your lender and how urgently you need the funds.

- Legal Expenses – Lenders will hire a solicitor to take care of the legal aspects of the loan. You’ll need to cover these legal costs, which generally start at £750, plus any additional disbursements.

- Closing Admin Fee – When your loan term comes to an end, some lenders charge a closing admin fee to cover tasks like removing their name from the property’s legal documentation.

- Brokerage Fees – If you decide to use a broker to find the best loan deal, keep in mind that brokerage fees can fluctuate widely. In some cases, these fees could even cost you thousands of pounds.

Being aware of these fees helps you to grasp the full financial picture of a bridging loan, allowing you to plan your finances more accurately.

>> More About the Costs of Bridging Loans

How Bridging Loans are Calculated: An Example

To help put the above rates and fees into perspective, let’s walk through an example.

Imagine you need to borrow £100,000 for a term of 6 months. Here’s how the numbers would break down:

| Description | Amount (£) | Monthly Rate (%) | Notes |

|---|---|---|---|

| Principal Loan Amount | £100,000 | – | Initial amount you’re borrowing |

| Loan Term | 6 months | – | Duration of the loan |

| Monthly Interest Rate | – | 0.5% | Charged monthly |

| Initial Setup Fee | £2,000 | – | 2% of the loan amount |

| Administrative Fee | £145 | – | Fixed fee |

| Valuation Fee | £500 | – | Fixed fee |

| Legal Expenses | £750 | – | Starting fee + disbursements |

| Description | Calculation Method | Total Cost (£) |

|---|---|---|

| Principal Loan Amount | – | £100,000 |

| Interest: | ||

| Monthly Interest | £100,000 x 0.5% | £500 |

| Total Interest for 6 months | £500 x 6 | £3,000 |

| Fees: | ||

| Initial Setup Fee | £100,000 x 2% | £2,000 |

| Administrative Fee | Fixed fee | £145 |

| Valuation Fee | Fixed fee | £500 |

| Legal Expenses | Starting fee + disbursements | £750 |

| Total Costs | Sum of all costs | £106,395 |

Notes:

- Principal Loan Amount – This is the initial amount you’re borrowing.

- Interest – You’ll pay a monthly interest rate on the loan. In this example, the rate is 0.5%, which translates to £500 per month. Over 6 months, you’ll pay £3,000 in interest.

- Fees – These include the initial setup fee, administrative fee, valuation fee, and legal expenses.

- Total Costs – This is the sum of the principal loan amount, interest, and all associated fees.

Digging Deeper: Bridging Loans Explained

What Can You Use a Bridging Loan For?

You can use a bridging loan for various legal purposes. Here are some common situations:

- Your property chain breaks, but you still want to buy your dream home.

- You win a property at auction and need quick cash.

- You want to buy a property that’s not mortgage-ready.

What Limits Your Loan Amount?

Your loan amount has limits, set by factors like your credit score, the property’s condition, and necessary repair costs. Lenders also have their rules that determine your loan size.

Is Scotland Different for Bridging Loans?

No, Scotland generally follows the same rules for bridging loans. However, if you’re buying in remote areas, fewer lenders may be available. Brokers can help you find lenders who do operate in Scotland.

How Does a Bridging Mortgage Work?

Often, people use a bridging loan to eventually get a regular mortgage. This is known as a bridging mortgage. Lenders use a special calculator to figure out your initial loan amount.

Then, they use a standard mortgage calculator to determine how much of your loan will convert into a long-term mortgage.

Lenders also examine your income, spending habits, existing debts, credit score, and age. Usually, your interest rate drops when you switch from a bridging loan to a long-term mortgage. Bridging loans last between 6 months and 2 years, while a typical mortgage term is 25 years.

Key Takeaways

- You can use the bridging loan calculator for a instant estimate of your bridging loan borrowing amount. But, for exact figures and personalised options speak with a bridging loan advisor

- Bridging loans are short-term, secured loans meant to “bridge the gap” in finances, typically involving property.

- Interest rates on bridging loans are generally higher due to their short-term nature and higher risk, with rates ranging from 0.4% to 2% per month.

- Bridging loan costs include interest, arrangement fees, administrative fees, valuation fees, legal expenses, and potentially brokerage fees.

- Loan amounts are influenced by factors like credit score, property condition, and lender rules.

Consider consulting a bridging finance broker for tailored advice, as they account for your unique circumstances.

To get started, reach out to us. We’ll link you up with a reputable bridging loan advisor to help you make an informed decision.

Get Matched With Your Dream Mortgage Advisor...

Frequently Asked Questions

Do I need a broker for a bridging loan?

While it’s not a requirement, it’s highly recommended. A broker can find the best loan for your situation and even negotiate better terms with lenders. Remember, the amount you can borrow will largely depend on your property’s equity.

How fast can I get a bridging loan?

Some loans can be ready in just 48 hours after your initial application. But generally, expect the process to take between two to four weeks.

What's a bridging loan exit plan?

An exit plan is simply your strategy for repaying the loan. Often, people plan to sell a property to pay off the loan.

Can I use a bridging loan to buy auction property?

Yes, you can. One of the perks of bridging loans is their speed, making them ideal for auction purchases.

Is bad credit a deal-breaker for a bridging loan?

Not necessarily. If the loan doesn’t require monthly payments, your credit history is less of a concern. What matters is the property’s value and your exit plan. So even with bad credit, a bridging loan could still be an option for you