- What is a Commercial Bridging Loan?

- What Sorts of Property Can You Finance?

- Why Choose a Bridging Loan Over a Mortgage?

- The Pros and Cons of Commercial Bridging Loans

- How Much Can I Borrow?

- What are the Interest Rates to Expect?

- How to Bag the Best Loan Rates?

- Eligibility Factors

- How to Apply for a Commercial Bridging Loan

- Alternative Route: Bridging to Commercial Mortgages

- The Bottom Line

What You Need To Know About Commercial Bridging Loans

Are you a business owner in need of quick funds?

Perhaps you’re an investor eyeing a promising property but lacking the immediate cash flow to make it happen. Commercial bridging loans may just be the lifeline you’re looking for.

In this guide, we’ll explore what commercial bridging loans are, how they can benefit your business, and what you need to know before taking one out.

What is a Commercial Bridging Loan?

A commercial bridging loan is a short-term loan, typically lasting up to 18 months, that businesses can use to finance the purchase of commercial property.

Unlike traditional loans, bridging loans do not require monthly payments. Instead, the interest rolls up and is repaid when the loan is settled

This loan is open to everyone, whether you’re an individual, a small business, or even a large company.

Here are some examples of how commercial bridging loans can be used:

- To purchase a commercial property while waiting for a long-term loan to be approved

- To bridge the gap between the sale of one commercial property and the purchase of another

- To finance the renovation of a commercial property

- To cover unexpected expenses related to the purchase or renovation of a commercial property

What Sorts of Property Can You Finance?

You can use bridging loans for a variety of properties including:

- Offices or professional spaces

- Pubs, eateries, and cafes

- Hotels and guest houses

- Retail spaces and business parks

- Factories and industrial warehouses

- Unique residential investments like large HMOs

- Mixed-use or special-purpose properties like care homes or places of worship

Why Choose a Bridging Loan Over a Mortgage?

Quick Cash

Sometimes, opportunities come knocking, and you need money fast. Maybe you’re bidding on a property at auction, and there’s no time to wait for mortgage approval.

A bridging loan can get you the funds in days, not months.

Flexibility

Let’s say the property you’re eyeing isn’t in the best shape. Traditional mortgages might turn you away, but bridging loans welcome you with open arms.

You can take the loan, fix the place up, and then switch to a mortgage later.

Short-Term Commitment

If you know you’ll get a big payout soon, like from selling another property, a bridging loan could be a great fit.

These loans can last from one month to two years, giving you enough time to gather the funds to pay it back.

The Pros and Cons of Commercial Bridging Loans

Commercial bridging loans come with both advantages and disadvantages. Here’s what you should know to make an informed decision.

Pros

- Quick Funds. Bridging loans offer fast access to money, often within a few days.

- Flexible Criteria. These loans have less stringent requirements than traditional mortgages, making them accessible to more people.

- Tailored Terms. Lenders can adjust the conditions of the loan to suit your specific needs.

- Specialised Lenders. Only certain lenders offer these loans, often tailoring deals to fit your project’s size and duration.

Cons

- High Costs. Bridging loans typically have higher interest rates compared to other loans.

- Repossession Risk. If you can’t repay the loan, you could lose the property used as collateral.

- Lack of Regulation. These loans are not regulated by the Financial Conduct Authority, although some lenders still assess your ability to repay.

- Variable Rates. The interest rates are often individually determined, meaning they can vary widely based on your circumstances.

How Much Can I Borrow?

The loan amount you can secure varies widely, from as low as £5,000 to an astonishing £25 million. The amount depends on two key factors: the value of your property and your financial standing.

Lenders generally offer up to 75% of your property’s value as a loan. In some cases, if the loan is a first charge, you could qualify for an even higher amount.

To get a better grasp of your potential loan repayments, you can utilise our bridging loan calculator here.

What are the Interest Rates to Expect?

Commercial bridging loans tend to have higher interest rates compared to residential bridging loans.

The reason is pretty straightforward: commercial loans are riskier for lenders. Unstable markets, variable income, and the added costs of running a business all contribute to this risk, and lenders bump up the rates to cover themselves.

In terms of actual numbers, you’ll often find rates from about 1% per month up to 1.75% per month or even more.

The specific rate you’ll get depends on your lender, the quality of your collateral, how stable your business is financially, and how good your credit score is.

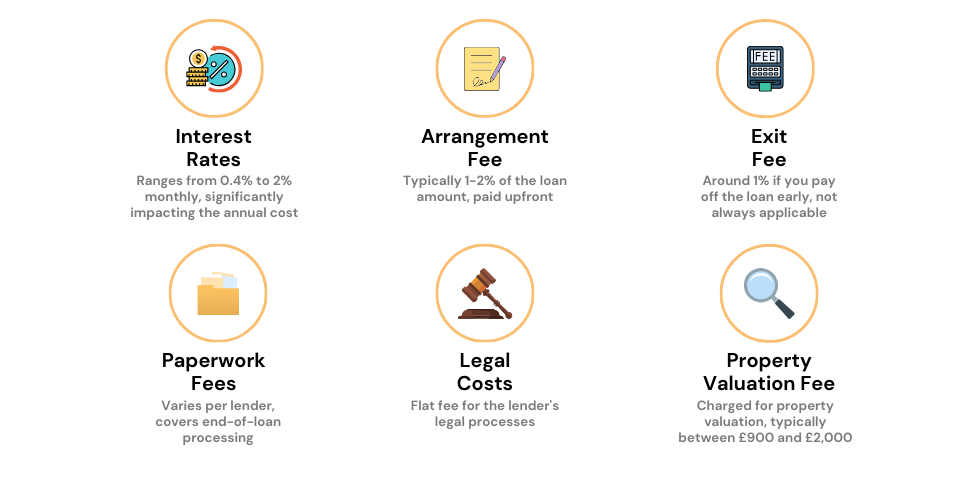

And don’t forget, the interest rate isn’t the whole story. You’ll also likely have to pay for additional fees such as:

- Lender arrangement fee – This is typically 1-2% of the loan amount.

- Exit fee – This is becoming less common, but some lenders may charge an exit fee equal to one month’s interest.

- Broker fees – Broker fees vary, but are typically around 1% of the loan amount.

- Valuation fee – This fee is paid to a chartered surveyor early in the process and is typically around £500.

- Legal fees – You will be expected to cover your own and the lender’s legal fees. Legal fees can vary depending on the complexity of the transaction but are typically around £1000-£2000.

These can all add up to the overall cost of the loan, making it pricier than it first seems. For the most up-to-date and personalised information, it’s best to consult a bridging loan broker or lender directly.

>> More about the Cost of a Bridging Loan

How to Bag the Best Loan Rates?

You don’t have to settle for sky-high interest rates. Use these tips to snag a deal that won’t break the bank.

- Make a Hefty Deposit – The bigger your initial deposit, the better the rate you’re likely to get. Bridging loans typically go up to a loan-to-value ratio of 75%, but lower ratios like 50% can get you a much better rate.

- Hire a Specialist – Get a bridging finance broker. They have strong connections with lenders and can secure you at a great rate.

- Add More Security – You can offer another property as extra security, not just the one you plan to buy. This strategy can get you an even better rate.

- Lender Compatibility – Since only specialised lenders offer these loans, look for one that aligns with your project’s size and duration for the best terms.

Eligibility Factors

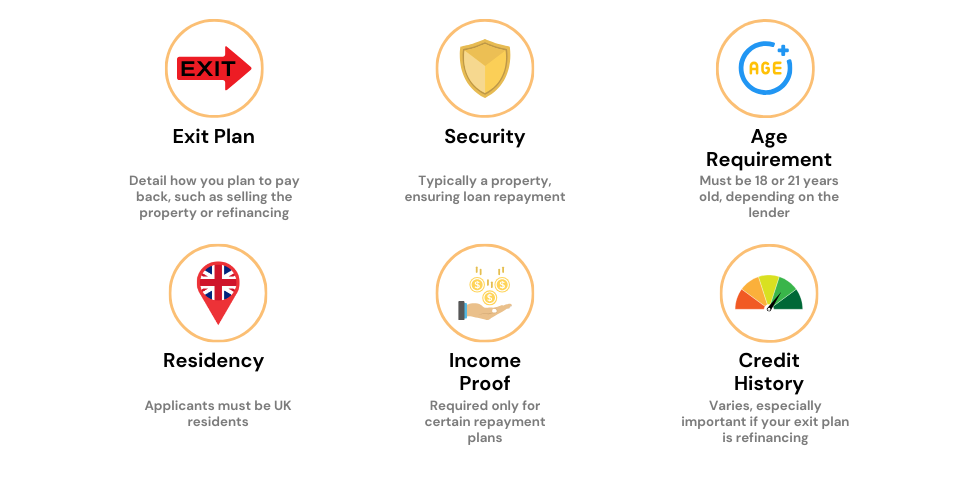

When it comes to securing a commercial bridging loan, lenders look at various factors to make their decision.

- Exit Plan – Your repayment strategy holds significant weight. Whether you plan to sell the property or transition to a traditional mortgage, the lender may assess factors like the property’s location and market liquidity. They may also consider any renovations needed before you can get a long-term mortgage.

- Credit Score – A solid credit score can help but isn’t a deal-breaker. Lenders evaluate your credit history in combination with other elements like your exit plan.

- Business Finances – If you’re applying through a business, you’ll need to present your financial statements.

- Property Experience – Your history in property management or development matters, especially for complex projects. Lenders may ask for evidence of successful past ventures.

How to Apply for a Commercial Bridging Loan

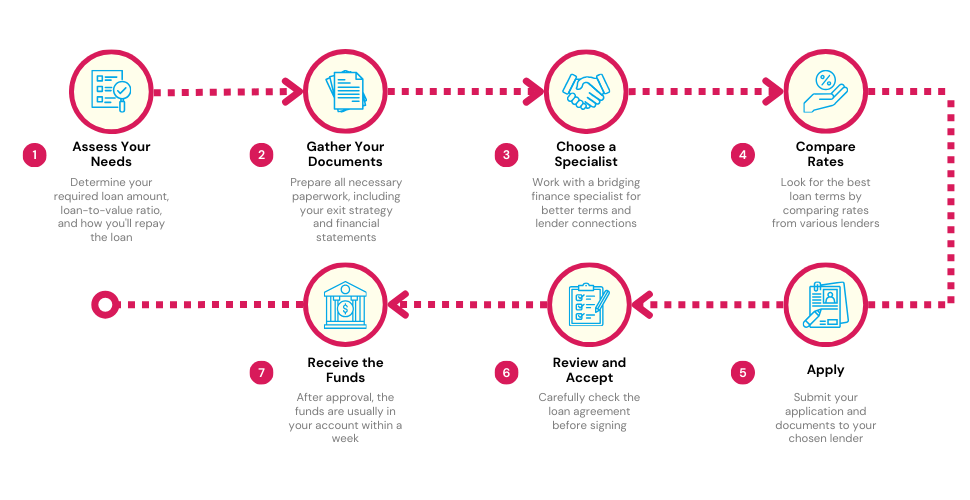

If you’ve decided a commercial bridging loan is the right move for you, here’s how you can secure one:

1. Assess Your Needs

Know what you’re looking for.

Determine the loan amount, the loan-to-value ratio, and your exit strategy. Make sure you’re clear on how you’ll repay the loan, whether that’s by selling the property or securing a traditional mortgage.

2. Gather Your Documents

Prepare all the necessary paperwork to speed up the approval process. Here’s what you’ll typically need:

- Exit Strategy Documentation – A detailed plan outlining how you intend to repay the loan.

- Business Financial Statements – Profit and loss accounts, balance sheets, and cash flow statements.

- Personal and Business Bank Statements – Usually covering the last 3 to 6 months.

- Proof of Income – Salary slips, tax returns (for self-employed), or other income evidence.

- Information about the property or Property Valuation – Recent valuation of the property you intend to purchase or use as collateral.

- Lease copies if the property is rented out

- Identification – Government-issued ID, such as a passport or driver’s licence.

3. Choose a Specialist

Work with a bridging finance specialist. These brokers have strong ties with lenders and can negotiate better terms for you.

4. Compare Rates

Don’t settle for the first lender you meet. Compare rates from different lenders to find the most attractive terms. Look for low-interest rates and fees, and read reviews to check the lender’s reputation.

5. Apply

Once you’ve chosen a lender, fill out the application form and submit your documents.

Expect a credit check and possibly a property valuation. If everything checks out, you’ll get your loan offer.

6. Review and Accept

Go through the loan agreement carefully. Make sure all the terms match what you’ve discussed with the lender or your broker. If everything is in order, sign the agreement.

7. Receive the Funds

Once the agreement is signed and all the checks are completed, the lender will release the funds. You can usually expect the money in your account within a week, sometimes even sooner.

Alternative Route: Bridging to Commercial Mortgages

A bridging-to-commercial mortgage is a strategy where you initially take out a bridging loan and transition to a traditional commercial mortgage when the time is right.

This option is particularly useful if you’re not currently eligible for a commercial mortgage—maybe you have a poor credit history that you’ll be sorting out soon or are awaiting a substantial return on investment.

Using a bridging loan, you can secure the property now and give yourself the breathing room to qualify for a more permanent financing solution later.

You have the flexibility to stick with the same lender for both the bridging loan and the commercial mortgage or switch to another if you find more favourable rates.

The Bottom Line

Deciding to opt for a commercial bridging loan is no small feat. Sure, the quick cash and flexibility are tempting, but it’s crucial to weigh your options carefully.

Ask yourself: is this the best financing route for me, or would a commercial mortgage better suit my needs?

Also, have a solid exit plan in place for loan repayment, and understand the total costs involved—from interest rates to various fees.

If you’re feeling a bit overwhelmed with all these considerations, you’re not alone. That’s why turning to an expert is a smart move.

A specialised bridging finance broker can provide you with invaluable insights tailored to your situation. They can clarify the terms, help you understand the costs, and guide you through the intricacies of your loan options.

And if you’re eyeing a commercial mortgage down the line, make sure your broker can assist you there too. Expertise in this niche area is rare, but we’ve got you covered.

We can help you find that expert. Simply, fill out this form, and we’ll introduce you to the right broker who can speed up the process and help you find the best deal.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long is the process to get a commercial bridging loan?

Normally, it takes about 10-14 days from start to finish. However, with all the paperwork in order, some loans can be finalised on the same day.

How to choose the right lender for a commercial bridging loan?

Commercial bridging loans are a niche product, so finding the right lender can be a challenge. Working with a seasoned broker can speed up the process and even save you money, as some brokers don’t charge a fee.

What different kinds of bridging loans are available?

There are a variety of types of bridging loans available to suit different needs.

For example, first-charge loans are commonly used if there is no other mortgage in place. Second-charge loans can be used if there is already a mortgage on the property.

Open bridging loans with no fixed repayment date and closed bridging loans with a fixed repayment period are also available. Each type of bridging loan has its own set of terms and conditions, so it is important to choose the one that matches your financial goals and exit plan.