- What Is A Buy To Let Remortgage?

- Why Should You Remortgage Your Buy-To-Let?

- Times To Hold Off On Remortgaging

- Am I Eligible?

- Do I Need To Pay A Deposit?

- How Much Can I Borrow On A Buy-To-Let Remortgage?

- Key Considerations Before You Remortgage

- What Interest Rates Should I Expect?

- What Are The Costs?

- Who Offers Buy-To-Let Remortgages?

- Remortgaging A Buy-To-Let To Release Equity

- Can I Remortgage A Buy-To-Let With Bad Credit?

- Remortgaging A Residential To Buy-To-Let Mortgage

- How Long Does Remortgaging Take?

- Key Takeaways

- The Bottom Line: How To Remortgage and Find The Best Deal?

An In-Depth Guide To Buy-To-Let Remortgages in 2025

As an investor, you don’t want get stuck in a deal that costs more than your rental earnings.

If your current fixed-rate deal is ending soon or you want to save money on mortgage payments, remortgaging your buy-to-let property can be the key.

This guide will explain everything you need to know about buy-to-let remortgages and how it can benefit you as a landlord.

What Is A Buy To Let Remortgage?

Just like a regular remortgage, a buy-to-let remortgage lets you swap your existing BTL mortgage with a new deal.

Investors often remortgage to grab better interest rates, free up property equity, or find a mortgage that fits their needs more closely.

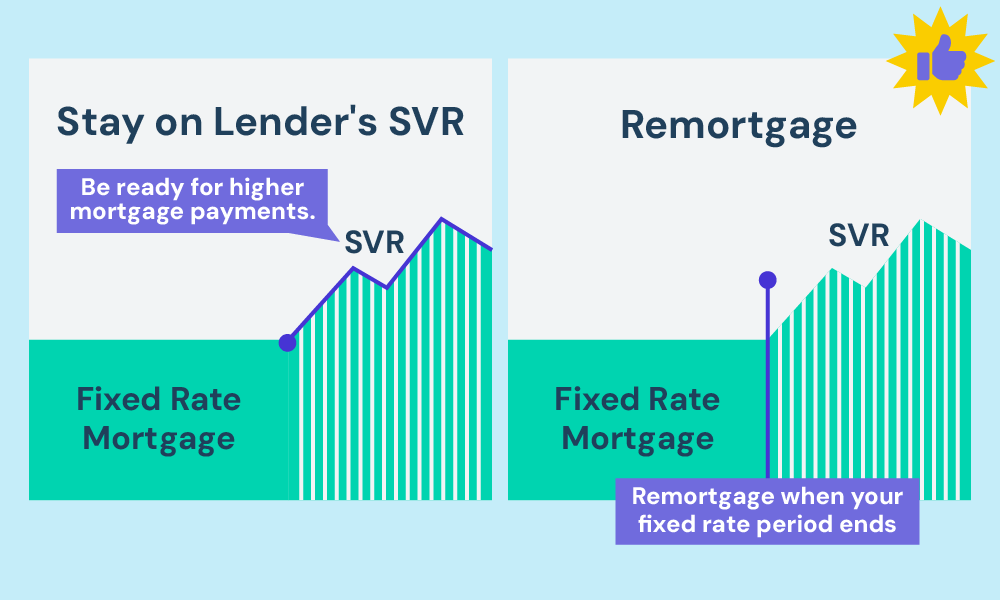

One key point to remember is when your fixed-rate deal ends, you’ll usually switch to the lender’s standard variable rate (SVR), which is often higher.

This is because SVRs can change with the lender’s interest rates, without following the Bank of England’s base rate directly, making them less predictable and often more expensive.

To avoid early repayment fees, which can be between 1% to 5% of your loan, it’s wise to wait for your current deal to end before you remortgage.

Why Should You Remortgage Your Buy-To-Let?

The main reason why most people remortgage is to save money.

As we’ve discussed, once your current fixed deal ends you’ll automatically move to your lender’s standard variable rate (SVR), which can cost you more.

And as a landlord, you also have the same goal – get a cheaper deal and pay lower interest rates.

Especially these days, you can’t deduct mortgage rates from your rental income to reduce your income tax. With the changes in tax relief on mortgage rates last April 2020, you can only credit a 20% basic rate of income tax.

Upgrading your property can also be a reason. If your property’s value has increased, you could release equity for improvements.

One smart move is investing in green upgrades. This could include anything from better insulation to more efficient heating systems.

In the UK, rental properties must follow the Energy Performance Certificate (EPC) standards.

Right now, your property needs at least an E rating to be rented out. However, there’s talk of changing the law to require a C rating by 2025 for new tenancies and by 2028 for all tenancies.

Not hitting these marks could mean hefty fines. Making energy-efficient upgrades now might save you a lot of hassle and expense down the line.

Plus, these upgrades can further increase your property’s value and might even allow you to ask for higher rents.

Another reason is to raise a deposit for buying another property.

If you’re expanding your portfolio, you might need to move to a specialist lender, especially if you’re buying multiple properties.

These lenders may charge higher rates but can help cover costs like the stamp duty surcharge for additional properties.

Debt consolidation is another reason landlords choose to remortgage. It’s a way to reduce monthly outgoings by paying off high-interest debts.

But, be cautious as it might mean paying more over time.

Lastly, you could remortgage to buy out a partner or invest in new opportunities.

Beyond these popular reasons, you might also consider remortgage a buy-to-let for the following reasons:

- You want to switch from an interest-only to a repayment mortgage (or vice-versa)

- You’re after a mortgage that offers more flexibility, like the ability to make overpayments or take payment holidays, which can help manage your finances better.

- Your circumstances have changed. Perhaps your rental income has significantly increased since you first got your mortgage, or you’re planning for retirement. Such changes might mean it’s time to look over your financial strategy, including your buy-to-let mortgages.

- You need to free up some cash for personal reasons, be it for education fees, wedding costs, or bolstering your retirement savings.

- You’re not too happy with your current lender and fancy a change.

These considerations often require the expertise of specialist buy-to-let mortgage lenders rather than your usual high-street bank.

This is where a mortgage broker becomes invaluable, helping you sift through your options to find the most suitable deal for your needs.

Times To Hold Off On Remortgaging

Sometimes, holding off on a remortgage can be the smarter choice. Here are a few reasons why:

- You might face high early repayment charges on your current mortgage. A good strategy is to begin looking into remortgaging about 3 months before your fixed deal ends. Most lenders let you arrange this in advance, giving you a bit of leeway for the switch.

- If the value of your property has dropped, getting a good remortgage deal could be tricky.

- Exit fees can also take a bite out of your budget. These are charges you might need to pay your current lender for leaving your deal early. Weigh these costs against the benefits of the new mortgage to see if switching is worthwhile.

- You might already be on a fantastic deal. If your current rate is unbeatable, staying put could be your best bet.

- The state of the buy-to-let mortgage market might not be in your favour. Rising interest rates, a drop in your income, or a dip in your credit score are all signs that waiting could be wise.

- If you’re nearly done with your mortgage, and your outstanding balance is low, the fees for switching could outweigh any savings.

Am I Eligible?

To be eligible for a buy-to-let remortgage, you need to tick a few boxes. Here’s what’s needed:

- You must own the property you’re planning to remortgage.

- You need enough equity built up in your property, usually around 25% or more. The more equity, the better the remortgage deal you could get.

- Your rental income usually needs to be 125-145% of your mortgage payments. Lenders use this to check if you can cover the mortgage.

- You have a good credit score. Lenders will check your credit history to see how reliably you’ve managed debts and payments in the past.

- Some lenders might require you to have a minimum personal income outside of your rental earnings.

- There might be age restrictions, both at the time of applying and by the time the mortgage term ends.

- The type of property you’re letting out can affect your eligibility. Some lenders have restrictions on property types.

Meeting these criteria doesn’t guarantee acceptance, but it’s a solid start. Each lender has their specific requirements, so it’s worth shopping around or consulting a mortgage broker to find the best deal for you.

Do I Need To Pay A Deposit?

The short answer is no, but here’s where equity plays a big part.

Equity is what’s left when you subtract the mortgage you owe from your property’s value.

Suppose your property is valued at £200,000 and you have an outstanding mortgage balance of £150,000.

The difference between your property’s value and what you owe — in this case, £50,000 — is known as equity. In remortgaging, the equity in your property acts similarly to a deposit.

For a buy-to-let remortgage, having at least 25% equity is typically required. So, with your property valued at £200,000, having £50,000 in equity meets this threshold.

The more equity you have, the better the mortgage deals you can access.

So, instead of thinking about saving for another deposit, consider how the equity in your property can work in your favour.

How Much Can I Borrow On A Buy-To-Let Remortgage?

The amount you can borrow is mainly based on your property’s value and the rental income it generates.

Lenders use a rental coverage ratio, wanting your rent to be 125%-145% of your mortgage repayments.

For instance, a £1,000 monthly mortgage means you should charge £1,250 to £1,450 in rent. This ensures you can cover both the mortgage and property maintenance costs.

They’ll also conduct a rental stress test.

For example, with an expected annual rent of £22,500 and a 125% coverage ratio, the rent must cover an annual mortgage payment of £18,000, equating to £1,500 monthly. Here’s the calculation:

- Annual Rental Income / Coverage Ratio = Maximum Annual Mortgage Payment

- £22,500 / 1.25 = £18,000

- £18,000 / 12 = £1,500 per month

In a 25-year term scenario, you might borrow up to £450,000, but this is an estimate.

Another thing they consider is your property’s value to determine your loan-to-value. For buy-to-let remortgages, lenders typically offer LTV ratios up to 75-80%.

So, if your property is currently valued at £200,000, you could potentially secure a remortgage loan ranging from £150,000 to £160,000. Lower LTV ratios mean you’ve got more equity, potentially unlocking better deals.

Your personal income and credit score, the property type, and its condition might also influence how much you can borrow. Each lender’s specific requirements and their take on the buy-to-let market further affect the loan amount.

For a clearer estimate of your borrowing capacity, try the calculator below.

[Embedded buy to let mortgage calculator]

Remember, this is just a guide. The actual amount varies based on your circumstances and the lender’s criteria. For personalised advice, consider speaking with a buy-to-let mortgage advisor.

Key Considerations Before You Remortgage

Before you decide to remortgage your buy-to-let property, there are several factors you should think about.

These considerations will help ensure you make a decision that aligns with your financial goals and current situation.

- Interest Rates. Check the current market to see if you can secure a lower interest rate than your existing deal. A lower rate could reduce your monthly payments and save you money over time.

- Lender Fees. Different lenders charge different fees for remortgaging. It’s worth comparing these costs as they can add up and impact the overall cost-effectiveness of switching.

- Long-term Investment Goals. Reflect on your long-term objectives for your property. Whether it’s building equity, expanding your portfolio, or securing a steady income, ensure your remortgaging decision supports these aims.

- Rental Yield. Consider how remortgaging might affect your rental yield. Lower interest rates could mean higher profits from your rental income, but additional fees could offset these gains.

What Interest Rates Should I Expect?

Interest Rates for buy-to-let (BTL) remortgages vary widely. These rates are influenced by current market trends, which fluctuate based on economic conditions.

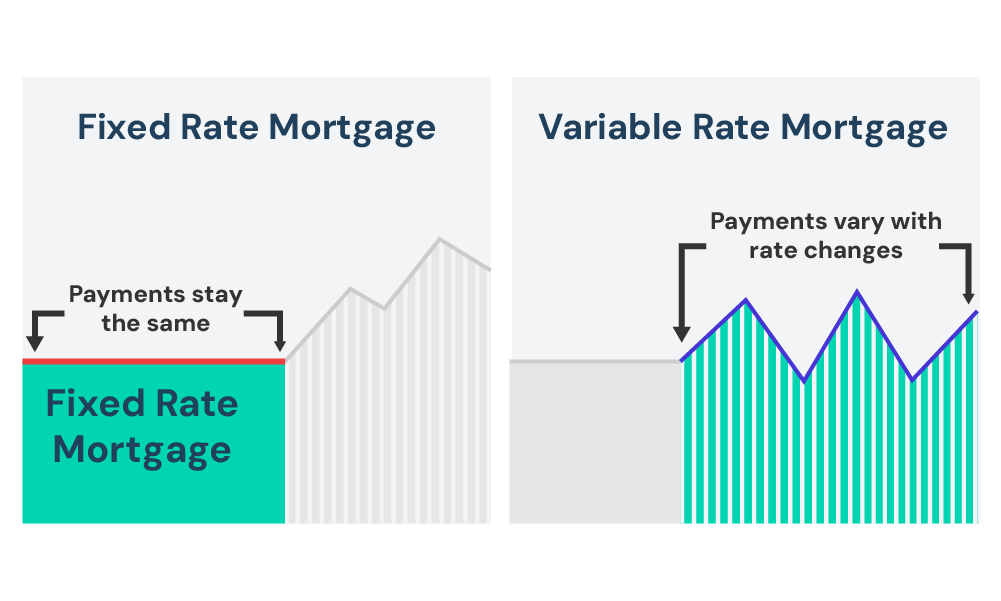

Understanding the difference between fixed-rate and variable-rate mortgages is key.

A fixed-rate mortgage keeps your interest rate steady for a set time, like two, five, or ten years. Your monthly payments won’t change during this period.

Pros

- Safe from rising interest rates.

- Easy to budget with consistent payments.

- Security knowing your rate stays the same.

Cons

- Initial rates might be higher.

- You won’t benefit if rates drop.

- There might be fees for switching early.

On the flip side, variable-rate mortgages can change, meaning your monthly payments might vary, usually based on the Bank of England’s base rate, which reflects the UK’s economic health.

Pros

- If rates drop, your repayments could decrease, saving you money.

- Offers flexibility, as you’re not locked into one rate.

Cons

- Your payments could increase if rates rise, making budgeting harder.

- Uncertainty can be stressful, as you don’t know what your future payments might be.

What Are The Costs?

Remortgaging involves several costs, and understanding these will help you budget more effectively. Here’s a breakdown of potential fees and expenses:

- Application Fee – Lenders charge this for processing your application. It varies but expect around £100-£250. Sometimes, you can add this to your mortgage, spreading the cost over time.

- Valuation Fee – This fee is for the lender to check how much your property is worth. It can range from £150 to over £1,500, depending on your property’s size and value.

- Legal Fees – You’ll need a solicitor or conveyancer to handle the legal side of things. This could cost between £500 and £1,500. Some deals come with free legal services, which can save you money.

- Booking Fee – To reserve your mortgage rate, some lenders ask for a booking fee, usually between £99 and £250. Remember, this fee is often non-refundable, even if the deal falls through.

- Arrangement Fee – This is for setting up your mortgage and can be one of the larger costs, ranging from £0 to over £2,000. Adding it to your mortgage could mean paying more interest in the long run.

- Early Repayment Charge – If you’re switching mortgages before your current deal ends, you might face this charge. It’s typically a percentage of your remaining mortgage, so it could be quite a large sum.

- Exit Fees – Finally, when you leave your current mortgage, there might be an exit fee, usually around £50 to £300. This covers the admin of closing your account.

Who Offers Buy-To-Let Remortgages?

Many banks and financial companies in the UK offer buy-to-let remortgages.

Well-known lenders such as NatWest, Barclays, Nationwide, Royal Bank of Scotland (RBS), TSB, Halifax, Accord, Santander, and HSBC have a range of options.

They have different remortgage options designed to meet what property investors are looking for.

Whether you need a fresh deal as your current one is ending, or you want to free up some money tied up in your property for new investments or to spruce up your place, you’ll find a lender that suits your needs.

Remortgaging A Buy-To-Let To Release Equity

You can remortgage your buy-to-let property to release cash for investments or upgrades. This means taking out a new loan based on the increased value of your property.

But be careful–Remortgaging often means higher repayments. Make sure your rental income covers these costs comfortably.

To remortgage, you’ll need enough equity in your property. Lenders typically allow borrowing up to 85% of the value, but this can vary.

Shop around to find the best remortgage deal for your situation. Consider different lenders and their offers. This way, you’ll make an informed decision that suits your finances.

Can I Remortgage A Buy-To-Let With Bad Credit?

Yes, you may be able to remortgage your buy-to-let even with bad credit. Here’s what to do:

- Check your credit report for errors and fix them. This can quickly boost your credit score.

- Find lenders specialising in bad credit mortgages. They’re more likely to approve of you and offer suitable deals.

- Increase your deposit or the equity in your property. This lowers the risk for the lender.

- Consider using a mortgage broker. They find good deals for people with bad credit and guide you through the process.

It’s important to know that even with help from a specialist broker, there’s no guarantee you’ll be able to remortgage.

Approval depends on your financial situation, how well you meet the lender’s criteria, and what mortgage options are available at the time.

Remortgaging A Residential To Buy-To-Let Mortgage

There are two ways to remortgage a residential to a buy-to-let:

- Get permission from your current lender; or

- Apply for a new buy-to-let mortgage from a different lender.

The same criteria apply–the expected rent needs to comfortably cover the mortgage– usually 125% to 145% of the payment. They’ll also consider your income and credit history.

This is a good option if you’re moving but want to keep your property as an investment, or if you’ve inherited a property or are buying a new home and want to rent out your old one.

Be aware of some conditions. Some lenders may not accept first-time landlords or might require you to stay with them for the buy-to-let mortgage. Look around or talk to a mortgage advisor to find the best option for you.

How Long Does Remortgaging Take?

Remortgaging your buy-to-let property is a process that can vary in length. Typically, it takes around 4 to 8 weeks from application to completion.

However, several factors can influence this timeline.

Property valuation is one such factor; the lender needs to assess your property’s current market value. Legal checks are another necessary step, ensuring all legal aspects are in order.

Lastly, the lender’s processing times can differ, affecting how quickly you can move through the remortgaging steps.

Being prepared with all the required documents can help speed up the process.

Key Takeaways

- Remortgaging your current buy-to-let mortgage can help you save money with better interest rates, free up property equity for improvements or expansions, and align your mortgage with your goals.

- You’ll need at least 25% equity in your property, a solid rental income covering 125%-145% of mortgage payments, and a good credit score. Some lenders may require additional income or specific property types.

- Avoid remortgaging before your fixed deal ends to dodge early repayment charges. Start exploring options about 3-6 months before your deal expires to ensure a smooth switch.

The Bottom Line: How To Remortgage and Find The Best Deal?

Remortgaging a buy-to-let involves a few key steps.

Start by gathering all the necessary documents, such as proof of income, identification, and details about your current mortgage and property.

Next, compare offers from different lenders to find the best deal for your situation. This is where a buy-to-let mortgage broker can make a big difference.

They can help you navigate through the options, understanding the small details that can have a big impact on your mortgage terms.

Consulting with a buy-to-let broker can not only save you time but also money. They have access to deals that might not be available directly to you and can advise on the best approach for your specific circumstances.

If you’re looking to apply or simply want more information, don’t hesitate to reach out to us. We can match you with a buy-to-let mortgage broker who’s just right for your needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is the LTV on a BTL remortgage?

Loan-to-Value (LTV) ratio represents the proportion of your property’s value that you can borrow against.

In BTL remortgages, the LTV ratio affects your interest rates and the terms of your mortgage. A lower LTV usually means better rates because the lender sees it as a lower risk.

What is the highest LTV buy to let mortgage?

Currently, the market offers high LTV BTL mortgages, some going up to 75-85%. These products are designed for borrowers looking to maximise their leverage.

However, higher LTVs come with higher interest rates and might require additional security. It’s important to consider your financial stability and investment strategy before opting for a high LTV mortgage.