- What Is An Investment Property Mortgage?

- What Counts As Investment Property?

- How To Finance Rental Properties: Mortgage Loan Types

- Who Can Apply?

- Rental Property Mortgage Rates Explained

- How Much Can You Borrow?

- Who Offers Investment Mortgages?

- Are You Ready to Invest in Property? Here’s How to Tell

- How To Apply For Investment Property Mortgages?

- Key Takeaways

- The Bottom Line

What You Need To Know About Investment Property Mortgage

Have you ever dreamed of earning money while you sleep?

Picture this: each morning, you wake to see new deposits in your account from your rental properties. This newfound freedom lets you spend your time and energy on what you truly enjoy.

That’s the power of passive income—earning without daily effort.

This is why many Brits want to own rental properties. And if you’re in this boat, this guide is for you.

We’ll dive into ways to finance rentals and give practical tips to make sure you’re ready to invest.

Sounds good?

Let’s get started!

What Is An Investment Property Mortgage?

An investment property mortgage lets you borrow money to buy a property that will make you money, typically through rent or resale.

Unlike a regular mortgage for your own home, this loan is for a property you won’t live in yourself.

What Counts As Investment Property?

As we’ve discussed, an investment property is a property you rent out for income. These properties come in various forms, each with unique pros and cons. This includes:

- Residential Investment Properties. These include rental homes, apartments, and student housing. They offer steady income through rent but may require ongoing maintenance and management.

- Commercial Investment Properties. These are spaces used for business purposes, like offices, shops, and warehouses. They often yield higher rents but might face longer vacancy periods.

- Raw Land. Buying undeveloped land can be a long-term investment opportunity. While it lacks immediate income, its value could significantly increase over time. However, this type of investment carries higher risks and requires thorough market research.

How To Finance Rental Properties: Mortgage Loan Types

There are many ways to invest in rental properties, from cash purchases to partnering with other investors.

But for mortgages, here are the types you can secure:

These are the go-to for purchasing rental properties. BTL mortgages cater specifically to landlords looking to rent out their properties. The interest rates for BTL mortgages can vary, so shopping around is wise.

House of Multiple Occupancy (HMO) Mortgages

If you plan to rent your property to three or more tenants from different families, you’ll need an HMO mortgage. These properties typically yield higher rental incomes but come with stricter regulations.

For those looking to rent out their property on a short-term basis, like vacation homes, Holiday Let mortgages are ideal. They accommodate the unique cash flow and occupancy rates of holiday rentals.

This type suits investors aiming to buy business premises to lease out. Whether it’s an office space, a retail shop, or a warehouse, Commercial BTL mortgages can back your business property ambitions.

Overseas BTL Mortgages

For UK investors wanting to own a rental property abroad, Overseas BTL mortgages are the answer. However, be prepared for varying regulations and market conditions in different countries.

Also known as ‘bridge loans’, these are short-term funding options for investors looking to renovate and flip a property quickly. They are not typical mortgages but can be crucial for certain investment strategies.

Who Can Apply?

If you’re considering an investment property mortgage, you’ll need to meet certain criteria.

Here’s a rundown of the eligibility requirements:

- Your deposit should cover 25% of the property’s value or more.

- Most lenders usually require the potential rental income to be 125-145% of your mortgage payments.

- Some lenders might require you to have a minimum annual income, often around £25,000.

- You have a good credit history.

- A low Debt to Income Ratio to show lenders you can manage additional mortgage payments.

- Your property type, condition, and location should meet the lender’s criteria.

- Some lenders require landlord experience (First-time landlords might face stricter criteria or higher rates, but this isn’t always the case.)

- Be at least 18 years old or older.

Meeting these criteria doesn’t guarantee approval, but it’s a solid start. Lenders will also consider the property’s location, condition, and marketability when deciding.

Rental Property Mortgage Rates Explained

Buy-to-let mortgages usually cost more than standard home loans. Landlords pay higher interest rates because lenders see rental properties as riskier investments.

Lenders worry about periods when the property might be empty with no rent coming in (rental voids). They also consider the wear and tear caused by tenants, which could hurt the property value and make it harder for you to afford the mortgage repayments.

Several factors can affect the interest rates on these mortgages:

- The size of your deposit – Larger deposits often secure lower interest rates, as they reduce the lender’s risk.

- Your credit history – A strong credit score can help you negotiate better rates.

- The property type and location: Some properties are seen as higher risk than others.

- The rental income – Expected rental income must comfortably cover mortgage repayments, typically 125-145% of the monthly mortgage payment.

How Much Can You Borrow?

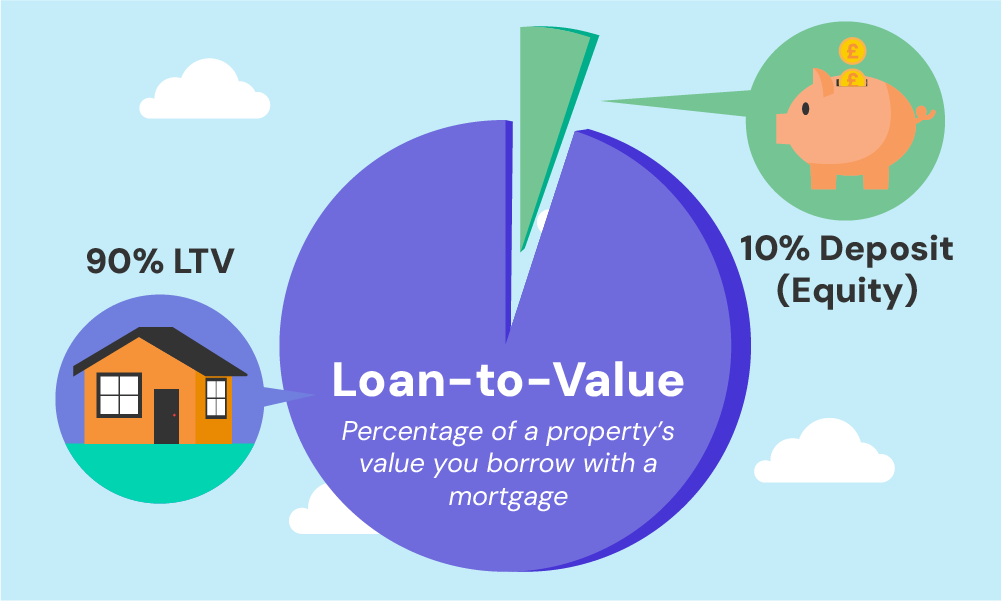

In the UK, the loan-to-value (LTV) ratio for buy-to-let mortgages typically ranges from 60% to 85%. This means you’ll need a deposit of at least 15-40% of the property’s value.

The exact amount you can borrow depends on the lender’s assessment of how much rental income the property will generate, your financial situation, and your existing property portfolio, if applicable.

Lenders use ‘stress tests’ to ensure you can cover mortgage payments even if interest rates rise or the property is unoccupied for a while. The potential rental income, therefore, significantly influences their decision.

To get an estimate of how much you might be able to borrow, why not use our buy-to-let mortgage calculator? It can give you a clearer picture of your potential monthly repayments and help you plan your investment more effectively.

Who Offers Investment Mortgages?

Many lenders offer investment property mortgages. These mortgages come in a variety of options to suit different investors and their strategies.

Here’s a brief overview:

- Buy to Let (BTL) Mortgages – Common among high street banks and specialist lenders, including Virgin Money, Santander for Intermediaries, and Metro Bank.

- House of Multiple Occupancy (HMO) Mortgages – Offered by lenders such as Central Trust Limited, Kensington Mortgages, and Barclays, catering to properties with multiple, non-related tenants.

- Overseas BTL Mortgages – Providers like Articus Finance, Barclays, and HSBC can help you invest in property abroad.

- Commercial BTL Mortgages – Designed for purchasing business premises, with lenders like TSB, Aldermore, and Generation Home offering these products.

- Holiday Let Mortgages – Suitable for short-term rental properties, offered by lenders such as CHL Mortgages, Together, and Hodge.

- Buy-to-Sell Mortgages – Short-term finance options available from lenders like Hope Capital, LendInvest, and Together for those looking to renovate and flip properties.

This isn’t everything, and what’s available will depend on your situation.

Feeling lost? The broker we collaborate with can search the whole market to find the right mortgage for your investment.

Are You Ready to Invest in Property? Here’s How to Tell

Being a real estate investor is a big move. Here are three key signs that suggest you’re ready:

1. You Can Handle the Financial Commitments

Investing in property isn’t just about buying the property; it’s about being able to afford the mortgage, maintenance, and unexpected costs that come with it.

If you’ve got a stable income, enough for a decent deposit, and a safety net for those just-in-case moments, you’re financially prepared.

2. The Numbers Make Sense for a Good Return

Successful investing is all about the return. You need to look at potential rental income and how much the property might appreciate.

Doing your homework on the local market can show you if there’s a good chance of making a profit. If the maths adds up, it could be time to make your move.

3. You’ve Got the Time or Resources to Manage the Property

Being a property investor isn’t a hands-off role; it requires your time and attention.

Whether it’s dealing directly with tenants or managing property upkeep, you need to be ready to commit.

If you can’t, consider whether you’re willing to hire someone to manage things for you.

How To Apply For Investment Property Mortgages?

If you’ve ticked all the boxes earlier, you’re likely curious about starting your mortgage application.

Here’s a step-by-step guide:

1. Assess if You Meet the Lender’s Criteria

Before anything else, make sure you align with the lender’s requirements. This includes checking your financial stability, credit history, and investment plan viability.

Meeting these criteria sets a strong foundation for your application.

2. Choose an Investment Mortgage Type

With various mortgage types available, selecting one that fits your investment strategy is crucial.

Whether it’s a Buy-to-Let, HMO, or a commercial mortgage, your choice should align with your property and financial goals.

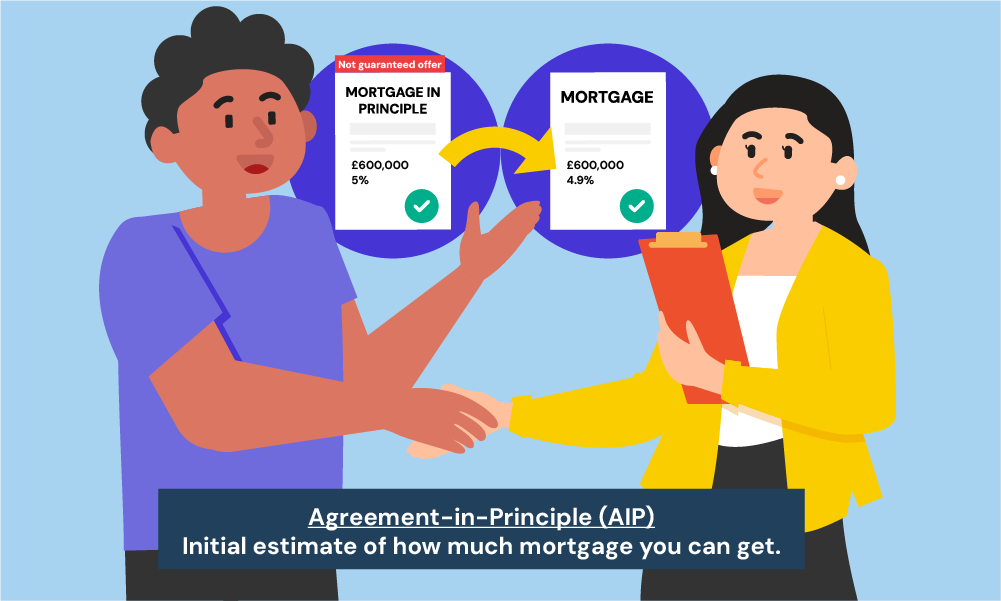

3. Get an Agreement in Principle

An Agreement in Principle (AIP) from a lender is a preliminary green light, showing they might lend to you based on initial checks.

This is not a guarantee but a good indication of your borrowing potential.

4. Gather Important Documents

You’ll need to compile several documents, including:

- Proof of income (e.g., payslips, tax returns)

- Valid identification (passport or driving licence)

- Bank statements (last 3-6 months)

- Proof of deposit (savings account statement)

- Details of current property/properties owned

- Information on the investment property (location, type, value)

- Rental income projection (if available)

- Details of existing mortgages or loans

Having these ready streamlines the process.

5. Apply to the Right Lender

Not all lenders are created equal, especially in the investment property market. Choose one that’s known for good rates and terms in the type of mortgage you’re seeking.

Using a broker can help match you with the best lender for your needs.

Key Takeaways

- Investment property mortgages are for properties intended to generate income, not for personal residence.

- You can invest in rental properties using mortgages such as Buy-to-Let, HMO, Holiday Let, Commercial, Overseas BTL, and Buy-to-Sell mortgages.

- To qualify for a mortgage, you need to meet criteria like having at least a 25% deposit, expected rental income, a stable personal income, a good credit score, and a suitable property.

- Mortgage rates for rental properties are usually higher than for personal homes because of the higher risk.

- If you’re financially stable, understand the returns you could make, and can manage the property (or hire someone to do it), you’re ready to invest.

The Bottom Line

Investing in real estate is smart, but you’ve got to play it right. Do your homework, know your budget, and think long-term.

Additionally, when it comes to investment property mortgages, knowing your options can make a big difference in your profits.

A good mortgage broker can make things easier. They don’t just find you a loan – they help you choose the right deal by looking at interest rates, terms and lenders. They can also advise you on property trends and potential, giving you an advantage.

Thinking about an investment property mortgage? Contact us and we’ll connect you with a great broker who’s an expert on investment property, so you can make a wise decision.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a second mortgage to buy an investment property?

Yes, you can take out a second mortgage to purchase an investment property, provided you meet the lender’s criteria for affordability and creditworthiness.

Can I get a second mortgage on my rental property?

It’s possible to secure a second mortgage on a rental property, often used to release equity for further investments or improvements, subject to lender approval.

How many investment property mortgages can I have?

There’s no fixed limit on the number of mortgages you can hold, but lenders will assess your ability to manage multiple loans before approving additional mortgages.

Should I hire a letting agent for my buy-to-let property?

Hiring a letting agent can ease the management burden, especially if you’re new to being a landlord or have multiple properties. They handle tenant queries, maintenance, and legal compliance.

What are the taxes I need to pay for buy-to-let properties?

You’ll need to pay Income Tax on rental earnings, Capital Gains Tax when selling the property, and possibly Stamp Duty Land Tax on purchase. Council tax and other local fees may also apply, depending on your arrangement with tenants.

>> More about Buy-to-let mortgages Taxes