How This Equity Release Calculator Works

Welcome to our Equity Release Calculator – your tool for estimating how much equity you could release from your property.

Whether you’re looking to supplement your retirement income, fund home improvements, or clear debts, our calculator provides valuable insights to help you understand your options and make informed decisions.

How To Use This Equity Release Calculator

To estimate your potential equity release, simply enter the following details:

- Property Value: Enter the current market value of your property.

- Outstanding Mortgage: Specify the remaining balance on your existing mortgage or any secured loans against your property.

- Property Purpose: Indicate the purpose of the property, such as main residence, second home or a buy to let property.

- Age of the Youngest Applicant: Provide the age of the youngest homeowner or applicant.

- Additional Property Charges: Include any additional charges associated with the equity release, such as arrangement fees or legal costs.

Our calculator will then reveal:

- Estimated Equity Release Amount: The amount of equity you could potentially release from your property.

Keep in mind:

- Enter up-to-date and precise information for reliable estimates.

- Results are general estimates. Consult a specialist for exact figures.

- The property value, your age, and location can impact calculations.

- The result from the calculator is not a formal mortgage offer.

- Feel free to try as many times you want and adjust variables to see different outcomes.

- Your data is secure and used only for calculations. No personal details are stored in our system.

For more personalised advice, reach out to us. We’ll connect you with a good mortgage broker for a quick, free, and no-obligation consultation to help with your equity release mortgage.

Understanding Your Equity Release Calculator Results

Using our equity release calculator, you’ll see options tailored to your situation. Here’s what the numbers mean:

- The maximum release plan shows the highest amount you can borrow against your property’s value.

- Calculations consider factors like your age, property value, and desired loan amount to determine your potential borrowing.

These insights help you understand equity release rates and the available choices. Our calculator is designed to guide you through these important financial decisions.

Digging Deeper: More on Equity Release

What is Equity Release?

Equity release is a way for homeowners aged 55 or over in the UK to get money from the value of their property.

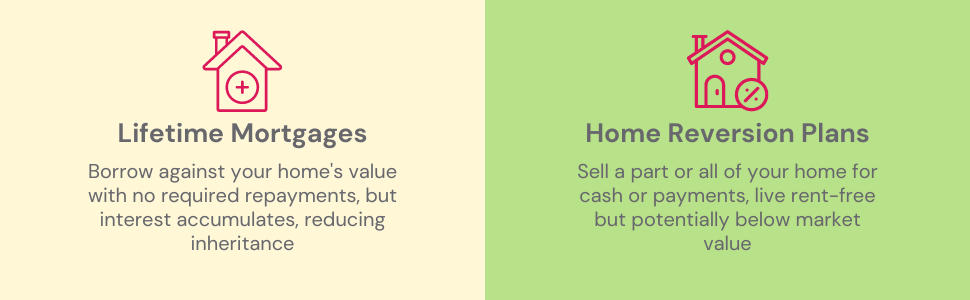

There are two common types: Lifetime Mortgages and Home Reversion Plans.

With Lifetime Mortgages, you take out a loan against your home but keep ownership. The interest is usually rolled up, meaning it accumulates and is repaid along with the loan when you die or move into care.

With Home Reversion Plans, you sell part or all of your property to a provider for money or regular payments.

In both cases, you can still live in your home, and the loan or sale is settled when you die or move into long-term care.

>> More about Equity Release

What are the Current Interest Rates for Equity Release?

As of 2023, the average equity release interest rates in the UK range around 6.21% to 8.99% APR. However, these rates can vary quite considerably.

To give you an idea, here’s a table that shows the current rates as of 4 August 2023. Bear in mind that these rates might have changed since we last updated.

| Lender | Product | Rate (MER) | Type | Offer |

|---|---|---|---|---|

| Legal & General | Premier Flexible Pearl | 5.78% | Fixed | Free Valuation |

| Legal & General | Premier Flexible Opal | 5.87% | Fixed | Free Valuation |

| Pure Retirement | Classic Drawdown Super Lite 2 | 6.03% | Fixed | Free Valuation |

| Standard Life Home Finance | Horizon 240 Drawdown Fee Free | 6.24% | Fixed | Free Valuation, no application fee |

| Aviva | Enhanced Lifestyle Flexible Option | 7.00% | Fixed | Free Valuation, no application fee |

| CanadaLife | Capital Select Gold (Flexible) | 7.15% | Fixed | Free Valuation, no application fee |

| Pure Retirement | Sovereign C Elite Drawdown (Fee Free) | 8.07% | Fixed | Free Valuation, no application fee |

Here’s what influences these rates:

- Loan-to-value ratio – The more you want to borrow, the higher your interest rate will be.

- Your home value – The more your home is worth, the lower your interest rate will be.

- Your health and lifestyle – If you have certain health conditions or lifestyle habits, you may be eligible for a lower interest rate.

- Your age and marital status – Older borrowers and couples may have to pay higher interest rates.

- Your lender – Different lenders have different rates.

- Economic conditions – Interest rates can be affected by inflation and other economic factors.

- Product features – Certain features, such as inheritance protection, may affect your rate

- Future property value projections – Lenders may consider what your home could be worth in the future when setting your interest rate.

- Your credit history – A poor credit history may affect your interest rate.

- Other costs – There are other costs associated with lifetime mortgages, such as setup fees and early repayment charges.

>> More about Equity Release Rates

How to Repay an Equity Release?

There are two common ways to repay an equity release namely – Roll-up interest and Interest Only.

Roll-up Interest

With this option, the interest is added to the total loan amount and compounded over time. You don’t make any monthly payments, but the amount you owe grows, increasing the final amount payable.

Here’s how it works: Compound Interest Illustration

Let’s say you secured a £100,000 lifetime mortgage with a fixed annual interest rate of 5%. Here’s how the interest would accumulate over 20 years:

| Year | Initial Balance (£) | Interest for the Year (£) | Total Balance (£) |

|---|---|---|---|

| 1 | 100,000 | 5,000 | 105,000 |

| 2 | 105,000 | 5,250 | 110,250 |

| 3 | 110,250 | 5,513 | 115,763 |

| 4 | 115,763 | 5,788 | 121,551 |

| 5 | 121,551 | 6,078 | 127,629 |

| 10 | 155,133 | 7,757 | 162,890 |

| 16 | 207,894 | 10,395 | 218,289 |

| 17 | 218,289 | 10,914 | 229,203 |

| 20 | 252,696 | 12,635 | 265,331 |

In this example, the total balance after 20 years would be £265,331, more than double the original amount borrowed. This amount will be paid when you die or move into long-term care.

Interest-Only Equity Release

With an interest-only lifetime mortgage, you only pay the interest on the loan each month. This means that the loan amount doesn’t grow, so you can keep the final amount under control.

If you pay the full interest each month, your total loan balance after the term will be for the loan amount plus any redemption fees or setup costs.

>> More about Interest Only Equity Release

How Much Does Equity Release Cost?

Interest rates for lifetime mortgages start at around 5% and can go up to 8.5% MER. This is much higher than the interest rates on standard residential mortgages. It’s important to compare interest rates and fees from different providers to get the best deal.

In addition to the interest, there are also fees associated with equity releases, such as arrangement fees, property valuation fees, and legal and surveyor charges. These fees typically range from £1,500 to £3,000.

It’s important to consider all of the costs involved in equity release before you make a decision. The actual costs will depend on your individual circumstances and the provider you choose.

Should You Pay Off Your Equity Release Early?

There are a few things to consider when deciding whether or not to pay off your equity release early.

> Interest Rates and Loan Amount – Paying early might save on interest.

> Penalties and Charges – Check for any early repayment fees.

> Future Financial Goals – Consider your long-term liquidity requirements.

What are Early Repayment Charges (ERCs)?

ERCs are fees you might incur if you decide to pay off your equity release early. There are mainly two types:

> Fixed Term ERC – These charges are fixed for a specific period, say five years, and typically decrease over time.

> Gilt-based ERC – These are linked to government bonds, and their value can change.

Special Circumstances Where ERCs Are Not Applied

You might be concerned about early repayment charges (ERCs) on your equity release plan. But, there are times when you don’t need to worry about these charges:

- If the Last Person on the Mortgage Dies

- If the Last Borrower Moves into Long-Term Care

- If there are specific exemptions in your plan – Some equity release plans have special rules where ERCs don’t apply. These will be different for each plan.

>> More about Paying Off Equity Release Early

These unique features can impact your decision when you calculate equity loan options. Try our equity release calculator to have further guidance about your choices and view what’s available.

Whether you’re new or looking to understand the finer details like interest rates and equity release, the right tools and information are here at your disposal.

The Bottom Line: Is Equity Release Expensive?

It’s a question many homeowners find themselves asking.

Yes, it can be. But with careful planning and understanding, it doesn’t have to break the bank.

Equity release can indeed seem costly, with higher interest rates and various fees like valuation and application charges. Compound interest can make the amount grow more than you’d expect, and if you wish to pay off early, there might be penalties.

But don’t let that scare you away. Some plans don’t require monthly repayments, and there are options to cap interest rates or even make interest payments.

With the right guidance from an experienced mortgage advisor who knows equity release inside and out, you can find a plan that fits your budget. They can also help you understand the risks and benefits of equity release and make sure you’re making the right decision for your future.

To get a started, feel free to try the calculator or reach out to get linked with an equity release specialist for personalised support.